Fixed deposits offer a higher interest rate with guaranteed returns over a fixed tenure, providing financial discipline and security for savers. Flexible savings plans allow easy access to funds with variable interest rates, making them ideal for those who prioritize liquidity and regular contributions. Choosing between the two depends on balancing the need for stable growth and the flexibility to access savings anytime.

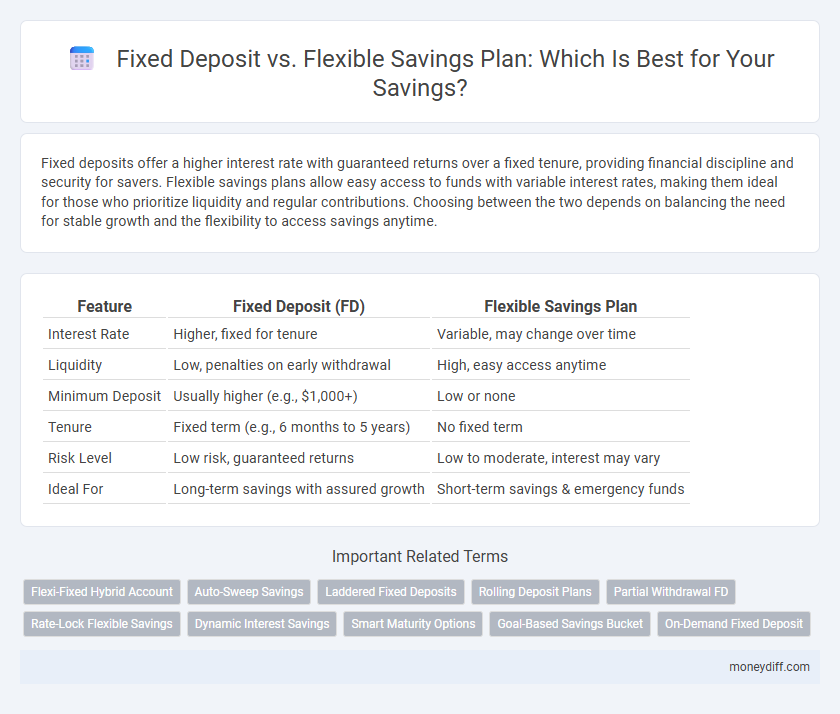

Table of Comparison

| Feature | Fixed Deposit (FD) | Flexible Savings Plan |

|---|---|---|

| Interest Rate | Higher, fixed for tenure | Variable, may change over time |

| Liquidity | Low, penalties on early withdrawal | High, easy access anytime |

| Minimum Deposit | Usually higher (e.g., $1,000+) | Low or none |

| Tenure | Fixed term (e.g., 6 months to 5 years) | No fixed term |

| Risk Level | Low risk, guaranteed returns | Low to moderate, interest may vary |

| Ideal For | Long-term savings with assured growth | Short-term savings & emergency funds |

Understanding Fixed Deposit and Flexible Savings Plans

Fixed deposits offer a fixed interest rate over a predetermined period, providing guaranteed returns and capital protection, making them ideal for risk-averse savers. Flexible Savings Plans allow variable contributions and offer liquidity with interest rates that may fluctuate, catering to those who need easy access to funds while earning moderate returns. Comparing the two requires evaluating the trade-off between fixed returns and flexibility to align with individual financial goals and cash flow needs.

Key Differences Between Fixed Deposit and Flexible Savings

Fixed Deposits offer a fixed interest rate and a locked-in investment tenure, providing higher returns with limited liquidity, whereas Flexible Savings Plans provide variable interest rates with easy access to funds and no fixed term. Fixed Deposits are suitable for risk-averse investors seeking guaranteed returns, while Flexible Savings are ideal for those needing liquidity and flexible contributions. The key difference lies in the trade-off between guaranteed higher interest rates in Fixed Deposits and the convenience of withdrawals and deposits in Flexible Savings Plans.

Interest Rates: Fixed vs Flexible Savings Plans

Fixed deposits generally offer higher interest rates compared to flexible savings plans, providing a guaranteed return over a specified period. Flexible savings plans often have variable interest rates that may yield lower returns but offer greater liquidity and access to funds without penalties. The choice depends on whether savers prioritize higher, stable interest earnings or flexibility in accessing their money.

Liquidity and Withdrawal Options Compared

Fixed Deposits offer higher interest rates but restrict liquidity by locking funds for a fixed tenure, with penalties applied for premature withdrawal. Flexible Savings Plans provide easier access to funds, allowing withdrawals without significant penalties, though they often yield lower returns compared to Fixed Deposits. Choosing between these options depends on the saver's need for immediate liquidity versus desire for higher interest earnings.

Risk Factors in Fixed Deposit vs Flexible Savings

Fixed deposits offer low-risk investment with guaranteed returns, as they are not affected by market fluctuations, making them suitable for risk-averse savers. Flexible savings plans, however, may expose investors to variable interest rates and market volatility, increasing risk but providing higher liquidity and potential for gains. Evaluating risk tolerance and financial goals is crucial when choosing between the stability of fixed deposits and the flexibility of savings plans.

Which Plan Suits Your Saving Goals?

Fixed Deposit offers higher interest rates and suits savers seeking guaranteed returns with fixed tenure, ideal for long-term goals. Flexible Savings Plans provide liquidity and convenience, allowing easy withdrawals that benefit short-term or emergency savings needs. Choosing between the two depends on your priority for either consistent growth or accessible funds.

Tax Implications of Fixed Deposit and Flexible Savings

Fixed Deposits typically offer taxable interest income, which is added to your total income and taxed as per your income slab, with tax deducted at source (TDS) if interest exceeds a specified threshold. Flexible Savings Plans often provide tax benefits under Section 80C or other sections, depending on the product type, allowing for tax deductions and potential tax-free returns. Understanding these tax implications helps in optimizing after-tax returns while balancing liquidity and risk tolerance.

How to Choose Between Fixed and Flexible Savings Plans

Choosing between Fixed Deposits and Flexible Savings Plans depends on your financial goals and liquidity needs. Fixed Deposits offer higher interest rates with locked-in terms ideal for long-term savings, while Flexible Savings Plans provide easy access to funds and variable interest rates suited for short-term goals and emergencies. Assess your risk tolerance, need for immediate cash, and expected returns to determine the best savings strategy.

Pros and Cons: Fixed Deposit vs Flexible Savings

Fixed Deposit offers higher interest rates and assured returns, making it ideal for long-term savings but lacks liquidity due to lock-in periods. Flexible Savings Plans provide easy access to funds with no penalties for withdrawals, suitable for emergency needs but generally yield lower returns compared to Fixed Deposits. Choosing between Fixed Deposit and Flexible Savings depends on prioritizing either growth potential or liquidity based on individual financial goals.

Final Thoughts: Making the Right Savings Decision

Fixed deposits offer guaranteed interest rates and capital protection, making them ideal for risk-averse savers seeking stable returns. Flexible savings plans provide liquidity and the ability to adjust contributions, catering to those who prioritize access and adaptability in their savings strategy. Evaluating financial goals, risk tolerance, and cash flow needs is essential to choosing between fixed deposits and flexible savings plans for optimal growth and security.

Related Important Terms

Flexi-Fixed Hybrid Account

A Flexi-Fixed Hybrid Account combines the high-interest benefits of a fixed deposit with the liquidity of a flexible savings plan, allowing savers to earn better returns without compromising on access to funds. This hybrid solution optimizes capital growth while maintaining financial flexibility, making it ideal for those seeking both stability and convenience in their savings strategy.

Auto-Sweep Savings

Fixed Deposit accounts offer higher interest rates with fixed tenure, ensuring guaranteed returns, while Flexible Savings Plans with Auto-Sweep facilities automatically transfer surplus funds from savings to fixed deposits, optimizing interest earnings without locking liquidity. Auto-Sweep Savings combine the safety of fixed deposits with the convenience of easy withdrawal, increasing overall savings efficiency by maximizing interest while maintaining access to funds.

Laddered Fixed Deposits

Laddered Fixed Deposits offer higher, predictable returns by staggering maturity dates to optimize liquidity and interest rates compared to Flexible Savings Plans, which provide lower interest but greater withdrawal flexibility. This strategy balances earning potential and risk by reinvesting matured deposits at prevailing rates, maximizing overall savings growth over time.

Rolling Deposit Plans

Rolling deposit plans in fixed deposits offer guaranteed higher interest rates with fixed tenures, ensuring consistent growth and capital protection, while flexible savings plans provide liquidity and easy access to funds with variable returns. Investors seeking predictability and better yield often prefer rolling fixed deposits, whereas those prioritizing flexibility choose flexible savings plans for their convenience and immediate fund availability.

Partial Withdrawal FD

Fixed Deposit accounts offer higher interest rates but typically restrict access to funds without penalties, whereas Flexible Savings Plans allow partial withdrawal without affecting the principal, providing liquidity and continuous interest accrual. Partial Withdrawal FDs combine the benefits by permitting limited withdrawals while keeping the remaining balance invested at fixed rates, optimizing both returns and cash flow flexibility.

Rate-Lock Flexible Savings

Rate-lock flexible savings plans offer the stability of a fixed interest rate combined with the liquidity of flexible withdrawals, contrasting with fixed deposits that lock in funds for a predetermined term at a fixed rate. This hybrid approach maximizes earning potential while maintaining access to funds, making it ideal for savers seeking both security and flexibility in their savings strategy.

Dynamic Interest Savings

Fixed Deposit accounts offer a fixed interest rate with guaranteed returns over a specified term, ideal for risk-averse savers seeking stability. In contrast, Flexible Savings Plans with dynamic interest rates adjust based on market conditions, providing liquidity and potentially higher earnings during economic upswings.

Smart Maturity Options

Fixed Deposit offers higher interest rates with fixed maturity terms, ensuring guaranteed returns, while Flexible Savings Plans provide the advantage of smart maturity options that allow partial withdrawals and flexible tenure adjustments to optimize liquidity and earnings. Smart maturity options in Flexible Savings Plans enable savers to tailor their savings according to changing financial needs without compromising on interest benefits.

Goal-Based Savings Bucket

Fixed Deposit offers guaranteed interest rates ideal for long-term, goal-based savings buckets, ensuring capital protection and predictable growth. In contrast, Flexible Savings Plans provide liquidity and ease of access, catering to short-term goals with variable interest rates aligned to market fluctuations.

On-Demand Fixed Deposit

On-Demand Fixed Deposit offers higher interest rates compared to Flexible Savings Plans, while allowing partial withdrawals without penalties, combining the benefits of fixed returns and liquidity. This option is ideal for savers seeking better yields and the flexibility to access funds as needed without compromising their earnings.

Fixed Deposit vs Flexible Savings Plan for savings. Infographic

moneydiff.com

moneydiff.com