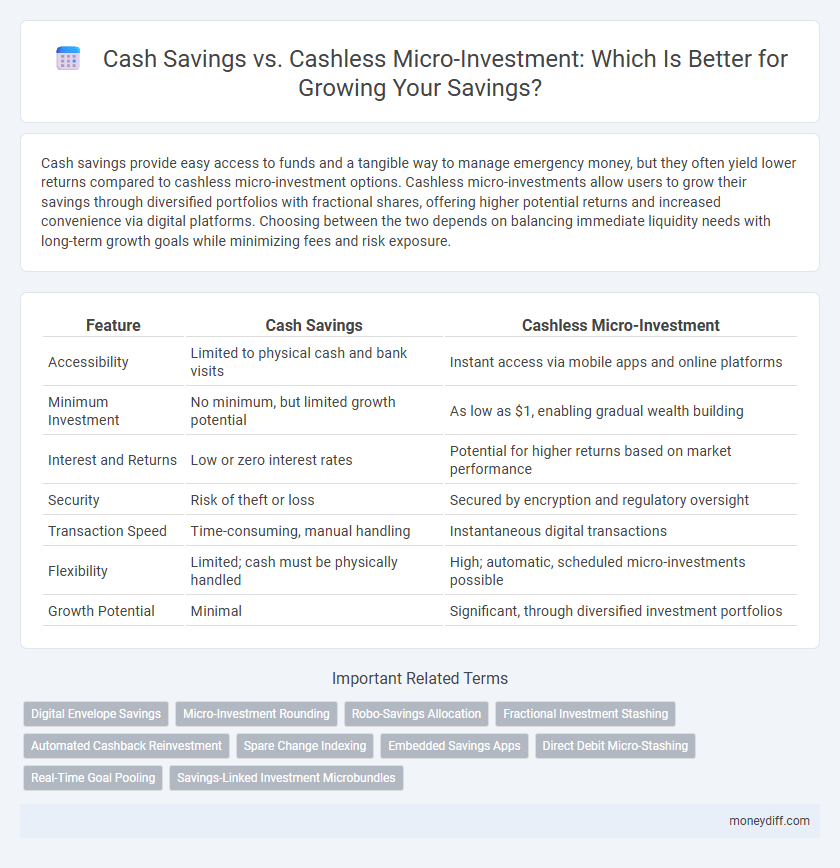

Cash savings provide easy access to funds and a tangible way to manage emergency money, but they often yield lower returns compared to cashless micro-investment options. Cashless micro-investments allow users to grow their savings through diversified portfolios with fractional shares, offering higher potential returns and increased convenience via digital platforms. Choosing between the two depends on balancing immediate liquidity needs with long-term growth goals while minimizing fees and risk exposure.

Table of Comparison

| Feature | Cash Savings | Cashless Micro-Investment |

|---|---|---|

| Accessibility | Limited to physical cash and bank visits | Instant access via mobile apps and online platforms |

| Minimum Investment | No minimum, but limited growth potential | As low as $1, enabling gradual wealth building |

| Interest and Returns | Low or zero interest rates | Potential for higher returns based on market performance |

| Security | Risk of theft or loss | Secured by encryption and regulatory oversight |

| Transaction Speed | Time-consuming, manual handling | Instantaneous digital transactions |

| Flexibility | Limited; cash must be physically handled | High; automatic, scheduled micro-investments possible |

| Growth Potential | Minimal | Significant, through diversified investment portfolios |

Understanding Cash Savings: The Traditional Approach

Cash savings refer to the traditional method of setting aside physical money or funds in a savings account to accumulate wealth over time with minimal risk. This approach provides immediate liquidity and control over the funds, making it easier to manage daily expenses and emergencies. The primary limitation is the lower interest rates compared to investment options, which can result in reduced growth potential due to inflation.

What Are Cashless Micro-Investments?

Cashless micro-investments refer to small, digital contributions made into investment portfolios through online platforms or mobile apps, allowing individuals to grow savings without handling physical cash. These investments often include automated round-ups from purchases, fractional shares, or micro-contributions to diversified assets, making investing accessible and convenient. Unlike traditional cash savings, cashless micro-investments offer the potential for higher returns by leveraging market growth while maintaining low entry barriers.

Liquidity: Cash Savings vs. Micro-Investments

Cash savings offer immediate liquidity, allowing instant access to funds without penalties or delays, which is critical for emergency expenses. In contrast, cashless micro-investments often involve processing times and potential withdrawal restrictions, reducing immediate access to funds. Evaluating liquidity needs helps determine whether traditional cash savings or micro-investments better align with an individual's short-term financial goals.

Accessibility and Convenience in Saving Methods

Cash savings offer straightforward accessibility with immediate availability, making them ideal for daily expenses and emergency funds. Cashless micro-investment platforms enhance convenience by enabling users to save and grow wealth through automated, small-scale contributions accessible via smartphones. These digital methods provide seamless integration with financial tools, increasing saving discipline and long-term financial inclusion.

Risk Factors: Safety of Your Savings

Cash savings in traditional bank accounts offer government-backed security and immediate access, minimizing the risk of principal loss. Cashless micro-investment platforms, while providing higher potential returns, expose savings to market volatility and platform risk, including cybersecurity threats and regulatory variations. Evaluating the safety of your savings requires balancing guaranteed protection in cash accounts against the investment risks inherent in digital micro-investment options.

Potential Returns: Growing Your Wealth

Cash savings typically offer lower interest rates, resulting in modest and steady growth of your principal amount. Cashless micro-investment platforms provide access to diversified portfolios with potential higher returns driven by market performance and compounding. Leveraging micro-investments can accelerate wealth accumulation by capitalizing on market gains while maintaining low entry barriers.

Costs and Fees: What to Expect

Cash savings accounts typically involve low or no fees, but offer minimal interest rates that may not keep pace with inflation, eroding purchasing power over time. Cashless micro-investment platforms often charge transaction fees, management fees ranging from 0.25% to 1%, and occasional withdrawal fees, which can impact overall returns depending on investment frequency and amount. Evaluating cost structures carefully is essential to optimize savings growth and minimize expenses in both cash and cashless options.

Flexibility and Withdrawal Options

Cash savings accounts offer immediate access and high liquidity, enabling flexible withdrawals without penalties, making them ideal for emergency funds. Cashless micro-investment platforms often impose lock-in periods or withdrawal limits, reducing flexibility but potentially providing higher returns through diversified asset exposure. Investors weighing short-term access against growth potential should consider their liquidity needs when choosing between cash savings and micro-investment options.

Best Practices for Blended Saving Strategies

Combining cash savings with cashless micro-investment enhances financial resilience by balancing liquidity and growth potential. Best practices include allocating a portion of savings to easily accessible cash for emergencies while directing surplus funds into diversified digital investment platforms with low entry barriers. Regularly reviewing and adjusting the ratio based on market trends and personal financial goals optimizes long-term wealth accumulation.

Choosing the Right Savings Method for Your Goals

Choosing the right savings method depends on your financial goals and risk tolerance. Cash savings offer liquidity and safety with minimal risk, ideal for short-term goals and emergency funds. Cashless micro-investment platforms provide higher potential returns through diversified portfolios, suited for long-term growth and wealth accumulation.

Related Important Terms

Digital Envelope Savings

Digital envelope savings leverage cashless micro-investment tools to allocate small, manageable amounts into diversified portfolios, enhancing growth potential beyond traditional cash savings. This method increases financial discipline and accessibility by enabling users to automate savings goals and monitor progress through intuitive digital platforms.

Micro-Investment Rounding

Micro-investment rounding optimizes savings by automatically investing spare change from everyday cashless transactions, enabling incremental wealth growth without impacting daily budgets. This approach outperforms traditional cash savings by leveraging digital platforms to compound small investments over time, increasing financial discipline and long-term gains.

Robo-Savings Allocation

Robo-savings allocation leverages AI algorithms to automatically direct idle funds into diversified micro-investment portfolios, enhancing returns compared to traditional cash savings that offer minimal interest growth. This technology optimizes liquidity while maximizing compound growth potential, making cashless micro-investments a smarter choice for dynamic savings management.

Fractional Investment Stashing

Fractional investment stashing enables investors to grow savings by purchasing partial shares of assets, offering higher potential returns compared to traditional cash savings accounts. This cashless micro-investment approach promotes disciplined saving habits while leveraging market growth, surpassing the low-interest yields of conventional cash savings.

Automated Cashback Reinvestment

Automated cashback reinvestment in cashless micro-investment platforms transforms everyday spending rewards into compounding growth opportunities, outperforming traditional cash savings by leveraging the power of consistent, small-scale investments. This seamless integration of cashback automation maximizes savings efficiency, driving higher returns without additional effort compared to stagnant cash reserves.

Spare Change Indexing

Cash savings offer immediate liquidity but often yield minimal interest growth, while cashless micro-investments leverage spare change indexing to automatically invest small amounts from everyday transactions, enhancing compound returns over time. Spare change indexing systems round up purchases and allocate the difference into diversified portfolios, providing a seamless way to boost savings through incremental investments.

Embedded Savings Apps

Embedded savings apps integrate micro-investment options into everyday spending, enabling users to effortlessly grow cash savings through automated, small-scale investments. This approach often yields higher returns compared to traditional cash savings accounts by leveraging diversified financial instruments within seamless app experiences.

Direct Debit Micro-Stashing

Direct Debit Micro-Stashing automates small, frequent transfers from your bank account into micro-investments, offering higher growth potential than traditional cash savings by leveraging compound interest and market returns. This cashless approach minimizes spending temptations and ensures consistent savings accumulation without the need for active management.

Real-Time Goal Pooling

Cash savings provide immediate liquidity but lack the dynamic growth potential offered by cashless micro-investments that leverage real-time goal pooling to optimize fund allocation and accelerate target achievement. Real-time goal pooling aggregates micro-investments across users, enhancing diversification and compounding effects, resulting in higher returns compared to static cash savings.

Savings-Linked Investment Microbundles

Savings-linked investment microbundles combine the security of cash savings with the growth potential of cashless micro-investments, offering small, manageable investments that accumulate value over time. These microbundles enable users to diversify savings through digital platforms while maintaining liquidity and minimizing risk, making them ideal for building long-term financial resilience.

Cash Savings vs Cashless Micro-Investment for savings. Infographic

moneydiff.com

moneydiff.com