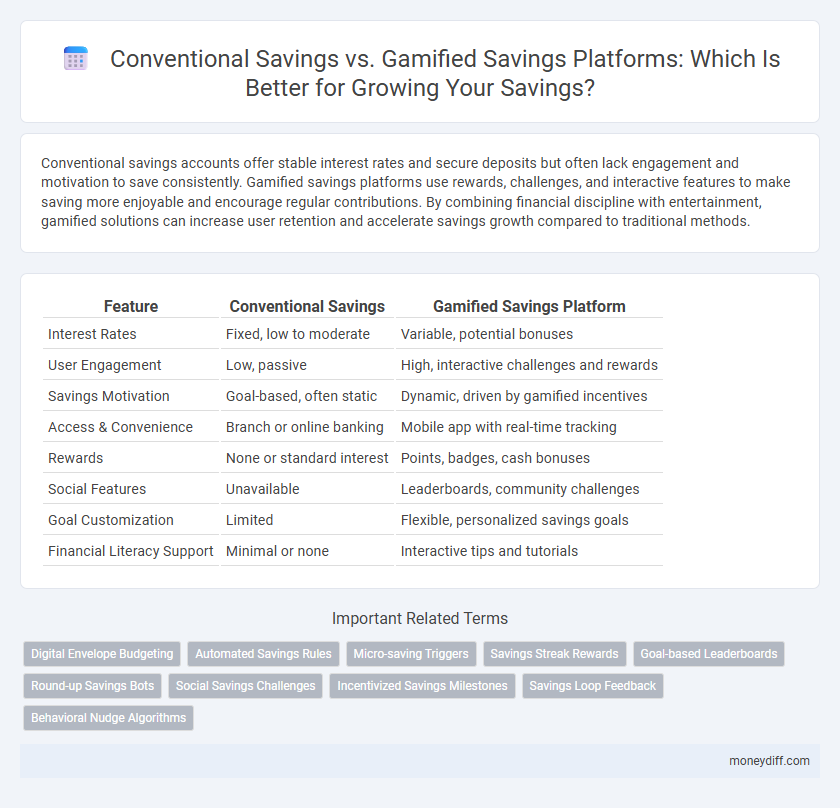

Conventional savings accounts offer stable interest rates and secure deposits but often lack engagement and motivation to save consistently. Gamified savings platforms use rewards, challenges, and interactive features to make saving more enjoyable and encourage regular contributions. By combining financial discipline with entertainment, gamified solutions can increase user retention and accelerate savings growth compared to traditional methods.

Table of Comparison

| Feature | Conventional Savings | Gamified Savings Platform |

|---|---|---|

| Interest Rates | Fixed, low to moderate | Variable, potential bonuses |

| User Engagement | Low, passive | High, interactive challenges and rewards |

| Savings Motivation | Goal-based, often static | Dynamic, driven by gamified incentives |

| Access & Convenience | Branch or online banking | Mobile app with real-time tracking |

| Rewards | None or standard interest | Points, badges, cash bonuses |

| Social Features | Unavailable | Leaderboards, community challenges |

| Goal Customization | Limited | Flexible, personalized savings goals |

| Financial Literacy Support | Minimal or none | Interactive tips and tutorials |

Understanding Conventional Savings Methods

Conventional savings methods typically involve depositing funds into traditional accounts such as savings accounts or fixed deposits offered by banks, providing steady interest rates with minimal risk. These methods prioritize security and liquidity, making them ideal for individuals seeking predictable growth without complexity or engagement features. While conventional savings are reliable, they often lack the motivational elements found in gamified savings platforms that encourage consistent saving habits through rewards and interactive goals.

Introduction to Gamified Savings Platforms

Gamified savings platforms leverage game mechanics such as rewards, challenges, and progress tracking to motivate users to save more consistently compared to conventional savings accounts. These platforms use behavioral economics principles to increase user engagement and encourage financial discipline, often resulting in higher saving rates and improved financial habits. Enhanced user experience through interactive features makes gamified savings an innovative alternative to traditional, passive savings methods.

Key Features of Traditional Savings Approaches

Traditional savings approaches feature fixed interest rates, government-backed security, and easy access through physical bank branches and ATMs. These conventional methods rely on predictable returns, low risk, and established regulatory frameworks, making them a trusted option for conservative savers. However, they often lack engagement tools and personalized incentives found in modern gamified savings platforms.

How Gamification Transforms the Savings Experience

Gamified savings platforms leverage game mechanics such as rewards, challenges, and progress tracking to motivate users, significantly increasing engagement compared to conventional savings accounts. These platforms create an interactive environment that transforms passive saving habits into active, goal-oriented behaviors by incorporating elements like points, badges, and leaderboards. Enhanced user experience and behavioral incentives in gamified systems often result in higher savings rates and improved financial discipline.

Comparing User Engagement in Both Platforms

Conventional savings platforms typically offer straightforward interest accrual but often struggle with low user engagement due to lack of interactive features. Gamified savings platforms leverage game mechanics such as rewards, challenges, and progress tracking to significantly boost user motivation and retention rates. Data from recent studies indicate that users of gamified platforms save up to 30% more frequently and maintain longer saving streaks compared to conventional savings users.

Psychological Drivers Behind Effective Saving

Conventional savings rely on disciplined routines and delayed gratification to build financial security, often facing challenges due to lack of immediate rewards and motivation. Gamified savings platforms leverage psychological drivers such as instant feedback, goal setting, and rewards systems to enhance user engagement and promote consistent saving habits. By tapping into intrinsic motivation and behavioral nudges, these platforms can improve saving outcomes more effectively than traditional methods.

Advantages of Using Gamified Savings Tools

Gamified savings platforms increase user engagement by incorporating game elements such as rewards, challenges, and progress tracking, which enhance motivation to save consistently. These tools leverage behavioral economics principles, making saving feel less like a chore and more like an interactive experience that encourages financial discipline. Data shows users of gamified apps often achieve higher savings rates and greater financial goal completion compared to traditional savings accounts.

Potential Drawbacks of Gamified Savings

Gamified savings platforms can introduce risks such as overspending due to game-like incentives that encourage frequent transactions rather than consistent saving habits. These platforms may also lead to distractions, causing users to focus more on earning rewards than on building substantial savings over time. Unlike conventional savings accounts, gamified platforms might lack transparent fee structures, potentially reducing overall savings growth.

Security and Trust: Conventional vs Gamified

Conventional savings accounts offer guaranteed security backed by federal insurance schemes such as FDIC or NCUA, ensuring depositor funds are protected. Gamified savings platforms, while engaging users through rewards and interactive features, must prioritize robust cybersecurity measures and transparent privacy policies to build trust. The perceived trustworthiness of conventional banks often surpasses emerging gamified platforms due to established regulatory compliance and longstanding reputations.

Choosing the Right Savings Strategy for Your Goals

Conventional savings accounts offer stable interest rates and easy access to funds, making them ideal for long-term financial security and emergency reserves. Gamified savings platforms use rewards, challenges, and social features to boost motivation and engagement, appealing to users who value interactive and goal-oriented saving experiences. Selecting the right savings strategy depends on your financial goals, risk tolerance, and preference for either predictable growth or motivational incentives.

Related Important Terms

Digital Envelope Budgeting

Conventional savings rely on fixed methods like predetermined amounts saved regularly, whereas gamified savings platforms enhance user engagement by integrating rewards, challenges, and social interaction to motivate consistent saving behavior. Digital envelope budgeting within these platforms allows users to allocate funds into virtual categories, providing a structured, flexible approach that improves tracking and encourages disciplined financial habits.

Automated Savings Rules

Automated savings rules in conventional savings accounts often require manual setup and limited customization, resulting in less consistent saving habits. Gamified savings platforms leverage automated rules with dynamic triggers and real-time feedback, enhancing user engagement and accelerating savings growth through personalized incentives.

Micro-saving Triggers

Micro-saving triggers in conventional savings rely on manual transfers and preset schedules, often lacking real-time motivation or engagement. Gamified savings platforms use behavioral nudges, instant rewards, and interactive challenges to stimulate frequent, small deposits, enhancing user commitment and accelerating savings growth.

Savings Streak Rewards

Conventional savings accounts offer steady interest accrual but often lack engaging incentives, whereas gamified savings platforms boost user motivation through Savings Streak Rewards that encourage consistent deposits over time. These streak-based rewards leverage behavioral psychology to increase saving frequency and long-term financial discipline.

Goal-based Leaderboards

Goal-based leaderboards in gamified savings platforms significantly enhance motivation by allowing users to track progress against peers while focusing on specific financial targets. Conventional savings methods lack this interactive and competitive element, resulting in lower engagement and less consistent achievement of personal savings goals.

Round-up Savings Bots

Round-up savings bots on gamified savings platforms automate micro-savings by rounding up everyday transactions to the nearest dollar, transferring the difference into a dedicated savings account, which accelerates wealth accumulation through consistent, low-effort contributions. Unlike conventional savings methods that require manual deposits and often prioritize higher interest rates, these bots leverage behavioral economics to enhance user engagement and promote habitual saving with real-time feedback and rewards.

Social Savings Challenges

Conventional savings rely on individual discipline and fixed interest rates, often lacking engagement and motivation for consistent contributions. Gamified savings platforms leverage social savings challenges, combining peer competition and rewards to boost participation, accountability, and overall savings growth.

Incentivized Savings Milestones

Conventional savings accounts typically offer fixed interest rates with limited motivational features, resulting in slower user engagement and lower savings growth. Gamified savings platforms leverage incentivized milestones, such as rewards and challenges, to boost user motivation, increase consistent deposits, and accelerate overall savings accumulation.

Savings Loop Feedback

Conventional savings rely on fixed interest rates and manual tracking, often leading to low user engagement and slower growth in savings balances. In contrast, gamified savings platforms use real-time feedback loops, rewards, and progress tracking to motivate continuous saving behavior, significantly enhancing user retention and accelerating savings growth.

Behavioral Nudge Algorithms

Conventional savings rely on standard interest accrual and fixed contribution schedules, while gamified savings platforms integrate behavioral nudge algorithms that use personalized incentives, real-time feedback, and goal-setting mechanics to enhance user engagement and increase savings rates. These algorithms leverage principles from behavioral economics, such as loss aversion and commitment devices, to effectively encourage consistent saving behavior and reduce cognitive friction.

Conventional Savings vs Gamified Savings Platform for savings. Infographic

moneydiff.com

moneydiff.com