Christmas clubs offer structured, goal-specific savings primarily for holiday expenses, promoting disciplined saving through regular contributions. Micro-savings platforms provide flexibility by allowing users to save small amounts frequently, often rounding up purchases or setting custom goals beyond seasonal needs. Both methods encourage financial discipline, but micro-savings platforms offer broader adaptability for diverse saving objectives year-round.

Table of Comparison

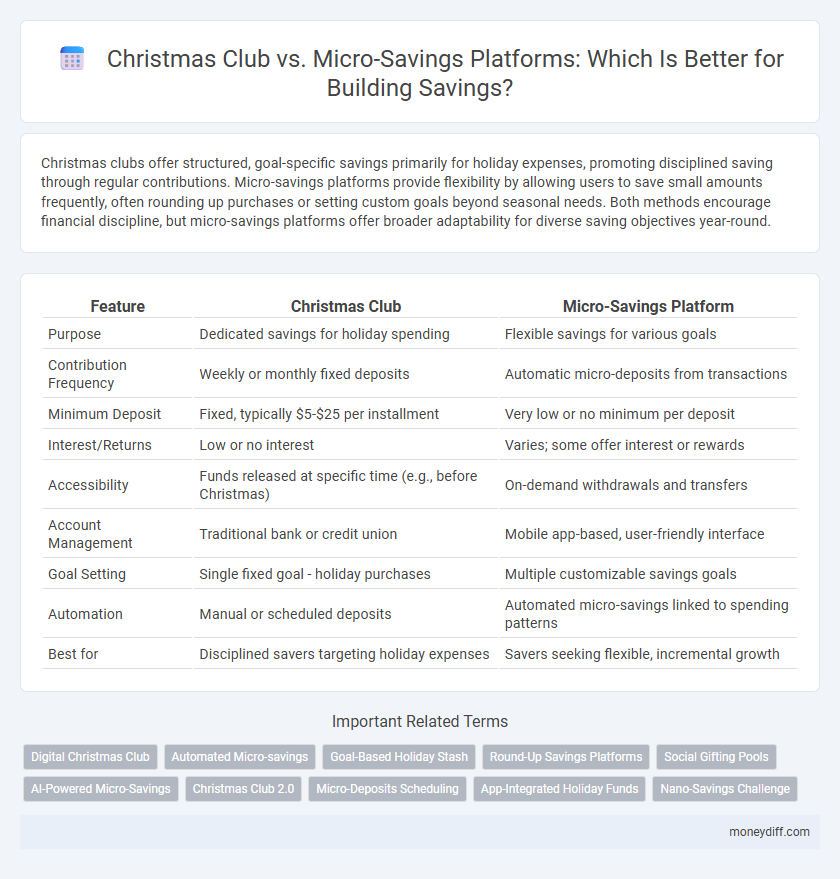

| Feature | Christmas Club | Micro-Savings Platform |

|---|---|---|

| Purpose | Dedicated savings for holiday spending | Flexible savings for various goals |

| Contribution Frequency | Weekly or monthly fixed deposits | Automatic micro-deposits from transactions |

| Minimum Deposit | Fixed, typically $5-$25 per installment | Very low or no minimum per deposit |

| Interest/Returns | Low or no interest | Varies; some offer interest or rewards |

| Accessibility | Funds released at specific time (e.g., before Christmas) | On-demand withdrawals and transfers |

| Account Management | Traditional bank or credit union | Mobile app-based, user-friendly interface |

| Goal Setting | Single fixed goal - holiday purchases | Multiple customizable savings goals |

| Automation | Manual or scheduled deposits | Automated micro-savings linked to spending patterns |

| Best for | Disciplined savers targeting holiday expenses | Savers seeking flexible, incremental growth |

Christmas Club vs Micro-Savings Platforms: An Overview

Christmas clubs offer a structured, seasonal savings approach where funds are accumulated over months for holiday expenses, typically through banks or credit unions. Micro-savings platforms provide flexible, automated savings by rounding up transactions or allowing small, frequent deposits, helping users build savings gradually year-round. Both methods enhance financial discipline, but micro-savings platforms offer greater convenience and adaptability beyond the holiday season.

Key Features of Christmas Club Accounts

Christmas club accounts offer a structured savings plan with fixed periodic deposits, allowing individuals to accumulate funds specifically for the holiday season. These accounts typically feature limited withdrawal options, encouraging disciplined savings habits and reducing impulse spending. Interest rates on Christmas club accounts are generally modest, emphasizing goal-oriented savings over high returns.

What are Micro-Savings Platforms?

Micro-savings platforms are digital financial tools designed to help users save small amounts of money automatically and consistently, often through round-ups on everyday purchases or recurring transfers. Unlike traditional Christmas club accounts that require lump-sum deposits at specific intervals, micro-savings platforms emphasize seamless, incremental savings that accumulate over time with minimal user effort. These platforms often include features such as goal setting, spending analysis, and personalized saving recommendations to enhance financial discipline and growth.

Accessibility: Traditional Banking vs Digital Apps

Christmas clubs are often limited by fixed deposit schedules and branch hours, restricting accessibility for users wanting flexibility in their savings. Micro-savings platforms leverage digital apps, enabling users to save small amounts anytime via smartphones, increasing convenience and real-time account management. The contrast highlights how digital solutions enhance accessibility compared to traditional banking methods.

Saving Habits: Structured vs Flexible Approaches

Christmas clubs promote structured saving habits by requiring regular, fixed contributions over a set period, fostering discipline and goal-oriented savings. Micro-savings platforms offer a flexible approach, allowing users to save small, variable amounts anytime, adapting to changing financial situations and encouraging spontaneous saving behavior. Both methods enhance savings but cater to different preferences: disciplined consistency versus adaptable convenience.

Interest Rates and Fees Comparison

Christmas clubs typically offer lower interest rates compared to micro-savings platforms, which leverage technology to provide higher returns through automated, small-scale deposits. Fees associated with Christmas clubs are often minimal or nonexistent, but micro-savings platforms may charge nominal service fees or subscription costs that vary by provider. Choosing between the two depends on the balance between interest earnings and fee structures, where micro-savings platforms generally yield better growth potential despite slight fees.

Security and FDIC Insurance: Are Your Savings Safe?

Christmas clubs and micro-savings platforms both prioritize security, but FDIC insurance coverage varies significantly; traditional Christmas clubs, often offered by established banks, typically come with FDIC insurance up to $250,000 per depositor, ensuring your funds are protected against bank failures. Micro-savings platforms may partner with FDIC-insured institutions or utilize sweep accounts to maintain FDIC protection, but it's critical to verify each platform's insurance status before depositing funds. Prioritizing FDIC-insured options safeguards your savings, providing peace of mind during the holiday season or everyday micro-saving goals.

Withdrawals and Penalties: Rules to Know

Christmas club accounts typically impose strict withdrawal limits and penalties if funds are accessed before the designated holiday date, encouraging disciplined saving but reducing flexibility. Micro-savings platforms offer more flexible withdrawal options with minimal or no penalties, allowing users to access funds quickly for unexpected expenses. Understanding these rules helps savers choose between structured, penalty-driven saving and flexible, penalty-free access depending on their financial goals.

Suitability: Which Option Fits Your Goals?

Christmas clubs offer structured, goal-specific saving ideal for individuals seeking disciplined, short-term saving for holiday expenses, whereas micro-savings platforms provide flexible, incremental saving options suitable for those aiming to build long-term financial habits with small, regular contributions. Choosing between the two depends on your saving frequency, flexibility needs, and specific financial targets. Understanding your spending timeline and commitment level will help determine whether the fixed schedule of Christmas clubs or the adaptable nature of micro-savings platforms better aligns with your savings goals.

Future Trends in Personalized Savings Tools

Christmas clubs and micro-savings platforms represent evolving tools in personalized savings strategies, with micro-savings gaining traction due to their flexibility and automation. Behavioral data and AI integration enable micro-savings apps to tailor saving goals and frequency to individual spending patterns, promoting consistent financial habits. Future trends indicate increasing adoption of real-time analytics and personalized incentives, enhancing user engagement and long-term savings success.

Related Important Terms

Digital Christmas Club

Digital Christmas Club platforms automate regular contributions, allowing users to build holiday savings effortlessly through goal-based, scheduled deposits. Compared to traditional Christmas clubs, micro-savings platforms offer enhanced flexibility and real-time tracking, optimizing user engagement and savings growth.

Automated Micro-savings

Automated micro-savings platforms offer more flexible, frequent, and goal-oriented savings compared to traditional Christmas clubs, which typically require fixed deposits over a limited period. By leveraging technology to round up purchases or set small recurring transfers, micro-savings apps enable users to build savings effortlessly without strict timelines or penalty fees.

Goal-Based Holiday Stash

Goal-based holiday stash savings are more flexible and personalized on micro-savings platforms compared to traditional Christmas clubs, allowing users to set specific targets and automate deposits aligned with their spending habits. Micro-savings platforms leverage AI-driven insights and round-up features to maximize contributions, enhancing the ability to reach holiday financial goals faster than fixed-contribution Christmas clubs.

Round-Up Savings Platforms

Round-up savings platforms automatically round up everyday purchases to the nearest dollar, channeling the spare change into a dedicated savings account optimized for effortless accumulation, unlike traditional Christmas clubs which require fixed periodic deposits. These micro-savings solutions leverage behavioral economics to maximize incremental savings without disrupting cash flow, making them a more flexible and user-friendly alternative for goal-oriented saving during the holiday season.

Social Gifting Pools

Christmas clubs typically require fixed, periodic deposits leading up to the holiday season, while micro-savings platforms offer flexible contributions that can be pooled socially for collective gifting purposes. Social gifting pools on micro-savings platforms enable groups to save collaboratively, increasing motivation and maximizing funds for shared presents or community goals.

AI-Powered Micro-Savings

AI-powered micro-savings platforms offer personalized, automatic transfers of small amounts into savings accounts, optimizing saving habits with predictive analytics and behavioral insights. Unlike traditional Christmas clubs, these platforms provide continuous, flexible savings options tailored to individual financial goals and spending patterns.

Christmas Club 2.0

Christmas Club 2.0 offers a structured savings approach with automated deposits and seasonal incentives that enhance commitment toward holiday expenses, outperforming traditional Christmas clubs in user flexibility and digital integration. Micro-savings platforms provide real-time rounding-up features and diverse goal settings but often lack the targeted, purpose-driven focus and community incentives embedded in Christmas Club 2.0's design.

Micro-Deposits Scheduling

Micro-savings platforms offer flexible micro-deposit scheduling, allowing users to automate small, frequent contributions tailored to their cash flow, unlike traditional Christmas clubs with fixed deposit timelines. This adaptive approach enhances saving consistency and helps build funds incrementally without financial strain.

App-Integrated Holiday Funds

App-integrated holiday funds on micro-savings platforms offer flexible, automated contributions that adapt to user spending habits, unlike traditional Christmas clubs that require fixed, scheduled deposits. These digital solutions enhance goal tracking and provide instant access to funds, improving user engagement and better preparing savers for holiday expenses.

Nano-Savings Challenge

Christmas clubs encourage disciplined saving through fixed deposits earmarked for holiday spending, while micro-savings platforms enable flexible, automated transfers of small amounts into savings accounts, enhancing accessibility and habit-building. The Nano-Savings Challenge leverages micro-savings technology to engage users in incremental deposit goals, boosting financial inclusion and promoting consistent saving behavior.

Christmas club vs Micro-savings platform for savings. Infographic

moneydiff.com

moneydiff.com