Automatic transfers ensure consistent savings by moving a fixed amount from checking to savings accounts on a regular schedule, reducing reliance on manual actions. Pay-yourself-first apps, on the other hand, use intelligent algorithms to analyze spending habits and automatically set aside personalized, manageable amounts, making saving effortless and tailored. Both methods enhance financial discipline, but pay-yourself-first apps offer a more dynamic and adaptive approach to growing savings over time.

Table of Comparison

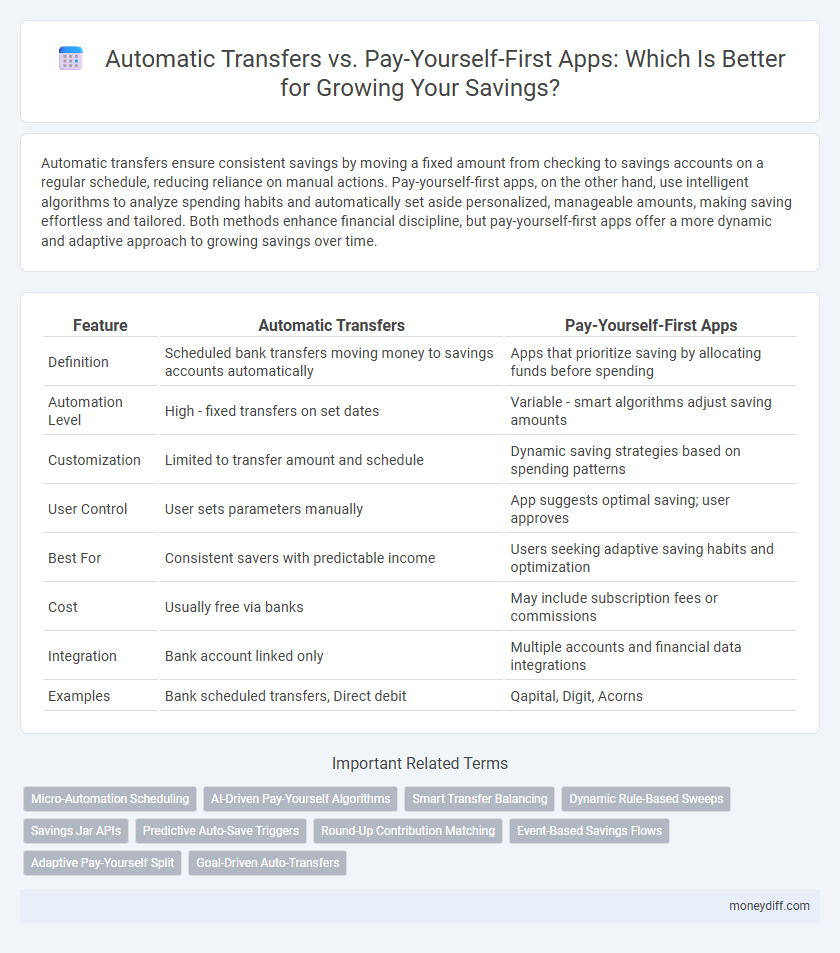

| Feature | Automatic Transfers | Pay-Yourself-First Apps |

|---|---|---|

| Definition | Scheduled bank transfers moving money to savings accounts automatically | Apps that prioritize saving by allocating funds before spending |

| Automation Level | High - fixed transfers on set dates | Variable - smart algorithms adjust saving amounts |

| Customization | Limited to transfer amount and schedule | Dynamic saving strategies based on spending patterns |

| User Control | User sets parameters manually | App suggests optimal saving; user approves |

| Best For | Consistent savers with predictable income | Users seeking adaptive saving habits and optimization |

| Cost | Usually free via banks | May include subscription fees or commissions |

| Integration | Bank account linked only | Multiple accounts and financial data integrations |

| Examples | Bank scheduled transfers, Direct debit | Qapital, Digit, Acorns |

Introduction: Comparing Automatic Transfers and Pay-Yourself-First Apps

Automatic transfers enable users to schedule regular money moves from checking to savings accounts, ensuring consistent saving without manual effort. Pay-Yourself-First apps automate this process further by prioritizing savings before other expenses, often using advanced algorithms to determine optimal transfer amounts. Comparing these methods reveals key differences in automation, personalization, and impact on saving discipline.

How Automatic Transfers Work for Savings

Automatic transfers for savings function by scheduling predetermined amounts to be moved from a checking account to a savings account at regular intervals, such as weekly or monthly. This method leverages the principle of forced savings, reducing the temptation to spend and promoting consistent accumulation without requiring manual intervention. By automating the process, individuals benefit from disciplined saving habits and seamless growth of their savings balance over time.

Understanding Pay-Yourself-First Savings Apps

Pay-yourself-first savings apps simplify disciplined saving by automatically allocating a set portion of income to savings before other expenses, ensuring consistent growth of funds. These apps often use algorithms to analyze spending habits and suggest optimal transfer amounts, enhancing financial control without manual effort. Compared to traditional automatic transfers, pay-yourself-first apps provide personalized, behavior-driven strategies that improve saving efficiency and goal attainment.

Key Benefits of Automatic Savings Transfers

Automatic savings transfers ensure consistent contributions by scheduling regular deposits from checking to savings accounts, promoting disciplined financial habits. This method reduces the temptation to spend disposable income, increasing the likelihood of reaching savings goals faster. It also minimizes the risk of missed deposits compared to manual transfers, offering a seamless and efficient approach to building emergency funds or long-term savings.

Advantages of Pay-Yourself-First Apps

Pay-Yourself-First apps automate savings by prioritizing funds directly from each paycheck, ensuring consistent contributions without relying on manual transfers. These apps often include features like goal setting, progress tracking, and personalized recommendations that enhance motivation and accountability. Users benefit from seamless integration with bank accounts and tailored alerts, which drive disciplined saving habits more effectively than generic automatic transfer setups.

Ease of Use: Automation vs App-Based Savings

Automatic transfers simplify savings by scheduling consistent fund moves from checking to savings accounts without user intervention, ensuring disciplined financial habits. Pay-yourself-first apps enhance ease of use by providing intuitive interfaces that allow users to set personalized savings goals, track progress in real-time, and adjust contributions via mobile platforms. Both methods eliminate manual saving barriers, but automation offers a set-and-forget approach while app-based solutions provide interactive and customizable saving experiences.

Flexibility and Customization in Saving Methods

Automatic transfers offer steady, consistent contributions to savings accounts, ensuring discipline without requiring active management, but they may lack flexibility for adjusting amounts frequently. Pay-yourself-first apps provide greater customization by allowing users to tailor savings goals and adjust contributions based on spending patterns, promoting dynamic financial planning. Choosing between these methods depends on prioritizing either fixed saving habits or adaptable strategies aligned with personal financial fluctuations.

Cost and Fees: Which Method Saves You More?

Automatic transfers typically incur no additional fees and allow consistent saving by moving a fixed amount directly from checking to savings accounts, maximizing growth without extra costs. Pay-yourself-first apps may charge subscription fees or transaction costs, which can reduce overall savings despite offering budgeting tools and personalized saving strategies. Evaluating fee structures and ensuring that transfer amounts outweigh app costs is critical to maximizing net savings over time.

Security and Reliability Considerations

Automatic transfers leverage established banking infrastructure, offering high levels of security through encryption and regulatory oversight, ensuring funds move safely to savings accounts. Pay-Yourself-First apps often incorporate biometric authentication and multi-factor security, but their reliance on third-party platforms can introduce potential vulnerabilities. Evaluating the reliability involves assessing the app's track record, data protection policies, and integration with insured financial institutions to ensure consistent and secure savings growth.

Choosing the Right Savings Strategy for Your Goals

Automatic transfers offer a reliable way to build savings by scheduling fixed amounts directly into your savings account, ensuring consistent contributions aligned with your financial goals. Pay-Yourself-First apps prioritize savings by allocating a portion of your income before other expenses, leveraging behavioral incentives to increase discipline and savings growth. Selecting the ideal strategy depends on your budgeting style, income regularity, and the urgency of your savings goals to maximize effectiveness.

Related Important Terms

Micro-Automation Scheduling

Automatic transfers enable micro-automation scheduling by systematically moving small amounts into savings accounts at set intervals, fostering consistent saving habits without manual intervention. Pay-yourself-first apps enhance this process by personalizing transfer rules and adapting schedules based on spending patterns, optimizing savings growth through behavioral insights.

AI-Driven Pay-Yourself Algorithms

AI-driven pay-yourself-first algorithms enhance savings efficiency by automatically analyzing spending patterns and adjusting transfer amounts, ensuring optimal fund allocation without manual intervention. These intelligent systems outperform traditional automatic transfers by dynamically prioritizing savings goals and maximizing financial growth through personalized recommendations.

Smart Transfer Balancing

Automatic transfers ensure consistent savings by scheduling fixed amounts from checking to savings accounts, leveraging principles of smart transfer balancing to maintain liquidity and maximize interest growth. Pay-yourself-first apps enhance this strategy by analyzing spending patterns and dynamically adjusting transfer amounts, optimizing cash flow and accelerating savings goals through personalized financial algorithms.

Dynamic Rule-Based Sweeps

Dynamic rule-based sweeps in automatic transfers optimize savings by analyzing spending patterns and adjusting transfer amounts accordingly, ensuring efficient fund allocation without manual intervention. Pay-yourself-first apps often lack this adaptive capability, making rule-based sweeps more effective for maximizing consistent savings growth over time.

Savings Jar APIs

Automatic Transfers streamline savings by scheduling recurring deposits directly from checking accounts, leveraging APIs like Savings Jar to enhance seamless fund allocation. Pay-Yourself-First Apps utilize Savings Jar APIs to automate goal-based savings, ensuring prioritized fund distribution before monthly expenses are deducted.

Predictive Auto-Save Triggers

Predictive auto-save triggers in automatic transfer systems analyze spending patterns and income flow to schedule optimal savings deposits without manual input, enhancing consistency and growth of savings. Pay-yourself-first apps employ these intelligent triggers to prioritize savings goals, ensuring funds are set aside immediately upon paycheck receipt, maximizing financial discipline and future security.

Round-Up Contribution Matching

Automatic transfers ensure consistent savings by regularly moving a fixed amount into your account, while pay-yourself-first apps enhance savings through round-up contribution matching, rounding purchases up to the nearest dollar and matching the difference to boost your savings faster. Round-up contribution matching maximizes saving potential by leveraging everyday spending to create incremental deposits, turning small change into significant growth over time.

Event-Based Savings Flows

Event-based savings flows in automatic transfers enable users to schedule deposits aligned with specific financial goals or upcoming expenses, enhancing targeted savings efficiency. Pay-yourself-first apps utilize algorithms to analyze spending patterns and automate contributions immediately after income receipt, optimizing continuous, goal-driven savings growth.

Adaptive Pay-Yourself Split

Adaptive Pay-Yourself Split automates savings by dynamically allocating income portions to multiple goals, enhancing personalized financial management compared to fixed automatic transfers. This method optimizes cash flow by adjusting contributions based on spending patterns and income changes, fostering consistent saving behavior.

Goal-Driven Auto-Transfers

Goal-driven automatic transfers tailor savings contributions based on predefined financial objectives, ensuring consistent progress toward specific targets without manual intervention. Pay-yourself-first apps automate savings by prioritizing allocating a portion of income directly to savings accounts, but may lack the nuanced customization found in goal-driven auto-transfer systems.

Automatic Transfers vs Pay-Yourself-First Apps for savings. Infographic

moneydiff.com

moneydiff.com