Traditional piggy banks offer a tactile and visual way to save money, encouraging discipline through physical cash deposits. Digital envelopes streamline savings by allowing users to categorize and track funds electronically, providing real-time insights and easy access via mobile apps. While piggy banks build foundational saving habits, digital envelopes enhance financial management with convenience and organized budgeting.

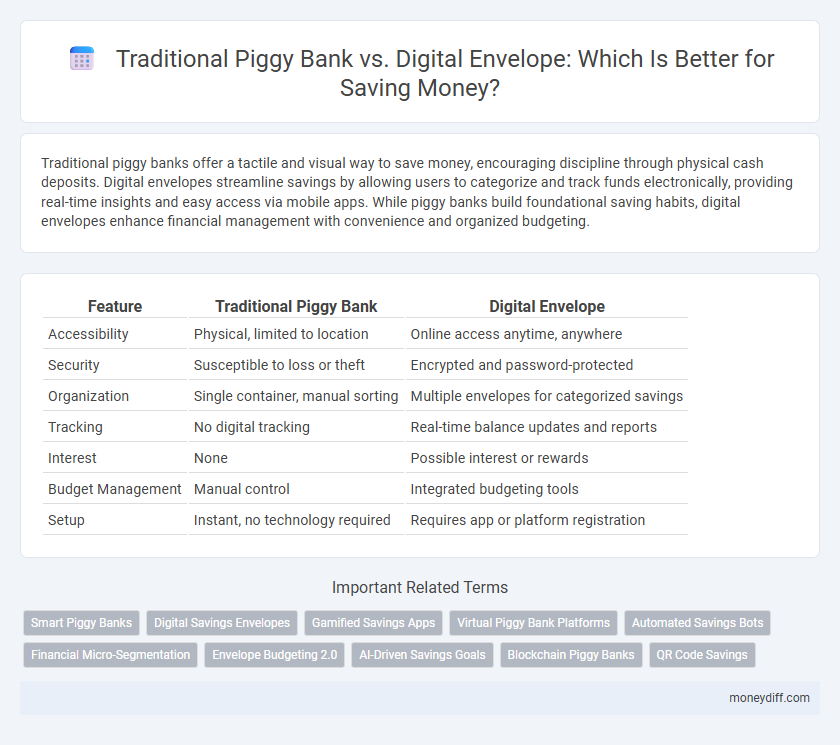

Table of Comparison

| Feature | Traditional Piggy Bank | Digital Envelope |

|---|---|---|

| Accessibility | Physical, limited to location | Online access anytime, anywhere |

| Security | Susceptible to loss or theft | Encrypted and password-protected |

| Organization | Single container, manual sorting | Multiple envelopes for categorized savings |

| Tracking | No digital tracking | Real-time balance updates and reports |

| Interest | None | Possible interest or rewards |

| Budget Management | Manual control | Integrated budgeting tools |

| Setup | Instant, no technology required | Requires app or platform registration |

Introduction: Comparing Savings Methods

Traditional piggy banks offer a simple, tangible way to save physical cash, promoting visual spending discipline and easy access. Digital envelopes enable users to allocate funds into specific virtual categories, enhancing budget management through real-time tracking and automated transfers. Choosing between these methods depends on preferences for physical saving habits versus digital financial organization and convenience.

The Origins of the Traditional Piggy Bank

The traditional piggy bank traces its origins to the Middle Ages when people used inexpensive orange clay called "pygg" to make household containers for saving coins. Over time, the term "pygg bank" evolved into "piggy bank," leading to the popular pig-shaped design that symbolizes saving money. This physical saving method contrasts with modern digital envelopes, which provide categorized virtual savings with enhanced flexibility and accessibility.

How Digital Envelope Systems Work

Digital envelope systems allocate specific budget categories into virtual "envelopes" within an app, enabling precise tracking of spending and savings goals. Users can set limits for each envelope, and transactions automatically update balances, enhancing financial discipline without the need for physical cash. Real-time synchronization with bank accounts provides instant updates, improving budgeting accuracy and promoting better money management compared to traditional piggy banks.

Security: Physical vs Digital Savings

Traditional piggy banks provide tangible security through physical storage, limiting access to cash but are vulnerable to theft or loss due to lack of encryption or backup. Digital envelopes offer enhanced security features such as password protection, encryption, and remote access, reducing physical risks and enabling safer management of savings. However, digital savings require vigilance against cyber threats and depend on secure technology infrastructure for optimal protection.

Accessibility and Convenience Factors

Traditional piggy banks offer tactile savings experiences but limit accessibility to physical retrieval and in-person deposits. Digital envelopes enhance convenience by allowing instant deposits, real-time balance monitoring, and easy transfers via smartphones or computers. This accessibility enables more flexible and frequent savings management, aligning with modern financial habits.

Teaching Kids about Money: Which is Better?

Traditional piggy banks offer a tactile way for kids to physically see and manage money, fostering basic counting skills and savings habits. Digital envelopes provide interactive features that can teach budgeting, goal setting, and real-time tracking, making money management more engaging and relevant to today's technology-driven world. Combining both methods can create a comprehensive approach, blending hands-on experience with digital financial literacy for children.

Tracking Progress: Manual vs Automated

Traditional piggy banks require manual tracking of savings progress, relying on physical counting and memory, which can lead to inaccuracies and overlooked contributions. Digital envelopes automate the tracking process by instantly updating balances, providing real-time insights and detailed spending reports that enhance budgeting precision. Automated savings tools integrate with financial apps, ensuring consistent monitoring and encouraging disciplined saving habits.

Interest and Growth Opportunities

Traditional piggy banks offer a secure but stagnant way to save money, with no interest or growth potential. Digital envelopes, often integrated with fintech platforms, enable users to allocate funds into high-yield savings accounts or investment options, maximizing interest and growth opportunities. These digital tools leverage compound interest and diversified portfolios to significantly increase savings over time compared to static cash storage.

Costs and Fees: Old School vs Modern Solutions

Traditional piggy banks require no fees or ongoing costs, making them an entirely free savings method but lack security and accessibility. Digital envelopes offer flexible budgeting with low to moderate fees depending on the app or platform, often including subscription costs or transaction charges. Modern solutions provide enhanced tracking and easier access but may incur expenses not present in old school piggy banks.

Choosing the Right Savings Method for You

Choosing the right savings method depends on your financial goals and habits; traditional piggy banks offer a tactile, visual way to save small amounts, ideal for children or casual savers. Digital envelopes provide segmented budgeting tools that help allocate funds more efficiently across multiple categories, enhancing control and tracking. Evaluating your preference for physical interaction versus digital convenience can optimize your saving strategy and improve financial discipline.

Related Important Terms

Smart Piggy Banks

Smart piggy banks combine traditional saving habits with digital technology, offering features like automatic coin recognition and app integration to track savings goals effectively. These devices enhance financial discipline by providing real-time feedback and customizable envelopes, bridging the gap between analog saving methods and modern digital budgeting tools.

Digital Savings Envelopes

Digital savings envelopes offer precise budget allocation and real-time tracking, enabling users to categorize funds for specific goals with automated transfers and spending notifications. Unlike traditional piggy banks, digital envelopes enhance financial discipline through customizable alerts and seamless integration with banking apps, promoting smarter, goal-oriented savings habits.

Gamified Savings Apps

Gamified savings apps enhance traditional piggy banks by using digital envelopes to categorize funds, making saving engaging and goal-oriented through rewards and progress tracking. These apps leverage behavioral psychology techniques to increase user motivation, resulting in more consistent saving habits compared to the physical, static nature of traditional piggy banks.

Virtual Piggy Bank Platforms

Virtual piggy bank platforms enhance savings by providing a digital envelope system that allows users to allocate funds into specific categories, promoting disciplined financial management and goal-oriented saving. These platforms offer real-time tracking, automated transfers, and personalized insights, making them superior to traditional piggy banks in convenience and efficiency.

Automated Savings Bots

Automated savings bots integrated with digital envelopes enable precise, scheduled transfers that optimize saving habits by leveraging user-defined goals and spending patterns. Unlike traditional piggy banks, these bots provide real-time tracking, adaptive adjustments, and enhanced security, significantly improving the efficiency and consistency of personal savings.

Financial Micro-Segmentation

Traditional piggy banks offer a tactile method for small-scale savings but lack the precision and customization found in digital envelope systems, which enable detailed financial micro-segmentation by categorizing funds into specific spending or saving goals. Digital envelope tools use data analytics to optimize budget allocation, track progress in real time, and adjust spending limits, enhancing personalized financial management compared to the one-size-fits-all approach of traditional piggy banks.

Envelope Budgeting 2.0

Envelope Budgeting 2.0 revolutionizes savings by replacing the physical limitations of traditional piggy banks with dynamic digital envelopes that allocate funds for specific goals with real-time tracking and automatic adjustments. This method enhances financial discipline by providing personalized spending insights and seamless integration with banking apps, maximizing savings efficiency.

AI-Driven Savings Goals

Traditional piggy banks offer a tangible method for saving money but lack personalized insights, while AI-driven digital envelopes leverage machine learning algorithms to analyze spending patterns and optimize savings goals dynamically. By using AI technology, digital envelopes provide real-time recommendations and automated adjustments that enhance financial discipline and accelerate goal achievement.

Blockchain Piggy Banks

Blockchain piggy banks offer enhanced security and transparency compared to traditional piggy banks by utilizing decentralized ledgers to securely track and manage savings. Digital envelopes leverage smart contracts to automate savings goals and withdrawals, providing users with improved control and flexibility over their financial planning.

QR Code Savings

Traditional piggy banks offer a physical method for saving coins but lack the convenience and tracking capabilities of digital envelopes, which utilize QR code savings to enable seamless transfers and real-time balance monitoring. QR code savings enhance security and accessibility by allowing instant deposits and withdrawals through smartphone scanning, making budget management more efficient and transparent.

Traditional piggy bank vs Digital envelope for savings. Infographic

moneydiff.com

moneydiff.com