Traditional bank savings offer security through insured accounts and often provide fixed interest rates, but they may limit access and flexibility. Digital envelope saving tools enhance budgeting by allowing users to allocate funds into specific categories, promoting disciplined spending and saving habits. This method encourages more personalized financial management and real-time tracking compared to conventional savings accounts.

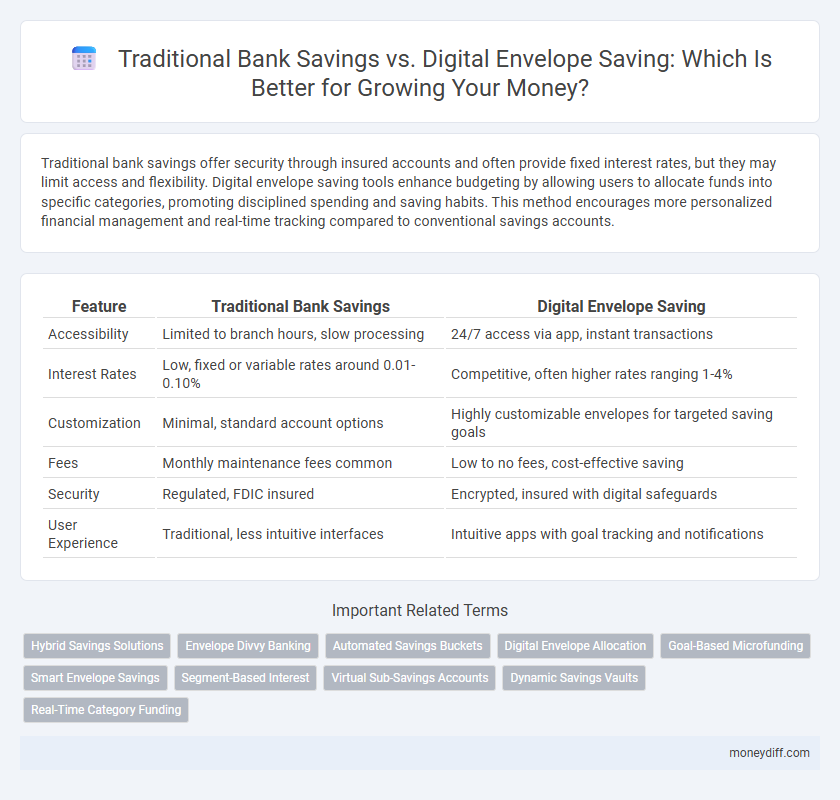

Table of Comparison

| Feature | Traditional Bank Savings | Digital Envelope Saving |

|---|---|---|

| Accessibility | Limited to branch hours, slow processing | 24/7 access via app, instant transactions |

| Interest Rates | Low, fixed or variable rates around 0.01-0.10% | Competitive, often higher rates ranging 1-4% |

| Customization | Minimal, standard account options | Highly customizable envelopes for targeted saving goals |

| Fees | Monthly maintenance fees common | Low to no fees, cost-effective saving |

| Security | Regulated, FDIC insured | Encrypted, insured with digital safeguards |

| User Experience | Traditional, less intuitive interfaces | Intuitive apps with goal tracking and notifications |

Overview: Traditional Bank Savings vs. Digital Envelope Saving

Traditional bank savings accounts offer secure, interest-bearing deposits with easy access through branches and ATMs, typically providing steady, low-risk growth. Digital envelope saving systems allocate funds into customizable categories or "envelopes," enhancing budget management and spending control through mobile apps with real-time tracking and notifications. Comparing both, traditional savings emphasize safety and simplicity, while digital envelope saving prioritizes personalized financial organization and adaptive money management tools.

Understanding Traditional Bank Savings Accounts

Traditional bank savings accounts offer a secure and regulated method to store funds with interest rates typically ranging from 0.01% to 0.10% annually, depending on the institution and account type. These accounts provide easy access through ATMs, online banking, and branch services while ensuring federal insurance protection up to $250,000 by the FDIC in the United States or equivalent agencies globally. However, traditional savings often lack the budgeting flexibility and spending categorization features found in digital envelope-saving systems that allocate funds into specific goal-based categories.

What Is Digital Envelope Saving?

Digital envelope saving is a budgeting method that allocates funds into virtual categories or "envelopes" for specific expenses or financial goals, enhancing spending discipline and financial organization. Unlike traditional bank savings that simply accumulate money in a single account, digital envelope systems provide real-time tracking and flexible fund management through mobile apps. This approach improves cash flow visibility and helps users adhere to budget limits while optimizing savings strategies.

Accessibility and Convenience: A Comparative Analysis

Traditional bank savings often require physical branch visits and standard business hours, limiting accessibility and convenience for many users. Digital envelope saving platforms offer 24/7 access through mobile apps, enabling instant allocation of funds into categorized virtual envelopes for tailored budgeting. This digital approach enhances user convenience by streamlining savings management, reducing reliance on in-person transactions, and providing real-time monitoring and adjustments.

Security Features: Traditional vs. Digital Methods

Traditional bank savings rely heavily on robust regulatory frameworks, FDIC insurance, and physical branch security to protect deposits, ensuring a high level of trust and protection against fraud. Digital envelope saving methods utilize advanced encryption technologies, multi-factor authentication, and real-time transaction monitoring to enhance security and provide users with immediate control over their funds. While traditional methods emphasize institutional reliability and insured deposits, digital solutions prioritize agile, user-centric security protocols that reduce the risk of cyber threats and unauthorized access.

Budgeting and Goal-Setting Capabilities

Traditional bank savings accounts provide limited budgeting tools and generic interest rates, making goal-setting more manual and less personalized. Digital envelope savings offer advanced budgeting capabilities by allocating funds into specific categories or goals, with real-time tracking and automated transfers enhancing disciplined saving habits. These digital solutions leverage AI-driven insights to optimize savings strategies aligned with user-defined financial objectives.

Fees and Interest Rates: What to Expect

Traditional bank savings accounts typically have lower interest rates and may charge maintenance fees that reduce overall returns, whereas digital envelope savings platforms often offer higher interest rates by minimizing operational costs and using automated budgeting tools. Fees in digital envelope savings are usually transparent and may be lower or nonexistent, allowing savers to maximize growth potential. Understanding fee structures and interest rate benefits is essential for choosing the most cost-effective savings option.

Tracking Progress and Financial Transparency

Traditional bank savings provide a straightforward overview of account balances but often lack real-time tracking and detailed categorization, making it harder to monitor specific savings goals. Digital envelope saving apps offer enhanced financial transparency by allowing users to allocate funds into distinct categories or envelopes, track progress visually, and receive instant updates on spending and saving habits. This granular level of monitoring supports more precise budgeting and increases accountability for achieving financial objectives.

User Experience: Which Method Fits Your Lifestyle?

Traditional bank savings offer familiarity and in-person support but often involve longer processing times and limited flexibility. Digital envelope saving apps provide a seamless, intuitive user experience with instant fund allocation and easy budgeting tools tailored for on-the-go lifestyles. Choosing between the two depends on whether you prioritize personalized service or real-time financial control and convenience.

Choosing the Right Savings Method for You

Traditional bank savings accounts offer stable interest rates and FDIC insurance, providing security and predictable growth for long-term funds. Digital envelope saving apps allow users to allocate money into specific categories, enhancing budgeting discipline and making it easier to manage short-term expenses. Selecting the right savings method depends on your financial goals, with traditional accounts suited for steady accumulation and digital envelopes ideal for organized, goal-oriented saving.

Related Important Terms

Hybrid Savings Solutions

Hybrid savings solutions combine traditional bank savings accounts with digital envelope saving methods, enhancing flexibility and personalized budgeting. This approach leverages secure, interest-bearing accounts alongside app-based goal tracking and spending categorization, optimizing both financial growth and disciplined saving habits.

Envelope Divvy Banking

Traditional bank savings often offer minimal interest rates and limited budgeting tools, whereas Digital Envelope Saving platforms like Envelope Divvy Banking provide automated, goal-oriented budget management with higher interest benefits and real-time analytics to optimize savings growth. Envelope Divvy Banking's innovative envelope system allocates funds into virtual categories, enhancing financial discipline and maximizing returns through personalized saving strategies tailored to user needs.

Automated Savings Buckets

Traditional bank savings accounts offer basic interest rates with limited organization options, while digital envelope savings platforms utilize automated savings buckets to allocate funds into designated categories, enhancing budgeting and goal tracking. This automated segmentation increases saving efficiency by enabling users to set specific targets, receive real-time progress updates, and manage multiple financial goals simultaneously.

Digital Envelope Allocation

Digital envelope savings enable precise allocation of funds into categorized virtual envelopes, enhancing budget management and goal tracking compared to traditional bank savings that aggregate money without detailed segmentation. This method leverages real-time adjustments and automated transfers to optimize spending habits and improve financial discipline.

Goal-Based Microfunding

Traditional bank savings focus on accumulating interest over time with fixed or variable rates, often lacking tailored solutions for specific financial goals, while digital envelope saving platforms enable goal-based microfunding by allowing users to allocate small amounts of money into customizable virtual envelopes for targeted savings objectives, improving budgeting discipline and financial transparency. Goal-based digital envelope saving enhances microfunding by providing real-time tracking, automated transfers, and personalized notifications, which help users achieve specific savings targets more efficiently than generic traditional savings accounts.

Smart Envelope Savings

Smart Envelope Savings offers a flexible and automated budgeting system that digitally allocates funds into categorized envelopes, enhancing spending control compared to traditional bank savings accounts with fixed interest rates. This method maximizes savings efficiency by providing real-time tracking and customized goals, making it ideal for users seeking tailored financial management without sacrificing liquidity.

Segment-Based Interest

Traditional bank savings accounts often offer uniform interest rates regardless of customer segmentation, limiting personalized growth potential. Digital envelope saving platforms utilize segment-based interest models, providing tailored rates that maximize returns by aligning with user-specific saving behaviors and financial goals.

Virtual Sub-Savings Accounts

Virtual sub-savings accounts offer enhanced flexibility by allowing users to allocate funds into multiple digital envelopes for specific goals, unlike traditional bank savings that typically provide a single pooled balance with limited categorization. This digital envelope saving approach improves financial organization, encourages disciplined budgeting, and often includes real-time tracking and automated transfers, features not commonly available in conventional banking savings accounts.

Dynamic Savings Vaults

Traditional bank savings offer fixed interest rates with limited flexibility, whereas Digital Envelope Savings leverage Dynamic Savings Vaults that enable users to allocate funds into customizable, goal-oriented sub-accounts with real-time adjustments and automated transfers. This innovative approach maximizes savings efficiency by optimizing cash flow management and increasing potential interest earnings through personalized, adaptable saving strategies.

Real-Time Category Funding

Traditional bank savings often lack real-time category funding, resulting in slower allocation of funds to specific financial goals. Digital envelope saving platforms enable instant categorization and allocation of savings, enhancing budgeting efficiency and financial control.

Traditional bank savings vs Digital envelope saving for savings. Infographic

moneydiff.com

moneydiff.com