Choosing between a piggy bank and a micro-investing app for savings depends on your financial goals and habits. A piggy bank offers a simple, tangible way to save small amounts of cash, ideal for short-term goals or teaching basic saving habits. Micro-investing apps provide opportunities to grow your savings by investing spare change in diversified portfolios, making them suitable for long-term wealth building with minimal effort.

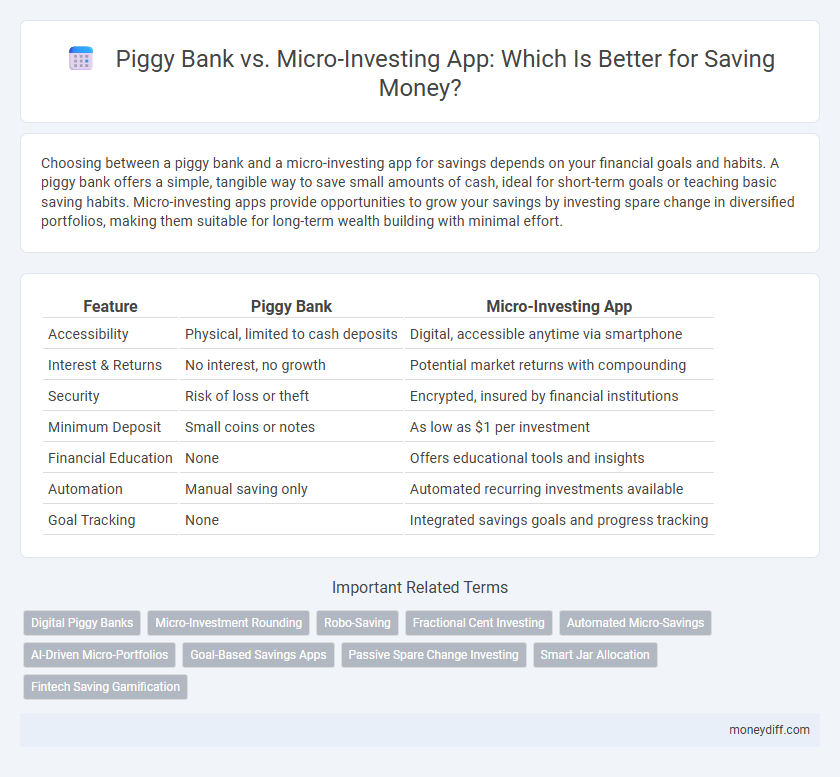

Table of Comparison

| Feature | Piggy Bank | Micro-Investing App |

|---|---|---|

| Accessibility | Physical, limited to cash deposits | Digital, accessible anytime via smartphone |

| Interest & Returns | No interest, no growth | Potential market returns with compounding |

| Security | Risk of loss or theft | Encrypted, insured by financial institutions |

| Minimum Deposit | Small coins or notes | As low as $1 per investment |

| Financial Education | None | Offers educational tools and insights |

| Automation | Manual saving only | Automated recurring investments available |

| Goal Tracking | None | Integrated savings goals and progress tracking |

Introduction: Piggy Banks and Micro-Investing Apps Explained

Piggy banks offer a traditional, tangible way to save small amounts of money by physically depositing coins and bills, promoting disciplined saving habits from a young age. Micro-investing apps enable users to invest spare change or small sums into diversified portfolios through automated platforms, leveraging technology for gradual wealth accumulation. These two methods represent distinct approaches to savings: one emphasizes simplicity and physical saving, while the other focuses on growth potential through digital investment.

Traditional Savings: The Enduring Appeal of Piggy Banks

Piggy banks offer a tactile and visual approach to traditional savings, fostering financial discipline through habitual coin deposits. Unlike micro-investing apps, they require no technological literacy, making them accessible for all ages and promoting basic money management skills. This enduring appeal lies in their simplicity, physical presence, and ability to instill saving habits without the complexities of the digital financial landscape.

Digital Revolution: Understanding Micro-Investing Apps

Micro-investing apps revolutionize savings by enabling users to invest small amounts of money digitally, offering higher growth potential compared to traditional piggy banks. These apps leverage automated algorithms and fractional shares, allowing for diversified portfolios with minimal entry barriers and fees. As digital tools, they provide real-time tracking and seamless integration with banking systems, enhancing user engagement and financial literacy in the savings process.

Security Comparison: Protecting Your Savings

Piggy banks offer physical security by keeping cash in a tangible container at home, but they lack protection against theft, loss, or fire. Micro-investing apps provide digital security features such as encryption, two-factor authentication, and FDIC-insured custodial accounts that protect funds from cyber threats and financial institution failures. Choosing between the two depends on prioritizing convenience and advanced security protocols versus simple cash storage.

Accessibility and Convenience: Analog vs. Digital

Piggy banks provide a simple, tactile method for saving cash, ideal for physical money storage and easy access at home. Micro-investing apps offer seamless digital accessibility, allowing users to invest spare change instantly through smartphones with features like automated contributions and real-time portfolio tracking. While piggy banks lack flexibility and investment growth, micro-investing apps enhance convenience by integrating savings with low barriers to entry and user-friendly interfaces.

Interest and Growth Potential: Earning More from Your Money

Piggy banks offer a zero-interest, low-growth option primarily for short-term savings and habit-building, while micro-investing apps provide opportunities to earn compound interest and capitalize on market growth through diversified portfolios. Micro-investing platforms often feature automated contributions and professional management, enhancing the potential for higher returns compared to traditional piggy banks. Choosing micro-investing apps can significantly increase your savings growth over time by leveraging interest accumulation and market appreciation.

Motivation and Savings Habits: Which Method Works Better?

Piggy banks encourage consistent saving by providing a tangible visual of accumulated funds, which boosts motivation through physical interaction. Micro-investing apps enhance saving habits by automating small, frequent contributions and offering real-time progress tracking, increasing user engagement and financial discipline. Studies show that combining physical saving tools with digital micro-investing platforms can optimize motivation and long-term savings growth.

Costs and Fees: Hidden Charges in Both Approaches

Piggy banks offer a no-cost, fee-free method for saving money physically without hidden charges, while micro-investing apps often involve management fees, transaction costs, and withdrawal limitations that may reduce overall returns. Users should carefully review each app's fee structure, including account maintenance and inactivity fees, which can accumulate and impact savings growth. Understanding these expenses is crucial for optimizing the cost-efficiency of saving strategies and maximizing long-term financial benefits.

User Demographics: Who Benefits Most from Each Option?

Piggy banks appeal primarily to children and individuals new to saving, offering a tangible and simple way to build habits without risk. Micro-investing apps attract young adults and tech-savvy users seeking to grow their savings through fractional investments with minimal initial capital. Each option benefits distinct demographics by aligning with their financial literacy, goals, and risk tolerance.

Conclusion: Choosing the Right Savings Tool for You

Selecting the right savings tool depends on your financial goals and habits; a piggy bank offers a simple, tangible method for short-term, small-amount savings, while micro-investing apps enable gradual wealth accumulation through diversified portfolios and compounding returns. Micro-investing platforms often provide automated contributions and access to professional asset management, making them ideal for long-term growth and building investment discipline. Evaluate factors such as risk tolerance, savings timeframe, and desired financial outcomes to determine whether traditional saving methods or digital investment tools best align with your personal finance strategy.

Related Important Terms

Digital Piggy Banks

Digital piggy banks offer an automated, user-friendly way to save small amounts frequently, bridging traditional savings with modern finance technology. Unlike micro-investing apps, digital piggy banks prioritize secure accumulation of funds without exposure to market risks, making them ideal for disciplined, short-term savings goals.

Micro-Investment Rounding

Micro-investing apps that utilize rounding features automatically invest spare change from everyday purchases, accelerating savings growth through diversified portfolios and compound interest. Compared to traditional piggy banks, these apps offer greater financial discipline, accessibility, and potential returns by harnessing market opportunities with minimal user effort.

Robo-Saving

Robo-saving features in micro-investing apps automate savings by analyzing spending patterns and transferring small amounts into investment portfolios, offering higher growth potential than traditional piggy banks. Unlike piggy banks that rely on physical deposits and manual discipline, robo-saving apps provide seamless, data-driven strategies for consistent and optimized wealth accumulation.

Fractional Cent Investing

Fractional cent investing in micro-investing apps allows users to save and grow wealth by automatically investing small amounts of money, often rounded up from everyday purchases, offering higher potential returns compared to traditional piggy banks that merely store physical cash without interest or growth. This method leverages the power of compounding and market exposure, making it a more effective and dynamic savings tool for gradual wealth accumulation over time.

Automated Micro-Savings

Automated micro-savings through micro-investing apps optimize financial growth by regularly transferring small amounts of money into diverse portfolios, unlike traditional piggy banks that simply store cash without potential returns. These apps leverage algorithms to maximize compounded interest and minimize manual involvement, making them a superior option for long-term wealth accumulation.

AI-Driven Micro-Portfolios

AI-driven micro-investing apps create optimized micro-portfolios by analyzing user spending patterns and risk tolerance, offering higher potential returns compared to traditional piggy banks. These platforms leverage machine learning algorithms to automate diversified investments, enhancing growth opportunities while maintaining ease of use for consistent savings.

Goal-Based Savings Apps

Goal-based savings apps like micro-investing platforms provide tailored investment options that help users accumulate wealth more efficiently compared to traditional piggy banks, which solely offer a secure place to store cash. These apps leverage automated contributions and diversified portfolios to align savings with specific financial objectives, enhancing growth potential and financial discipline.

Passive Spare Change Investing

Piggy banks offer a simple, physical way to save spare change, but micro-investing apps automate passive spare change investing by rounding up purchases and investing the difference into diversified portfolios. This digital approach not only encourages consistent savings but also leverages compound growth, making it a more effective strategy for building wealth over time.

Smart Jar Allocation

Smart Jar Allocation in Piggy Banks offers a tangible way to physically separate savings goals, promoting disciplined cash management and visual motivation. Micro-Investing Apps enhance this strategy by digitally automating fund distribution across diversified portfolios, optimizing growth potential through algorithm-driven allocation and real-time market adjustments.

Fintech Saving Gamification

Piggy banks offer tangible, simple saving methods, but micro-investing apps integrate fintech gamification to enhance user engagement and encourage consistent savings. Features like rewards, progress tracking, and social sharing in micro-investing apps significantly improve saving habits and financial literacy compared to traditional piggy banks.

Piggy Bank vs Micro-Investing App for savings. Infographic

moneydiff.com

moneydiff.com