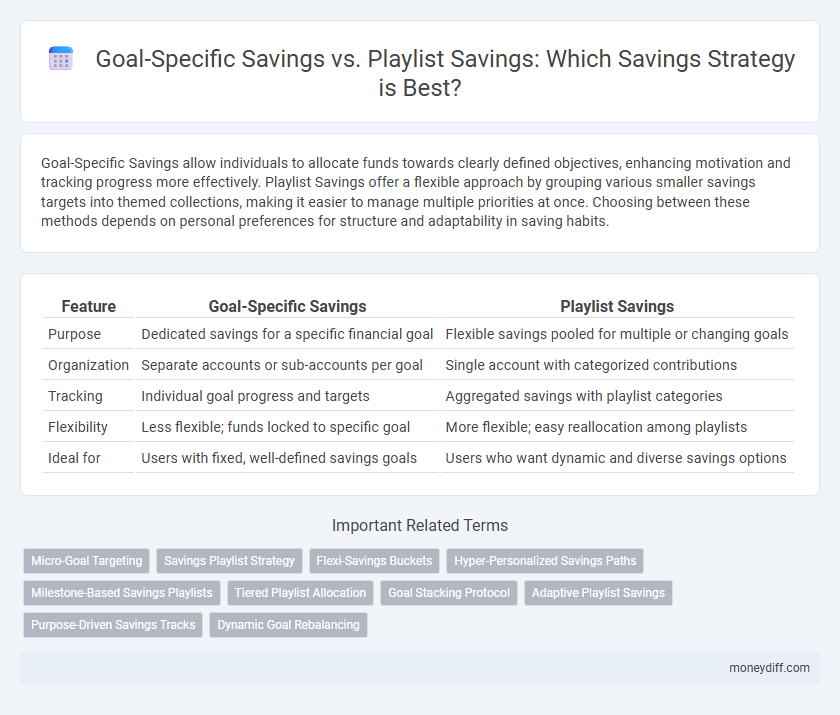

Goal-Specific Savings allow individuals to allocate funds towards clearly defined objectives, enhancing motivation and tracking progress more effectively. Playlist Savings offer a flexible approach by grouping various smaller savings targets into themed collections, making it easier to manage multiple priorities at once. Choosing between these methods depends on personal preferences for structure and adaptability in saving habits.

Table of Comparison

| Feature | Goal-Specific Savings | Playlist Savings |

|---|---|---|

| Purpose | Dedicated savings for a specific financial goal | Flexible savings pooled for multiple or changing goals |

| Organization | Separate accounts or sub-accounts per goal | Single account with categorized contributions |

| Tracking | Individual goal progress and targets | Aggregated savings with playlist categories |

| Flexibility | Less flexible; funds locked to specific goal | More flexible; easy reallocation among playlists |

| Ideal for | Users with fixed, well-defined savings goals | Users who want dynamic and diverse savings options |

Understanding Goal-Specific Savings

Goal-specific savings target particular financial objectives, enabling structured accumulation for expenses like vacations, emergencies, or large purchases, which increases motivation and tracking precision. These savings accounts often feature tailored tools for monitoring progress and setting deadlines, enhancing disciplined financial planning. Goal-specific savings improve money management by clearly defining purpose-driven funds, minimizing impulse spending compared to generalized playlist savings.

What Is Playlist Savings?

Playlist Savings is a flexible approach where multiple savings goals are grouped into a single organized collection, allowing users to track and manage them collectively while maintaining individual targets. This method contrasts with Goal-Specific Savings, which isolates each financial objective into separate accounts or funds. Playlist Savings enhances visibility and control by enabling easy adjustments and reallocation of funds within the combined savings pool, optimizing overall goal achievement.

Key Differences Between Goal-Specific and Playlist Savings

Goal-specific savings are designed to allocate funds toward a single, clearly defined objective, providing focused progress tracking and motivation. Playlist savings allow users to create multiple savings "playlists" or buckets within one account, enabling simultaneous saving for various goals with greater flexibility. The key difference lies in the targeted approach of goal-specific accounts versus the multi-goal, customizable structure of playlist savings.

Benefits of Goal-Specific Savings Strategies

Goal-specific savings strategies enhance financial discipline by allowing individuals to allocate funds toward distinct objectives like emergencies, vacations, or large purchases, ensuring clarity and motivation. These strategies enable better tracking and prioritization of savings progress compared to general playlist savings, which often blend multiple goals and reduce focus. By setting clear targets and timelines, goal-specific savings optimize resource allocation and improve the likelihood of achieving financial milestones efficiently.

Advantages of Playlist Savings Approach

Playlist Savings offers enhanced flexibility by allowing users to create multiple savings buckets within a single account, each tailored to distinct financial goals. This approach enables concurrent tracking and management of diverse objectives such as emergencies, vacations, and large purchases, promoting organized and intentional saving habits. Seamless reallocation between playlists increases adaptability, optimizing financial planning and improving goal attainment efficiency.

When to Choose Goal-Specific Savings

Goal-specific savings accounts are ideal when you have a clear, defined target such as buying a home, funding education, or building an emergency fund, as they help track progress toward a specific financial goal. These accounts often offer features like automated contributions, goal tracking tools, and motivational milestones to keep you focused and disciplined. Choose goal-specific savings when you need structured savings with measurable outcomes rather than flexible, unstructured funds like those in playlist savings.

When Playlist Savings Makes Sense

Playlist Savings makes sense when prioritizing multiple short-term financial goals simultaneously, allowing users to organize funds into distinct categories within one savings account. This method enhances tracking and flexibility compared to Goal-Specific Savings, which focuses on a single target with a fixed purpose. It is ideal for individuals who want to manage various expenses like vacations, emergency funds, and large purchases without opening multiple accounts.

Challenges of Each Savings Method

Goal-specific savings often face challenges like rigidity, limiting flexibility when unexpected expenses arise, and the risk of discouragement if goals are not met quickly. Playlist savings, while more flexible and user-friendly for managing multiple saving priorities, can lead to lack of focus and slower progress due to dispersed funds. Both methods require disciplined tracking to avoid misallocation and ensure financial targets are achieved effectively.

Combining Goal-Specific and Playlist Savings

Combining Goal-Specific Savings with Playlist Savings enhances financial organization by allowing users to allocate funds toward individual objectives while simultaneously grouping related goals for broader categories. This dual approach increases flexibility, enabling prioritization of urgent targets within playlists for streamlined tracking and motivation. Leveraging both methods results in optimized savings efficiency and improved achievement of short-term and long-term financial goals.

Choosing the Right Savings Strategy for You

Goal-specific savings target distinct financial objectives by allocating funds to clearly defined purposes, enhancing focus and motivation. Playlist savings offer a flexible approach, allowing users to create multiple categorized savings buckets under a single account for easier management. Selecting the right savings strategy depends on personal financial discipline, the complexity of goals, and preferred tracking methods to maximize effectiveness.

Related Important Terms

Micro-Goal Targeting

Goal-specific savings enable targeted micro-goal achievement by allocating funds directly toward defined objectives, enhancing focus and motivation. Playlist savings aggregate multiple smaller goals into a flexible, customizable saving experience, promoting incremental progress across various financial priorities.

Savings Playlist Strategy

Savings Playlist Strategy organizes funds into targeted categories, enhancing financial clarity and discipline by assigning specific goals or purposes to each playlist. This method improves money management efficiency, enabling savers to track progress toward distinct objectives while maintaining overall savings growth.

Flexi-Savings Buckets

Flexi-Savings Buckets offer a versatile solution combining Goal-Specific Savings' targeted approach with Playlist Savings' customizable sub-accounts, enabling users to allocate funds for multiple objectives within a single account while maintaining flexibility in contributions and withdrawals. This hybrid structure optimizes fund management by allowing tailored saving strategies without compromising liquidity, ideal for users balancing short-term goals and long-term financial plans.

Hyper-Personalized Savings Paths

Goal-Specific Savings enable users to create targeted financial plans tailored to individual objectives such as emergency funds or vacation expenses, enhancing motivation and clarity. Playlist Savings offer flexible, customizable savings buckets within a unified account, allowing for simultaneous goal tracking and seamless fund allocation based on changing priorities.

Milestone-Based Savings Playlists

Milestone-based savings playlists enable users to allocate funds toward specific financial goals by breaking down large objectives into manageable milestones, improving motivation and tracking progress effectively. This structured approach fosters disciplined saving habits by aligning contributions with defined achievement stages, enhancing overall financial planning efficiency.

Tiered Playlist Allocation

Goal-specific savings prioritize targeted financial objectives with distinct accounts, while playlist savings utilize tiered playlist allocation to distribute funds dynamically across multiple savings categories, optimizing resource management and ensuring flexible prioritization based on evolving financial goals. Tiered playlist allocation enhances savings efficiency by automatically adjusting contributions according to predefined priority levels and balance targets within each playlist.

Goal Stacking Protocol

Goal-Specific Savings allows users to allocate funds toward individual financial targets with clear deadlines, enhancing focus and discipline, while Playlist Savings employs a flexible, collective approach to group multiple goals under one umbrella. The Goal Stacking Protocol optimizes these methods by enabling simultaneous, prioritized progress on various savings objectives, increasing overall efficiency and motivation.

Adaptive Playlist Savings

Adaptive Playlist Savings dynamically allocate funds based on your prioritized financial goals, optimizing savings efficiency by adjusting contributions to each goal according to real-time spending patterns and income fluctuations. This method outperforms traditional Goal-Specific Savings by providing flexibility and responsiveness, ensuring balanced progress across multiple savings objectives without manual intervention.

Purpose-Driven Savings Tracks

Goal-specific savings accounts enable individuals to allocate funds toward distinct objectives such as vacations or emergency funds, promoting focused financial discipline. Playlist savings, meanwhile, allow flexibility by grouping various short-term or long-term targets into customizable saving streams, enhancing user engagement and saving efficiency.

Dynamic Goal Rebalancing

Goal-specific savings allow dynamic goal rebalancing to adjust contributions automatically based on changing priorities, maximizing progress toward individual financial targets. Playlist savings aggregate multiple goals, but lack dynamic rebalancing, often requiring manual adjustments to maintain optimal fund allocation.

Goal-Specific Savings vs Playlist Savings for Savings. Infographic

moneydiff.com

moneydiff.com