Standard cash jars offer a tangible, physical method for managing savings, making it easier to visually track and control spending habits. Digital wallet segmentation provides a more flexible and automated approach, allowing users to allocate funds into different categories for specific goals with real-time updates and enhanced accessibility. Combining both methods can optimize savings by leveraging the physical discipline of cash jars and the convenience of digital wallets.

Table of Comparison

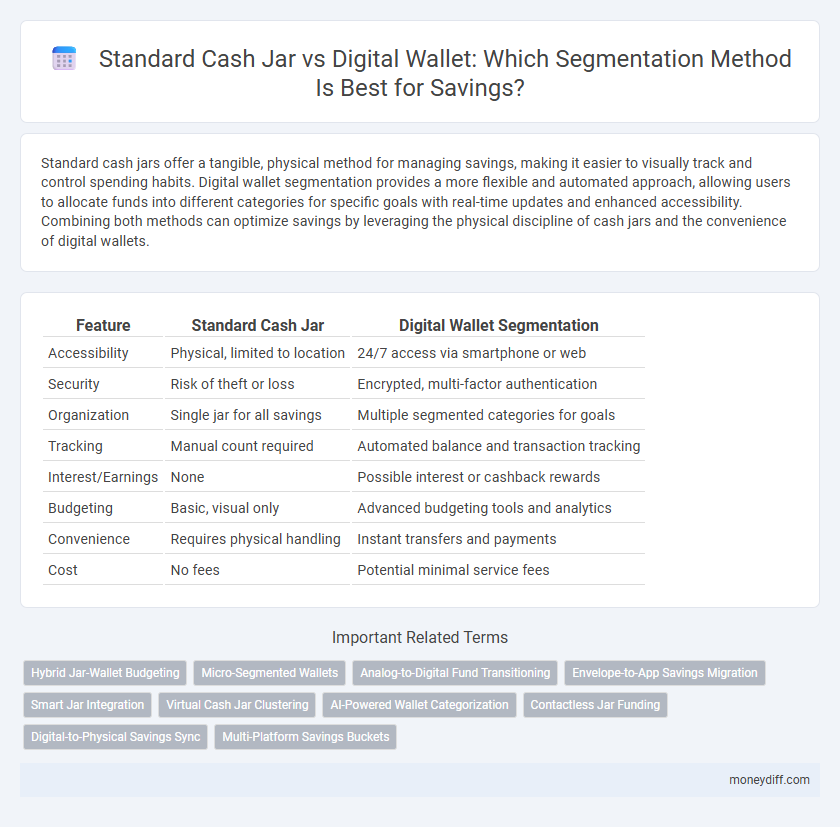

| Feature | Standard Cash Jar | Digital Wallet Segmentation |

|---|---|---|

| Accessibility | Physical, limited to location | 24/7 access via smartphone or web |

| Security | Risk of theft or loss | Encrypted, multi-factor authentication |

| Organization | Single jar for all savings | Multiple segmented categories for goals |

| Tracking | Manual count required | Automated balance and transaction tracking |

| Interest/Earnings | None | Possible interest or cashback rewards |

| Budgeting | Basic, visual only | Advanced budgeting tools and analytics |

| Convenience | Requires physical handling | Instant transfers and payments |

| Cost | No fees | Potential minimal service fees |

Introduction to Cash Jars and Digital Wallets for Savings

Cash jars offer a tangible, physical method for allocating savings into distinct categories like bills, groceries, and entertainment, enhancing budgeting clarity through visual cues. Digital wallets provide a flexible, app-based platform enabling users to create segmented savings goals with real-time tracking, automated transfers, and spending analytics. Both tools serve crucial roles in personal finance management, accommodating diverse preferences for savings organization and accessibility.

Traditional Cash Jar Method: An Overview

The traditional cash jar method for savings involves physically dividing money into labeled containers to allocate funds for specific goals, promoting tangible budgeting and spending awareness. This hands-on approach enhances discipline by limiting access to each cash jar, making overspending less likely compared to digital wallets. Despite lacking digital features like transaction tracking and automatic transfers, the cash jar method remains a straightforward, low-tech savings strategy favored for its simplicity and visual motivation.

Digital Wallet Segmentation: Modern Approach Explained

Digital wallet segmentation offers a modern approach to savings by categorizing funds based on specific goals, spending habits, and time frames, enhancing user control and financial organization. Unlike the traditional standard cash jar method, digital wallets integrate real-time tracking, automated transfers, and personalized insights, increasing saving efficiency and motivation. This technology-driven strategy leverages data analytics to tailor saving plans, making digital wallet segmentation a superior choice for contemporary money management.

Ease of Use: Cash Jars vs Digital Wallet Apps

Standard cash jars offer a tangible and straightforward method for saving money, allowing users to physically separate funds for different goals without needing technical skills. Digital wallet apps provide enhanced convenience through features like automatic transfers, real-time balance tracking, and budgeting tools, streamlining the saving process on smartphones. Users prioritizing simplicity may prefer cash jars, while those seeking efficiency and advanced management typically benefit from digital wallet segmentation.

Security Considerations in Physical and Digital Savings

Standard cash jars offer tangible control and immediate access to savings without reliance on technology, reducing risks of cyber theft but increasing vulnerability to physical loss or damage. Digital wallets provide encrypted storage with multi-factor authentication, significantly enhancing protection against unauthorized access but depend on device security and digital literacy. Evaluating savings methods requires balancing physical security risks against digital cybersecurity measures to choose the optimal platform for individual needs.

Accessibility: Managing Funds in Jars Versus Digital Wallets

Standard Cash Jars offer physical accessibility, making cash readily available for immediate use but limiting remote management and tracking capabilities. Digital wallets enhance accessibility by enabling instant fund transfers, real-time balance monitoring, and integration with mobile banking apps, supporting efficient savings segmentation. The choice between cash jars and digital wallets depends on the need for physical control versus digital convenience in managing segmented savings.

Tracking and Visualization of Savings Goals

Standard cash jars provide a physical method to segregate savings but lack real-time tracking and detailed visualization features, making goal monitoring less precise. Digital wallets offer advanced tracking tools with automated categorization and progress visualization, enhancing the ability to manage multiple savings goals simultaneously. Integration with mobile apps enables instant updates and insightful analytics, improving motivation and financial discipline.

Cost and Fees: Comparing Physical and Digital Methods

Standard cash jars eliminate transaction fees and offer complete control over physical money, making them a zero-cost saving method. Digital wallets often impose fees for transfers, currency conversions, and maintenance, which can accumulate and impact savings growth. Comparing cost efficiency, cash jars incur no hidden charges, while digital wallets provide convenience at the expense of potential service fees.

Behavioral Impact: Spending Habits with Jars vs Apps

Standard cash jars encourage physical separation of funds, reinforcing disciplined saving through tangible limits and visual cues, which reduces impulsive spending. Digital wallet segmentation offers real-time tracking and categorization, enhancing budget control but may increase the temptation for quick transfers and less mindful spending. Behavioral impact studies show that cash jars promote stronger saving habits due to physical engagement, while apps provide greater convenience with mixed effects on spending discipline.

Which Method Fits You? Choosing the Right Savings Strategy

Standard cash jars offer a tangible, physical approach to budgeting by dividing money into separate envelopes for specific goals, ideal for individuals who benefit from visual and hands-on saving methods. Digital wallets provide a more flexible, tech-savvy solution with features like automated transfers, goal tracking, and instant access, best suited for users comfortable with mobile apps and seeking convenience. Assess your spending habits, financial discipline, and preference for either physical money management or digital tools to determine which savings strategy aligns with your lifestyle and encourages consistent saving behavior.

Related Important Terms

Hybrid Jar-Wallet Budgeting

Hybrid Jar-Wallet budgeting combines the tangible control of Standard Cash Jars with the convenience and real-time tracking of Digital Wallets, optimizing savings by segmenting funds into specific categories for spending, goals, and emergencies. This approach enhances financial discipline through physical cash allocation while leveraging digital tools for automated transfers, balance monitoring, and spending alerts, driving more effective and adaptive savings management.

Micro-Segmented Wallets

Micro-segmented wallets enable precise allocation of funds into targeted savings categories, enhancing financial discipline through customized budgeting and real-time transaction tracking. Unlike standard cash jars, these digital wallets offer granular data analytics and automated goal adjustments, optimizing savings efficiency and user engagement.

Analog-to-Digital Fund Transitioning

Standard cash jars offer tangible, physical segmentation for savings, enhancing visual and tactile control over funds, while digital wallets provide seamless, real-time allocation and transfer capabilities optimized for automated budgeting and tracking. Transitioning from analog cash jars to digital wallets boosts efficiency by enabling instant fund reallocation, reducing cash handling risks, and integrating with financial management platforms for comprehensive savings optimization.

Envelope-to-App Savings Migration

Envelope-to-app savings migration leverages digital wallets to replicate the traditional standard cash jar method by categorizing funds into virtual envelopes, enhancing tracking and allocation efficiency. This segmentation allows users to maintain the psychological benefits of physical cash separation while benefiting from real-time balance updates and automated saving features within the app environment.

Smart Jar Integration

Smart Jar Integration enhances the Standard Cash Jar by enabling automatic categorization and real-time tracking of savings, outperforming traditional methods with instant updates and personalized financial insights. Digital Wallet Segmentation leverages this technology to divide funds into distinct goals, increasing saving discipline and optimizing fund allocation through seamless connectivity and AI-driven analytics.

Virtual Cash Jar Clustering

Virtual cash jar clustering within digital wallet segmentation enables precise allocation of funds into distinct savings categories, enhancing budget management and financial goal tracking. This approach leverages AI-driven data analysis to optimize savings behavior by grouping virtual jars based on spending patterns and priority levels.

AI-Powered Wallet Categorization

AI-powered wallet categorization enhances digital wallet segmentation by analyzing spending patterns and automatically sorting funds into designated savings jars, outperforming the manual allocation method of a standard cash jar. This technology increases accuracy in expense tracking and personalized savings goals, driving optimized financial management and more efficient fund allocation.

Contactless Jar Funding

Contactless jar funding enhances the convenience of standard cash jars by allowing instant, wireless deposits directly from digital wallets, increasing saving frequency and accessibility. This seamless integration between physical cash management and digital wallet technology drives more consistent savings behavior and greater user engagement.

Digital-to-Physical Savings Sync

Digital wallets enable real-time synchronization between virtual funds and physical cash jars, enhancing seamless savings management across both platforms. This digital-to-physical savings sync leverages automated updates and biometric security to ensure accurate tracking and increased user engagement compared to traditional standard cash jar methods.

Multi-Platform Savings Buckets

Multi-platform savings buckets enable users to allocate funds across both standard cash jars and digital wallets, optimizing financial organization and accessibility. This segmentation enhances savings strategies by leveraging physical cash control with seamless digital transactions, catering to diverse user preferences and spending habits.

Standard Cash Jar vs Digital Wallet Segmentation for savings. Infographic

moneydiff.com

moneydiff.com