Direct deposit savings automatically transfer funds to your savings account, ensuring consistent growth without manual effort. Robo-savings tools analyze your spending patterns and intelligently move small amounts to savings, optimizing your ability to save without impacting daily expenses. Both methods encourage disciplined saving habits, but robo-savings offer personalized optimization for greater long-term financial benefits.

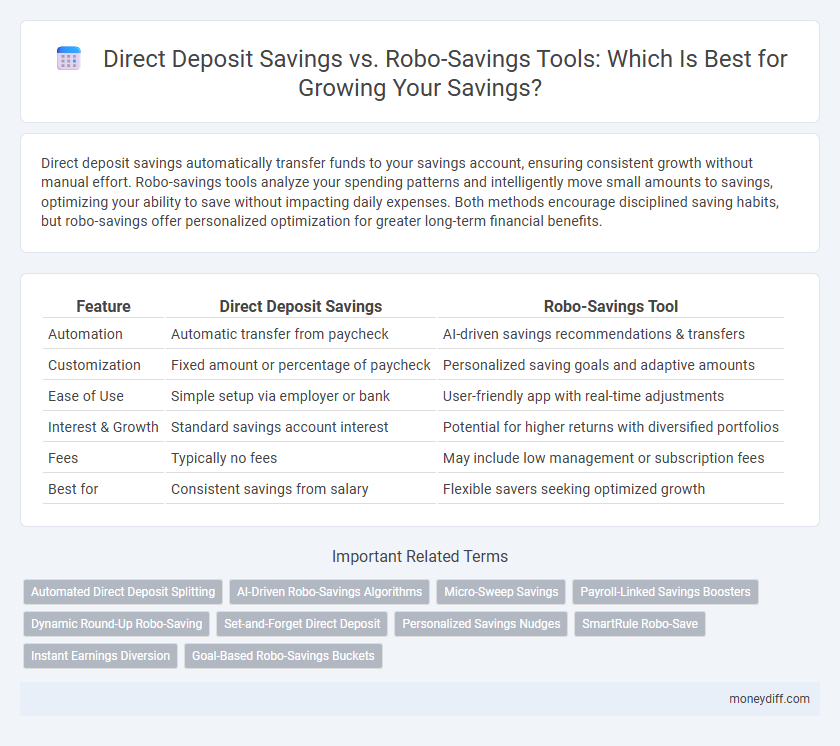

Table of Comparison

| Feature | Direct Deposit Savings | Robo-Savings Tool |

|---|---|---|

| Automation | Automatic transfer from paycheck | AI-driven savings recommendations & transfers |

| Customization | Fixed amount or percentage of paycheck | Personalized saving goals and adaptive amounts |

| Ease of Use | Simple setup via employer or bank | User-friendly app with real-time adjustments |

| Interest & Growth | Standard savings account interest | Potential for higher returns with diversified portfolios |

| Fees | Typically no fees | May include low management or subscription fees |

| Best for | Consistent savings from salary | Flexible savers seeking optimized growth |

Understanding Direct Deposit Savings

Direct deposit savings automatically transfers a portion of your paycheck into a separate savings account, promoting consistent saving habits without manual intervention. This method leverages paycheck frequency and employer payroll systems to enhance disciplined financial growth while minimizing impulsive spending. Understanding direct deposit savings is crucial for optimizing cash flow management and ensuring steady accumulation toward financial goals.

What Are Robo-Savings Tools?

Robo-savings tools are automated financial apps designed to help users save money by analyzing spending habits and transferring small amounts into savings accounts without manual intervention. These tools often use algorithms and artificial intelligence to set aside optimal savings based on individual income patterns and expenditure. Compared to direct deposit savings, robo-savings provide dynamic, flexible, and personalized saving strategies to boost financial discipline and grow savings efficiently.

Automated Savings: Direct Deposit vs Robo-Savings

Direct deposit savings automatically transfers a fixed amount from your paycheck into a savings account, ensuring consistent, scheduled deposits that build your savings steadily over time. Robo-savings tools use algorithms to analyze spending patterns and automatically transfer varying amounts into savings, optimizing growth without manual input. Both methods leverage automation, but robo-savings offer dynamic adjustments to maximize savings efficiency based on individual financial behavior.

Advantages of Direct Deposit Savings

Direct deposit savings offers automatic fund transfers directly from your paycheck into a savings account, ensuring consistent contributions without manual effort. This method reduces the temptation to spend, enhances disciplined saving habits, and often results in faster accumulation of emergency funds or goals. By eliminating delays, direct deposit savings also supports better cash flow management and interest accumulation compared to sporadic transfers to robo-savings tools.

Benefits of Using Robo-Savings Tools

Robo-savings tools automate the saving process by analyzing spending patterns and transferring optimal amounts into savings accounts, which reduces the risk of manual errors and increases consistency. These tools often provide personalized insights, helping users meet specific financial goals faster through smart algorithms that adjust saving rates dynamically. Integration with various financial accounts allows seamless management and visibility, enhancing overall financial discipline compared to traditional direct deposit savings methods.

Comparing Fees and Costs

Direct deposit savings accounts typically have low to no fees, allowing users to maximize their interest earnings without monthly maintenance costs. Robo-savings tools may charge a small service fee, often around 0.25% to 0.50% of assets managed, which can reduce overall savings growth over time. Comparing fees is crucial as even minimal costs can significantly impact long-term savings accumulation, making direct deposit savings more cost-effective for fee-sensitive individuals.

Security and Accessibility

Direct deposit savings offer enhanced security by automatically transferring funds directly into a bank account, reducing the risk of lost or stolen checks. Robo-savings tools provide accessible, user-friendly platforms with advanced encryption and multi-factor authentication to protect user data. Both methods ensure secure access to savings, but direct deposits prioritize seamless integration with banking institutions while robo-savings focus on digital convenience and customizable saving strategies.

Flexibility: Manual vs Algorithmic Savings

Direct deposit savings offer flexibility through manual control, allowing individuals to decide when and how much to save from each paycheck, adapting to changing financial situations. Robo-savings tools use algorithmic savings to automatically transfer funds based on spending patterns and income, ensuring consistent growth without manual intervention. Algorithmic methods provide disciplined, hands-off saving, whereas manual direct deposit requires active management but offers greater immediate adjustment capabilities.

Which Option Fits Your Savings Goals?

Direct deposit savings provide a disciplined approach by automatically transferring a fixed amount into your savings account, ideal for consistent, goal-oriented saving such as emergency funds or planned purchases. Robo-savings tools use algorithms to analyze spending habits and round up transactions or transfer small amounts, offering a flexible, automated method perfect for incremental savings and building habits over time. Choosing between these depends on whether you prefer guaranteed savings with a fixed schedule or adaptive, behavior-driven contributions aligned with fluctuating cash flow.

Choosing the Best Savings Strategy for You

Direct deposit savings offer a disciplined approach by automatically transferring a fixed amount from your paycheck to a savings account, ensuring consistent growth. Robo-savings tools utilize algorithms to analyze spending habits and automate small transfers, optimizing savings without manual input. Assess your financial habits and preferences to select a strategy that maximizes convenience, automation, and savings potential.

Related Important Terms

Automated Direct Deposit Splitting

Automated direct deposit splitting enhances savings by allowing a predetermined portion of each paycheck to be instantly allocated to a savings account, promoting consistent, effortless financial growth. This method provides more control and predictability compared to robo-savings tools, which rely on algorithms to transfer varying amounts based on spending patterns and often lack fixed savings contributions.

AI-Driven Robo-Savings Algorithms

AI-driven robo-savings algorithms analyze spending patterns and income flows to automatically allocate funds into savings, offering a personalized and dynamic approach compared to the fixed amounts typically deposited via direct deposit savings. These algorithms optimize savings growth by adjusting contributions based on real-time financial behavior, enhancing flexibility and efficiency over traditional direct deposit methods.

Micro-Sweep Savings

Direct deposit savings automate regular contributions, ensuring consistent growth without manual intervention, while Robo-savings tools, like Micro-Sweep Savings, enhance automated saving by analyzing spending patterns and sweeping small, unspent amounts from checking to savings accounts, maximizing effortless wealth accumulation. Micro-Sweep Savings optimize saving efficiency by targeting micro-transactions, offering a dynamic, adaptive approach compared to static direct deposits.

Payroll-Linked Savings Boosters

Payroll-linked savings boosters integrated with direct deposit maximize automatic contributions by allocating a fixed percentage of each paycheck directly into a savings account, ensuring consistent growth without manual intervention. Robo-savings tools use algorithms to analyze spending patterns and automate micro-deposits into savings, optimizing growth through personalized, data-driven adjustments.

Dynamic Round-Up Robo-Saving

Dynamic Round-Up Robo-Saving tools automatically round up everyday purchases to the nearest dollar and transfer the difference into a high-yield savings account, optimizing savings growth with minimal user effort. Direct deposit savings rely on fixed amounts set by the user, lacking the adaptive flexibility and incremental boost provided by round-up technology in robo-saving platforms.

Set-and-Forget Direct Deposit

Set-and-forget direct deposit savings automatically transfers a fixed portion of your paycheck into a separate savings account, ensuring consistent growth without manual intervention. Unlike robo-savings tools that use algorithms to optimize transfers based on spending patterns, direct deposit provides predictable, disciplined saving habits ideal for steady financial goals.

Personalized Savings Nudges

Direct deposit savings automatically allocate a fixed portion of your paycheck into a savings account, ensuring consistent growth without active management, while robo-savings tools utilize personalized savings nudges based on real-time spending patterns to optimize savings behavior. These AI-driven nudges adapt to your financial habits, providing tailored suggestions that help maximize savings efficiency beyond standard direct deposit methods.

SmartRule Robo-Save

Direct deposit savings automate money transfer into a savings account with fixed amounts, ensuring consistent saving habits, whereas the SmartRule Robo-Save tool uses AI-driven algorithms to analyze spending patterns and intelligently allocate surplus funds to savings, maximizing growth potential. SmartRule Robo-Save adapts to individual financial behavior, offering personalized savings strategies and optimizing cash flow without manual intervention.

Instant Earnings Diversion

Direct deposit savings enable instant earnings diversion by automatically transferring a fixed portion of your paycheck into a separate savings account, ensuring consistent and disciplined saving without manual intervention. Robo-savings tools leverage algorithms to analyze spending patterns and divert surplus funds in real time, optimizing savings growth through adaptive and personalized transfers.

Goal-Based Robo-Savings Buckets

Goal-based Robo-savings buckets automate personalized savings by allocating funds into distinct categories aligned with specific financial objectives, optimizing progress through algorithm-driven contributions. Unlike traditional direct deposit savings that rely on manual transfers to a single account, robo-savings tools enhance discipline and efficiency by dynamically adjusting deposits to meet targeted milestones.

Direct deposit savings vs Robo-savings tool for savings. Infographic

moneydiff.com

moneydiff.com