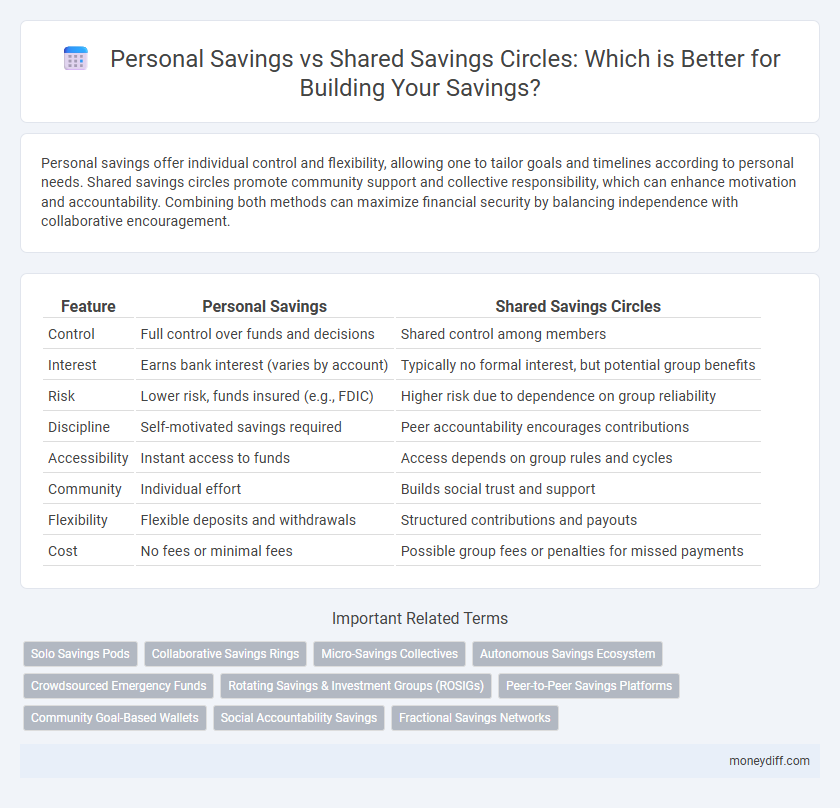

Personal savings offer individual control and flexibility, allowing one to tailor goals and timelines according to personal needs. Shared savings circles promote community support and collective responsibility, which can enhance motivation and accountability. Combining both methods can maximize financial security by balancing independence with collaborative encouragement.

Table of Comparison

| Feature | Personal Savings | Shared Savings Circles |

|---|---|---|

| Control | Full control over funds and decisions | Shared control among members |

| Interest | Earns bank interest (varies by account) | Typically no formal interest, but potential group benefits |

| Risk | Lower risk, funds insured (e.g., FDIC) | Higher risk due to dependence on group reliability |

| Discipline | Self-motivated savings required | Peer accountability encourages contributions |

| Accessibility | Instant access to funds | Access depends on group rules and cycles |

| Community | Individual effort | Builds social trust and support |

| Flexibility | Flexible deposits and withdrawals | Structured contributions and payouts |

| Cost | No fees or minimal fees | Possible group fees or penalties for missed payments |

Introduction to Personal Savings and Shared Savings Circles

Personal savings refer to the individual practice of setting aside a portion of income regularly to build financial security and achieve specific goals. Shared savings circles, also known as rotating savings and credit associations (ROSCAs), involve groups pooling money collectively, allowing members to access larger sums through structured contributions. Both methods promote disciplined saving habits, with personal savings emphasizing autonomy and shared savings circles fostering community support and mutual financial assistance.

Defining Personal Savings: Pros and Cons

Personal savings refer to funds an individual sets aside from their income for future use, offering full control and immediate accessibility but limited growth potential due to lower interest rates compared to collective investment options. This method promotes financial independence and emergency preparedness but may lack the social support and accountability mechanisms found in shared savings circles. While personal savings ensure security and privacy, they often miss the pooled resources and mutual aid benefits that shared savings circles provide.

Understanding Shared Savings Circles: Key Features

Shared savings circles empower individuals to pool funds regularly, fostering collective financial growth and mutual support. Participants contribute predetermined amounts into a communal pot, which is then distributed cyclically, enhancing discipline and trust among members. This collaborative approach combines social accountability with savings goals, often leading to higher commitment and improved financial outcomes compared to personal savings.

Financial Security: Individual Savings vs Savings Circles

Personal savings provide direct financial security by offering an individual-controlled reserve for emergencies and future investments, ensuring immediate access and decision-making autonomy. Savings circles, or rotating savings groups, distribute financial responsibility and support among members, enhancing collective trust and social capital while potentially increasing saving capacity through pooled resources. Individual savings focus on personal liquidity and uninterrupted access, whereas savings circles emphasize community accountability and shared risk mitigation.

Accessibility and Flexibility in Saving Methods

Personal savings offer greater accessibility by allowing individuals to manage funds independently without reliance on group consensus, ensuring immediate access and personalized control. Shared savings circles enhance flexibility through collective pooling, enabling members to access larger sums via rotating loans and mutual support, fostering community trust and financial inclusion. Comparing both, personal savings prioritize individual autonomy while shared circles provide adaptable, socially driven saving methods.

Risk Management: Personal Savings versus Group Dynamics

Personal savings offer direct control and lower exposure to group-related risks, ensuring funds remain accessible without dependency on others' financial behavior. Shared savings circles involve collective risk management but may face challenges like trust issues, delayed contributions, or uneven withdrawals that can impact individual access to funds. Balancing risk requires evaluating personal discipline against the social dynamics and mutual accountability inherent in group savings structures.

Trust and Accountability in Shared Savings Models

Shared savings circles enhance trust and accountability through collective responsibility, where members commit to regular contributions and mutual support. In contrast to personal savings, which rely solely on individual discipline, shared models foster transparency and peer monitoring, reducing the risk of default and encouraging consistent saving behavior. This social accountability mechanism strengthens financial commitment and builds community-based trust essential for sustained savings growth.

Goal Achievement and Motivation in Different Saving Systems

Personal savings enable individuals to directly control and track their progress toward financial goals, fostering a strong sense of personal accountability and discipline. Shared savings circles create a collaborative environment that enhances motivation through mutual support, collective accountability, and shared successes. Both systems influence goal achievement by leveraging either personal commitment or social encouragement, which can significantly impact consistent saving behavior.

Technology and Tools for Managing Savings Efficiently

Technology and tools for managing personal savings include mobile banking apps, automated budgeting software, and AI-driven financial advisors that provide tailored insights and optimize individual savings goals. Shared savings circles benefit from collaborative platforms and group budgeting apps that track contributions, automate reminders, and facilitate transparent fund distribution to enhance accountability and collective financial growth. Integrating blockchain technology and secure digital wallets can further improve trust and efficiency in both personal and shared savings management systems.

Choosing the Right Savings Method: Personal vs Collective Approaches

Personal savings offer greater control and flexibility, allowing individuals to tailor their saving strategies to specific financial goals and timelines. Shared savings circles enhance collective accountability and provide access to pooled resources, which can accelerate savings growth through group contributions and mutual support. Selecting between these methods depends on one's preference for autonomy versus community engagement, as well as the desired pace and discipline of savings accumulation.

Related Important Terms

Solo Savings Pods

Solo Savings Pods offer individuals complete control over their personal savings, enabling tailored goals and flexible contributions without dependence on group consensus. Unlike Shared Savings Circles, Solo Pods eliminate risks related to group default and provide privacy, ensuring personal financial growth aligned with individual timelines and priorities.

Collaborative Savings Rings

Collaborative savings rings enable individuals to pool resources regularly, fostering collective financial discipline and mutual support compared to personal savings, which rely solely on individual commitment and control. These shared savings circles often accelerate wealth accumulation by leveraging trust and accountability within a community, reducing reliance on formal banking systems.

Micro-Savings Collectives

Micro-savings collectives leverage pooled resources within shared savings circles to accelerate individual wealth accumulation and provide mutual financial support, reducing the risks and barriers faced in personal savings alone. These collective models enhance savings discipline, provide access to small loans, and foster community trust, making them more effective for low-income groups or those without formal banking access.

Autonomous Savings Ecosystem

Personal savings enable individuals to build financial security independently, leveraging autonomous savings ecosystems that use digital platforms and smart contracts to maximize growth and control. Shared savings circles foster collective financial empowerment through peer-to-peer contributions and trust networks, enhancing liquidity and access to funds within a decentralized, community-driven savings model.

Crowdsourced Emergency Funds

Crowdsourced emergency funds within shared savings circles provide a safety net by pooling resources, offering greater financial resilience compared to personal savings, which rely solely on individual contributions. These collective funds enable quicker access to emergency money, reduce the risk of financial shortfalls, and foster community support during crises.

Rotating Savings & Investment Groups (ROSIGs)

Rotating Savings and Investment Groups (ROSIGs) offer a community-based alternative to personal savings by pooling funds that rotate among members, enhancing access to larger sums and fostering financial discipline. Unlike individual savings accounts, ROSIGs leverage collective trust and shared responsibility to support participants in meeting short-term financial goals, reducing reliance on formal banking systems.

Peer-to-Peer Savings Platforms

Peer-to-peer savings platforms facilitate both personal savings and shared savings circles by enabling individuals to pool funds collaboratively while maintaining flexible access to their contributions. These platforms leverage social trust networks and automated scheduling to optimize savings growth and provide financial inclusion beyond traditional banking systems.

Community Goal-Based Wallets

Personal savings offer individual control and flexibility, while shared savings circles leverage a community goal-based wallet system to enhance collective financial discipline and accelerate goal achievement. These community-driven wallets pool funds, increase accountability, and provide mutual support, making them effective for group savings targets and fostering stronger financial collaboration.

Social Accountability Savings

Personal savings rely on individual discipline and financial goals, often lacking external motivation. Shared savings circles provide social accountability, enhancing commitment through group support and collective financial responsibility, which can lead to higher savings rates and improved financial behavior.

Fractional Savings Networks

Personal savings offer individual control and flexibility, while shared savings circles leverage collective contributions to accelerate financial growth through Fractional Savings Networks, which pool fractional amounts from members to create larger, accessible funds. These networks enhance liquidity and reduce risk by distributing savings across participants, fostering community-driven financial empowerment and optimized capital utilization.

Personal Savings vs Shared Savings Circles for Savings. Infographic

moneydiff.com

moneydiff.com