Savings accounts offer secure, interest-bearing deposits regulated by banks, providing predictable growth and easy access to funds. Digital wallet savings combine convenience and flexibility, allowing instant transfers and management through mobile apps but may lack the interest benefits and regulatory protections of traditional accounts. Choosing between the two depends on priorities like earning interest versus quick accessibility and technology integration.

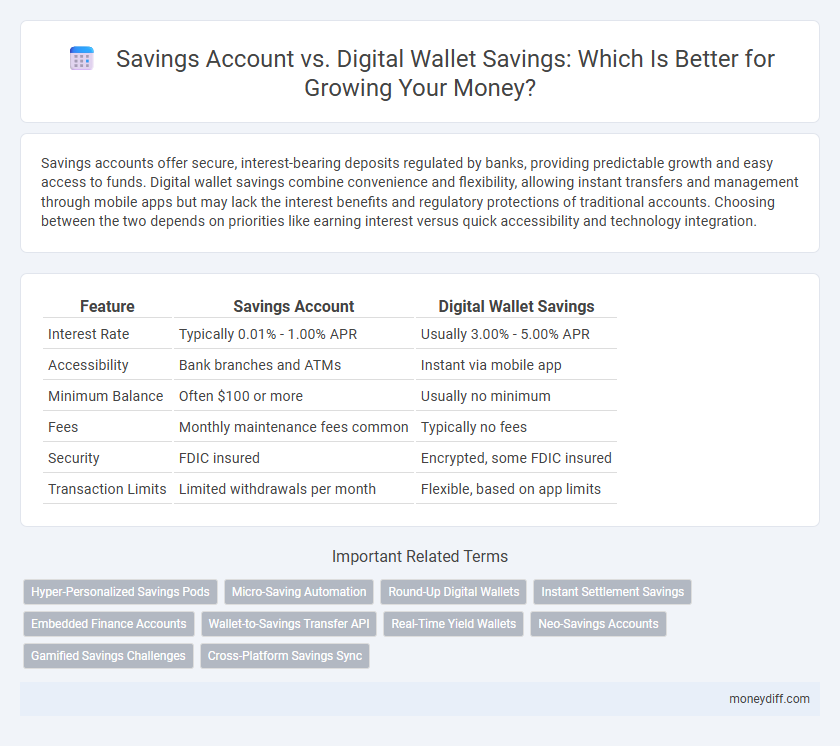

Table of Comparison

| Feature | Savings Account | Digital Wallet Savings |

|---|---|---|

| Interest Rate | Typically 0.01% - 1.00% APR | Usually 3.00% - 5.00% APR |

| Accessibility | Bank branches and ATMs | Instant via mobile app |

| Minimum Balance | Often $100 or more | Usually no minimum |

| Fees | Monthly maintenance fees common | Typically no fees |

| Security | FDIC insured | Encrypted, some FDIC insured |

| Transaction Limits | Limited withdrawals per month | Flexible, based on app limits |

Understanding Savings Accounts and Digital Wallet Savings

Savings accounts offer secure, interest-bearing deposits insured by financial institutions, typically providing higher interest rates and regulated protection. Digital wallet savings combine ease of access and quick transactions with flexible saving options but often lack formal insurance and may yield lower interest rates. Understanding the trade-offs between traditional savings accounts and digital wallet savings is essential for optimizing liquidity, security, and growth potential.

Key Differences Between Savings Accounts and Digital Wallets

Savings accounts offer higher interest rates, FDIC insurance, and structured withdrawal limits, providing a secure environment for long-term asset growth. Digital wallet savings prioritize convenience and accessibility with instant transfers, integration with payment apps, and minimal fees but typically lack significant interest earnings and federal insurance protections. Understanding these differences helps savers choose based on their priorities for security, liquidity, and returns.

Interest Rates: Which Option Maximizes Your Savings?

Savings accounts generally offer higher interest rates ranging from 0.5% to 2%, providing a more consistent opportunity to grow your funds over time. Digital wallet savings options often have lower or variable interest rates, typically below 1%, but they offer enhanced liquidity and immediate access for everyday transactions. Choosing a traditional savings account maximizes interest earned, while digital wallets prioritize convenience and spending flexibility.

Accessibility and Convenience: Banking vs Digital Wallets

Savings accounts offer secure access through bank branches and ATMs, providing regulated financial services ideal for long-term deposits. Digital wallet savings enable instant transfers and payments via smartphones, enhancing convenience with 24/7 accessibility and seamless integration with daily transactions. While banking requires physical visits or online portals, digital wallets prioritize user-friendly interfaces and real-time fund management for quicker access.

Security Features: Protecting Your Savings

Savings accounts typically offer robust security features such as FDIC insurance, protecting deposits up to $250,000 against bank failures, and multi-factor authentication to prevent unauthorized access. Digital wallet savings provide encryption technology and biometric authentication, ensuring secure transactions and safeguarding funds from cyber threats. Both options prioritize security, but traditional savings accounts often have stronger regulatory protections compared to emerging digital wallet savings platforms.

Fees and Hidden Charges: What to Watch Out For

Savings accounts often come with monthly maintenance fees, minimum balance requirements, and potential withdrawal limits that could lead to penalty charges. Digital wallet savings may offer lower fees and more flexible access but can include hidden costs such as transaction fees, inactivity charges, or currency conversion fees. Consumers should carefully review fee structures and terms to avoid unexpected expenses that erode savings growth.

Account Management and User Experience

Savings accounts offer robust account management features such as automated transfers, detailed transaction histories, and FDIC insurance, providing users with security and traditional banking stability. Digital wallet savings prioritize seamless user experience with instant access, easy fund transfers, and real-time balance updates through mobile apps, enhancing convenience and flexibility. Both options support efficient savings strategies, but digital wallets excel in intuitive interfaces while savings accounts maintain stronger regulatory protections.

Withdrawal Limits and Liquidity Factors

Savings accounts often impose daily withdrawal limits ranging from $500 to $1,000, which can restrict immediate access to funds, while digital wallet savings typically offer higher liquidity with fewer or no withdrawal caps. Bank savings accounts may require several business days to process fund transfers, impacting liquidity, whereas digital wallets provide near-instant access to saved funds for transactions and transfers. For optimal flexibility, digital wallet savings minimize withdrawal constraints and enhance cash availability compared to traditional savings accounts.

Suitability for Different Savings Goals

Savings accounts offer higher interest rates and greater security, making them ideal for long-term savings goals such as emergency funds or major purchases. Digital wallet savings provide instant access and flexibility, perfect for short-term goals like daily expenses or occasional splurges. Choosing between the two depends on whether the priority is growth potential or convenience for specific saving objectives.

Choosing the Right Savings Option for Your Financial Future

Choosing the right savings option involves comparing traditional savings accounts and digital wallet savings based on interest rates, accessibility, and security features. Savings accounts typically offer higher interest rates and federal insurance protection, while digital wallet savings provide convenience and instant access to funds through mobile platforms. Evaluating your financial goals and spending habits ensures optimal growth and liquidity tailored to your future needs.

Related Important Terms

Hyper-Personalized Savings Pods

Savings accounts traditionally offer steady interest rates and FDIC insurance, providing secure, predictable growth for deposited funds. Digital wallet savings leverage hyper-personalized savings pods that use AI to categorize spending habits and automate micro-deposits, optimizing personalized goals for faster, behavior-driven savings growth.

Micro-Saving Automation

Micro-saving automation in savings accounts offers structured, interest-bearing growth by automatically transferring small amounts into a secure bank account, optimizing long-term financial stability. Digital wallet savings leverage AI-driven algorithms for instant round-up transactions and flexible access, promoting frequent, low-effort savings while integrating seamless spending and budgeting features.

Round-Up Digital Wallets

Round-up digital wallets automatically save spare change from transactions, accelerating savings growth compared to traditional savings accounts that rely on manual deposits. This seamless, incremental saving method leverages behavioral finance principles to improve financial discipline and boost overall savings without significant effort.

Instant Settlement Savings

Savings accounts typically offer secure, regulated interest earnings with delayed settlement times, while digital wallet savings provide instant settlement, enabling immediate access to funds. Instant settlement savings via digital wallets enhance liquidity and financial flexibility, making them ideal for quick, seamless transactions without traditional banking delays.

Embedded Finance Accounts

Embedded finance accounts integrate savings features directly within digital platforms, offering seamless access and automated savings opportunities compared to traditional savings accounts, which often require separate banking interactions and offer lower flexibility. These digital wallet savings enable instant transfers, real-time balance tracking, and personalized financial insights, enhancing user engagement and optimizing saving habits.

Wallet-to-Savings Transfer API

Savings accounts offer secure interest-earning options with FDIC insurance, while digital wallet savings provide flexibility and instant access through seamless Wallet-to-Savings Transfer APIs enabling real-time fund movement. Integrating Wallet-to-Savings Transfer APIs enhances liquidity by allowing users to quickly shift balances between wallets and higher-yield savings accounts, optimizing both convenience and returns.

Real-Time Yield Wallets

Real-time yield wallets offer instant access to accrued interest, providing higher flexibility and competitive returns compared to traditional savings accounts that typically compound interest monthly. These digital wallet savings leverage advanced algorithms and market data to optimize earnings continuously, enhancing overall savings growth.

Neo-Savings Accounts

Neo-savings accounts offer higher interest rates and enhanced security compared to traditional savings accounts, making them ideal for maximizing returns on savings. Digital wallet savings provide instant access and seamless integration with daily transactions but generally offer lower interest rates than neo-savings accounts.

Gamified Savings Challenges

Savings accounts offer steady interest rates, while digital wallet savings leverage gamified savings challenges to boost user engagement and encourage consistent saving habits through rewards and goal-tracking features. These interactive challenges create a motivational environment, making saving more appealing and accessible compared to traditional bank accounts.

Cross-Platform Savings Sync

Savings accounts traditionally offer secure interest accrual with FDIC protection, while digital wallet savings provide seamless cross-platform savings sync, enabling users to access and manage funds across multiple devices and services in real-time. This synchronization ensures consistent tracking of savings progress and immediate updates, enhancing financial flexibility and convenience.

Savings Account vs Digital Wallet Savings for savings. Infographic

moneydiff.com

moneydiff.com