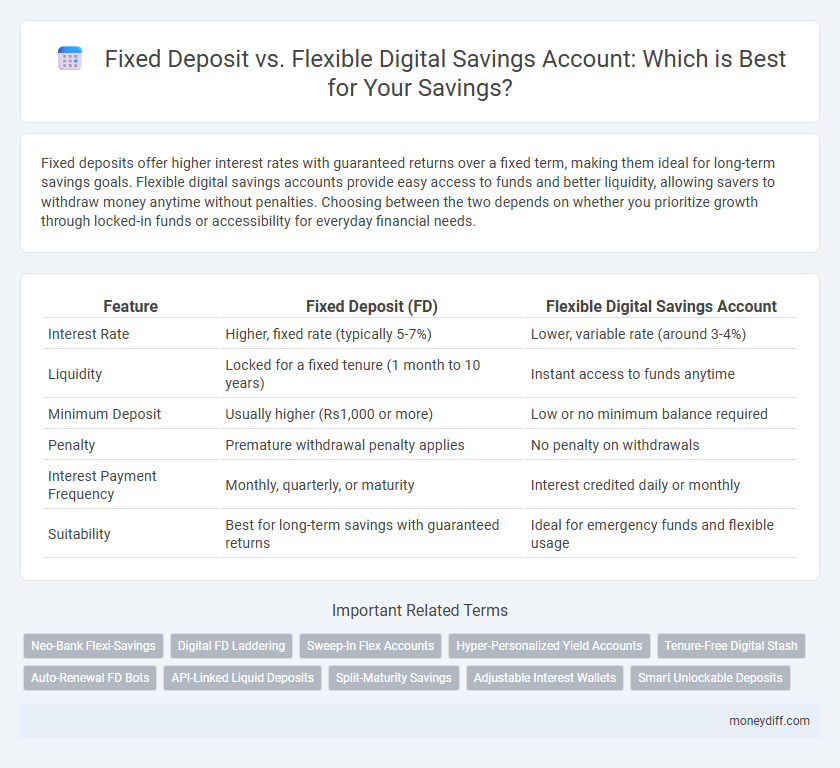

Fixed deposits offer higher interest rates with guaranteed returns over a fixed term, making them ideal for long-term savings goals. Flexible digital savings accounts provide easy access to funds and better liquidity, allowing savers to withdraw money anytime without penalties. Choosing between the two depends on whether you prioritize growth through locked-in funds or accessibility for everyday financial needs.

Table of Comparison

| Feature | Fixed Deposit (FD) | Flexible Digital Savings Account |

|---|---|---|

| Interest Rate | Higher, fixed rate (typically 5-7%) | Lower, variable rate (around 3-4%) |

| Liquidity | Locked for a fixed tenure (1 month to 10 years) | Instant access to funds anytime |

| Minimum Deposit | Usually higher (Rs1,000 or more) | Low or no minimum balance required |

| Penalty | Premature withdrawal penalty applies | No penalty on withdrawals |

| Interest Payment Frequency | Monthly, quarterly, or maturity | Interest credited daily or monthly |

| Suitability | Best for long-term savings with guaranteed returns | Ideal for emergency funds and flexible usage |

Understanding Fixed Deposits: The Basics

Fixed deposits offer a secure savings option with a fixed interest rate and tenure, providing guaranteed returns without market risks. Unlike flexible digital savings accounts, fixed deposits require locking in funds for a predetermined period, which can range from a few months to several years. This fixed tenure and interest rate structure ensures predictable growth, making fixed deposits ideal for conservative savers aiming for capital preservation and steady income.

What Is a Flexible Digital Savings Account?

A Flexible Digital Savings Account offers higher liquidity and instant access to funds compared to a traditional Fixed Deposit, which locks money for a fixed term to earn higher interest. This account typically provides competitive interest rates with no penalties for withdrawal, making it ideal for emergency savings and daily transactions. Digital platforms enhance user experience by allowing seamless account management, transfers, and real-time balance updates.

Interest Rates: Fixed Deposit vs Flexible Savings

Fixed Deposit accounts typically offer higher and fixed interest rates, providing guaranteed returns over a specified tenure, making them ideal for long-term savings. Flexible Digital Savings Accounts, while offering lower interest rates, provide liquidity and instant access to funds without penalties. Investors seeking stable growth usually prefer Fixed Deposits, whereas those valuing flexibility and quick withdrawals opt for Digital Savings Accounts.

Liquidity and Access: Comparing Withdrawal Options

Fixed deposits offer higher interest rates but restrict liquidity, allowing withdrawals only after maturity or with penalties. Flexible digital savings accounts provide instant access to funds with no withdrawal limits, enhancing convenience for daily financial needs. For savers prioritizing easy access to money, flexible digital accounts outperform fixed deposits in withdrawal options.

Safety and Security of Your Savings

Fixed Deposits offer a high level of safety with guaranteed returns and protection by government deposit insurance schemes like FDIC or DICGC, ensuring your principal is secure. Flexible Digital Savings Accounts provide insured deposits along with enhanced security features such as two-factor authentication and real-time fraud monitoring. Both options prioritize the safety and security of your savings, but Fixed Deposits emphasize capital protection with fixed interest, while Digital Savings Accounts combine convenience with advanced digital security measures.

Minimum Deposit and Account Opening Requirements

Fixed Deposits typically require a higher minimum deposit, often starting from $500 or more, alongside a rigid account opening process involving physical documentation. Flexible Digital Savings Accounts allow users to open accounts online with minimal or zero minimum deposit, offering convenient, paperless verification. These features make digital savings accounts more accessible for small savers seeking immediate and flexible savings options.

Tenure and Flexibility: Which Suits Your Goals?

Fixed deposits offer a fixed tenure with higher interest rates ideal for long-term savings goals, locking your funds for a specified period. Flexible digital savings accounts provide easier access to funds without penalties, suiting short-term or emergency savings with variable interest rates. Choosing between them depends on whether you prioritize guaranteed returns over flexibility or immediate liquidity over higher fixed interest.

Penalties and Charges: What to Watch Out For

Fixed deposits often impose penalties such as premature withdrawal fees and forfeited interest, which can significantly reduce returns if funds are accessed before maturity. Flexible digital savings accounts typically offer higher liquidity with minimal or no charges on withdrawals, but users should watch out for daily transaction limits and potential inactivity fees. Carefully reviewing the terms for penalties and charges is essential to maximize savings growth and avoid unexpected costs.

Who Should Choose Fixed Deposits?

Fixed deposits suit individuals seeking predictable returns and low risk with a fixed interest rate over a specified tenure, typically ideal for conservative investors or those saving for short- to medium-term financial goals. Savers prioritizing capital protection and willing to lock in funds without needing frequent access benefit from fixed deposits' guaranteed maturity amount and penalty-free interest payments. Those who prefer financial discipline and higher interest rates compared to regular savings accounts should consider fixed deposits as a strategic savings instrument.

Is a Flexible Digital Savings Account Right for You?

A Flexible Digital Savings Account offers higher liquidity and instant access to funds compared to traditional Fixed Deposits, making it ideal for those seeking flexibility in managing their savings. While Fixed Deposits provide higher interest rates and guaranteed returns over a fixed term, digital savings accounts allow for seamless transfers and no penalties on withdrawals. Choose a Flexible Digital Savings Account if you prioritize quick access to your money and prefer an easy-to-manage, digitally accessible savings option.

Related Important Terms

Neo-Bank Flexi-Savings

Neo-Bank Flexi-Savings offers higher liquidity and competitive interest rates compared to traditional Fixed Deposits, allowing instant access to funds without penalty. This flexible digital savings account combines the security of fixed-term deposits with the convenience of digital banking, optimizing returns while maintaining flexibility for savers.

Digital FD Laddering

Digital FD laddering enhances savings growth by allowing staggered fixed deposits with varied maturity dates, maximizing interest earnings while maintaining liquidity. Unlike traditional fixed deposits, a flexible digital savings account linked to laddered FDs provides both higher returns and easy access to funds, balancing stability and flexibility for optimal wealth accumulation.

Sweep-In Flex Accounts

Sweep-In Flex Accounts combine the high-interest benefits of Fixed Deposits with the liquidity of Flexible Digital Savings Accounts, enabling automatic transfer of surplus funds into fixed deposits to maximize returns. This seamless integration offers better interest rates than traditional savings accounts while maintaining easy access to funds without penalties.

Hyper-Personalized Yield Accounts

Fixed Deposits offer guaranteed interest rates with fixed terms, ensuring predictable returns but limited liquidity, while Flexible Digital Savings Accounts with hyper-personalized yield features provide dynamic interest rates tailored to individual spending and saving behaviors, enhancing both flexibility and earning potential. These innovative digital accounts leverage AI-driven analytics to optimize interest earnings based on user profiles, making them an attractive alternative for savers seeking personalized growth without locking funds.

Tenure-Free Digital Stash

Tenure-Free Digital Stash offers unmatched flexibility compared to traditional fixed deposits, allowing savers to access funds anytime without penalties while still earning competitive interest rates. This digital savings account eliminates lock-in periods, making it ideal for users seeking liquidity alongside steady growth.

Auto-Renewal FD Bots

Fixed Deposit accounts offer higher interest rates and secure returns with auto-renewal FD bots that simplify reinvestment without manual intervention, ensuring uninterrupted growth of savings. Flexible Digital Savings Accounts provide easy access to funds with lower interest but lack the automated compounding benefits of auto-renewal FDs, making them ideal for liquidity rather than long-term growth.

API-Linked Liquid Deposits

Fixed deposits offer higher interest rates with locked-in periods, ensuring capital safety but limited liquidity, whereas flexible digital savings accounts with API-linked liquid deposits provide seamless real-time fund access and integration, enhancing cash flow management for businesses and individuals. API connectivity enables automated transfers and instant balance updates, optimizing both savings growth and operational efficiency.

Split-Maturity Savings

Split-maturity savings strategies leverage fixed deposits' higher interest rates by staggering deposit terms to ensure liquidity and optimize returns, while flexible digital savings accounts provide instant access and variable interest rates that adapt to market conditions. Combining these options helps savers balance fixed returns and liquidity, maximizing the benefits of both fixed deposits and flexible digital savings.

Adjustable Interest Wallets

Fixed Deposit accounts offer higher interest rates with locked-in terms, ensuring predictable returns but limited liquidity, while Flexible Digital Savings Accounts with Adjustable Interest Wallets provide dynamic interest rates based on market trends, allowing savers to optimize earnings with instant access to funds. Adjustable Interest Wallets adapt interest payouts in real-time, combining flexibility and competitive growth potential for modern savers seeking both stability and accessibility.

Smart Unlockable Deposits

Fixed deposits offer higher interest rates with locked-in terms, providing stable returns but limited liquidity, while flexible digital savings accounts with smart unlockable deposits enable instant access to funds and competitive interest rates tailored for dynamic savings needs. Smart unlockable deposits combine the security of fixed deposits with the flexibility of digital accounts by allowing partial withdrawals without penalties, optimizing both growth and accessibility.

Fixed Deposit vs Flexible Digital Savings Account for savings. Infographic

moneydiff.com

moneydiff.com