Goal-Based Savings involves setting specific financial targets, such as buying a house or funding education, which helps maintain motivation and track progress. The Envelope Savings Method allocates cash into physical or digital envelopes for different expense categories, promoting disciplined spending and budget control. Combining both strategies can enhance financial management by aligning savings with clear objectives while ensuring practical budgeting.

Table of Comparison

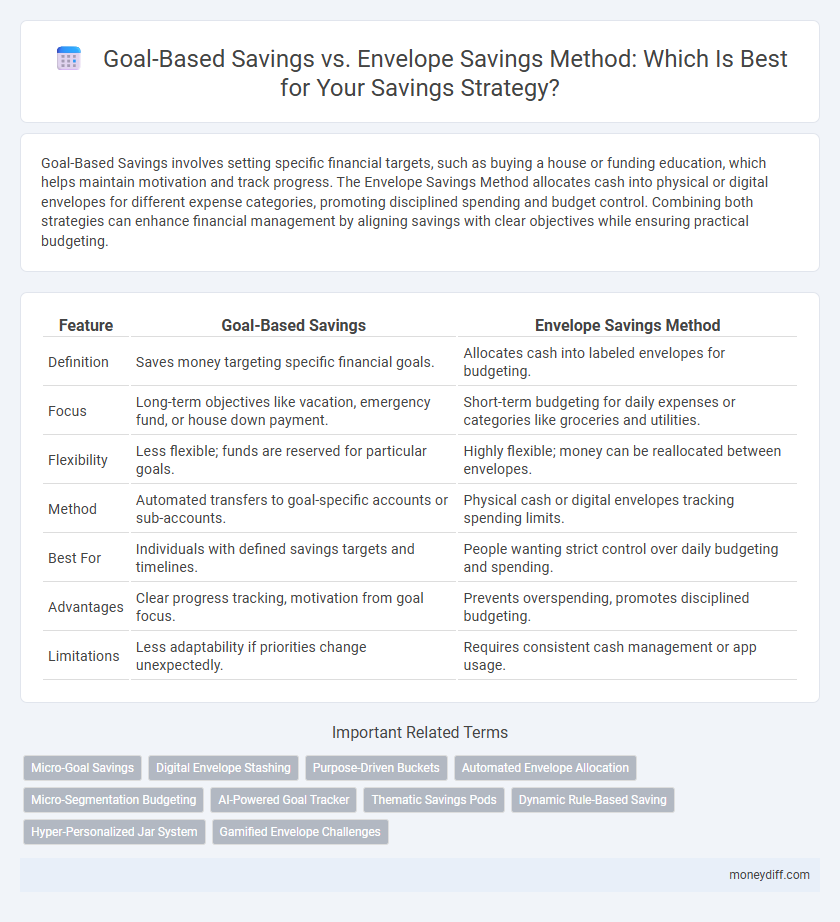

| Feature | Goal-Based Savings | Envelope Savings Method |

|---|---|---|

| Definition | Saves money targeting specific financial goals. | Allocates cash into labeled envelopes for budgeting. |

| Focus | Long-term objectives like vacation, emergency fund, or house down payment. | Short-term budgeting for daily expenses or categories like groceries and utilities. |

| Flexibility | Less flexible; funds are reserved for particular goals. | Highly flexible; money can be reallocated between envelopes. |

| Method | Automated transfers to goal-specific accounts or sub-accounts. | Physical cash or digital envelopes tracking spending limits. |

| Best For | Individuals with defined savings targets and timelines. | People wanting strict control over daily budgeting and spending. |

| Advantages | Clear progress tracking, motivation from goal focus. | Prevents overspending, promotes disciplined budgeting. |

| Limitations | Less adaptability if priorities change unexpectedly. | Requires consistent cash management or app usage. |

Understanding Goal-Based Savings

Goal-Based Savings focuses on allocating funds toward specific financial objectives such as emergency funds, vacations, or retirement, allowing for targeted progress tracking and motivation. This method enhances financial discipline by breaking down savings into clear, measurable goals, improving the likelihood of meeting distinct monetary targets. Compared to the Envelope Savings Method, Goal-Based Savings provides a structured approach that aligns saving habits with personalized priorities and timelines.

What Is the Envelope Savings Method?

The Envelope Savings Method is a budgeting strategy where you allocate a specific amount of cash into physical envelopes labeled for different spending categories, helping control expenses and prevent overspending. This tactile approach allows savers to visually manage their money and prioritize essential expenses while setting aside funds for savings goals. Unlike Goal-Based Savings, which focuses on targeting specific financial objectives, the Envelope Method emphasizes disciplined daily money management to build savings gradually.

Key Differences Between the Two Methods

Goal-based savings centers on allocating funds toward specific financial objectives, such as buying a house or retirement, providing clear motivation and progress tracking. The envelope savings method involves dividing cash into physical or digital envelopes categorized by spending purposes, promoting disciplined budget management and limiting overspending. Key differences lie in goal specificity and flexibility: goal-based savings is target-oriented with measurable milestones, whereas envelope saving is more about daily expense control and allocating resources within set categories.

Pros and Cons of Goal-Based Savings

Goal-based savings allows individuals to allocate funds towards specific financial objectives, enhancing motivation and tracking progress. This method promotes disciplined saving habits but can become rigid, limiting flexibility for unexpected expenses. While it fosters targeted achievement, it may also lead to stress if goals are not met within set timelines.

Advantages and Disadvantages of Envelope Savings

The Envelope Savings Method offers a straightforward, tangible way to control spending by allocating cash into categorized envelopes, which helps prevent overspending and increases financial discipline. However, its reliance on physical cash can pose security risks and limit flexibility in managing digital transactions or emergencies. This method may also complicate saving for multiple long-term goals compared to Goal-Based Savings, which uses targeted accounts or sub-accounts to align savings with specific objectives.

Choosing the Right Savings Method for Your Needs

Goal-Based Savings focuses on setting specific financial targets, such as buying a home or funding education, providing clear motivation and structured progress tracking. Envelope Savings Method allocates money into separate categories or "envelopes" for budgeting daily expenses and savings, enhancing spending discipline. Choosing the right savings method depends on individual financial goals, spending habits, and the level of organization preferred to maximize efficiency and meet personal objectives.

How to Set Achievable Savings Goals

Setting achievable savings goals involves clearly defining specific targets aligned with timeframes and financial priorities. Goal-Based Savings emphasizes creating measurable objectives such as emergency funds or vacation budgets, which enhances motivation and tracking progress. The Envelope Savings Method allocates funds into distinct categories, simplifying expense management but requiring discipline to prevent overspending within each envelope.

Tips for Tracking Your Savings Progress

Utilize digital tools like budgeting apps or spreadsheets to effectively monitor your Goal-Based Savings and Envelope Savings progress, ensuring each category aligns with your financial objectives. Regularly review and adjust your savings targets based on monthly income fluctuations and expense patterns to stay on track. Opt for visual aids such as progress charts or color-coded envelopes to instantly gauge how close you are to reaching specific savings milestones.

Combining Goal-Based and Envelope Methods

Combining goal-based savings with the envelope method enhances financial discipline by allocating funds to specific objectives while managing daily expenses within set limits, promoting targeted and controlled savings. Using goal-based strategies ensures resources are directed toward defined milestones, whereas the envelope method helps prevent overspending by physically or digitally separating money into distinct spending categories. This hybrid approach optimizes budgeting efficiency and increases the likelihood of meeting both short-term needs and long-term financial goals.

Maximizing Savings Success: Best Practices

Maximizing savings success involves choosing strategies aligned with personal financial goals, where the Goal-Based Savings method ensures focused allocation by setting specific targets and timelines. The Envelope Savings Method enhances discipline by physically or digitally segregating funds into categories, preventing overspending. Combining these approaches offers a structured framework that promotes accountability, improves budgeting accuracy, and accelerates the achievement of financial objectives.

Related Important Terms

Micro-Goal Savings

Micro-goal savings, a refined approach within goal-based savings, allocates small, specific targets to enhance financial discipline and tracking accuracy compared to the broader envelope savings method that divides cash into physical categories. This targeted strategy leverages digital tools and behavioral insights to prioritize incremental progress, optimizing motivation and ensuring adaptable, focused fund allocation for diverse short-term objectives.

Digital Envelope Stashing

Digital Envelope Stashing enhances the traditional envelope savings method by allowing users to allocate funds into specific virtual envelopes for distinct goals, improving budget tracking and financial discipline. This method leverages digital tools to automate transfers, monitor progress, and adjust allocations in real-time, making goal-based savings more flexible and transparent.

Purpose-Driven Buckets

Goal-Based Savings organizes funds into purpose-driven buckets, each aligned with specific financial objectives such as emergency funds, vacations, or retirement, enhancing clarity and motivation. Envelope Savings Method allocates cash physically or digitally into labeled envelopes for routine expenses, prioritizing budget discipline but lacking explicit goal differentiation.

Automated Envelope Allocation

Automated envelope allocation enhances the envelope savings method by digitally categorizing funds into specific spending and saving goals, ensuring precise budget management without manual tracking. This technology-driven approach streamlines goal-based savings by automatically adjusting and distributing income according to predefined financial targets, increasing efficiency and consistency in achieving long-term objectives.

Micro-Segmentation Budgeting

Goal-Based Savings leverages micro-segmentation budgeting by allocating funds to specific financial objectives, enhancing targeted discipline and measurable progress toward each goal. The Envelope Savings Method organizes cash into designated categories, promoting controlled spending but often lacks the granular tracking capabilities essential for micro-segmentation and precise financial optimization.

AI-Powered Goal Tracker

AI-powered goal trackers enhance goal-based savings by analyzing spending patterns and automatically adjusting contributions to specific financial objectives, ensuring personalized and efficient progress toward targets. Unlike the envelope savings method, which physically segregates cash into categories, AI technology offers dynamic, real-time optimization of funds allocation, maximizing savings potential and financial discipline.

Thematic Savings Pods

Thematic Savings Pods enhance goal-based savings by organizing funds into specific categories aligned with financial objectives, increasing clarity and motivation. This method contrasts with the Envelope Savings approach, which allocates cash into physical envelopes without explicit themes, potentially limiting focused progress tracking and targeted financial growth.

Dynamic Rule-Based Saving

Dynamic rule-based saving in goal-based savings allows users to automatically allocate funds to specific objectives based on predefined criteria such as income fluctuations, spending habits, or upcoming expenses, enhancing financial discipline and flexibility. This contrasts with the envelope savings method, which rigidly divides cash into fixed categories, limiting adaptability and responsiveness to changing financial priorities.

Hyper-Personalized Jar System

The Hyper-Personalized Jar System enhances the Envelope Savings Method by digitally segmenting funds into multiple goal-oriented jars, allowing precise allocation based on individual financial objectives and spending habits. This method offers superior customization compared to traditional Goal-Based Savings, enabling dynamic adjustments and real-time tracking for optimized financial discipline.

Gamified Envelope Challenges

Gamified envelope challenges enhance the traditional envelope savings method by incorporating interactive goals and rewards, increasing user engagement and motivation to save consistently. This approach leverages behavioral finance principles to turn mundane saving tasks into fun, achievable challenges, driving higher savings rates compared to standard goal-based saving strategies.

Goal-Based Savings vs Envelope Savings Method for savings. Infographic

moneydiff.com

moneydiff.com