A high-yield savings account offers significantly higher interest rates compared to a traditional savings account, helping your money grow faster over time. While both accounts provide a safe place to store funds with easy access, high-yield accounts often come with online access and may require higher minimum balances. Choosing a high-yield savings account maximizes your savings potential without sacrificing liquidity or security.

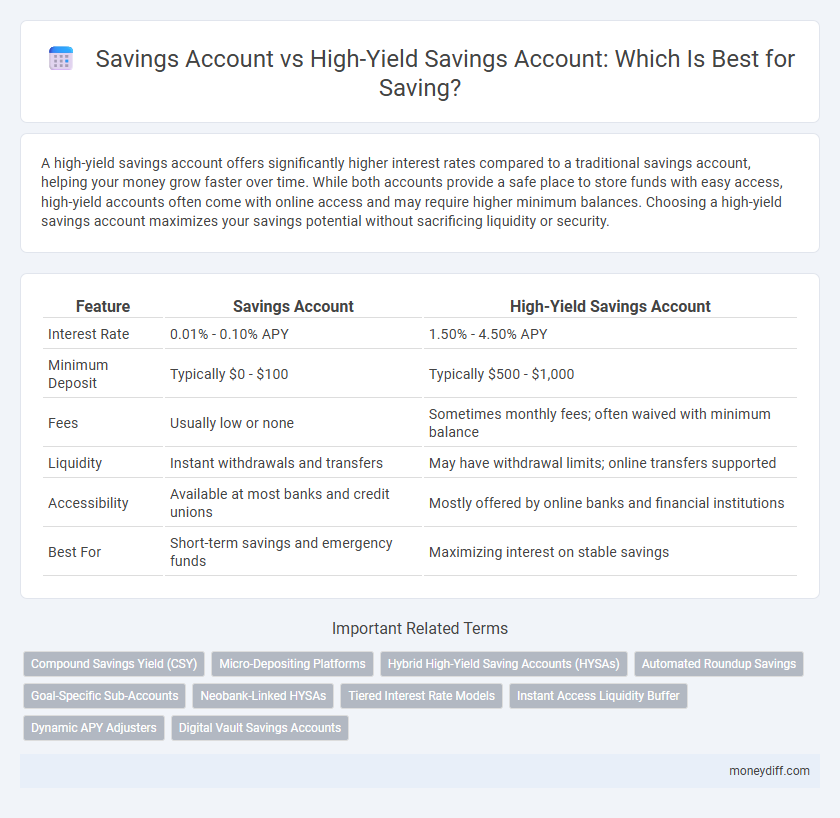

Table of Comparison

| Feature | Savings Account | High-Yield Savings Account |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 1.50% - 4.50% APY |

| Minimum Deposit | Typically $0 - $100 | Typically $500 - $1,000 |

| Fees | Usually low or none | Sometimes monthly fees; often waived with minimum balance |

| Liquidity | Instant withdrawals and transfers | May have withdrawal limits; online transfers supported |

| Accessibility | Available at most banks and credit unions | Mostly offered by online banks and financial institutions |

| Best For | Short-term savings and emergency funds | Maximizing interest on stable savings |

Understanding Savings Accounts vs High-Yield Savings Accounts

Savings accounts typically offer lower interest rates, usually around 0.01% to 0.10% APY, making them ideal for easy access and emergency funds. High-yield savings accounts provide significantly higher APYs, often between 3% and 5%, allowing savings to grow faster while maintaining liquidity. Choosing between the two depends on balancing accessibility needs with the desire for higher returns on deposited funds.

Key Differences Between Savings and High-Yield Accounts

Savings accounts typically offer lower interest rates and more accessible withdrawal options, making them suitable for emergency funds and short-term savings. High-yield savings accounts provide significantly higher annual percentage yields (APYs) by investing in less liquid assets but may impose stricter withdrawal limits or minimum balance requirements. Choosing between the two depends on balancing liquidity needs with the goal of maximizing interest earnings on saved funds.

Interest Rates: Maximizing Your Savings Potential

High-yield savings accounts offer significantly higher interest rates compared to traditional savings accounts, often ranging from 1.5% to 4% APY versus the typical 0.01% to 0.10% found in standard accounts. This elevated rate allows your savings to grow faster due to compound interest, maximizing your returns over time while maintaining liquidity and FDIC insurance. Choosing a high-yield savings account can dramatically enhance your savings potential by boosting interest earnings with minimal additional risk.

Accessibility and Ease of Use for Each Account Type

Savings accounts offer greater accessibility with features like ATM access, debit cards, and easy transfers, making them convenient for everyday use. High-yield savings accounts typically require online management and may have limited withdrawal options, prioritizing higher interest rates over immediate accessibility. Choosing between the two depends on balancing ease of access and maximizing interest earnings.

Minimum Balance and Fee Structures: What to Expect

Savings accounts typically require a lower minimum balance, often around $0 to $300, and may impose monthly maintenance fees if the balance drops below this threshold, impacting overall earnings. High-yield savings accounts usually demand higher minimum balances, ranging from $500 to $5,000, but offer significantly higher interest rates, which can offset potential fees. Understanding the fee structures and minimum balance requirements is crucial to maximizing returns and minimizing penalties in both savings and high-yield accounts.

Safety and FDIC Insurance: Protecting Your Funds

Savings accounts and high-yield savings accounts both offer FDIC insurance up to $250,000, ensuring your funds remain safe even if the bank fails. The primary safety feature is this federal insurance, which protects your principal regardless of the interest rate differences. Choosing between these accounts should prioritize FDIC insurance coverage while evaluating interest returns to optimize savings growth securely.

Online vs Traditional Institutions: Where to Open Your Account

High-yield savings accounts offered by online institutions typically provide significantly higher annual percentage yields (APYs) compared to traditional brick-and-mortar banks, often exceeding 3% APY versus the national average below 0.10%. Online banks minimize overhead costs, passing savings to consumers through better interest rates and lower fees, while traditional banks offer easier in-person access and integrated financial services. Choosing between online and traditional institutions depends on balancing higher returns with convenience and personalized customer support.

Withdrawal Limits and Account Flexibility

Savings accounts typically offer greater withdrawal flexibility with fewer restrictions, allowing easier access to funds for everyday needs. High-yield accounts often impose stricter withdrawal limits, such as a maximum of six convenient withdrawals per month, to maintain higher interest rates. Choosing between these accounts depends on balancing the need for liquidity against earning potential from elevated interest yields.

Who Should Choose a High-Yield Savings Account?

Individuals seeking to maximize interest earnings on their savings should opt for a high-yield savings account, which typically offers annual percentage yields (APYs) significantly higher than traditional savings accounts. Those with emergency funds or short-term savings goals who prefer FDIC insurance and easy access to funds without market risk benefit most from high-yield accounts. Savers comfortable with maintaining minimum balance requirements and avoiding frequent withdrawals can leverage these accounts to grow savings more efficiently.

Making the Right Choice for Your Savings Goals

Choosing between a standard savings account and a high-yield savings account depends on your financial goals and accessibility needs. High-yield savings accounts offer significantly higher interest rates, often 10 to 20 times more than traditional accounts, helping your savings grow faster over time. However, standard accounts provide easier access and typically no minimum balance requirements, making them suitable for short-term savings or emergency funds.

Related Important Terms

Compound Savings Yield (CSY)

High-yield savings accounts typically offer significantly higher interest rates compared to regular savings accounts, resulting in a more favorable Compound Savings Yield (CSY) over time. The accelerated compounding effect in high-yield accounts maximizes exponential growth of savings, making them ideal for long-term financial goals.

Micro-Depositing Platforms

Micro-depositing platforms integrate seamlessly with high-yield savings accounts to maximize interest earnings on small, frequent deposits, offering superior returns compared to traditional savings accounts with lower interest rates. These platforms enable automated, incremental savings growth, leveraging compounding interest benefits that enhance overall financial health for users prioritizing efficient, scalable savings strategies.

Hybrid High-Yield Saving Accounts (HYSAs)

Hybrid High-Yield Savings Accounts (HYSAs) combine the safety of traditional savings with competitive interest rates typically found in high-yield accounts, offering a balanced option for maximizing returns without sacrificing liquidity. These accounts often feature tiered interest rates, easy access to funds, and lower minimum balance requirements, making them ideal for savers seeking both growth and flexibility.

Automated Roundup Savings

Automated Roundup Savings feature available in both traditional savings and high-yield accounts rounds up purchases to the nearest dollar, transferring the difference into savings, effectively boosting funds without effort. High-yield accounts typically offer interest rates several times higher than standard savings accounts, maximizing growth potential through compounded returns while maintaining easy access to rounded-up contributions.

Goal-Specific Sub-Accounts

Goal-specific sub-accounts in savings accounts allow users to allocate funds toward distinct financial objectives with personalized tracking and budgeting features, enhancing discipline without merging funds. High-yield accounts generally lack this granularity but offer superior interest rates, making a combined strategy beneficial for maximizing growth while maintaining clear goal separation.

Neobank-Linked HYSAs

Neobank-linked high-yield savings accounts (HYSAs) offer significantly higher annual percentage yields (APYs) compared to traditional savings accounts, often exceeding 4%, while maintaining FDIC insurance and low minimum deposits. These digital-first platforms provide seamless mobile access, enhanced user experience, and automated savings tools, making them a preferred choice for maximizing interest earnings without sacrificing liquidity or security.

Tiered Interest Rate Models

Savings accounts with tiered interest rate models offer varying rates based on balance thresholds, allowing account holders to earn higher returns as their deposits increase. High-yield savings accounts often feature more competitive tiered rates, maximizing interest earnings for larger balances compared to traditional savings accounts.

Instant Access Liquidity Buffer

High-yield savings accounts provide significantly higher interest rates compared to traditional savings accounts, making them ideal for maximizing growth on your instant access liquidity buffer while maintaining easy accessibility. Traditional savings accounts offer lower returns but may provide more widespread accessibility and fewer restrictions on withdrawals, balancing convenience with liquidity needs.

Dynamic APY Adjusters

High-yield savings accounts offer dynamic APY adjusters that increase interest rates based on market conditions, maximizing returns compared to traditional savings accounts with fixed, lower APYs. This flexibility enables savers to benefit from rising rates, enhancing the growth potential of their deposits over time.

Digital Vault Savings Accounts

Digital Vault Savings Accounts offer enhanced security features and higher interest rates compared to traditional savings accounts, making them ideal for long-term financial growth. Their high-yield rates combined with digital management tools provide better returns and convenience for savers prioritizing both accessibility and wealth preservation.

Savings account vs High-yield account for savings. Infographic

moneydiff.com

moneydiff.com