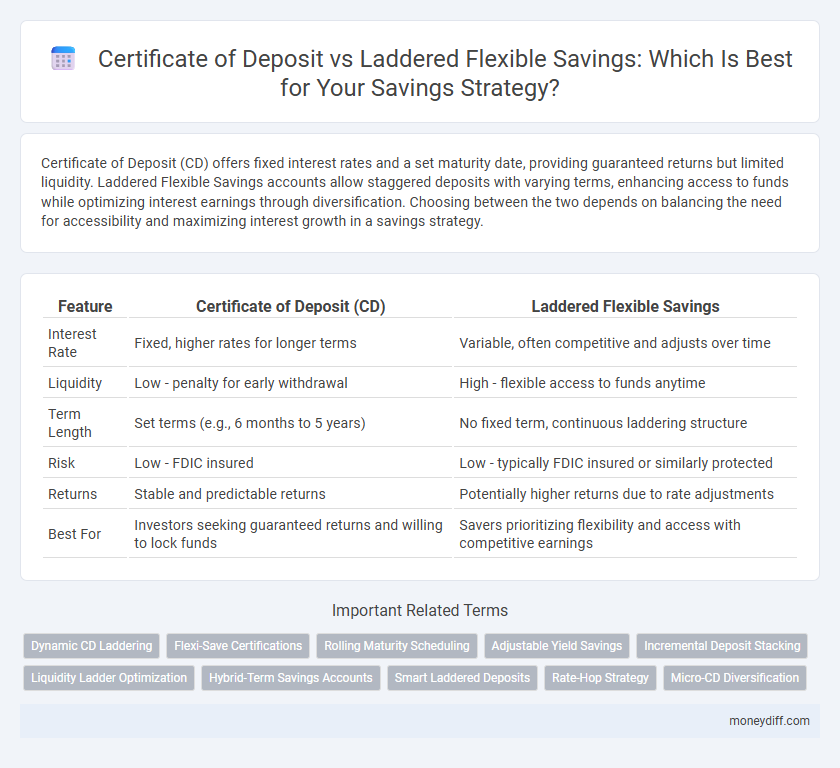

Certificate of Deposit (CD) offers fixed interest rates and a set maturity date, providing guaranteed returns but limited liquidity. Laddered Flexible Savings accounts allow staggered deposits with varying terms, enhancing access to funds while optimizing interest earnings through diversification. Choosing between the two depends on balancing the need for accessibility and maximizing interest growth in a savings strategy.

Table of Comparison

| Feature | Certificate of Deposit (CD) | Laddered Flexible Savings |

|---|---|---|

| Interest Rate | Fixed, higher rates for longer terms | Variable, often competitive and adjusts over time |

| Liquidity | Low - penalty for early withdrawal | High - flexible access to funds anytime |

| Term Length | Set terms (e.g., 6 months to 5 years) | No fixed term, continuous laddering structure |

| Risk | Low - FDIC insured | Low - typically FDIC insured or similarly protected |

| Returns | Stable and predictable returns | Potentially higher returns due to rate adjustments |

| Best For | Investors seeking guaranteed returns and willing to lock funds | Savers prioritizing flexibility and access with competitive earnings |

Understanding Certificate of Deposit (CD) Savings

Certificate of Deposit (CD) savings offer fixed interest rates and specified terms, typically ranging from three months to five years, providing predictable returns and increased security compared to regular savings accounts. CDs often require funds to be locked in until maturity, with penalties for early withdrawal, making them ideal for investors seeking stable, low-risk growth. Laddered flexible savings strategies mitigate this rigidity by staggering CD maturities at regular intervals, optimizing liquidity while maintaining higher interest rates.

What Is Laddered Flexible Savings?

Laddered Flexible Savings is a strategic savings method that involves dividing funds into multiple accounts or deposits with staggered maturity dates to maximize interest earnings and maintain liquidity. Unlike Certificates of Deposit (CDs), which lock funds for a fixed term, laddered flexible savings allow partial access to funds without penalties, providing greater financial flexibility. This approach balances higher interest rates typically associated with longer-term CDs and the need for readily available cash, optimizing overall savings growth.

Comparing Interest Rates: CDs vs Laddered Savings

Certificates of Deposit (CDs) typically offer fixed interest rates that are higher than regular savings accounts, providing guaranteed returns over a specified term. Laddered Flexible Savings accounts benefit from variable rates that adjust with market conditions, potentially increasing earnings over time while maintaining liquidity. Choosing between CDs and laddered savings depends on the investor's preference for stable, predictable income versus the flexibility to capitalize on rising interest rates.

Liquidity and Accessibility Differences

Certificate of Deposit (CD) accounts typically offer higher fixed interest rates but lock funds for a fixed term, limiting liquidity and making early withdrawals subject to penalties. Laddered flexible savings accounts enhance accessibility by spreading investments across multiple savings products with staggered maturities, allowing partial access to funds without penalties. This strategy balances earning potential with improved liquidity, catering to savers who need periodic access to their savings.

Risk Factors: Security of Your Savings

Certificates of Deposit (CDs) offer a fixed interest rate and FDIC insurance up to $250,000, ensuring high security of your savings with minimal risk of principal loss. Laddered flexible savings accounts provide diversified access to funds with varying maturity dates, reducing liquidity risk while maintaining FDIC protection within insured limits. Both options minimize credit risk, but CDs lock funds for a set term, whereas laddered savings offer more flexibility and staggered interest rate exposure.

Penalties and Early Withdrawal Considerations

Certificates of Deposit (CDs) typically impose strict penalties for early withdrawal, often forfeiting a portion of the earned interest, which can diminish overall returns. Laddered Flexible Savings accounts offer greater liquidity with minimal or no penalties, allowing savers to access funds early without significantly compromising interest income. Understanding these differences is crucial for optimizing savings strategies based on cash flow needs and financial goals.

Maximizing Returns: Which Strategy Wins?

Certificates of Deposit (CDs) offer fixed interest rates with higher returns for locking funds over a set term, making them ideal for predictable growth. Laddered Flexible Savings accounts provide a mix of liquidity and compounded interest by staggering deposits, helping to capitalize on rising rates without sacrificing access to funds. For maximizing returns, laddering leverages fluctuating market trends, while CDs guarantee steady income, with the best choice depending on risk tolerance and interest rate environments.

Suitability for Short-Term and Long-Term Goals

Certificates of Deposit (CDs) offer fixed interest rates and maturity dates, making them ideal for savers with specific short-term financial targets who can lock funds without early withdrawal penalties. Laddered Flexible Savings plans provide staggered access to portions of savings at varying intervals, combining liquidity with capital growth, which suits individuals balancing both short-term needs and long-term accumulation. Choosing between these options depends on the desired balance of access to funds versus maximizing interest earnings over different time horizons.

Tax Implications for CD and Laddered Savings

Certificates of Deposit (CDs) often have fixed interest rates subject to federal and state income taxes, with interest typically taxed in the year it is earned, even if the funds are reinvested. Laddered flexible savings accounts, while offering more liquidity and variable interest rates, also incur taxable interest income annually, but allow for staggered withdrawals that can be strategically timed for tax efficiency. Understanding the tax treatment of interest from both options is crucial for optimizing after-tax returns in savings planning.

Choosing the Right Product for Your Financial Plan

Evaluating Certificates of Deposit (CDs) against Laddered Flexible Savings accounts involves considering interest rates, liquidity needs, and penalty structures. CDs offer fixed, often higher interest rates for a set term but limit access to funds without penalties, making them ideal for long-term, low-risk savings goals. Laddered Flexible Savings provide staggered maturity dates and more liquidity, allowing tailored access to funds while balancing returns, suitable for savers seeking both flexibility and steady growth within their financial plan.

Related Important Terms

Dynamic CD Laddering

Dynamic CD laddering optimizes interest earnings by staggering certificate of deposit (CD) maturities, allowing investors to capitalize on rising rates while maintaining liquidity. Compared to laddered flexible savings, this strategy offers higher yield potential through varying term lengths, reducing interest rate risk without sacrificing access to funds.

Flexi-Save Certifications

Flexi-Save Certifications offer higher liquidity compared to traditional Certificates of Deposit (CDs) by allowing partial withdrawals without penalty, making them ideal for savers seeking flexible access to funds. Laddered Flexible Savings strategies optimize interest earnings by staggering maturity dates, combining steady growth with the adaptable benefits of Flexi-Save products.

Rolling Maturity Scheduling

Certificate of Deposit (CD) offers fixed interest rates with a fixed term, while laddered flexible savings accounts provide staggered maturity dates to optimize liquidity and capitalize on changing interest rates. Rolling maturity scheduling in laddered accounts ensures continuous access to funds as each deposit matures, enhancing flexibility compared to the rigid structure of traditional CDs.

Adjustable Yield Savings

A Certificate of Deposit (CD) offers a fixed interest rate with limited liquidity, making it ideal for long-term savings but less flexible for changing financial needs. Laddered Flexible Savings accounts provide adjustable yields by staggering deposit maturities, maximizing interest earnings while maintaining accessibility and minimizing interest rate risk.

Incremental Deposit Stacking

Certificate of Deposit (CD) offers fixed interest rates with a locked term, limiting incremental deposit stacking flexibility compared to Laddered Flexible Savings accounts, which enable investors to incrementally add funds across staggered maturities to optimize liquidity and interest earnings. Laddering strategies in Flexible Savings facilitate continuous compounding benefits and risk diversification by spreading investments over multiple deposits, enhancing cash flow management relative to single-term CDs.

Liquidity Ladder Optimization

Certificate of Deposit (CD) offers fixed interest rates with lower liquidity due to fixed terms, making it less flexible for urgent access, whereas laddered flexible savings accounts optimize liquidity by staggering maturities, allowing partial withdrawals without penalties while maximizing interest earnings. This liquidity ladder optimization balances earning potential and access to funds, catering to savers seeking both growth and financial flexibility.

Hybrid-Term Savings Accounts

Hybrid-term savings accounts combine the fixed interest benefits of certificates of deposit (CDs) with the accessibility of laddered flexible savings, offering optimized liquidity and higher yield potential by staggering maturity dates. This strategy enhances savings growth by balancing steady returns from CDs with the ability to access funds without penalties, maximizing overall portfolio flexibility.

Smart Laddered Deposits

Smart Laddered Deposits optimize savings by staggering Certificate of Deposit (CD) maturities, providing liquidity and higher interest rates compared to traditional single-term CDs. This strategy balances risk and return, allowing savers to access funds periodically while maximizing yield through diversified deposit terms.

Rate-Hop Strategy

The Rate-Hop Strategy leverages a Certificate of Deposit's fixed interest rates by strategically purchasing CDs at different maturities to maximize returns while minimizing interest rate risk. Laddered Flexible Savings accounts offer more liquidity and variable rates, allowing savers to adjust holdings as rates fluctuate, but often yield lower overall returns compared to the structured gains from a CD ladder.

Micro-CD Diversification

Micro-CD diversification within laddered flexible savings accounts enhances risk management by allocating funds across multiple maturity dates, providing consistent liquidity and interest rate optimization compared to a single certificate of deposit. This strategy reduces reinvestment risk and maximizes returns by capitalizing on varied interest rate environments while maintaining structured access to funds.

Certificate of Deposit vs Laddered Flexible Savings for savings. Infographic

moneydiff.com

moneydiff.com