Manual saving requires consistent discipline to set aside money regularly, often leading to missed opportunities due to forgetfulness or irregular income. Automated micro-saving tools transfer small amounts automatically into savings, creating a seamless habit that grows wealth over time with minimal effort. This strategy leverages technology to reduce human error and ensure steady progress toward financial goals.

Table of Comparison

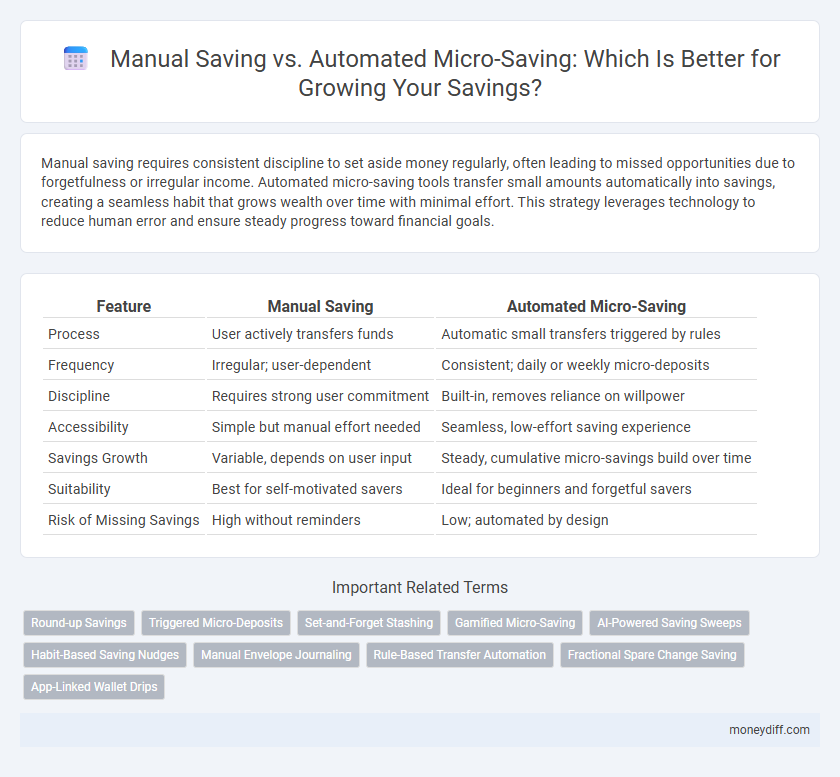

| Feature | Manual Saving | Automated Micro-Saving |

|---|---|---|

| Process | User actively transfers funds | Automatic small transfers triggered by rules |

| Frequency | Irregular; user-dependent | Consistent; daily or weekly micro-deposits |

| Discipline | Requires strong user commitment | Built-in, removes reliance on willpower |

| Accessibility | Simple but manual effort needed | Seamless, low-effort saving experience |

| Savings Growth | Variable, depends on user input | Steady, cumulative micro-savings build over time |

| Suitability | Best for self-motivated savers | Ideal for beginners and forgetful savers |

| Risk of Missing Savings | High without reminders | Low; automated by design |

Manual Saving vs Automated Micro-Saving: An Overview

Manual saving requires individuals to consciously set aside money, which can lead to inconsistent saving habits and missed opportunities for growth. Automated micro-saving leverages technology to transfer small amounts regularly, enhancing saving discipline and steadily building wealth with minimal effort. Both methods influence financial behavior, but automated micro-saving often provides higher consistency and long-term benefits.

Understanding Manual Saving: Pros and Cons

Manual saving requires individuals to consciously set aside money, offering greater control over saving amounts and timing but demands consistent discipline and can lead to missed contributions during busy periods. This method allows for flexible decision-making based on current financial status, yet risks lower overall savings due to occasional forgetfulness or lack of motivation. Compared to automated micro-saving, manual saving may result in slower accumulation of funds and increased effort in managing financial goals.

The Rise of Automated Micro-Saving Tools

Automated micro-saving tools have revolutionized personal finance by enabling users to save small amounts consistently without manual effort, leveraging technology to boost savings rates effectively. These tools use algorithms to analyze spending patterns and transfer spare change or predetermined micro-amounts into savings accounts, enhancing financial discipline and accumulation. The rise of apps like Acorns, Chime, and Digit highlights a growing trend where convenience and automation drive smarter, sustained saving habits compared to traditional manual saving methods.

Comparing Flexibility: Manual vs Automated Approaches

Manual saving offers high flexibility, allowing individuals to decide when and how much to save based on their fluctuating income and expenses. Automated micro-saving leverages consistent, small transfers triggered by algorithms or spending behaviors, promoting disciplined savings but with less day-to-day control. While manual saving adapts instantly to financial changes, automated methods provide steady growth through programmed consistency and minimal effort.

Control Over Finances: Manual Saving Advantage

Manual saving offers individuals greater control over their finances by allowing them to decide exactly when and how much money to set aside, promoting conscious budgeting and discipline. This hands-on approach helps savers tailor their strategies to fluctuating expenses, avoiding the risk of overdrafts or insufficient funds common in automated micro-saving systems. Consequently, manual saving enhances financial awareness and adaptability to personal cash flow variations.

Consistency & Habit Building with Automation

Automated micro-saving leverages technology to ensure consistent, small transfers into savings accounts, helping build a disciplined financial habit without relying on manual effort. Manual saving often suffers from irregularity due to fluctuating motivation and forgetfulness, making it challenging to establish a steady saving routine. Automation enhances consistency by removing decision fatigue and embedding saving as an effortless, habitual action supported by scheduled transfers and app notifications.

Accessibility and Integration with Banking

Manual saving requires active effort and discipline, often leading to inconsistent contributions and limited accessibility for those with busy schedules. Automated micro-saving integrates seamlessly with banking apps, enabling users to effortlessly transfer small amounts regularly, enhancing accessibility and promoting consistent saving habits. This integration with financial institutions ensures real-time tracking and adjustment, making automated micro-saving a more efficient and user-friendly option.

Fees and Costs: Hidden Charges Explained

Manual saving often involves fewer fees but risks inconsistent contributions that can delay financial goals. Automated micro-saving platforms might charge small transaction fees or subscription costs, which can accumulate unnoticed over time and impact overall savings growth. Understanding these hidden charges is essential for optimizing the balance between convenience and cost-effectiveness in saving strategies.

Security and Privacy in Saving Methods

Manual saving requires individuals to actively transfer funds, which may expose sensitive financial information during transactions if not encrypted properly. Automated micro-saving platforms often utilize advanced security protocols such as end-to-end encryption and multi-factor authentication to safeguard user data, reducing the risk of breaches. Privacy policies in automated systems are generally transparent and compliant with regulations like GDPR, ensuring user consent and data protection throughout the saving process.

Which Saving Method Suits Your Financial Goals?

Manual saving requires active effort and discipline to set aside funds regularly, which suits those who prefer control over their savings timing and amount. Automated micro-saving leverages technology to transfer small amounts frequently, aligning well with individuals seeking convenient, consistent growth without conscious effort. Choosing between these methods depends on your financial goals, spending habits, and preference for hands-on management versus seamless automation.

Related Important Terms

Round-up Savings

Manual saving requires active effort and discipline to set aside funds regularly, often leading to inconsistent contributions and slower growth. Automated micro-saving through round-up savings leverages technology to effortlessly round up purchases to the nearest dollar, channeling spare change into savings accounts and accelerating wealth accumulation with minimal user intervention.

Triggered Micro-Deposits

Triggered micro-deposits in automated micro-saving systems enable consistent, small contributions based on specific spending behaviors or account activities, increasing savings efficiency and reducing reliance on manual effort. These precise, personalized triggers help maximize saving potential by seamlessly integrating with user habits, offering a strategic advantage over traditional manual saving methods.

Set-and-Forget Stashing

Manual saving requires consistent effort and discipline to regularly set aside funds, often leading to irregular contributions and missed savings goals. Automated micro-saving leverages set-and-forget technology by transferring small amounts into savings accounts automatically, ensuring consistent growth and reducing the risk of depletion by aligning with spending habits.

Gamified Micro-Saving

Gamified micro-saving leverages automated small transfers combined with engaging game-like features to boost user motivation and consistency in building savings, outperforming manual saving which often relies on irregular, deliberate deposits. By integrating reward systems and progress tracking, gamified micro-saving enhances financial discipline and increases the likelihood of achieving savings goals efficiently.

AI-Powered Saving Sweeps

AI-powered saving sweeps optimize savings by automatically transferring small amounts from checking to savings accounts based on spending patterns and income flow, maximizing fund growth without user intervention. Manual saving relies on conscious effort and discipline, often resulting in inconsistent contributions and slower accumulation compared to the precision and efficiency of automated micro-saving technologies.

Habit-Based Saving Nudges

Manual saving relies on conscious effort and discipline, often leading to inconsistent contributions, while automated micro-saving leverages habit-based saving nudges by seamlessly transferring small amounts, enhancing saving frequency and long-term financial growth. Habit-based nudges in automated systems reduce friction and optimize savings behavior by reinforcing consistency through regular, low-impact transactions aligned with users' spending patterns.

Manual Envelope Journaling

Manual envelope journaling enhances savings discipline by allocating cash into physically labeled envelopes for specific expenses, fostering conscious spending habits and budget awareness. This hands-on approach contrasts with automated micro-saving apps by promoting active participation and immediate visibility of funds, which can improve financial mindfulness and reduce impulsive spending.

Rule-Based Transfer Automation

Rule-based transfer automation streamlines savings by automatically moving predetermined amounts from checking to savings accounts based on user-defined criteria, reducing reliance on manual transfers and enhancing consistency. This system leverages algorithms to trigger savings actions, optimizing cash flow management while fostering disciplined saving habits.

Fractional Spare Change Saving

Manual saving relies on individual discipline to set aside funds regularly, which can be inconsistent and prone to lapses, whereas automated micro-saving, particularly fractional spare change saving, effortlessly rounds up everyday purchases to the nearest dollar, depositing the difference into a savings account. This seamless approach leverages small, frequent contributions that accumulate over time, enhancing savings without impacting monthly budgets.

App-Linked Wallet Drips

Manual saving requires consistent user effort to transfer funds, often resulting in irregular saving patterns, whereas automated micro-saving through app-linked wallet drips enables seamless, incremental transfers directly from spending accounts, increasing overall savings consistency. By leveraging real-time transaction data, app-linked wallet drips optimize savings amounts based on individual spending behavior, enhancing financial discipline without requiring active user intervention.

Manual saving vs Automated micro-saving for savings. Infographic

moneydiff.com

moneydiff.com