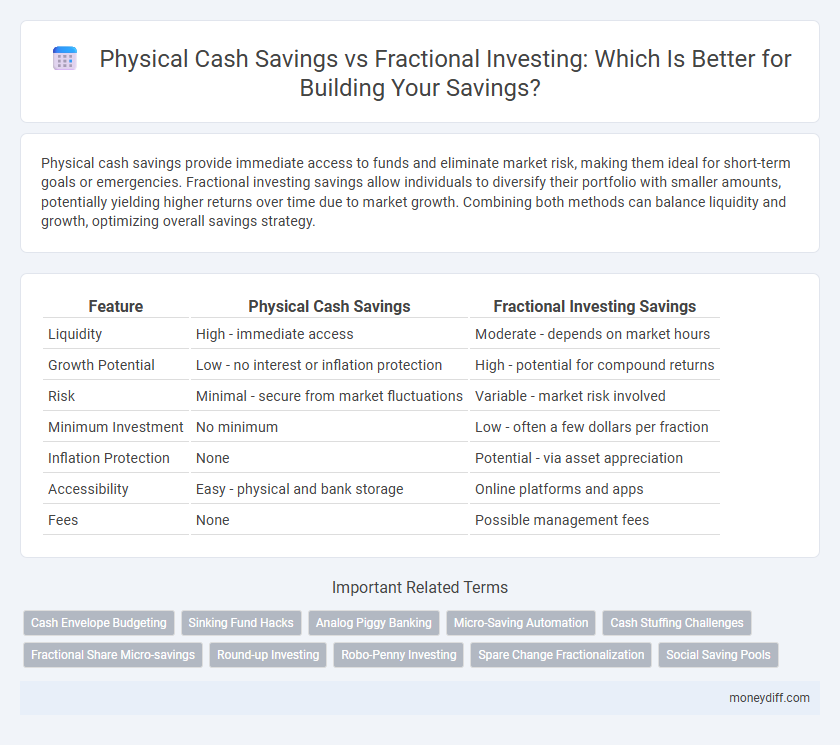

Physical cash savings provide immediate access to funds and eliminate market risk, making them ideal for short-term goals or emergencies. Fractional investing savings allow individuals to diversify their portfolio with smaller amounts, potentially yielding higher returns over time due to market growth. Combining both methods can balance liquidity and growth, optimizing overall savings strategy.

Table of Comparison

| Feature | Physical Cash Savings | Fractional Investing Savings |

|---|---|---|

| Liquidity | High - immediate access | Moderate - depends on market hours |

| Growth Potential | Low - no interest or inflation protection | High - potential for compound returns |

| Risk | Minimal - secure from market fluctuations | Variable - market risk involved |

| Minimum Investment | No minimum | Low - often a few dollars per fraction |

| Inflation Protection | None | Potential - via asset appreciation |

| Accessibility | Easy - physical and bank storage | Online platforms and apps |

| Fees | None | Possible management fees |

Introduction: Physical Cash Savings vs Fractional Investing

Physical cash savings offer immediate liquidity and tangible security, allowing individuals to store funds without market exposure or digital dependencies. Fractional investing savings provide access to diversified portfolios by enabling purchases of partial shares, optimizing growth potential through compound returns with lower capital requirements. Balancing physical cash savings with fractional investments enhances financial flexibility and long-term wealth accumulation.

Understanding Physical Cash Savings

Physical cash savings involve storing money in tangible currency, providing immediate liquidity and control without reliance on digital systems. This method offers protection against market volatility but lacks potential growth compared to fractional investing, which allocates funds into diversified assets. Understanding the trade-offs between physical cash savings and fractional investing is essential for optimizing financial security and long-term wealth accumulation.

What Is Fractional Investing for Savings?

Fractional investing allows individuals to save by purchasing partial shares of stocks or ETFs, enabling diversification with smaller amounts compared to physical cash savings held in traditional accounts. This method increases accessibility to high-value assets, reducing barriers to entry and promoting consistent investment habits. Fractional investing can potentially generate higher returns over time compared to the limited interest earned on physical cash savings.

Security: Physical Cash vs Digital Investments

Physical cash savings offer immediate access and tangibility but carry risks such as theft, loss, and lack of inflation protection. Fractional investing savings provide enhanced security through encrypted digital platforms, regulatory oversight, and diversified asset holdings, reducing risk exposure. Digital investments also benefit from insured accounts and transparency, making them a safer long-term option for preserving wealth compared to storing physical cash.

Accessibility and Liquidity Comparison

Physical cash savings offer immediate accessibility and liquidity, allowing instant withdrawals without market dependency. Fractional investing savings provide diversified exposure with high liquidity through platforms enabling partial asset sales, but access depends on trading hours and potential transaction delays. Both methods vary in ease of access, with cash being more straightforward and fractional investing offering flexible yet slightly less immediate liquidity.

Potential Returns: Cash Savings vs Fractional Investments

Physical cash savings offer stability and immediate liquidity but typically yield low interest rates that often fail to outpace inflation. Fractional investing enables diversification across stocks and ETFs, presenting higher potential returns through compound growth despite some market risk. Over time, fractional investments can significantly increase the value of savings compared to the minimal growth of cash holdings.

Inflation Impact on Savings Methods

Physical cash savings suffer significant erosion in value due to inflation, often resulting in decreased purchasing power over time. Fractional investing savings offer a hedge against inflation as the diversified portfolio can yield returns that outpace rising prices, preserving and potentially increasing the real value of savings. Analyzing historical inflation rates alongside investment performance highlights fractional investing as a more effective method to maintain wealth compared to holding physical cash.

Flexibility and Control over Funds

Physical cash savings offer immediate access and full control over funds without reliance on external platforms, providing maximum liquidity in emergencies. Fractional investing savings provide increased flexibility through smaller, diversified investments but may involve market risks and potential delays in converting investments back to cash. Balancing physical cash with fractional investments enhances financial control while optimizing growth opportunities.

Risks and Drawbacks of Each Approach

Physical cash savings face risks such as theft, loss, and depreciation due to inflation, which erodes purchasing power over time. Fractional investing savings carry market risks, including volatility and potential loss of principal, alongside fees and the complexity of managing diversified portfolios. Both approaches require careful consideration of liquidity needs and risk tolerance to align with individual financial goals.

Choosing the Right Savings Strategy for You

Physical cash savings offer liquidity and immediate access but often lack growth potential due to low or no interest rates. Fractional investing savings allow diversification with smaller amounts, enabling potential higher returns through stock or ETF exposure. Selecting the right savings strategy depends on your risk tolerance, financial goals, and need for accessibility.

Related Important Terms

Cash Envelope Budgeting

Cash envelope budgeting enhances physical cash savings by allocating specific amounts to designated categories, promoting disciplined spending and preventing overspending. Fractional investing savings offer growth potential through diversified portfolios but lack the immediate tangibility and spending control inherent in cash envelope methods.

Sinking Fund Hacks

Physical cash savings provide immediate liquidity and complete control over funds, making it ideal for short-term sinking funds without market risk. Fractional investing savings optimize growth potential by allowing diversified, low-cost access to assets, which can significantly enhance sinking fund value over time through compound returns.

Analog Piggy Banking

Analog piggy banking enables tangible cash savings by physically storing money, fostering disciplined budgeting and immediate access without digital dependency. Fractional investing savings, in contrast, offers diversified asset exposure and potential growth but lacks the hands-on control and simplicity inherent in traditional physical cash savings methods.

Micro-Saving Automation

Physical cash savings offer tangible security but lack growth potential and automation, whereas fractional investing savings enable micro-saving automation, allowing individuals to regularly invest small amounts into diversified portfolios with ease. This automated approach maximizes compounding benefits and financial discipline, optimizing long-term wealth accumulation compared to traditional cash hoarding.

Cash Stuffing Challenges

Physical cash savings through cash stuffing faces challenges such as limited security, lack of interest growth, and difficulty managing large sums, which can hinder long-term financial goals. Fractional investing savings overcome these issues by enabling diversified portfolio growth, offering liquidity, and reducing the risks associated with holding physical cash.

Fractional Share Micro-savings

Fractional share micro-savings enable investors to accumulate wealth by purchasing portions of high-value stocks, enhancing diversification with minimal capital compared to traditional physical cash savings that often lose value due to inflation. Platforms offering fractional investing facilitate consistent micro-investments, allowing users to build a robust, diversified portfolio and achieve higher long-term returns than conventional cash savings accounts.

Round-up Investing

Physical cash savings offer immediate liquidity but often yield low interest rates, while fractional investing savings, particularly through round-up investing platforms, allow users to automatically invest small amounts by rounding up everyday purchases, enhancing portfolio growth with minimal effort. Round-up investing leverages micro-investments to diversify savings, potentially achieving higher returns over time compared to traditional cash savings accounts.

Robo-Penny Investing

Physical cash savings provide immediate access and tangible security but often yield low returns due to minimal interest rates. Robo-Penny investing leverages fractional investing to grow savings through diversified portfolios with automated, low-cost strategies, enabling incremental wealth accumulation beyond traditional cash savings.

Spare Change Fractionalization

Spare Change Fractionalization enables investors to convert small, everyday cash amounts into diversified portfolio shares, maximizing savings potential beyond traditional physical cash storage. This method leverages fractional investing to grow micro-savings efficiently, offering higher returns and improved liquidity compared to holding physical cash.

Social Saving Pools

Social Saving Pools leverage fractional investing to pool resources from multiple individuals, enabling access to diversified assets and higher returns compared to traditional physical cash savings stored individually. Unlike physical cash savings, these collective investment methods reduce liquidity constraints and benefit from shared risk, enhancing overall financial growth potential within community networks.

Physical cash savings vs Fractional investing savings for savings. Infographic

moneydiff.com

moneydiff.com