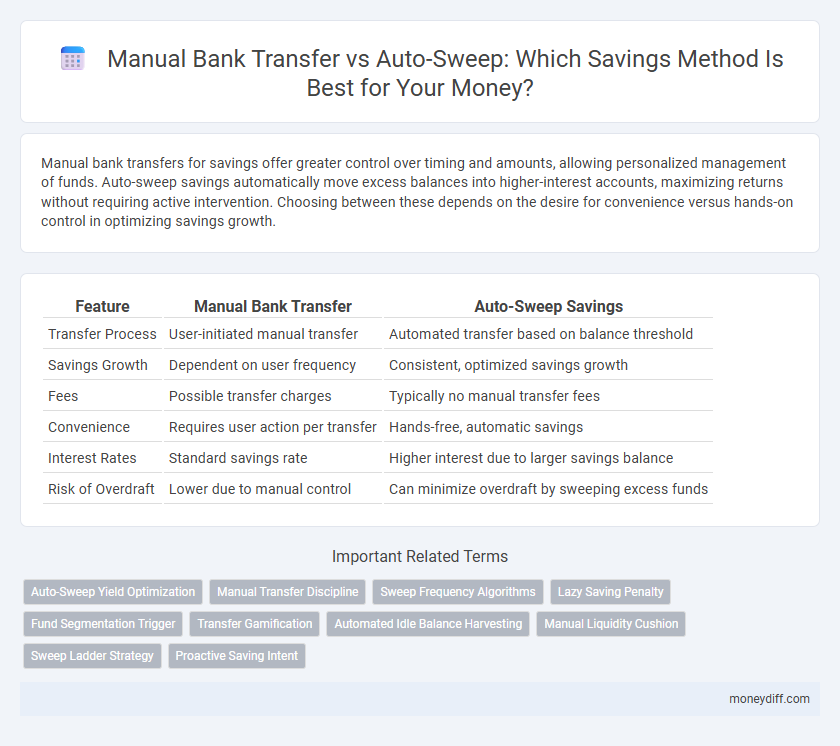

Manual bank transfers for savings offer greater control over timing and amounts, allowing personalized management of funds. Auto-sweep savings automatically move excess balances into higher-interest accounts, maximizing returns without requiring active intervention. Choosing between these depends on the desire for convenience versus hands-on control in optimizing savings growth.

Table of Comparison

| Feature | Manual Bank Transfer | Auto-Sweep Savings |

|---|---|---|

| Transfer Process | User-initiated manual transfer | Automated transfer based on balance threshold |

| Savings Growth | Dependent on user frequency | Consistent, optimized savings growth |

| Fees | Possible transfer charges | Typically no manual transfer fees |

| Convenience | Requires user action per transfer | Hands-free, automatic savings |

| Interest Rates | Standard savings rate | Higher interest due to larger savings balance |

| Risk of Overdraft | Lower due to manual control | Can minimize overdraft by sweeping excess funds |

Understanding Manual Bank Transfers

Manual bank transfers provide direct control over when and how funds move between accounts, allowing savers to time their decisions based on personal cash flow needs. This method requires active management, ensuring transfers occur only when initiated, which can help in avoiding unintended overdrafts or liquidity issues. Compared to auto-sweep savings, manual transfers offer greater flexibility but may lack the consistency and automation that enhances disciplined savings growth.

What Is Auto-Sweep Savings?

Auto-Sweep Savings automatically transfers funds exceeding a preset threshold from a savings account to a fixed deposit, maximizing interest earnings without manual intervention. This service ensures optimal liquidity by allowing easy withdrawals while generating higher returns on idle funds. Compared to manual bank transfers, auto-sweep savings offers seamless fund management and improved interest accumulation.

Comparing Interest Rates

Manual bank transfers often involve lower or no interest accumulation during the transfer period, as funds remain inactive outside the savings account. Auto-sweep savings accounts automatically transfer excess funds to higher-interest accounts, maximizing interest earnings with minimal effort. Comparing interest rates, auto-sweep solutions typically offer superior returns due to continuous compounding on larger balances.

Convenience and Accessibility

Manual bank transfers require users to initiate each transfer individually, which can be time-consuming and less convenient for consistent savings habits. Auto-sweep savings automatically transfer surplus funds from a checking account to a savings account, ensuring effortless and regular savings without repeated manual intervention. This automation enhances accessibility by providing seamless fund management and reducing the risk of missed savings opportunities.

Automation: Pros and Cons

Manual bank transfers offer greater control over the timing and amount of savings but require consistent user action, increasing the risk of missed deposits. Auto-sweep savings automate fund transfers from checking to savings accounts once a set balance threshold is reached, ensuring disciplined saving without daily intervention. However, automation limits flexibility and may lead to reduced liquidity if unexpected expenses arise.

Control and Flexibility

Manual Bank Transfers offer greater control over the exact timing and amount of funds moved, allowing savers to tailor their transfers based on current financial needs. Auto-Sweep Savings automate transfers when balances exceed a set threshold, providing convenience but less flexibility in timing and amounts. Savers prioritizing precise management often prefer manual transfers, while those seeking seamless growth benefit from auto-sweep features.

Security and Fraud Prevention

Manual bank transfers require user-initiated actions that reduce the risk of automated fraud but may expose accounts to human error or social engineering attacks. Auto-sweep savings leverage automated transfers with built-in encryption and secure protocols, offering real-time fraud detection to prevent unauthorized withdrawals. Choosing secure platforms with multi-factor authentication enhances protection in both manual and auto-sweep transfer methods.

Costs and Hidden Fees

Manual bank transfers often involve higher transaction fees and potential hidden charges that can erode savings over time. Auto-sweep savings typically minimize costs by automatically transferring excess funds to high-interest accounts without frequent transfer fees. Evaluating fee structures and transaction limits is crucial to maximizing savings growth and avoiding unexpected expenses.

Suitability for Different Savings Goals

Manual bank transfers offer greater control for individuals targeting specific savings goals with flexible, on-demand transfers, making them suitable for irregular or occasional saving habits. Auto-sweep savings automatically transfers surplus funds into a higher-interest account, ideal for steady, long-term savings objectives by maximizing interest earnings without user intervention. Choosing between these depends on the saver's preference for convenience versus customized timing in managing their financial goals.

Which Method Maximizes Savings Growth?

Manual bank transfers require actively moving funds, often delaying interest accumulation and limiting compounding benefits. Auto-sweep savings automatically transfer surplus funds into higher-interest accounts, maximizing daily interest gains and optimizing growth potential. This automated approach leverages seamless fund movement to consistently enhance savings performance and accelerate wealth accumulation.

Related Important Terms

Auto-Sweep Yield Optimization

Auto-Sweep Savings automatically transfers surplus funds from your checking account to a high-yield savings account, maximizing interest earnings without manual intervention. This yield optimization strategy ensures continuous growth by capturing higher interest rates on idle balances, outperforming traditional manual bank transfers that often miss out on timely interest accruals.

Manual Transfer Discipline

Manual bank transfers require disciplined scheduling and proactive management, ensuring savers maintain control over the exact amount and timing of their deposits. This method fosters financial responsibility and prevents overdrawing, but may risk missed transfers without consistent attention.

Sweep Frequency Algorithms

Manual bank transfer requires customers to initiate fund movements themselves, resulting in irregular withdrawal and deposit schedules that may reduce interest-earning potential. Auto-sweep savings utilize sweep frequency algorithms to automatically transfer excess balances between accounts at optimized intervals, maximizing interest accrual and maintaining liquidity with minimal user intervention.

Lazy Saving Penalty

Manual bank transfers require users to actively move funds to savings accounts, often leading to inconsistent saving habits and missed opportunities for optimizing interest, while auto-sweep savings automatically transfer excess funds from current to savings accounts, minimizing the lazy saving penalty by ensuring consistent, discipline-driven growth. Auto-sweep mechanisms maximize returns by reducing idle balances and leveraging compounding interest, thereby overcoming the drawbacks of manual transfers that can result in penalties due to delayed or irregular savings.

Fund Segmentation Trigger

Manual bank transfers require individuals to actively move funds between accounts, offering direct control but risking delayed segmentation of savings. Auto-sweep savings use automated triggers based on balance thresholds to instantly transfer excess funds into higher-yield accounts, optimizing savings growth without manual intervention.

Transfer Gamification

Manual bank transfer requires users to initiate transfers actively, which can lead to inconsistent savings habits due to the lack of immediate reinforcement. Auto-sweep savings leverages transfer gamification by automatically moving excess funds into savings, creating a seamless, rewarding experience that encourages regular saving through automated triggers.

Automated Idle Balance Harvesting

Auto-sweep savings automatically transfer idle funds from your checking account to a higher-interest savings account, maximizing returns without manual intervention. Manual bank transfers require active monitoring and initiation, often resulting in lower efficiency and missed opportunities for automated idle balance harvesting.

Manual Liquidity Cushion

Manual bank transfers provide greater control over liquidity management by allowing savers to maintain a personalized liquidity cushion, ensuring immediate access to funds when needed. In contrast, auto-sweep savings automatically transfer excess balances into fixed deposits, optimizing returns but potentially limiting instant fund availability.

Sweep Ladder Strategy

Manual bank transfers require active management and may lead to missed opportunities for maximizing interest, while auto-sweep savings implement the sweep ladder strategy by automatically moving excess funds into higher-yield accounts to optimize returns. The sweep ladder strategy incrementally transfers idle balances across linked accounts, enhancing liquidity and compounding interest without daily intervention.

Proactive Saving Intent

Manual bank transfers for savings require deliberate action, fostering conscious saving habits by prompting account holders to decide when and how much to save. Auto-sweep savings automatically transfer surplus funds to a higher-interest account, enabling proactive saving by consistently optimizing idle balances without manual intervention.

Manual Bank Transfer vs Auto-Sweep Savings for savings. Infographic

moneydiff.com

moneydiff.com