Automatic transfers create a disciplined savings habit by transferring fixed amounts regularly from checking to savings accounts, ensuring consistent growth of funds without manual intervention. Micro-savings apps round up everyday purchases or allow small, frequent deposits, making saving effortless and accessible for those with irregular incomes or tight budgets. Both methods promote financial stability, with automatic transfers favoring steady progress and micro-savings apps enabling gradual accumulation through daily habits.

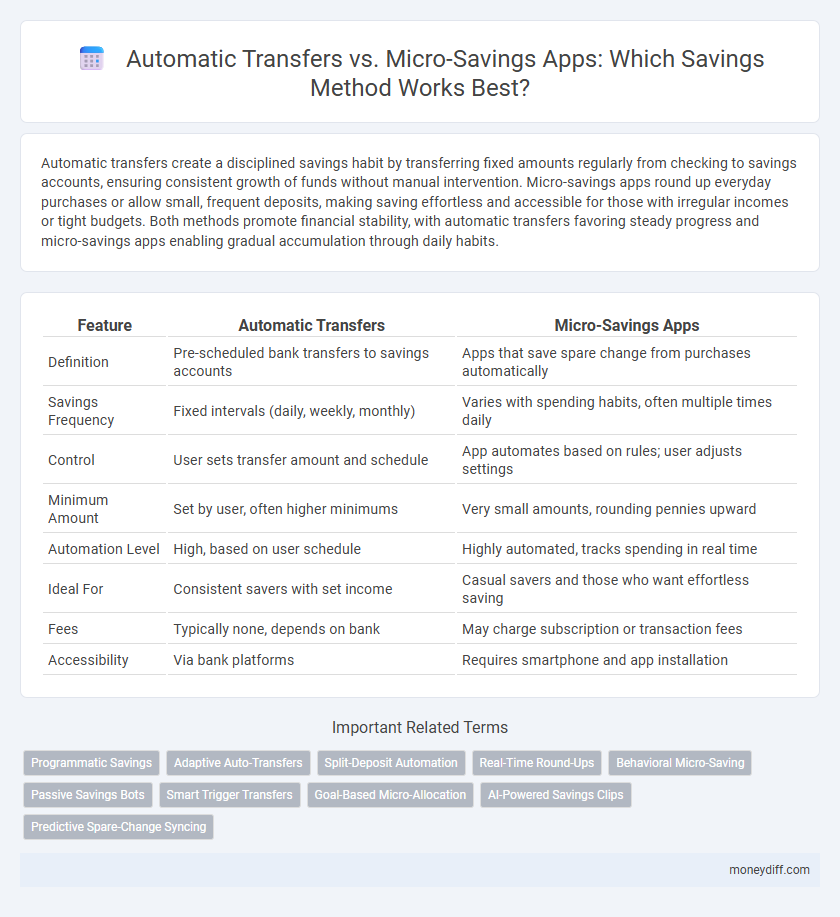

Table of Comparison

| Feature | Automatic Transfers | Micro-Savings Apps |

|---|---|---|

| Definition | Pre-scheduled bank transfers to savings accounts | Apps that save spare change from purchases automatically |

| Savings Frequency | Fixed intervals (daily, weekly, monthly) | Varies with spending habits, often multiple times daily |

| Control | User sets transfer amount and schedule | App automates based on rules; user adjusts settings |

| Minimum Amount | Set by user, often higher minimums | Very small amounts, rounding pennies upward |

| Automation Level | High, based on user schedule | Highly automated, tracks spending in real time |

| Ideal For | Consistent savers with set income | Casual savers and those who want effortless saving |

| Fees | Typically none, depends on bank | May charge subscription or transaction fees |

| Accessibility | Via bank platforms | Requires smartphone and app installation |

Introduction: The Importance of Effective Savings Strategies

Effective savings strategies significantly impact financial stability by maximizing the ease and consistency of setting money aside. Automatic transfers facilitate disciplined saving through scheduled, fixed amounts moved directly from checking to savings accounts, creating a reliable habit without manual intervention. Micro-savings apps complement this by rounding up everyday purchases and investing small change, making savings seamless and accessible for users with varying income levels.

What Are Automatic Transfers?

Automatic transfers are scheduled, recurring transactions that move a fixed amount of money from a checking account to a savings account at regular intervals, such as weekly or monthly. This method ensures consistent contributions to savings without requiring manual intervention, helping build a disciplined savings habit. Banks and financial institutions often provide automatic transfer options with customizable frequencies and amounts to fit individual financial goals.

Understanding Micro-Savings Apps

Micro-savings apps automatically round up everyday purchases to the nearest dollar and transfer the difference into a savings account, making small, frequent contributions effortless and consistent. These apps use algorithms to analyze spending patterns and suggest optimal saving amounts without impacting daily budgets significantly. Compared to automatic transfers that move fixed sums on set dates, micro-savings apps adapt dynamically, promoting incremental financial growth through behavioral nudges.

Key Differences Between Automatic Transfers and Micro-Savings Apps

Automatic transfers enable scheduled, predefined amounts to move directly from checking to savings accounts, ensuring consistent saving habits without manual intervention. Micro-savings apps round up everyday purchases and transfer spare change into savings, promoting incremental accumulation through everyday spending. While automatic transfers focus on disciplined, larger sums, micro-savings apps leverage behavioral nudges for gradual growth, appealing to users seeking effortless, small-scale saving strategies.

Benefits of Using Automatic Transfers for Savings

Automatic transfers enable consistent, disciplined saving by scheduling fixed amounts to move from checking to savings accounts, reducing the temptation to spend. This method leverages the power of compound interest by ensuring regular contributions without manual effort. Automatic transfers also provide predictability and easy budgeting, as savers can align transfers with paydays or bill cycles for optimal cash flow management.

Advantages of Micro-Savings Apps

Micro-savings apps offer seamless, automated savings by rounding up everyday purchases and transferring small amounts, making it easier to save without significant effort. They provide personalized savings goals and real-time progress tracking, enhancing motivation and financial discipline. These apps often incorporate behavioral nudges and rewards, helping users develop consistent saving habits compared to traditional automatic transfers.

Potential Drawbacks of Automatic Transfers

Automatic transfers may lead to reduced financial flexibility as fixed transfer amounts can strain budgets during unexpected expenses. These transfers might also cause overdraft fees if the account balance is insufficient at the time of withdrawal. Unlike micro-savings apps, automatic transfers lack adaptive features that adjust based on spending habits or income fluctuations, potentially limiting optimized saving strategies.

Cons to Consider with Micro-Savings Apps

Micro-savings apps often impose fees that can erode the overall savings growth, making them less cost-effective for small or frequent deposits. These apps may also encourage overspending by rounding up purchases automatically, leading to unintended financial strain. Security concerns arise as users must grant access to bank accounts, increasing the risk of data breaches or unauthorized transactions.

Choosing the Right Savings Approach for Your Financial Goals

Automatic transfers ensure consistent, scheduled deposits into savings accounts, ideal for building a disciplined savings habit aligned with specific financial goals like emergency funds or vacation planning. Micro-savings apps round up everyday purchases or transfer small amounts automatically, perfect for individuals seeking gradual growth without altering spending habits significantly. Selecting the right approach depends on your income stability, savings goals, and preference for hands-off versus incremental saving strategies.

Conclusion: Maximizing Savings Efficiency Through Technology

Automatic transfers offer a reliable method for consistent savings by scheduling fixed amounts directly from your checking to savings account, ensuring disciplined financial growth. Micro-savings apps optimize savings through round-ups and small, frequent deposits, leveraging behavioral psychology to increase funds without requiring conscious effort. Combining both strategies enhances savings efficiency by balancing automatic discipline with incremental, effortless contributions driven by technology.

Related Important Terms

Programmatic Savings

Automatic transfers enable consistent, scheduled contributions directly from checking to savings accounts, ensuring disciplined programmatic savings without manual intervention. Micro-savings apps round up everyday purchases or set small, frequent deposits, leveraging behavioral finance to boost savings with minimal borrower effort.

Adaptive Auto-Transfers

Adaptive auto-transfers optimize savings by automatically adjusting transfer amounts based on income patterns and spending habits, ensuring consistent growth without manual intervention. This dynamic approach outperforms micro-savings apps by aligning deposits with real-time financial behavior, enhancing long-term savings efficiency.

Split-Deposit Automation

Split-deposit automation enhances savings by automatically directing portions of income into designated accounts, ensuring consistent fund allocation without manual intervention. Compared to micro-savings apps, which round up transactions to save small amounts, split-deposit automation offers more control and predictability in managing savings goals.

Real-Time Round-Ups

Real-time round-ups in micro-savings apps automatically link to spending accounts, rounding each purchase to the nearest dollar and transferring the difference into a savings account, accelerating small but consistent saving habits. Automatic transfers offer scheduled, fixed-amount deposits that can build savings steadily but lack the immediate, transaction-based responsiveness provided by round-up technology.

Behavioral Micro-Saving

Behavioral micro-saving apps leverage psychological triggers by automating small, frequent transfers based on spending habits to build savings effortlessly, leading to higher user engagement and consistent growth over time. Unlike traditional automatic transfers with fixed amounts, these apps adapt to individual behavior, encouraging saving through personalized nudges and real-time adjustments that optimize accumulation without impacting daily budgets.

Passive Savings Bots

Automatic transfers enable consistent, scheduled deposits into savings accounts without manual intervention, ensuring disciplined savings growth over time. Micro-savings apps use passive savings bots to round up purchases or analyze spending patterns, seamlessly transferring small amounts to savings, maximizing incremental wealth accumulation with minimal user effort.

Smart Trigger Transfers

Smart trigger transfers use behavioral data and spending patterns to automatically move funds into savings accounts when predefined conditions are met, optimizing the growth of savings without manual input. This method outperforms traditional automatic transfers and micro-savings apps by ensuring transfers occur during low-spending periods, reducing the risk of overdraft and maximizing saving efficiency.

Goal-Based Micro-Allocation

Goal-based micro-allocation in micro-savings apps enables precise, small-scale deposits aligned with specific financial objectives, optimizing progress without disrupting cash flow. Automatic transfers, while consistent, often lack the nuanced targeting and flexibility that micro-allocation strategies provide for personalized savings growth.

AI-Powered Savings Clips

AI-powered savings clips enhance automatic transfers and micro-savings apps by intelligently analyzing spending patterns to optimize the timing and amount of transfers, ensuring consistent and personalized savings growth. These clips leverage machine learning algorithms to adjust savings rules dynamically, maximizing efficiency without requiring manual intervention.

Predictive Spare-Change Syncing

Automatic transfers schedule fixed amounts from checking to savings accounts, ensuring consistent growth, while micro-savings apps use predictive spare-change syncing by analyzing spending patterns and rounding up transactions to save small, incremental amounts invisibly. This predictive syncing leverages machine learning algorithms to optimize savings without impacting daily cash flow, making micro-savings apps a dynamic tool for gradual wealth accumulation.

Automatic Transfers vs Micro-Savings Apps for Savings. Infographic

moneydiff.com

moneydiff.com