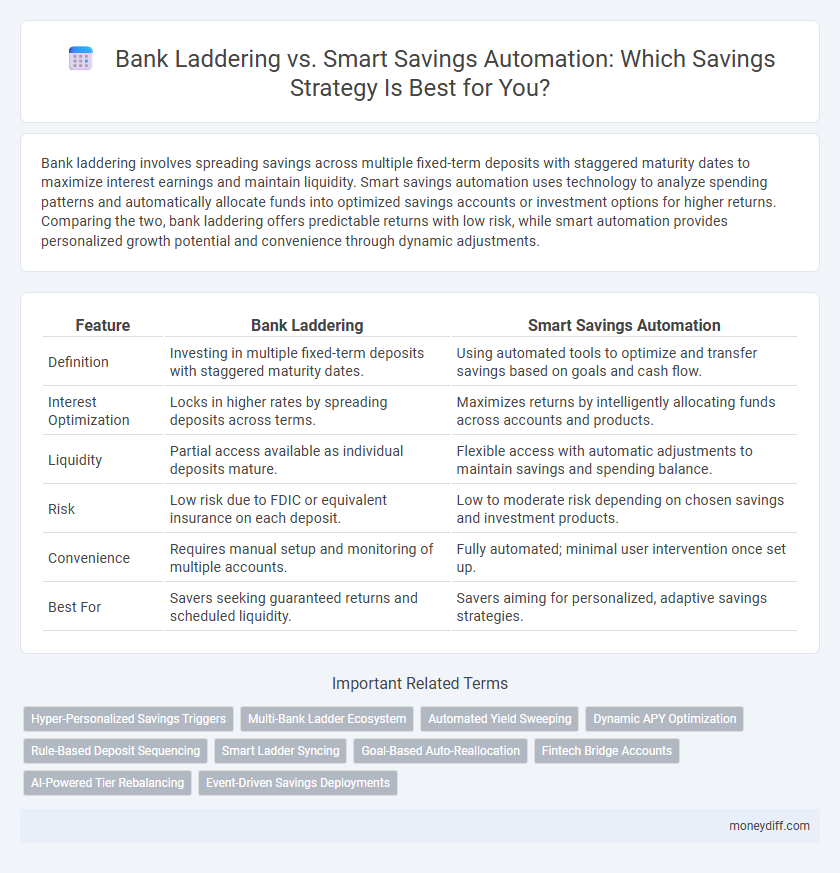

Bank laddering involves spreading savings across multiple fixed-term deposits with staggered maturity dates to maximize interest earnings and maintain liquidity. Smart savings automation uses technology to analyze spending patterns and automatically allocate funds into optimized savings accounts or investment options for higher returns. Comparing the two, bank laddering offers predictable returns with low risk, while smart automation provides personalized growth potential and convenience through dynamic adjustments.

Table of Comparison

| Feature | Bank Laddering | Smart Savings Automation |

|---|---|---|

| Definition | Investing in multiple fixed-term deposits with staggered maturity dates. | Using automated tools to optimize and transfer savings based on goals and cash flow. |

| Interest Optimization | Locks in higher rates by spreading deposits across terms. | Maximizes returns by intelligently allocating funds across accounts and products. |

| Liquidity | Partial access available as individual deposits mature. | Flexible access with automatic adjustments to maintain savings and spending balance. |

| Risk | Low risk due to FDIC or equivalent insurance on each deposit. | Low to moderate risk depending on chosen savings and investment products. |

| Convenience | Requires manual setup and monitoring of multiple accounts. | Fully automated; minimal user intervention once set up. |

| Best For | Savers seeking guaranteed returns and scheduled liquidity. | Savers aiming for personalized, adaptive savings strategies. |

Understanding Bank Laddering: A Classic Approach to Savings

Bank laddering involves dividing savings across multiple fixed-term deposits with staggered maturity dates, enabling consistent access to funds while potentially benefiting from higher interest rates. This classic savings strategy minimizes interest rate risk and enhances liquidity, making it ideal for risk-averse savers seeking steady returns. Understanding bank laddering helps optimize capital allocation and timing for withdrawals aligned with financial goals.

How Smart Savings Automation Transforms Financial Management

Smart savings automation leverages algorithms and real-time data to dynamically allocate funds across multiple accounts, maximizing interest earnings while minimizing risk. This technology reduces manual intervention by automatically adjusting contributions based on spending patterns, income fluctuations, and financial goals. By integrating personalized insights and continuous optimization, smart savings automation enhances cash flow management and accelerates wealth accumulation compared to traditional bank laddering strategies.

Bank Laddering vs Smart Automation: A Feature-by-Feature Comparison

Bank laddering offers predictable interest rates by dividing savings across multiple fixed-term deposits with staggered maturities, enabling liquidity at regular intervals and reduced interest rate risk. Smart savings automation leverages algorithms to analyze spending habits and autonomously allocate funds for optimal growth, featuring real-time adjustments and personalized goal setting. While bank laddering emphasizes stability and fixed returns, smart automation provides dynamic portfolio management and tailored savings strategies for maximizing returns.

Maximizing Returns: Which Method Offers Better Interest Rates?

Bank laddering maximizes returns by diversifying deposits across multiple fixed-term certificates of deposit (CDs) with staggered maturities, securing higher interest rates over time as market rates fluctuate. Smart savings automation leverages algorithms to allocate funds dynamically into high-yield savings accounts and optimal investment vehicles, potentially enhancing returns through timely rate adjustments. While bank laddering offers stability and predictable interest earnings, smart automation adapts to market changes, often delivering superior interest rates through real-time optimization.

Flexibility and Accessibility: Breaking Down Withdrawal Options

Bank laddering offers structured withdrawal schedules with limited early access, reducing flexibility but ensuring predictable returns. Smart savings automation provides greater accessibility with on-demand withdrawals and dynamic adjustments based on spending patterns. Prioritizing flexibility, smart automation adapts to liquidity needs, while laddering emphasizes planned, time-bound access to funds.

Risk Management: Security in Bank Laddering and Automated Savings

Bank laddering enhances risk management by spreading funds across multiple banks, each insured separately by the FDIC up to $250,000, thereby reducing exposure to any single institution's failure. Smart savings automation leverages technology to optimize deposit allocation dynamically while maintaining security protocols such as encryption and multi-factor authentication to protect accounts. Both methods ensure stronger financial security by mitigating risk through diversification and advanced cybersecurity measures.

Customization and Control: Tailoring Your Savings Strategy

Bank laddering offers precise control by allowing individuals to customize the maturity dates of certificates of deposit, optimizing interest rates while maintaining access to funds at staggered intervals. Smart savings automation leverages algorithms to tailor contributions based on spending habits and financial goals, ensuring consistent growth without manual intervention. Comparing the two, laddering excels in fixed return customization, while automation provides dynamic control aligned with evolving personal finances.

Technology in Savings: The Role of Apps and Fintech Platforms

Bank laddering offers a structured approach to savings by staggering deposit maturities, maximizing interest rates while maintaining liquidity. In contrast, smart savings automation leverages fintech apps that use algorithms and AI to optimize contributions based on spending habits and financial goals, ensuring consistent growth with minimal effort. These technologies transform traditional savings strategies by enhancing accessibility, personalization, and real-time financial insights.

Which Suits Your Goals? Choosing the Right Savings Approach

Bank laddering offers a structured approach by diversifying savings across multiple certificates of deposit with staggered maturities, providing predictable returns and easy access to funds over time. Smart savings automation leverages technology to optimize contributions and adjust savings patterns based on spending habits and financial goals, enhancing flexibility and growth potential. Evaluating your priorities for liquidity, interest rates, and financial discipline helps determine whether the stability of laddering or the adaptability of automation best aligns with your savings objectives.

Future Trends: The Evolution of Automated and Laddered Savings

Bank laddering strategically staggers fixed deposits to optimize liquidity and interest rates, while smart savings automation leverages AI to dynamically allocate funds across accounts based on spending patterns and goals. Future trends indicate an integration of these methods through machine learning algorithms that predict optimal ladder intervals and automate transfers, maximizing returns with minimal manual input. This evolution in savings technology enhances personalized financial planning and fosters increased savings efficiency in digital banking platforms.

Related Important Terms

Hyper-Personalized Savings Triggers

Bank laddering strategically staggers fixed deposits across varying maturities to optimize liquidity and interest rates, while smart savings automation leverages hyper-personalized savings triggers based on spending patterns and income fluctuations for dynamic fund allocation. Hyper-personalized triggers enable real-time adjustments to savings goals, maximizing growth potential and financial resilience.

Multi-Bank Ladder Ecosystem

Multi-Bank Ladder Ecosystem enhances savings by distributing funds across various banks to maximize interest rates and FDIC insurance limits, ensuring optimal asset protection and growth. Smart Savings Automation integrates this laddering approach with automated transfers and real-time rate adjustments, streamlining multi-bank fund allocation to boost returns efficiently.

Automated Yield Sweeping

Automated yield sweeping in smart savings automation reallocates funds across multiple accounts to maximize interest earnings by continuously monitoring and transferring balances into higher-yield options. This dynamic strategy contrasts with bank laddering, which locks funds into fixed terms, offering less flexibility and potential for missed higher rates.

Dynamic APY Optimization

Bank laddering offers structured maturity dates with fixed APYs, while smart savings automation leverages dynamic APY optimization by continuously reallocating funds to accounts offering the highest interest rates. This strategy maximizes returns by adapting to market fluctuations in real-time, outperforming static laddering methods.

Rule-Based Deposit Sequencing

Rule-based deposit sequencing in bank laddering strategically allocates funds across multiple fixed-term deposits to optimize interest rates and liquidity while minimizing risk. Smart savings automation leverages algorithms to dynamically adjust deposit amounts and terms based on market trends and personal financial goals, enhancing returns through adaptive, rule-driven scheduling.

Smart Ladder Syncing

Smart Ladder Syncing integrates the strategic timing of Bank Laddering with automated transfers, optimizing interest gains by dynamically adjusting deposit schedules across multiple accounts. This approach enhances liquidity management and maximizes returns through real-time synchronization with fluctuating interest rates and savings goals.

Goal-Based Auto-Reallocation

Goal-based auto-reallocation in smart savings automation dynamically adjusts fund distribution to align with evolving financial objectives, enhancing goal achievement efficiency compared to static bank laddering. This approach leverages real-time data and algorithms to optimize returns and liquidity across multiple savings vehicles, ensuring personalized and adaptive financial progress.

Fintech Bridge Accounts

Bank laddering involves distributing savings across multiple fixed-term deposits to optimize interest rates and liquidity, while smart savings automation leverages fintech bridge accounts to seamlessly transfer funds between checking and high-yield savings, maximizing returns without sacrificing accessibility. Fintech bridge accounts enable real-time fund movement and automated goal-based saving, combining the benefits of flexibility and higher earnings compared to traditional laddering methods.

AI-Powered Tier Rebalancing

Bank laddering offers structured fixed-term deposits with staggered maturity dates to optimize interest returns, while smart savings automation employs AI-powered tier rebalancing algorithms that dynamically adjust fund allocations across accounts to maximize yield and liquidity. Leveraging machine learning, smart savings automation continuously analyzes interest rate trends and balance thresholds to ensure efficient capital deployment and minimize downtime, outperforming traditional laddering strategies.

Event-Driven Savings Deployments

Event-driven savings deployments in bank laddering optimize liquidity by staggering maturity dates across multiple certificates of deposit, enhancing interest earnings while maintaining access to funds. Smart savings automation leverages algorithms to trigger deposits and transfers based on spending patterns and income fluctuations, maximizing growth without manual intervention.

Bank Laddering vs Smart Savings Automation for Savings. Infographic

moneydiff.com

moneydiff.com