A physical piggy bank offers a tangible way to save money, making it easier to visualize progress and control spending habits. In contrast, the digital envelope system provides enhanced organization by categorizing funds for specific goals, streamlining budget management through apps or software. Both methods encourage disciplined saving but cater to different preferences for managing finances and tracking progress.

Table of Comparison

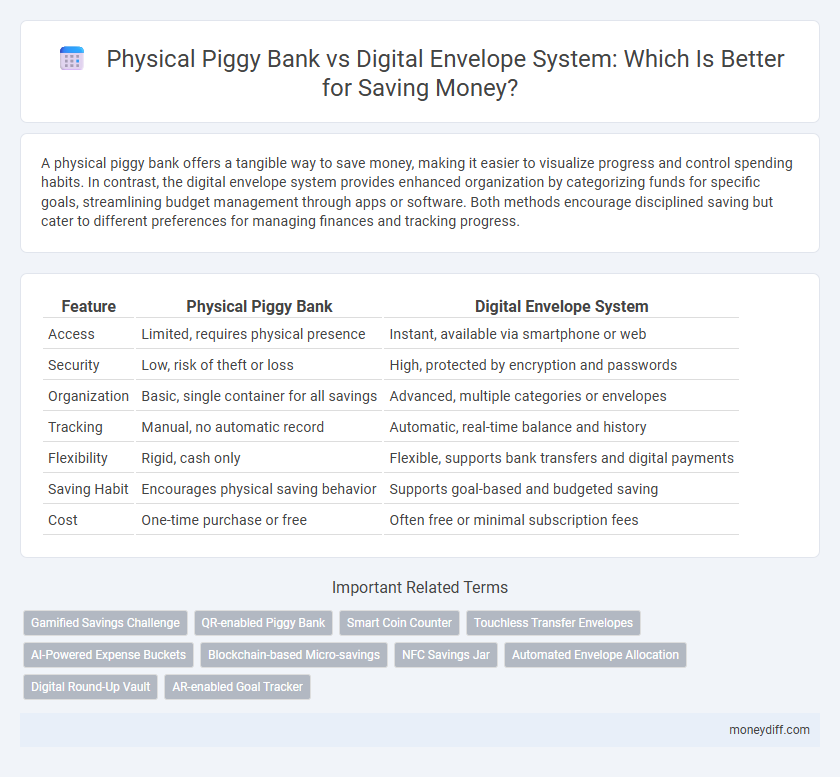

| Feature | Physical Piggy Bank | Digital Envelope System |

|---|---|---|

| Access | Limited, requires physical presence | Instant, available via smartphone or web |

| Security | Low, risk of theft or loss | High, protected by encryption and passwords |

| Organization | Basic, single container for all savings | Advanced, multiple categories or envelopes |

| Tracking | Manual, no automatic record | Automatic, real-time balance and history |

| Flexibility | Rigid, cash only | Flexible, supports bank transfers and digital payments |

| Saving Habit | Encourages physical saving behavior | Supports goal-based and budgeted saving |

| Cost | One-time purchase or free | Often free or minimal subscription fees |

Introduction to Traditional and Digital Savings Methods

Physical piggy banks offer a tactile, visual method for managing savings, encouraging disciplined coin and cash-saving habits often favored by children and minimal spenders. Digital envelope systems enhance financial organization by allocating funds into virtual categories, providing real-time tracking and flexible access via mobile apps, which appeals to tech-savvy users aiming for detailed budget control. Both methods serve foundational roles in personal finance, with physical piggy banks emphasizing simplicity and digital envelopes prioritizing efficiency and adaptability.

Overview of Physical Piggy Banks

Physical piggy banks offer a tactile and visual method for saving money, often made from ceramic, plastic, or metal materials. They provide an immediate sense of progress as users can see and physically add coins or bills, promoting consistent saving habits. Despite limitations like lack of interest accrual and vulnerability to loss or theft, physical piggy banks remain a popular, straightforward tool for encouraging disciplined financial behavior.

Understanding the Digital Envelope System

The Digital Envelope System organizes savings by allocating specific amounts of money into virtual categories that mirror physical envelopes, enhancing budget control and spending awareness. Unlike physical piggy banks, this method integrates with online banking and mobile apps, allowing real-time tracking and adjustments to savings goals. Users benefit from automated reminders and detailed expenditure reports that foster disciplined saving habits and financial planning.

Security: Physical vs Digital Savings

Physical piggy banks offer tangible security through controlled access and no reliance on internet connectivity, reducing risks of hacking or cyber theft. Digital envelope systems implement advanced encryption and multi-factor authentication, providing robust protection against unauthorized access while enabling real-time monitoring and alerts. Choosing between physical and digital savings security depends on balancing convenience, accessibility, and susceptibility to different types of threats.

Accessibility and Convenience Comparison

Physical piggy banks offer tactile engagement and immediate access for small, frequent savings but lack portability and require manual management. Digital envelope systems provide seamless accessibility via smartphones or computers, enabling instant transfers, automated budgeting, and real-time tracking for enhanced convenience. The digital approach supports multi-account integration and secure, remote access, surpassing the physical piggy bank's limitations in flexibility and efficiency.

Tracking and Managing Savings Goals

A digital envelope system offers precise tracking and easy categorization of savings goals, allowing users to allocate funds to specific purposes with real-time updates. Physical piggy banks provide a tangible way to save money but lack detailed tracking and can hinder goal management due to limited visibility of progress. Advanced savings apps integrate automatic notifications and spending reports, enhancing goal adherence and simplifying adjustments compared to manual methods.

Teaching Financial Discipline: Piggy Banks vs Digital Envelopes

Physical piggy banks provide a tangible method to teach children financial discipline by allowing them to see and feel their savings grow. Digital envelope systems enhance this learning by categorizing funds into specific spending targets, promoting deliberate budgeting and goal-setting. Both tools encourage regular saving habits but the digital approach offers real-time tracking and flexibility for adapting to changing financial priorities.

Costs and Setup Requirements

Physical piggy banks require a one-time purchase cost, typically under $20, and no technology setup, making them ideal for users seeking simplicity and low initial investment. Digital envelope systems often involve subscription fees or app purchases ranging from $5 to $15 per month, alongside setup steps like account linking and digital budgeting configuration. While physical options have minimal ongoing costs, digital systems provide enhanced tracking and customization but require smartphone or internet access.

Ideal Users for Each Savings Method

Physical piggy banks are ideal for children and individuals who benefit from tangible, visual reinforcement of savings goals, promoting discipline through physical interaction. Digital envelope systems suit tech-savvy savers who prefer automated budget tracking and flexibility across multiple spending categories, enhancing financial organization. Each method aligns with different user behaviors, where physical banks emphasize simplicity and habit formation, while digital envelopes cater to detailed financial planning and accessibility.

Choosing the Best Savings Solution for You

Choosing the best savings solution depends on your personal financial habits and goals. A physical piggy bank offers tangible, visual cues that can help reinforce saving discipline, especially for short-term goals, while digital envelope systems provide enhanced budgeting tools and real-time tracking ideal for detailed financial planning. Evaluating factors like ease of access, security, and the ability to monitor progress will guide you in selecting between traditional saving methods and modern digital platforms.

Related Important Terms

Gamified Savings Challenge

Physical piggy banks provide a tactile and visual way to save money, enhancing motivation through tangible progress, while digital envelope systems offer interactive gamified savings challenges with instant feedback and rewards to boost user engagement. Gamified features such as points, badges, and leaderboards in digital platforms increase consistent saving behaviors by turning financial discipline into an enjoyable and competitive experience.

QR-enabled Piggy Bank

QR-enabled piggy banks combine tangible saving habits with digital convenience, allowing users to scan codes for instant tracking and transferring of funds, enhancing engagement and control. This hybrid approach offers secure, real-time savings management compared to traditional physical piggy banks and purely digital envelope systems, making saving more interactive and accessible.

Smart Coin Counter

A smart coin counter in a physical piggy bank streamlines saving by automatically tallying coins, providing instant feedback on progress without manual counting. In contrast, a digital envelope system leverages software algorithms to allocate funds into virtual categories, enabling precise budgeting and real-time tracking on mobile devices.

Touchless Transfer Envelopes

Touchless transfer envelopes in digital envelope systems enable seamless, contact-free allocation of funds across savings categories, enhancing transaction speed and reducing physical handling risks. Unlike physical piggy banks, these systems offer real-time balance tracking and automated fund transfers, optimizing financial management with greater accuracy and convenience.

AI-Powered Expense Buckets

AI-powered expense buckets in a digital envelope system enhance savings by automatically categorizing transactions and optimizing budget allocation, offering precise control over spending categories compared to a physical piggy bank. This technology leverages machine learning algorithms to predict future expenses and suggest adjustments, improving financial discipline and goal achievement efficiency.

Blockchain-based Micro-savings

Blockchain-based micro-savings platforms offer enhanced security and transparency compared to traditional physical piggy banks by leveraging decentralized ledgers to track incremental deposits. Digital envelope systems utilize smart contracts to automate savings goals, enabling users to allocate funds efficiently and access real-time balance updates, surpassing the manual limitations of physical storage methods.

NFC Savings Jar

The NFC Savings Jar enhances traditional physical piggy banks by enabling users to track deposits and savings goals digitally through near-field communication technology, combining tactile saving habits with modern financial tracking. This hybrid approach improves accountability and motivation compared to the purely manual method of a physical piggy bank and offers a more intuitive alternative to purely digital envelope budgeting systems.

Automated Envelope Allocation

Automated envelope allocation in digital envelope systems streamlines savings by allowing users to preset specific budget categories and automatically distribute funds, enhancing financial discipline and reducing manual tracking errors. Physical piggy banks lack this automation, requiring manual sorting and limiting efficiency in managing multiple savings goals simultaneously.

Digital Round-Up Vault

Digital Round-Up Vaults automatically accumulate spare change by rounding up each purchase to the nearest dollar, enhancing savings efficiency and consistency. This method leverages technology for seamless micro-savings, outperforming the traditional Physical Piggy Bank's manual deposit approach.

AR-enabled Goal Tracker

An AR-enabled goal tracker integrates seamlessly with a digital envelope system, enhancing savings by visually projecting progress and motivating users through interactive, augmented reality experiences. This innovative tool surpasses traditional physical piggy banks by providing real-time analytics and personalized financial insights, optimizing saving strategies with data-driven precision.

Physical Piggy Bank vs Digital Envelope System for Savings. Infographic

moneydiff.com

moneydiff.com