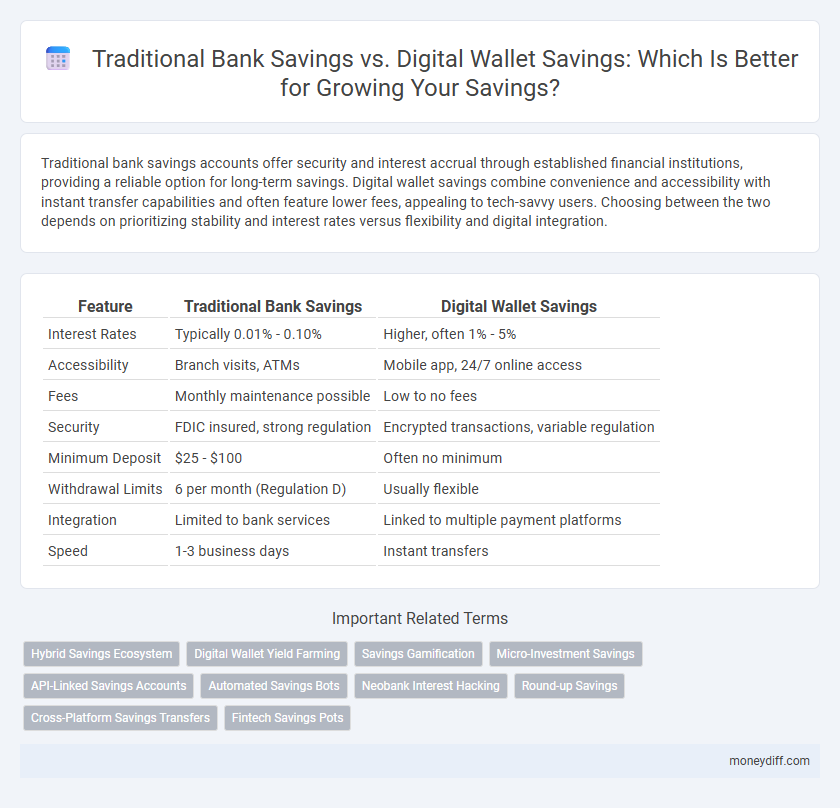

Traditional bank savings accounts offer security and interest accrual through established financial institutions, providing a reliable option for long-term savings. Digital wallet savings combine convenience and accessibility with instant transfer capabilities and often feature lower fees, appealing to tech-savvy users. Choosing between the two depends on prioritizing stability and interest rates versus flexibility and digital integration.

Table of Comparison

| Feature | Traditional Bank Savings | Digital Wallet Savings |

|---|---|---|

| Interest Rates | Typically 0.01% - 0.10% | Higher, often 1% - 5% |

| Accessibility | Branch visits, ATMs | Mobile app, 24/7 online access |

| Fees | Monthly maintenance possible | Low to no fees |

| Security | FDIC insured, strong regulation | Encrypted transactions, variable regulation |

| Minimum Deposit | $25 - $100 | Often no minimum |

| Withdrawal Limits | 6 per month (Regulation D) | Usually flexible |

| Integration | Limited to bank services | Linked to multiple payment platforms |

| Speed | 1-3 business days | Instant transfers |

Overview: Traditional Bank Savings vs Digital Wallet Savings

Traditional bank savings accounts offer secured interest rates and federal insurance protection, making them a reliable option for risk-averse savers. Digital wallet savings provide faster access to funds, user-friendly interfaces, and often integrate with various financial services but may lack the same level of insurance coverage. Comparing annual percentage yields (APYs), accessibility, and security features is essential when choosing between traditional banks and digital wallets for effective savings management.

Accessibility and Convenience of Saving

Traditional bank savings accounts offer secure, regulated access with widespread ATM networks but often require visits to physical branches and have limited online flexibility. Digital wallet savings provide instant access via mobile apps, enabling seamless transfers and real-time balance monitoring without geographic constraints. The convenience of digital wallets enhances saving habits through ease of use, though security protocols and regulatory oversight vary compared to traditional banks.

Security Features: Banks vs Digital Wallets

Traditional bank savings accounts offer robust security features such as FDIC insurance, multi-factor authentication, and advanced encryption protocols ensuring protection against fraud and cyber threats. Digital wallet savings prioritize convenience with biometric authentication and tokenization but may lack the comprehensive federal insurance that traditional banks provide. Choosing between the two options involves weighing the guaranteed security of regulated banks against the innovative, yet evolving, security measures in digital wallets.

Interest Rates and Earnings Potential

Traditional bank savings accounts typically offer lower interest rates, often below 1%, resulting in modest earnings potential over time. Digital wallet savings platforms frequently provide higher interest rates, ranging from 3% to 6%, which can significantly boost accumulated savings. Higher APYs on digital wallets maximize growth by compounding interest more effectively compared to conventional bank savings.

Fees and Maintenance Costs

Traditional bank savings accounts often involve monthly maintenance fees, minimum balance requirements, and transaction charges that can reduce overall savings growth. Digital wallet savings typically offer lower fees or no maintenance costs, making them more cost-effective for frequent, smaller transactions. Comparing fee structures is crucial for maximizing savings potential and minimizing unnecessary expenses.

Flexibility in Deposits and Withdrawals

Traditional bank savings accounts often have fixed deposit and withdrawal schedules, sometimes limiting access to funds due to branch hours and processing times. Digital wallet savings provide enhanced flexibility, allowing instant deposits and withdrawals 24/7 through mobile apps, making fund management more convenient. This real-time access to savings empowers users to respond quickly to financial needs and opportunities without delay.

Mobile App Integration and User Experience

Traditional bank savings accounts offer secure, FDIC-insured storage with limited mobile app functionality, often focusing on basic transaction tracking and fund transfers. Digital wallet savings integrate seamlessly with mobile apps, providing real-time balance updates, instant transfers, and personalized spending insights that enhance user experience. The intuitive interface and faster access in digital wallets encourage frequent savings adjustments and improved financial management on-the-go.

Customer Support and Service Efficiency

Traditional bank savings typically offer personalized customer support through branch visits and dedicated phone lines, ensuring direct assistance but often with longer response times. Digital wallet savings provide rapid, 24/7 customer service via in-app chat and AI-powered support, enhancing service efficiency and immediate issue resolution. The choice impacts user experience significantly, with digital wallets favoring speed and convenience while traditional banks emphasize personalized interaction.

Insurance and Protection of Funds

Traditional bank savings accounts benefit from robust federal insurance programs such as the FDIC in the United States, protecting deposits up to $250,000 per depositor per institution. Digital wallet savings may not always offer the same level of insurance, often relying on the security measures of partnered banks or financial institutions. Investors should verify the presence of deposit insurance coverage and understand the protection policies before choosing between conventional banks and digital wallets for saving funds.

Choosing the Right Savings Method for Your Goals

Traditional bank savings accounts offer federally insured security and typically provide consistent, though modest, interest rates suited for long-term financial goals. Digital wallet savings combine convenience and quick access with competitive interest rates, making them ideal for short-term savings and frequent transactions. Selecting the right savings method depends on factors such as liquidity needs, risk tolerance, and interest rate preferences aligned with your financial objectives.

Related Important Terms

Hybrid Savings Ecosystem

The hybrid savings ecosystem combines traditional bank savings security with the convenience and accessibility of digital wallet savings, enabling users to optimize interest rates while maintaining liquidity and seamless integration for everyday transactions. This synergy enhances financial flexibility and promotes smarter saving habits by leveraging both regulated banking institutions and innovative fintech platforms.

Digital Wallet Yield Farming

Digital wallet savings through yield farming offer higher interest rates compared to traditional bank savings accounts, leveraging decentralized finance (DeFi) protocols for enhanced returns. This method enables users to earn passive income by staking digital assets, often surpassing the nominal rates provided by conventional banks while maintaining liquidity.

Savings Gamification

Traditional bank savings accounts offer steady interest accrual but often lack engaging user experiences, while digital wallet savings incorporate gamification elements like rewards, challenges, and interactive goals that enhance user motivation and promote consistent saving habits. Gamified digital savings platforms leverage behavioral economics to increase user retention and lead to higher average savings balances compared to conventional banking methods.

Micro-Investment Savings

Traditional bank savings accounts provide steady interest rates and FDIC insurance, making them reliable for micro-investment savings with low risk. Digital wallet savings offer higher interest rates and seamless integration with micro-investment platforms, enabling faster growth and easier access for small, frequent contributions.

API-Linked Savings Accounts

API-linked savings accounts in digital wallets offer seamless integration with various financial services, providing real-time access and enhanced control over funds compared to traditional bank savings which typically have slower transaction processes and limited digital connectivity. These digital wallet solutions maximize flexibility and often include automated saving features, boosting overall savings efficiency and user engagement.

Automated Savings Bots

Automated savings bots integrated with digital wallets enhance the efficiency of savings by analyzing spending patterns and transferring small amounts regularly, optimizing personal finance management beyond the fixed interest rates offered by traditional bank savings accounts. This technological innovation provides real-time tracking and personalized saving goals, making digital wallets a more dynamic and adaptive tool for growing savings effortlessly.

Neobank Interest Hacking

Neobank interest hacking leverages higher digital wallet savings rates compared to traditional bank savings accounts, enabling users to maximize returns through seamless, low-fee platforms. Digital wallets often offer flexible access and superior interest rates driven by minimal overhead, contrasting with the lower yields and stricter withdrawal limits common in conventional banks.

Round-up Savings

Round-up savings in digital wallets automatically round transactions to the nearest dollar, transferring the difference into a savings account, offering a seamless micro-saving method that traditional bank savings often lack. Traditional banks typically require manual transfers or fixed deposits, making digital wallet round-up features more efficient for incremental savings growth.

Cross-Platform Savings Transfers

Traditional bank savings accounts often involve slower cross-platform transfer times and higher fees compared to digital wallet savings, which enable instant, low-cost transfers across multiple platforms and devices. Digital wallets provide seamless integration with various financial services, enhancing accessibility and flexibility for saving and transferring funds.

Fintech Savings Pots

Fintech savings pots offer higher interest rates and automated round-up features compared to traditional bank savings accounts, enhancing efficiency and growth potential for savers. Digital wallets integrated with these pots provide seamless, instant access to funds while enabling personalized financial management tools unavailable in conventional banking.

Traditional Bank Savings vs Digital Wallet Savings for savings. Infographic

moneydiff.com

moneydiff.com