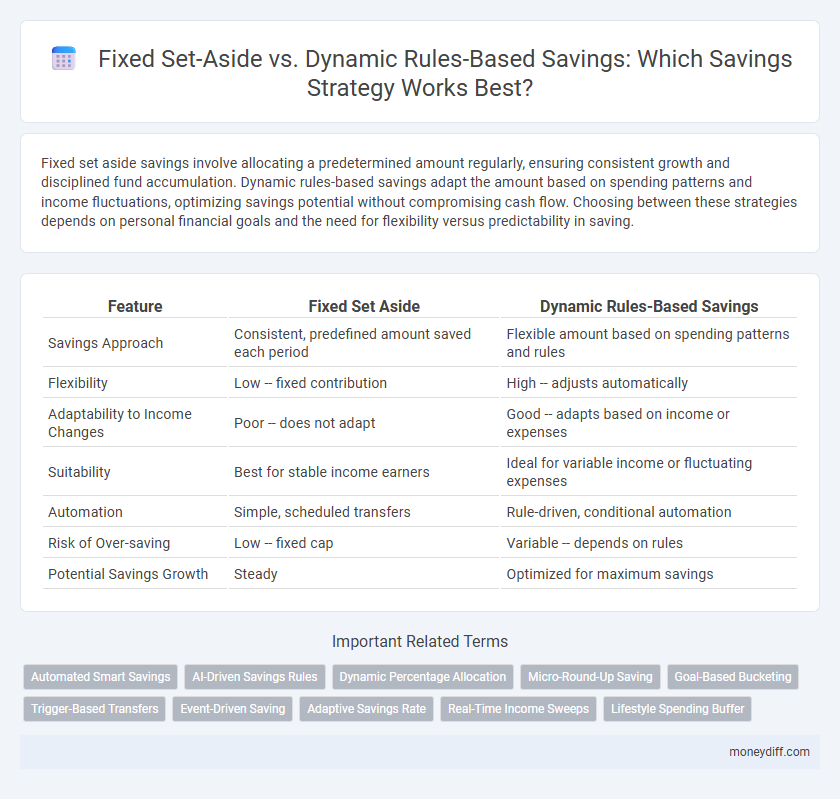

Fixed set aside savings involve allocating a predetermined amount regularly, ensuring consistent growth and disciplined fund accumulation. Dynamic rules-based savings adapt the amount based on spending patterns and income fluctuations, optimizing savings potential without compromising cash flow. Choosing between these strategies depends on personal financial goals and the need for flexibility versus predictability in saving.

Table of Comparison

| Feature | Fixed Set Aside | Dynamic Rules-Based Savings |

|---|---|---|

| Savings Approach | Consistent, predefined amount saved each period | Flexible amount based on spending patterns and rules |

| Flexibility | Low -- fixed contribution | High -- adjusts automatically |

| Adaptability to Income Changes | Poor -- does not adapt | Good -- adapts based on income or expenses |

| Suitability | Best for stable income earners | Ideal for variable income or fluctuating expenses |

| Automation | Simple, scheduled transfers | Rule-driven, conditional automation |

| Risk of Over-saving | Low -- fixed cap | Variable -- depends on rules |

| Potential Savings Growth | Steady | Optimized for maximum savings |

Fixed Set Aside Savings: Definition and Overview

Fixed Set Aside Savings involves allocating a predetermined amount of money at regular intervals into a separate savings account, ensuring consistent savings growth over time. This method emphasizes discipline and predictability, as the set amount remains unchanged regardless of income fluctuations or spending habits. It helps in building a stable financial cushion by committing to a steady savings plan without the need for frequent adjustments.

Dynamic Rules-Based Savings: How It Works

Dynamic rules-based savings automatically adjust contribution amounts based on predefined criteria such as income fluctuations, spending patterns, or financial goals. By leveraging algorithms and real-time data, this method ensures optimal savings rates without manual intervention, enhancing flexibility and responsiveness. This adaptive approach outperforms fixed set-asides by aligning savings strategies with changing personal finances and market conditions.

Comparing Predictability: Fixed vs. Dynamic Savings

Fixed set aside savings offer consistent, predictable contributions, ensuring a steady accumulation of funds over time. Dynamic rules-based savings adjust contributions based on spending patterns or income fluctuations, providing flexibility but reducing predictability. Predictability favors fixed savings for long-term planning, while dynamic approaches cater to variable cash flow scenarios.

Flexibility in Savings: Pros and Cons

Fixed set aside savings involve allocating a predetermined amount regularly, offering simplicity and disciplined growth but lacking flexibility to adjust for unexpected expenses or income changes. Dynamic rules-based savings adapt contributions based on personal financial conditions and goals, allowing for greater responsiveness and potential maximization of savings. However, this approach requires active management and may introduce complexity and inconsistency in savings patterns.

Impact on Financial Goals Achievement

Fixed set aside savings create a consistent habit by dedicating a predetermined amount regularly, ensuring steady progress toward financial goals with minimal decision-making effort. Dynamic rules-based savings adjust contributions based on spending patterns, income fluctuations, or specific milestones, enhancing flexibility and potentially accelerating goal achievement during favorable conditions. Choosing between these approaches depends on individual financial behavior and the desired balance between predictability and adaptability in reaching savings targets.

Adapting to Income Changes with Dynamic Savings

Dynamic rules-based savings adjust allocations automatically based on fluctuating income levels, ensuring consistent contribution growth during high-earning periods and protection during lean months. Unlike fixed set-aside methods that maintain a static savings amount regardless of income variability, dynamic strategies leverage algorithms or predefined rules to optimize savings rates adaptively. This approach enhances financial resilience by aligning savings with real-time income changes, promoting sustainable wealth accumulation.

Automating Your Savings: Methods and Tools

Automating your savings can be streamlined using fixed set-aside methods, which allocate a predetermined amount regularly, ensuring consistent contributions without manual intervention. Dynamic rules-based savings use algorithms to adjust the amount saved based on spending patterns, income fluctuations, or specific financial goals, offering a more personalized and flexible approach. Tools like budgeting apps and robo-advisors facilitate both methods, enhancing efficiency and helping savers achieve their targets with minimal effort.

Risk Management: Stability vs. Adaptability

Fixed set aside savings provide stability by allocating a predetermined amount regularly, reducing the risk of overspending and ensuring consistent growth. Dynamic rules-based savings adapt to changing financial conditions and income fluctuations, offering flexibility to optimize savings without compromising immediate financial needs. Balancing these approaches enhances risk management by combining the predictability of fixed contributions with the adaptability to respond to unexpected expenses or income variability.

Psychological Factors in Savings Behavior

Fixed set aside savings provide a consistent and predictable amount that helps build disciplined financial habits by reducing decision fatigue and enhancing self-control. Dynamic rules-based savings adapt amounts based on behavioral triggers and spending patterns, leveraging psychological insights such as loss aversion and reward mechanisms to encourage higher savings rates. Understanding these psychological factors helps tailor savings strategies that align better with individual motivation and cognitive biases, optimizing long-term financial security.

Which Approach Suits Different Lifestyles?

Fixed set aside savings suits individuals with stable incomes and predictable expenses, providing disciplined, consistent contributions that build wealth steadily. Dynamic rules-based savings cater to fluctuating earnings or irregular expenses by adjusting saving amounts based on real-time financial conditions, ideal for freelancers or gig workers. Understanding personal income patterns and financial goals helps determine the optimal savings strategy to maximize financial security and growth.

Related Important Terms

Automated Smart Savings

Automated smart savings leverage dynamic rules-based algorithms to adjust contributions based on spending habits and income fluctuations, optimizing growth potential compared to fixed set-aside methods with static amounts. This adaptive approach enhances savings efficiency by maximizing flexibility and responsiveness to financial changes, leading to improved wealth accumulation over time.

AI-Driven Savings Rules

AI-driven savings rules enable dynamic, personalized allocation of funds by analyzing spending patterns and financial goals in real-time, optimizing fixed set aside methods that traditionally lack adaptability. This approach enhances savings efficiency by automatically adjusting contributions based on predictive analytics and behavioral insights, ensuring higher returns and sustained financial discipline.

Dynamic Percentage Allocation

Dynamic Percentage Allocation in savings adjusts contribution amounts based on real-time income fluctuations and spending patterns, optimizing savings growth without sacrificing liquidity. This rules-based approach outperforms fixed set-aside methods by balancing financial discipline with adaptive flexibility, maximizing returns tailored to individual cash flow variability.

Micro-Round-Up Saving

Micro-round-up saving leverages dynamic rules-based strategies by rounding purchases to the nearest dollar and automatically transferring the spare change into a savings account, promoting consistent, effortless accumulation compared to fixed set aside methods that require predetermined amounts. This adaptive approach maximizes savings growth by tailoring contributions to spending behavior, enhancing flexibility and financial discipline.

Goal-Based Bucketing

Fixed set aside savings allocate a predetermined amount regularly, ensuring consistent contributions to specific goal-based buckets, while dynamic rules-based savings adjust amounts based on income fluctuations and spending patterns to optimize goal achievement. Goal-based bucketing enhances financial discipline by categorizing funds toward distinct objectives, improving tracking and prioritization within both fixed and dynamic saving strategies.

Trigger-Based Transfers

Trigger-based transfers in fixed set-aside savings involve predefined amounts moving on specific dates, ensuring consistent contributions without adjustment. In contrast, dynamic rules-based savings adapt the transfer amount based on real-time financial triggers like income changes or spending patterns for optimized growth.

Event-Driven Saving

Event-driven saving leverages dynamic rules-based strategies that automatically adjust saving amounts in response to specific triggers such as salary increases, bill payments, or unexpected expenses, enhancing flexibility and responsiveness. Fixed set aside savings maintain a consistent, predetermined amount, offering stability but lacking the adaptability to optimize savings growth based on real-time financial events.

Adaptive Savings Rate

Adaptive savings rates in dynamic rules-based savings adjust contributions based on income fluctuations and spending habits, promoting consistent growth without straining cash flow. Fixed set-aside strategies maintain a constant savings amount, potentially limiting flexibility and responsiveness to financial changes.

Real-Time Income Sweeps

Real-time income sweeps enable dynamic, rules-based savings by automatically transferring excess funds above a set threshold into savings accounts, optimizing cash flow without manual intervention. Fixed set-aside savings lack this flexibility, often resulting in missed opportunities to maximize savings potential based on fluctuating income patterns.

Lifestyle Spending Buffer

Fixed set aside savings allocate a predetermined amount regularly, establishing a consistent Lifestyle Spending Buffer that safeguards against unexpected expenses. Dynamic rules-based savings adjust contributions based on fluctuating income and spending patterns, providing a tailored buffer that aligns with real-time lifestyle needs and financial goals.

Fixed set aside vs Dynamic rules-based savings for savings. Infographic

moneydiff.com

moneydiff.com