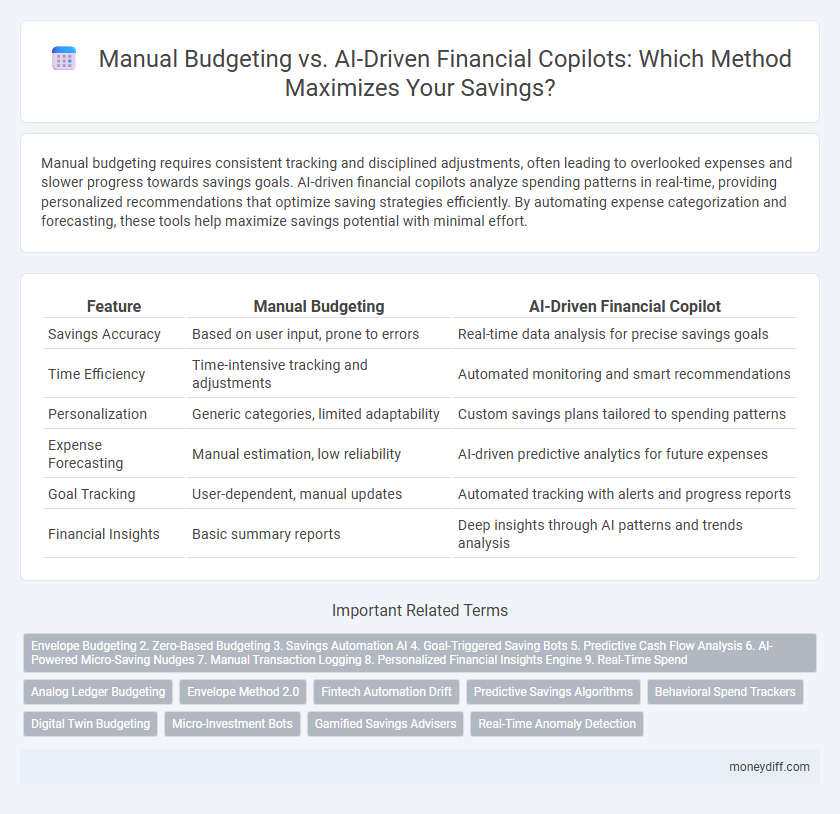

Manual budgeting requires consistent tracking and disciplined adjustments, often leading to overlooked expenses and slower progress towards savings goals. AI-driven financial copilots analyze spending patterns in real-time, providing personalized recommendations that optimize saving strategies efficiently. By automating expense categorization and forecasting, these tools help maximize savings potential with minimal effort.

Table of Comparison

| Feature | Manual Budgeting | AI-Driven Financial Copilot |

|---|---|---|

| Savings Accuracy | Based on user input, prone to errors | Real-time data analysis for precise savings goals |

| Time Efficiency | Time-intensive tracking and adjustments | Automated monitoring and smart recommendations |

| Personalization | Generic categories, limited adaptability | Custom savings plans tailored to spending patterns |

| Expense Forecasting | Manual estimation, low reliability | AI-driven predictive analytics for future expenses |

| Goal Tracking | User-dependent, manual updates | Automated tracking with alerts and progress reports |

| Financial Insights | Basic summary reports | Deep insights through AI patterns and trends analysis |

Understanding Manual Budgeting: Traditional Approaches to Saving

Manual budgeting relies on tracking income and expenses through spreadsheets or pen-and-paper methods, demanding consistent effort and discipline to maintain accuracy. Traditional approaches emphasize categorizing spending, setting fixed limits, and periodic review to control finances and prioritize savings goals. Despite its simplicity, manual budgeting often lacks real-time insights and adaptive recommendations found in AI-driven financial tools.

Introduction to AI-Driven Financial Copilots

AI-driven financial copilots leverage machine learning algorithms to analyze spending patterns and optimize savings strategies automatically. These tools provide personalized budgeting recommendations, track expenses in real-time, and forecast future financial goals with high precision. By replacing manual budgeting's time-consuming processes, AI copilots enable users to maximize savings efficiently and make informed financial decisions.

Key Differences Between Manual and AI-Driven Budgeting

Manual budgeting relies on personal input and periodic updates, requiring consistent effort to track expenses and adjust savings goals. AI-driven financial copilots utilize machine learning algorithms to analyze spending patterns in real time, offering automated insights and personalized recommendations for optimizing savings. The key difference lies in AI's ability to dynamically adapt budgets based on predictive analytics, while manual budgeting depends on static, user-managed data entries.

Time Efficiency: Manual Tracking vs Automated Insights

Manual budgeting demands significant time investment for tracking expenses and updating spreadsheets, often leading to delays and inaccuracies. AI-driven financial copilots automate data collection and provide real-time insights, drastically reducing the time required for monitoring savings. This efficiency enables users to quickly adjust spending habits and optimize savings growth without the burden of manual calculations.

Accuracy in Budgeting: Human Calculations vs AI Algorithms

Manual budgeting relies on human calculations that are prone to errors and inconsistencies, often leading to inaccurate savings forecasts. AI-driven financial copilots use advanced algorithms to analyze spending patterns and predict future expenses with higher precision. This increased accuracy helps users optimize their savings strategies by providing real-time adjustments and personalized financial insights.

Personalization: Customizing Savings Plans with AI

Manual budgeting relies on static categories and fixed rules, often missing personalized nuances in spending behavior. AI-driven financial copilots analyze real-time transaction data and financial goals to create dynamic, customized savings plans tailored to individual preferences and life changes. This personalization enhances savings efficiency by adapting strategies based on spending patterns and upcoming expenses.

Adapting to Financial Changes: Flexibility of Manual vs AI Systems

Manual budgeting offers personalized control but often lacks real-time adaptability to fluctuating expenses and income. AI-driven financial copilots continuously analyze spending patterns and financial changes, providing dynamic adjustments to optimize savings goals. This flexibility enables AI systems to respond faster and more accurately to unexpected financial shifts, enhancing overall savings efficiency.

Overcoming Human Bias in Savings Decisions

Manual budgeting often suffers from human biases such as over-optimism and inconsistent tracking, leading to missed savings goals. AI-driven financial copilots analyze spending patterns objectively, adjust recommendations in real-time, and eliminate emotional decision-making. Leveraging machine learning algorithms enhances precision in savings plans, ensuring more accurate and consistent financial outcomes.

Security and Privacy: Manual Methods vs AI Platforms

Manual budgeting ensures direct control over personal financial data, reducing exposure to digital vulnerabilities and potential cyber threats. AI-driven financial copilots, while offering advanced analytical insights and automation, rely on cloud-based systems that may pose risks of data breaches if not equipped with robust encryption and privacy safeguards. Choosing between these methods requires balancing convenience with the strength of security protocols and privacy protections integrated into the AI platform.

Choosing the Right Financial Tool: Manual Budgeting or AI Copilot for Maximum Savings

Manual budgeting provides precise control over expenses and savings by requiring detailed tracking of income and expenditures, helping savers stay disciplined. AI-driven financial copilots leverage machine learning algorithms to analyze spending patterns, predict future expenses, and suggest personalized savings strategies, optimizing financial decisions automatically. Selecting between manual budgeting and an AI copilot depends on individual preferences for control versus automation, with AI tools often leading to higher savings through data-driven insights and real-time adjustments.

Related Important Terms

Envelope Budgeting 2. Zero-Based Budgeting 3. Savings Automation AI 4. Goal-Triggered Saving Bots 5. Predictive Cash Flow Analysis 6. AI-Powered Micro-Saving Nudges 7. Manual Transaction Logging 8. Personalized Financial Insights Engine 9. Real-Time Spend

Envelope Budgeting and Zero-Based Budgeting provide structured frameworks for manual savings allocation, while AI-driven financial copilots enhance savings through Savings Automation AI, Goal-Triggered Saving Bots, and Predictive Cash Flow Analysis that optimize cash flows in real time. AI-Powered Micro-Saving Nudges, Personalized Financial Insights Engine, and Real-Time Spend monitoring automate transaction logging and deliver tailored financial advice, significantly improving savings efficiency and goal attainment.

Analog Ledger Budgeting

Manual budgeting using analog ledgers offers a tactile and visual method for tracking expenses and savings, promoting meticulous habit formation and direct engagement with financial data. However, this approach often lacks real-time insights and automated analysis found in AI-driven financial copilots, which optimize savings strategies through predictive algorithms and personalized recommendations.

Envelope Method 2.0

Manual budgeting using the Envelope Method 2.0 involves allocating physical or digital envelopes for specific savings goals, enhancing spending discipline through tangible categorization of funds. AI-Driven Financial Copilots automate this process by analyzing spending patterns, dynamically adjusting envelopes, and optimizing savings strategies to maximize financial efficiency.

Fintech Automation Drift

Manual budgeting relies heavily on user input and discipline, often leading to inconsistent savings outcomes, whereas AI-driven financial copilots leverage real-time data analysis and predictive algorithms to automate savings and optimize financial decisions. The fintech automation drift increasingly favors AI solutions that adapt to spending patterns, maximize interest accrual, and minimize human error, resulting in more efficient and personalized savings strategies.

Predictive Savings Algorithms

Predictive savings algorithms in AI-driven financial copilots analyze spending patterns and income fluctuations to optimize savings goals with personalized recommendations. Manual budgeting lacks this dynamic adaptability, often resulting in less efficient allocation of funds and missed opportunities for maximizing savings growth.

Behavioral Spend Trackers

Behavioral spend trackers in manual budgeting rely on user input and self-discipline to categorize expenses and monitor savings goals, often leading to inconsistent results due to human error and bias. AI-driven financial copilots automatically analyze spending patterns using machine learning algorithms, providing personalized recommendations and real-time adjustments that enhance savings efficiency and promote smarter financial habits.

Digital Twin Budgeting

Manual budgeting relies on static inputs and user discipline, often leading to missed opportunities and rigid savings plans. AI-driven financial copilots leverage Digital Twin Budgeting by simulating real-time financial scenarios, optimizing savings strategies through dynamic adjustments based on predictive analytics and personalized spending behavior.

Micro-Investment Bots

Manual budgeting requires constant tracking and adjustment, often leading to missed saving opportunities, whereas AI-driven financial copilots utilize micro-investment bots to automatically allocate small amounts into diversified portfolios, optimizing savings growth with minimal user effort. These bots analyze spending patterns and market trends in real-time, enabling personalized, efficient micro-investments that enhance long-term financial goals.

Gamified Savings Advisers

Manual budgeting relies on user discipline and static categories, often limiting savings growth, whereas AI-driven financial copilots utilize gamified savings advisers that engage users through personalized challenges and reward-based systems, boosting motivation and optimizing saving strategies. These gamified tools leverage behavioral data and machine learning algorithms to adapt goals dynamically, making savings both interactive and efficient.

Real-Time Anomaly Detection

AI-driven financial copilots offer real-time anomaly detection by continuously monitoring transactions and instantly flagging unusual spending patterns, ensuring faster identification of potential fraud or budgeting errors compared to manual budgeting methods. This real-time insight enhances savings by preventing unexpected expenses and promoting more accurate financial decision-making.

Manual Budgeting vs AI-Driven Financial Copilot for Savings. Infographic

moneydiff.com

moneydiff.com