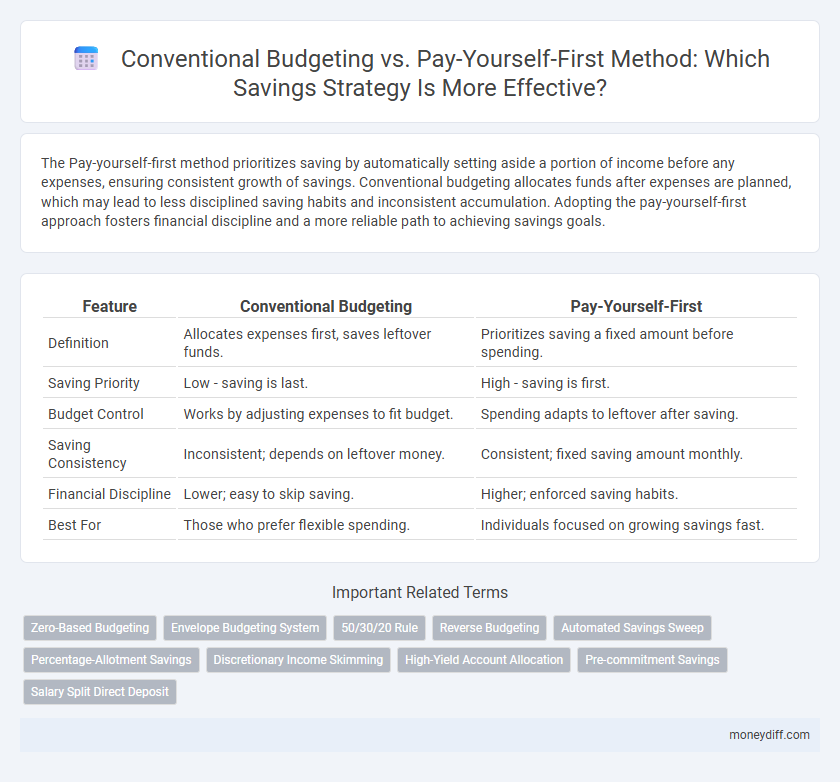

The Pay-yourself-first method prioritizes saving by automatically setting aside a portion of income before any expenses, ensuring consistent growth of savings. Conventional budgeting allocates funds after expenses are planned, which may lead to less disciplined saving habits and inconsistent accumulation. Adopting the pay-yourself-first approach fosters financial discipline and a more reliable path to achieving savings goals.

Table of Comparison

| Feature | Conventional Budgeting | Pay-Yourself-First |

|---|---|---|

| Definition | Allocates expenses first, saves leftover funds. | Prioritizes saving a fixed amount before spending. |

| Saving Priority | Low - saving is last. | High - saving is first. |

| Budget Control | Works by adjusting expenses to fit budget. | Spending adapts to leftover after saving. |

| Saving Consistency | Inconsistent; depends on leftover money. | Consistent; fixed saving amount monthly. |

| Financial Discipline | Lower; easy to skip saving. | Higher; enforced saving habits. |

| Best For | Those who prefer flexible spending. | Individuals focused on growing savings fast. |

Understanding Conventional Budgeting for Savings

Conventional budgeting for savings involves allocating a portion of income to various expense categories before setting aside savings, often leaving saving as the final step. This method requires meticulous tracking of spending to identify potential savings but risks insufficient saving if expenses consume most income. Understanding this approach helps individuals recognize its limitations and consider alternative methods like the pay-yourself-first strategy for more effective savings.

What is the Pay-Yourself-First Method?

The Pay-Yourself-First method prioritizes setting aside a fixed portion of income for savings before addressing any expenses, ensuring consistent financial growth. Unlike conventional budgeting that allocates funds based on monthly spending habits, this approach automates savings, reducing the risk of overspending. It effectively builds an emergency fund and accelerates long-term financial goals by making savings a non-negotiable expense.

Key Differences Between Budgeting Approaches

Conventional budgeting allocates income to various expenses before designating funds for savings, often leading to less disciplined saving habits. The Pay-yourself-first method prioritizes saving by automatically setting aside a fixed amount before any other expenses, ensuring consistent contribution to savings goals. This approach fosters financial discipline and helps build wealth more effectively compared to the reactive adjustments typical of conventional budgeting.

Pros and Cons of Conventional Budgeting

Conventional budgeting offers clear expense tracking and control, enabling individuals to allocate funds toward savings after accounting for bills and discretionary spending. However, this method may lead to inconsistent savings since it prioritizes expenses before setting aside money for future goals, risking reduced saving if unexpected costs arise. Conventional budgeting can be rigid and time-consuming, making it challenging to adapt to fluctuating income or financial emergencies.

Pros and Cons of Pay-Yourself-First Method

The pay-yourself-first method prioritizes saving by automatically allocating a portion of income to savings before any expenses, promoting disciplined financial habits and consistent wealth accumulation. This approach reduces the risk of overspending and ensures goal-oriented savings but may limit flexibility in monthly budgeting and can be challenging for those with irregular income or tight cash flow. Compared to conventional budgeting, which allocates savings leftover after expenses, pay-yourself-first provides a proactive strategy that safeguards savings but requires careful planning to avoid financial strain.

Effectiveness in Building Savings

The pay-yourself-first method proves more effective in building savings by prioritizing automatic transfers to savings accounts before any expenses, ensuring consistent growth over time. Conventional budgeting often fails to secure dedicated savings as it relies on leftover funds after expenses, which can lead to inconsistent or minimal savings. Studies show that individuals using pay-yourself-first save up to 30% more annually compared to those who follow traditional budgeting approaches.

Ideal Users for Each Budgeting Method

Conventional budgeting suits individuals who prefer detailed expense tracking and want to allocate funds across multiple categories to maintain financial control. The pay-yourself-first method benefits those with irregular incomes or a strong focus on building savings quickly by prioritizing automatic transfers to savings before spending. Ideal users of the pay-yourself-first approach often include freelancers and employees seeking simple, automated saving habits without complex budgeting.

Common Pitfalls to Avoid

Conventional budgeting often leads to overspending because it prioritizes expenses before savings, increasing the risk of depleting funds. The Pay-yourself-first method requires setting aside savings immediately after income, which helps avoid the common pitfall of neglecting savings due to impulsive purchases. Failing to automate savings or account for variable expenses can undermine both approaches, reducing the effectiveness of long-term financial goals.

Tips for Transitioning Between Methods

Shifting from conventional budgeting to the pay-yourself-first method requires setting automated transfers to savings accounts immediately upon receiving income, ensuring consistent saving habits. Analyze monthly expenses to identify non-essential costs that can be minimized, freeing up funds to prioritize savings first. Monitor progress regularly and adjust transfer amounts as income or expenses change to maintain financial balance and accelerate savings growth.

Choosing the Best Savings Strategy for You

Conventional budgeting allocates funds based on expenses first, saving what remains, which can often lead to inconsistent savings growth. The pay-yourself-first method prioritizes automatic savings deposits before any spending, ensuring steady wealth accumulation and financial discipline. Selecting the best savings strategy depends on your spending habits and financial goals, with the pay-yourself-first approach typically benefiting those seeking consistent savings growth.

Related Important Terms

Zero-Based Budgeting

Zero-Based Budgeting allocates every dollar of income to specific expenses or savings, ensuring no funds remain unassigned, which contrasts with the Pay-Yourself-First method that prioritizes savings before other expenditures. This approach enhances financial discipline by requiring justification for all expenses, ultimately optimizing cash flow and maximizing savings efficiency.

Envelope Budgeting System

Envelope budgeting system allocates specific amounts of cash into labeled envelopes for each expense category, promoting disciplined spending and tangible budget tracking. Unlike the pay-yourself-first method that prioritizes savings by automating transfers, envelope budgeting emphasizes controlled cash flow management to prevent overspending and ensure financial accountability.

50/30/20 Rule

The 50/30/20 Rule in conventional budgeting allocates 50% of income to needs, 30% to wants, and 20% to savings or debt repayment, providing a balanced approach to managing finances. The Pay-yourself-first method prioritizes allocating a fixed percentage directly to savings before other expenses, ensuring consistent wealth accumulation.

Reverse Budgeting

Reverse budgeting prioritizes saving by allocating funds to savings goals first, then using the remaining income for expenses, contrasting with conventional budgeting which assigns expenses before savings. This pay-yourself-first approach improves financial discipline, increases savings rates, and ensures long-term wealth accumulation.

Automated Savings Sweep

Automated savings sweep enhances the pay-yourself-first method by automatically transferring a predetermined amount to savings accounts, ensuring consistent growth without manual intervention. Conventional budgeting often lacks this automation, increasing the risk of undersaving due to delayed or forgotten transfers after expenses are accounted for.

Percentage-Allotment Savings

Conventional budgeting typically allocates fixed percentages of income to various expenses before savings, often resulting in inconsistent saving amounts, while the pay-yourself-first method prioritizes setting aside a designated percentage of income for savings immediately upon receiving pay, ensuring disciplined and consistent wealth accumulation. Employing a percentage-allotment strategy within the pay-yourself-first method optimizes savings growth by automatically dedicating a predetermined portion of income, such as 20%, directly to savings accounts or investment vehicles.

Discretionary Income Skimming

Conventional budgeting allocates discretionary income after all expenses, often leading to skimming where savings are deprioritized or overlooked. The pay-yourself-first method ensures a fixed portion of discretionary income is saved upfront, reducing the risk of skimming and promoting consistent wealth accumulation.

High-Yield Account Allocation

Allocating funds to a high-yield savings account within the pay-yourself-first method ensures consistent growth by prioritizing savings before expenses, maximizing interest earnings compared to conventional budgeting where savings are often residual. This strategic approach leverages higher interest rates, compounding returns, and reduces the temptation to spend, accelerating wealth accumulation effectively.

Pre-commitment Savings

The Pay-yourself-first method enhances pre-commitment savings by automatically allocating a fixed portion of income to savings before other expenses, ensuring consistent growth in financial reserves. Conventional budgeting often postpones savings as a residual activity, increasing the risk of under-saving and undermining long-term financial goals.

Salary Split Direct Deposit

Salary split direct deposit enhances savings efficiency by automatically allocating funds between conventional budgeting and the pay-yourself-first method, ensuring predetermined amounts are saved before expenses are managed. This approach reduces the risk of overspending and reinforces disciplined savings habits by prioritizing automatic transfers to savings accounts as soon as the salary is received.

Conventional budgeting vs Pay-yourself-first method for savings. Infographic

moneydiff.com

moneydiff.com