An emergency fund provides immediate access to cash for unexpected expenses, ensuring financial stability without incurring debt, while rollover savings allow individuals to transfer and consolidate funds for long-term growth and flexibility. Prioritizing an emergency fund builds a safety net that protects against financial shocks, whereas rollover savings optimize returns by reinvesting accumulated balances into higher-yield accounts or investment options. Balancing both strategies enhances overall financial security by addressing short-term needs and maximizing long-term savings potential.

Table of Comparison

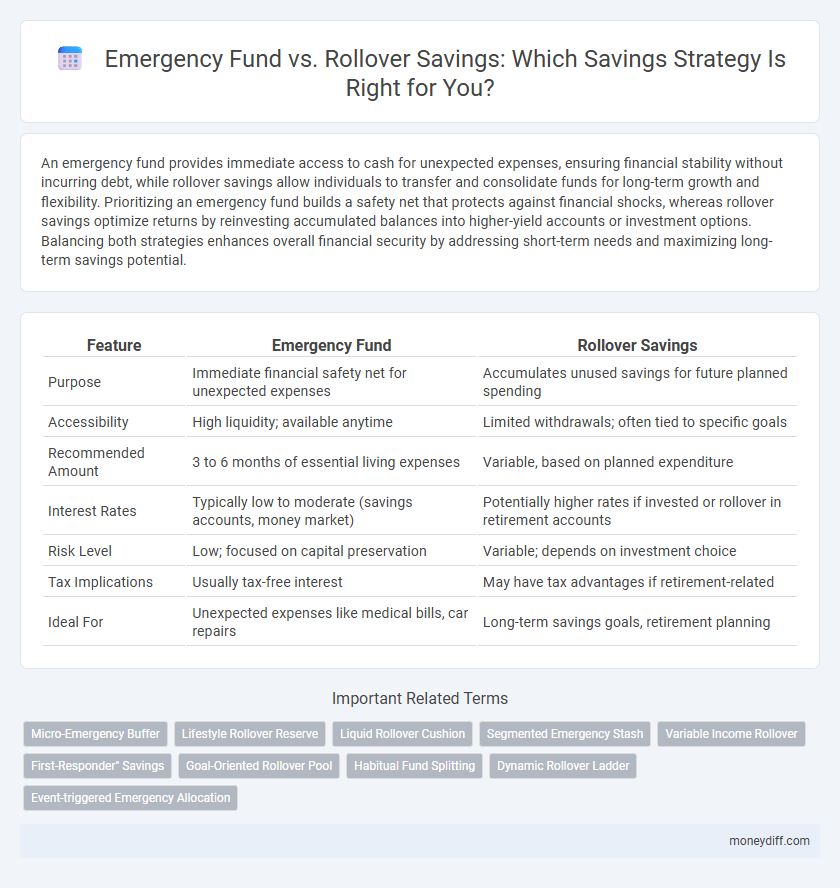

| Feature | Emergency Fund | Rollover Savings |

|---|---|---|

| Purpose | Immediate financial safety net for unexpected expenses | Accumulates unused savings for future planned spending |

| Accessibility | High liquidity; available anytime | Limited withdrawals; often tied to specific goals |

| Recommended Amount | 3 to 6 months of essential living expenses | Variable, based on planned expenditure |

| Interest Rates | Typically low to moderate (savings accounts, money market) | Potentially higher rates if invested or rollover in retirement accounts |

| Risk Level | Low; focused on capital preservation | Variable; depends on investment choice |

| Tax Implications | Usually tax-free interest | May have tax advantages if retirement-related |

| Ideal For | Unexpected expenses like medical bills, car repairs | Long-term savings goals, retirement planning |

Emergency Fund vs Rollover Savings: Key Differences

An emergency fund is a designated savings account specifically set aside to cover unexpected expenses such as medical emergencies or job loss, typically holding three to six months' worth of living expenses. Rollover savings, often associated with retirement accounts or unused benefits, are funds transferred from one account to another without tax penalties, designed to grow over time for long-term financial goals. The key difference lies in liquidity and purpose: emergency funds provide immediate access to cash for urgent needs, while rollover savings focus on preserving and maximizing retirement or long-term assets.

Purpose of an Emergency Fund

An emergency fund is specifically designed to cover unexpected expenses such as medical bills, car repairs, or job loss, ensuring financial stability without incurring debt. Unlike rollover savings, which accumulate surplus funds from previous periods for future discretionary spending, the emergency fund prioritizes liquidity and accessibility. Maintaining a dedicated emergency fund protects against financial emergencies and prevents disruption to long-term savings goals.

What Is Rollover Savings?

Rollover savings refer to funds transferred from one savings account or retirement plan to another without incurring taxes or penalties, enabling continued growth and compounding over time. Unlike emergency funds, which are liquid and reserved for immediate, unexpected expenses, rollover savings primarily serve to maintain investment continuity and optimize long-term financial goals. This strategy is essential for preserving retirement contributions while adapting to job changes or financial restructuring.

How Much Should You Save in an Emergency Fund?

An emergency fund should ideally cover three to six months' worth of essential living expenses, including rent, utilities, groceries, and transportation. This buffer provides financial security against unexpected job loss, medical emergencies, or major repairs without dipping into rollover savings or retirement accounts. Establishing this safety net before contributing to rollover savings ensures immediate access to cash for urgent needs while maintaining long-term financial growth.

Building an Effective Rollover Savings Strategy

Building an effective rollover savings strategy involves systematically transferring leftover funds from one savings account or paycheck into a dedicated rollover savings fund to maximize growth and liquidity. Prioritizing automated transfers and aligning rollover contributions with financial goals ensures consistent accumulation of emergency reserves while maintaining accessible cash flow. This approach helps balance immediate financial security with long-term savings growth, optimizing both emergency fund readiness and rollover fund expansion.

Accessibility: Emergency Fund vs Rollover Savings

An emergency fund offers immediate accessibility, allowing quick access to cash during unforeseen expenses without penalties or delays. Rollover savings, often linked to retirement accounts or investment plans, typically restrict withdrawals and may incur fees or taxes if accessed prematurely. Prioritizing an emergency fund ensures liquidity and financial security, whereas rollover savings serve long-term growth but lack short-term accessibility.

Risk Management: Protecting Your Savings

Emergency funds provide immediate liquidity to cover unexpected expenses, reducing the risk of debt accumulation during financial crises. Rollover savings, typically invested for longer-term growth, carry market risks and may not be accessible quickly in emergencies. Balancing an accessible emergency fund with rollover savings ensures both risk protection and potential financial growth.

Interest Rates: Where to Keep Emergency and Rollover Funds

Emergency funds typically benefit from highly liquid accounts such as high-yield savings accounts or money market accounts, offering competitive interest rates around 3-4% to ensure quick access without penalty. Rollover savings, often allocated to retirement or long-term investments, can leverage tax-advantaged accounts like IRAs or 401(k) plans, where interest rates and returns vary based on investment choices and market performance, typically ranging from 5-8% historically. Prioritizing interest rates with liquidity for emergency funds and growth potential for rollover savings optimizes financial security and long-term wealth accumulation.

When to Use Your Emergency Fund vs Rollover Savings

Use your emergency fund exclusively for unexpected expenses like medical emergencies, urgent home repairs, or sudden job loss to maintain financial stability. Rollover savings, however, are better suited for planned or flexible costs such as upcoming vacations, non-urgent purchases, or investment opportunities that don't disrupt essential finances. Prioritizing this distinction ensures your emergency fund remains intact for true financial crises while rollover savings support manageable spending.

Creating a Balanced Savings Plan

Creating a balanced savings plan involves allocating funds between an emergency fund and rollover savings to ensure financial stability and growth. An emergency fund typically covers three to six months of essential expenses, providing a safety net during unexpected situations. Rollover savings, often constituting surplus funds, can be invested or moved to higher-yield accounts to maximize returns while maintaining liquidity for future needs.

Related Important Terms

Micro-Emergency Buffer

A Micro-Emergency Buffer functions as a quick-access savings reserve for unexpected small expenses, bridging the gap until a larger Emergency Fund can be utilized. Unlike Rollover Savings, which gradually accumulates unspent funds from previous months, the Micro-Emergency Buffer prioritizes immediate liquidity to reduce reliance on high-interest debt during minor financial disruptions.

Lifestyle Rollover Reserve

A Lifestyle Rollover Reserve offers flexible access to funds without penalties, making it ideal for managing planned lifestyle expenses and unexpected financial shifts compared to a traditional Emergency Fund, which is strictly reserved for urgent, unforeseen events. Allocating savings into a rollover account enhances financial adaptability by allowing periodic contributions and withdrawals aligned with long-term lifestyle goals.

Liquid Rollover Cushion

An emergency fund offers immediate liquidity for unexpected expenses, while a liquid rollover savings cushion blends accessibility with the benefit of higher interest rates from longer-term accounts, providing a strategic balance between liquidity and growth. Prioritizing a liquid rollover cushion enhances financial resilience by maintaining accessible funds without sacrificing potential returns seen in fixed-term rollovers.

Segmented Emergency Stash

Segmented Emergency Stash enhances financial security by dividing emergency funds into distinct categories based on potential needs, such as medical, housing, and travel expenses, ensuring targeted access during crises. Unlike rollover savings, which pool funds into a single account for generalized use, segmented emergency funds provide clearer allocation and quicker response, optimizing preparedness and minimizing financial stress.

Variable Income Rollover

Variable income rollover savings provide a flexible alternative to emergency funds by allowing individuals to allocate fluctuating monthly earnings into a continuous savings pool, ensuring liquidity during income variability. This approach optimizes cash flow management by adapting to inconsistent revenue streams, enhancing financial stability without depleting designated emergency reserves.

First-Responder" Savings

Emergency funds provide first responders with immediate access to liquid cash during unforeseen events, ensuring financial stability without disrupting long-term savings. Rollover savings, while growing over time, may lack the flexibility and quick accessibility crucial for first responders facing sudden emergencies.

Goal-Oriented Rollover Pool

Goal-oriented rollover savings pools offer a flexible strategy by allowing unused emergency fund allocations to roll over into specific savings goals, maximizing the utility of reserved funds. This method enhances financial discipline and progress by repurposing surplus emergency savings towards targeted objectives such as vacations, home upgrades, or large purchases.

Habitual Fund Splitting

Habitual fund splitting between an emergency fund and rollover savings ensures financial resilience by earmarking immediate cash for unforeseen expenses while systematically growing long-term savings. Prioritizing regular contributions to both accounts optimizes liquidity and maximizes compounded growth, balancing short-term security with future financial goals.

Dynamic Rollover Ladder

A Dynamic Rollover Ladder enhances emergency fund savings by systematically shifting short-term assets into longer-term investments, optimizing liquidity while maximizing interest earnings. This strategy balances immediate access to funds with staggered maturity dates, reducing risk and improving overall financial flexibility compared to a static emergency fund.

Event-triggered Emergency Allocation

Event-triggered emergency allocation prioritizes immediate access to funds during unexpected expenses, making emergency funds highly liquid and specifically reserved for crises such as medical emergencies or job loss. Rollover savings, while flexible and capable of growing over time through interest or investments, lack the instant availability crucial for urgent financial needs, often requiring time-consuming transfers or penalties for early withdrawal.

Emergency Fund vs Rollover Savings for savings. Infographic

moneydiff.com

moneydiff.com