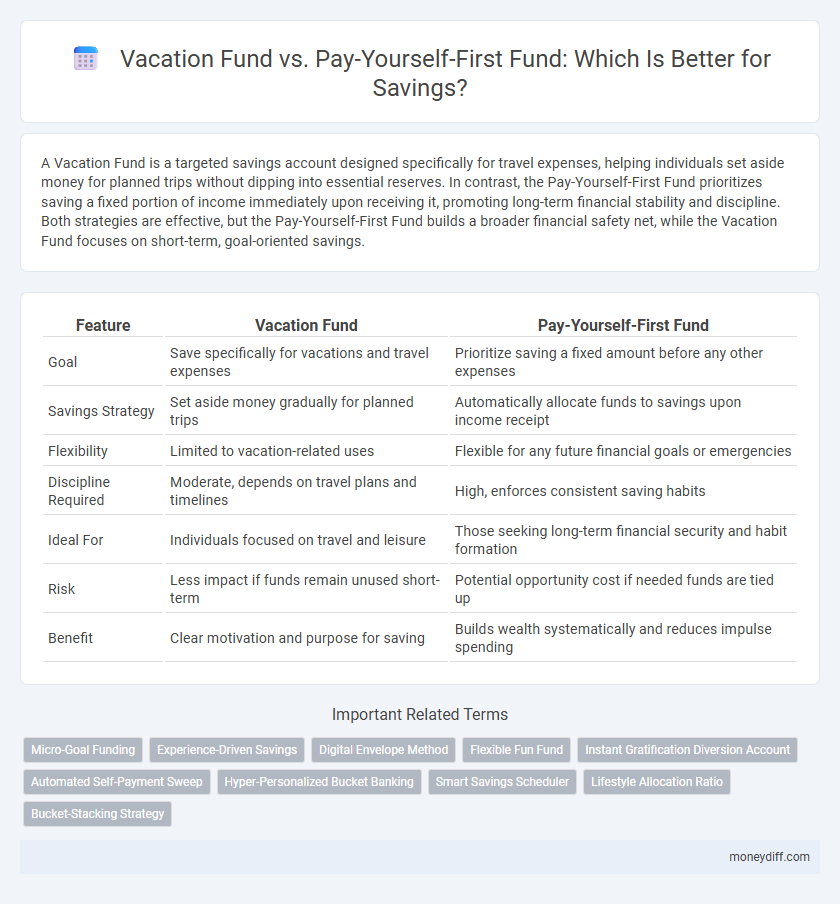

A Vacation Fund is a targeted savings account designed specifically for travel expenses, helping individuals set aside money for planned trips without dipping into essential reserves. In contrast, the Pay-Yourself-First Fund prioritizes saving a fixed portion of income immediately upon receiving it, promoting long-term financial stability and discipline. Both strategies are effective, but the Pay-Yourself-First Fund builds a broader financial safety net, while the Vacation Fund focuses on short-term, goal-oriented savings.

Table of Comparison

| Feature | Vacation Fund | Pay-Yourself-First Fund |

|---|---|---|

| Goal | Save specifically for vacations and travel expenses | Prioritize saving a fixed amount before any other expenses |

| Savings Strategy | Set aside money gradually for planned trips | Automatically allocate funds to savings upon income receipt |

| Flexibility | Limited to vacation-related uses | Flexible for any future financial goals or emergencies |

| Discipline Required | Moderate, depends on travel plans and timelines | High, enforces consistent saving habits |

| Ideal For | Individuals focused on travel and leisure | Those seeking long-term financial security and habit formation |

| Risk | Less impact if funds remain unused short-term | Potential opportunity cost if needed funds are tied up |

| Benefit | Clear motivation and purpose for saving | Builds wealth systematically and reduces impulse spending |

Understanding Vacation Funds: Purpose and Benefits

Vacation funds are dedicated savings accounts designed specifically to cover travel expenses, providing a clear financial goal and reducing the risk of accumulating debt from vacations. By allocating money regularly to a vacation fund, individuals can manage trip costs more effectively and enjoy stress-free travel experiences. This targeted saving strategy encourages disciplined financial planning while ensuring that leisure activities do not interfere with essential financial goals.

What is a Pay-Yourself-First Fund?

A Pay-Yourself-First Fund is a strategic savings method where individuals allocate a fixed amount of money to their savings account immediately after receiving income, before covering any other expenses. This approach prioritizes personal savings goals, ensuring consistent growth and financial security over time. Unlike a Vacation Fund, which often accumulates sporadically for short-term leisure goals, the Pay-Yourself-First Fund builds a disciplined and sustainable savings habit for long-term financial stability.

Key Differences Between Vacation Fund and Pay-Yourself-First Fund

Vacation Fund targets short-term leisure expenses, emphasizing periodic saving goals for trips, while Pay-Yourself-First Fund prioritizes automatic, consistent contributions to build long-term financial security. Vacation Fund savings are often more flexible and accessed as needed, whereas Pay-Yourself-First Fund promotes disciplined, early allocation of income before other expenses. The key difference lies in purpose and timing--Vacation Fund supports discretionary spending, contrasting with the foundational habit of wealth accumulation in Pay-Yourself-First Fund.

Financial Priorities: Travel vs. Building Wealth

Allocating savings between a Vacation Fund and a Pay-Yourself-First Fund reflects a balance between short-term enjoyment and long-term financial security. Prioritizing a Pay-Yourself-First Fund supports wealth accumulation through disciplined investing and compound growth, while a dedicated Vacation Fund enables budgeting for travel without incurring debt. Strategic savings plans that emphasize wealth-building typically yield greater financial stability, even as intentional travel savings provide lifestyle satisfaction.

How to Set Goals for Each Savings Fund

Establish clear, specific goals for each savings fund by determining the target amount and timeline tailored to the purpose, such as a $3,000 Vacation Fund for a trip within 12 months versus a $5,000 Pay-Yourself-First Fund for emergency savings over 24 months. Prioritize regular contributions by automating transfers based on your budget and income, ensuring consistent growth toward each fund's objective. Use SMART criteria--Specific, Measurable, Achievable, Relevant, Time-bound--to track progress and adjust goals as needed to maintain motivation and financial discipline.

Pros and Cons of Vacation Savings

Vacation savings offer a dedicated fund specifically for travel expenses, helping to prevent overspending on non-essential purchases and ensuring funds are readily available when planning trips, which enhances financial discipline. However, this approach can limit flexibility, as money allocated to vacation goals is often less accessible for emergencies or unexpected expenses compared to a pay-yourself-first fund, which prioritizes overall financial stability and long-term savings. The lack of interest or investment growth in many vacation savings accounts may also reduce potential earnings compared to diversified investment strategies within broader savings plans.

The Psychological Impact of Paying Yourself First

Paying yourself first creates a powerful psychological commitment to savings by prioritizing personal financial goals before any discretionary spending. This approach fosters consistent saving behavior, reducing the temptation to deplete funds on non-essential expenses, unlike a vacation fund that may be perceived as optional or leisure-driven. By automating transfers to a pay-yourself-first fund, individuals build financial discipline and a sense of security that supports long-term wealth accumulation.

Tips for Automating Contributions to Both Funds

Automate contributions to your Vacation Fund and Pay-Yourself-First Fund by scheduling recurring transfers from your checking account immediately after each paycheck deposits. Use budgeting apps like YNAB or Mint to set personalized goals and track progress in real time, ensuring consistent saving habits. Prioritize direct deposit allocations to separate accounts, minimizing temptation and maximizing efficiency for both short-term and long-term savings goals.

Choosing the Right Savings Strategy for Your Lifestyle

Choosing the right savings strategy depends on your personal financial goals and lifestyle priorities. A Vacation Fund targets short-term enjoyment and helps manage travel expenses without disrupting monthly budgets, while a Pay-Yourself-First Fund prioritizes long-term wealth building by automatically allocating funds to savings before other expenditures. Assessing your spending habits and future objectives ensures the chosen method aligns with both immediate wants and financial security.

Integrating Vacation and Pay-Yourself-First Funds into Your Budget

Integrating both Vacation Fund and Pay-Yourself-First Fund into your budget ensures disciplined savings while enjoying planned leisure. Allocating a fixed percentage of income to the Pay-Yourself-First Fund secures long-term financial goals, while setting aside monthly contributions to the Vacation Fund prepares for stress-free travel. Prioritizing these funds in your budget enhances financial stability and prevents overspending by clearly defining saving objectives.

Related Important Terms

Micro-Goal Funding

Micro-goal funding enhances savings efficiency by prioritizing specific objectives such as a Vacation Fund or a Pay-Yourself-First Fund, allowing clear tracking and motivation through defined targets. Allocating small, consistent amounts to each fund supports disciplined financial management and accelerates goal achievement by breaking large savings into manageable milestones.

Experience-Driven Savings

Vacation Fund prioritizes saving specifically for memorable travel experiences, enhancing personal fulfillment by allocating money directly toward trips and activities. Pay-Yourself-First Fund emphasizes consistent, automated savings deposited immediately from income, fostering disciplined growth but without a dedicated focus on experiential goals like vacations.

Digital Envelope Method

The Digital Envelope Method enhances the efficiency of managing Vacation Funds and Pay-Yourself-First Funds by digitally allocating specific budget portions into separate virtual envelopes, ensuring disciplined savings and reducing overspending risks. This method allows seamless tracking and real-time adjustments, optimizing financial goals through automated fund distribution tailored to individual savings priorities.

Flexible Fun Fund

A Flexible Fun Fund offers greater adaptability compared to a Vacation Fund or Pay-Yourself-First Fund by allowing savers to allocate money for spontaneous activities and unexpected leisure opportunities. This type of savings encourages financial freedom and enjoyment without strict budget constraints, enhancing overall saving habits and personal satisfaction.

Instant Gratification Diversion Account

A Vacation Fund serves as an Instant Gratification Diversion Account by allowing savers to enjoy short-term rewards and maintain motivation, whereas a Pay-Yourself-First Fund prioritizes long-term financial stability by automatically allocating savings before expenses. Utilizing an Instant Gratification Diversion Account balances the psychological need for immediate rewards with consistent saving habits, ultimately enhancing overall financial discipline.

Automated Self-Payment Sweep

Automated self-payment sweep enhances savings efficiency by directly allocating a fixed portion of income into either a Vacation Fund or a Pay-Yourself-First Fund, ensuring consistent growth without manual intervention. Prioritizing the Pay-Yourself-First Fund in this automation strategy accelerates wealth accumulation by securing essential savings before discretionary expenses like vacation spending.

Hyper-Personalized Bucket Banking

Vacation Fund targets short-term leisure goals with flexible, accessible savings, while Pay-Yourself-First Fund emphasizes disciplined, automatic contributions toward long-term financial security. Hyper-personalized bucket banking enables users to create customized savings buckets that optimize fund allocation, tracking, and goal achievement for each specific purpose.

Smart Savings Scheduler

A Smart Savings Scheduler strategically allocates funds to both a Vacation Fund for planned leisure expenses and a Pay-Yourself-First Fund prioritizing long-term financial goals, ensuring balanced growth and disciplined saving habits. This automated approach maximizes savings efficiency by adjusting contributions based on income fluctuations and set priorities, optimizing financial stability and enjoyment.

Lifestyle Allocation Ratio

The Lifestyle Allocation Ratio guides effective savings by balancing Vacation Funds for leisure with Pay-Yourself-First Funds dedicated to long-term financial goals. Prioritizing a higher percentage in Pay-Yourself-First ensures wealth accumulation, while allocating a moderate portion to Vacation Funds supports well-being and prevents burnout.

Bucket-Stacking Strategy

Vacation funds and Pay-Yourself-First funds serve distinct purposes within the Bucket-Stacking Strategy, where the vacation fund targets short-term, discretionary spending while the Pay-Yourself-First fund prioritizes long-term financial goals and emergency savings. Allocating specific amounts to each bucket ensures balanced saving habits, enhancing financial discipline and achieving both immediate enjoyment and future security.

Vacation Fund vs Pay-Yourself-First Fund for savings. Infographic

moneydiff.com

moneydiff.com