Passbook savings offer a traditional, low-risk way to store funds with guaranteed interest rates and easy bank access, ideal for conservative savers. Crypto stablecoin savings provide higher yield opportunities through decentralized finance platforms but come with increased volatility and regulatory uncertainty. Choosing between them depends on risk tolerance, desired liquidity, and the importance of stable returns versus potential growth.

Table of Comparison

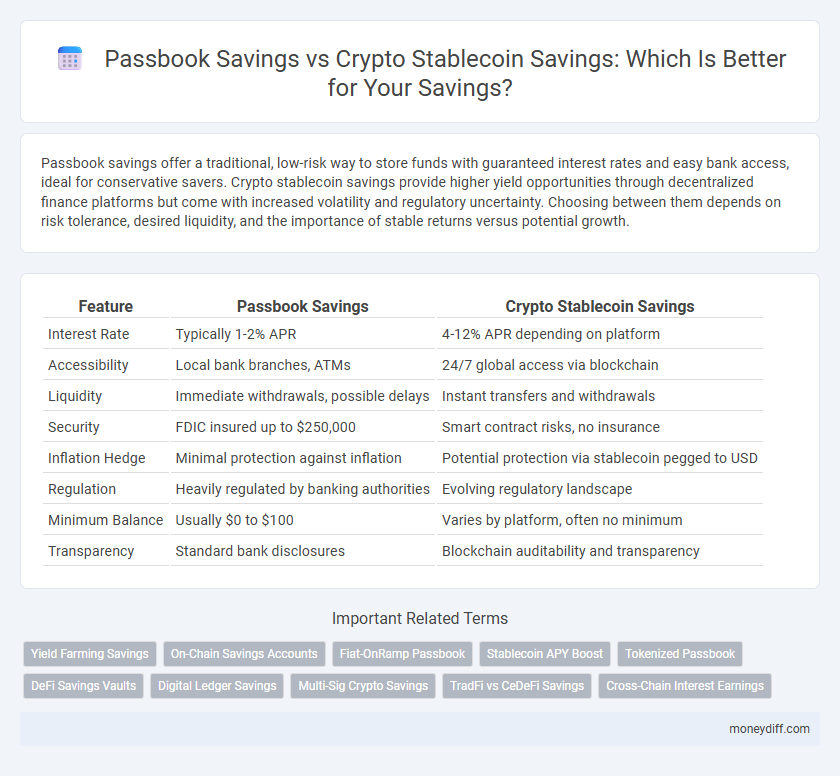

| Feature | Passbook Savings | Crypto Stablecoin Savings |

|---|---|---|

| Interest Rate | Typically 1-2% APR | 4-12% APR depending on platform |

| Accessibility | Local bank branches, ATMs | 24/7 global access via blockchain |

| Liquidity | Immediate withdrawals, possible delays | Instant transfers and withdrawals |

| Security | FDIC insured up to $250,000 | Smart contract risks, no insurance |

| Inflation Hedge | Minimal protection against inflation | Potential protection via stablecoin pegged to USD |

| Regulation | Heavily regulated by banking authorities | Evolving regulatory landscape |

| Minimum Balance | Usually $0 to $100 | Varies by platform, often no minimum |

| Transparency | Standard bank disclosures | Blockchain auditability and transparency |

Introduction to Passbook Savings and Crypto Stablecoin Savings

Passbook savings accounts offer traditional, government-insured deposits with fixed interest rates, making them a low-risk option for steady growth. In contrast, crypto stablecoin savings leverage blockchain technology to provide potentially higher yields through decentralized financial protocols, while maintaining price stability by pegging tokens to fiat currencies. Both methods cater to different risk appetites and liquidity preferences, reflecting evolving trends in the savings landscape.

How Passbook Savings Accounts Work

Passbook savings accounts function through physical or digital passbooks that record deposits, withdrawals, and interest earnings, providing a straightforward way to track savings without requiring online access. These accounts typically offer fixed interest rates insured by government entities like the FDIC, ensuring security and predictable growth. Unlike crypto stablecoin savings, passbook savings avoid volatility and market risks, appealing to conservative savers prioritizing stability and regulatory protection.

What are Crypto Stablecoin Savings Accounts?

Crypto stablecoin savings accounts offer a way to earn interest by holding stablecoins pegged to fiat currencies, providing more yield compared to traditional passbook savings accounts with low fixed interest rates. These accounts leverage blockchain technology to enable faster transactions, higher liquidity, and often feature interest rates ranging from 4% to 12%, far surpassing the 0.01% to 0.5% rates typical in passbook savings. Stablecoin savings reduce volatility risk compared to other cryptocurrencies while offering the security of decentralized finance protocols and transparent smart contract operations.

Comparing Interest Rates: Passbook vs Stablecoin Savings

Passbook savings accounts typically offer interest rates between 0.01% and 1%, reflecting traditional banking constraints and FDIC insurance. In contrast, crypto stablecoin savings platforms can provide significantly higher yields ranging from 5% to 15%, driven by decentralized finance (DeFi) protocols and liquidity incentives. However, the higher interest rates on stablecoin savings come with increased risk factors such as market volatility and regulatory uncertainties.

Safety and Security: Traditional Banks vs Crypto Platforms

Passbook savings accounts in traditional banks offer regulated security features, FDIC insurance up to $250,000, and established fraud protections, ensuring depositor funds are safeguarded against loss. Crypto stablecoin savings platforms, while offering potentially higher returns, expose users to smart contract vulnerabilities, platform insolvency risks, and lack federal insurance protections. Choosing between these options depends on prioritizing either regulatory-backed safety or the innovative, yet riskier, decentralized finance environment.

Accessibility and Ease of Use for Savers

Passbook savings accounts provide easy access through physical bank branches and ATMs, making them beginner-friendly for savers who prefer traditional methods. Crypto stablecoin savings offer seamless digital accessibility via mobile apps and online platforms, enabling instant transactions without geographical restrictions. While passbook savings rely on banking hours and locations, stablecoin savings grant 24/7 access with minimal user interface complexity for tech-savvy individuals.

Risk Factors: Market Volatility and Regulatory Concerns

Passbook savings accounts offer stable, FDIC-insured returns with minimal market risk, making them a low-risk option for preserving capital. Crypto stablecoin savings, while providing higher interest rates, expose investors to market volatility and fluctuating regulatory frameworks that can impact asset security and liquidity. Regulatory uncertainties surrounding stablecoins increase the risk of sudden restrictions or devaluations, unlike the predictable legal protections of traditional savings.

Deposit Insurance and Protection Mechanisms

Passbook savings accounts are typically insured by government agencies such as the FDIC or NCUA, guaranteeing deposits up to $250,000 per account holder and providing a secure safety net against bank failures. Crypto stablecoin savings lack federal deposit insurance, relying instead on smart contract security, collateral reserves, and centralized custodial safeguards, which expose them to risks like hacking, regulatory changes, and platform insolvency. Investors should carefully weigh the robust protection mechanisms of passbook accounts against the higher yield potential but increased risk profile of stablecoin savings.

Transaction Fees and Hidden Costs Comparison

Passbook savings accounts typically have low or no transaction fees, making them cost-effective for frequent deposits and withdrawals, whereas crypto stablecoin savings often incur network fees that vary based on blockchain activity. Hidden costs in passbook savings are minimal, primarily limited to maintenance fees, while stablecoin savings can include costs related to gas fees, exchange spreads, and wallet management. Comparing transaction fees and hidden costs reveals passbook savings as a more predictable, low-cost option, whereas crypto stablecoin savings can offer higher yields offset by variable and sometimes substantial fees.

Which Savings Option is Right for You?

Passbook savings accounts offer low-risk, FDIC-insured deposits with stable interest rates ideal for conservative savers prioritizing security and liquidity. Crypto stablecoin savings provide higher potential yields through decentralized finance platforms but come with increased volatility and regulatory uncertainty. Choosing the right option depends on your risk tolerance, desired returns, and preference for traditional banking security versus innovative digital asset exposure.

Related Important Terms

Yield Farming Savings

Passbook savings accounts offer low, fixed interest rates with high liquidity and FDIC insurance, providing secure but minimal returns. Crypto stablecoin savings through yield farming deliver significantly higher yields by leveraging decentralized finance protocols, though they carry increased risks such as smart contract vulnerabilities and market volatility.

On-Chain Savings Accounts

On-chain savings accounts using crypto stablecoins offer higher interest rates and enhanced liquidity compared to traditional passbook savings, enabling instant access and secure, transparent transactions on blockchain networks. Unlike passbook savings that rely on banks and fixed rates, stablecoin savings leverage decentralized finance protocols to optimize yields with reduced counterparty risk.

Fiat-OnRamp Passbook

Fiat On-Ramp Passbook savings offer a secure, interest-bearing account backed by traditional banks and government insurance, ensuring stable returns without market volatility. Unlike crypto stablecoin savings, which can expose funds to regulatory risks and platform liquidity issues, Fiat On-Ramp Passbook facilitates seamless fiat currency deposits and withdrawals with transparent interest rates, ideal for conservative savers seeking reliability.

Stablecoin APY Boost

Stablecoin savings offer significantly higher APY compared to traditional passbook savings accounts, often providing returns ranging from 6% to 12% annually due to DeFi protocols and staking opportunities. Unlike passbook savings with minimal interest rates typically below 1%, stablecoin savings combine the stability of pegged assets like USDC or DAI with enhanced yield generation, making them attractive for maximizing passive income.

Tokenized Passbook

Tokenized Passbook savings offer a secure, transparent alternative to traditional passbook savings by leveraging blockchain technology for instant verification and low transaction costs, while crypto stablecoin savings provide high liquidity and potentially higher yields but carry volatility and regulatory risks. Choosing Tokenized Passbook savings maximizes asset protection through regulatory compliance and fixed-interest returns, making it ideal for conservative savers seeking digital innovation without exposure to crypto market fluctuations.

DeFi Savings Vaults

Passbook savings accounts offer low volatility and government-backed security but typically yield lower interest rates compared to DeFi savings vaults utilizing crypto stablecoins, which provide higher APYs through decentralized finance protocols. DeFi savings vaults leverage smart contracts and liquidity pools to generate passive income, though they carry risks such as smart contract vulnerabilities and market fluctuations absent in traditional passbook savings.

Digital Ledger Savings

Passbook savings accounts offer traditional, regulated security with fixed interest rates ideal for conservative savers, while crypto stablecoin savings leverage blockchain technology and digital ledger systems to provide higher yields through decentralized finance platforms. Digital ledger savings enable transparent, real-time transaction tracking and smart contract automation, enhancing liquidity and accessibility compared to conventional passbook methods.

Multi-Sig Crypto Savings

Passbook savings offer traditional security with FDIC insurance but limited interest rates, while multi-sig crypto stablecoin savings enable decentralized custody and require multiple approvals for transactions, enhancing security and reducing risks of single-point failures. Multi-signature wallets also provide faster access to digital assets and exposure to stablecoin yields, often surpassing conventional savings account returns.

TradFi vs CeDeFi Savings

Passbook savings accounts offer low-risk, interest-bearing deposits insured by traditional banks, ensuring capital protection and steady returns within the TradFi ecosystem. Crypto stablecoin savings, facilitated by CeDeFi platforms, provide higher yield opportunities through decentralized finance protocols but carry increased market volatility and regulatory risks compared to conventional passbook savings.

Cross-Chain Interest Earnings

Passbook savings accounts offer steady interest through traditional banking systems but lack cross-chain functionality, limiting diversification opportunities. Crypto stablecoin savings enable cross-chain interest earnings by leveraging multiple blockchain protocols, maximizing returns through decentralized finance platforms.

Passbook savings vs Crypto stablecoin savings for savings. Infographic

moneydiff.com

moneydiff.com