Regular savings plans offer structured, consistent contributions that help build a disciplined approach to growing wealth over time, often with higher minimum deposit requirements and potential for interest accrual. Micro-savings platforms enable users to save small amounts frequently, making it easier to accumulate funds without significant budget strain while leveraging automated features and rounding-up mechanisms. Both methods promote financial security but cater to different saving habits and income levels, allowing individuals to choose based on their comfort and goals.

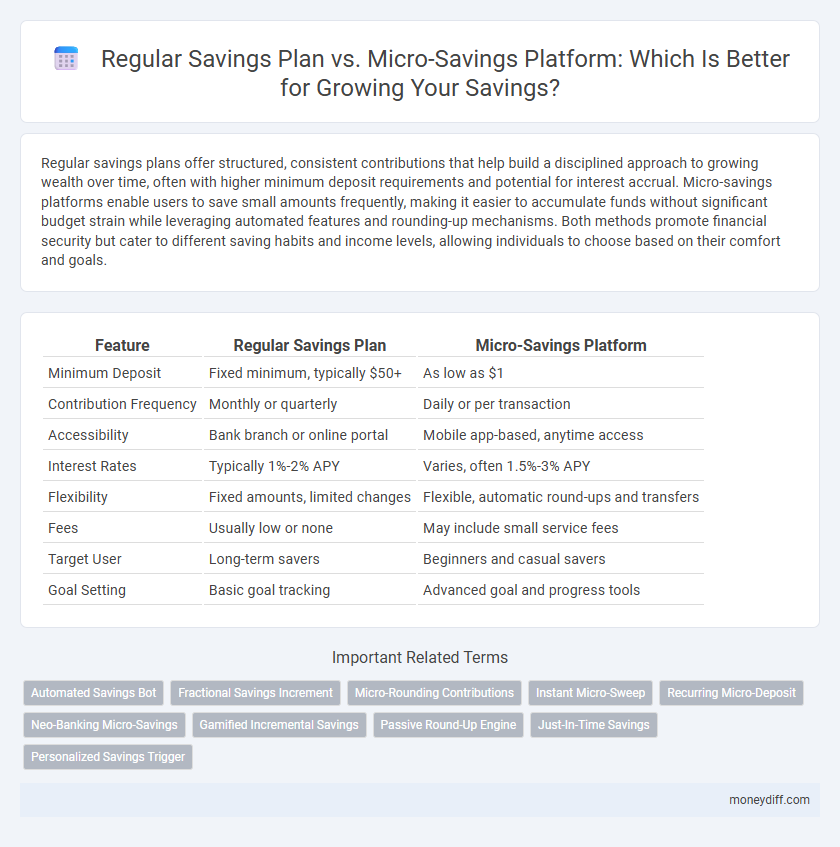

Table of Comparison

| Feature | Regular Savings Plan | Micro-Savings Platform |

|---|---|---|

| Minimum Deposit | Fixed minimum, typically $50+ | As low as $1 |

| Contribution Frequency | Monthly or quarterly | Daily or per transaction |

| Accessibility | Bank branch or online portal | Mobile app-based, anytime access |

| Interest Rates | Typically 1%-2% APY | Varies, often 1.5%-3% APY |

| Flexibility | Fixed amounts, limited changes | Flexible, automatic round-ups and transfers |

| Fees | Usually low or none | May include small service fees |

| Target User | Long-term savers | Beginners and casual savers |

| Goal Setting | Basic goal tracking | Advanced goal and progress tools |

Understanding Regular Savings Plans

Regular Savings Plans offer a structured approach to saving by allowing consistent, scheduled contributions over time, often with fixed amounts and set intervals. These plans typically provide higher interest rates or incentives through banks and financial institutions, encouraging disciplined saving habits and long-term financial growth. Compared to Micro-Savings Platforms, Regular Savings Plans emphasize commitment and predictability, making them ideal for building substantial savings goals steadily.

What Are Micro-Savings Platforms?

Micro-savings platforms enable users to save small amounts of money frequently by rounding up daily purchases or setting automatic transfers, making saving effortless and accessible. Unlike traditional Regular Savings Plans that often require fixed, larger deposits, micro-savings capitalize on behavioral finance by encouraging incremental saving habits. These platforms leverage technology to integrate with bank accounts or digital wallets, promoting consistent saving without impacting cash flow significantly.

Key Differences Between Regular Savings and Micro-Savings

Regular savings plans involve consistent, predetermined contributions often through bank accounts or investment products, promoting disciplined long-term wealth accumulation. Micro-savings platforms enable users to save small amounts frequently, often via rounding up purchases or automated transfers, enhancing accessibility and financial inclusion for low-income or beginner savers. The primary differences lie in contribution size, frequency, accessibility, and targeting: regular savings support structured, larger deposits while micro-savings emphasize convenience and incremental growth.

How Do Regular Savings Plans Work?

Regular Savings Plans work by setting up fixed, automatic contributions from an individual's bank account to a designated savings account or investment fund, typically on a monthly basis. These plans encourage disciplined saving by enforcing consistent deposits, which accumulate over time with potential interest or investment returns. They often offer structured goals and periodic reviews, helping savers track progress and adjust contributions to meet financial objectives.

Benefits of Using Micro-Savings Platforms

Micro-savings platforms offer users the advantage of automated, small-scale deposits that accumulate into substantial savings over time without impacting daily budgets. These platforms provide greater accessibility and flexibility compared to regular savings plans, enabling individuals to save spontaneously and align contributions with their cash flow. Integration with mobile apps and AI-driven insights enhances user engagement and helps optimize individualized saving strategies, fostering consistent financial discipline.

Interest Rates: Regular Savings vs Micro-Savings

Regular savings plans typically offer higher interest rates, averaging between 1% to 3% annually, providing steady growth for long-term goals. Micro-savings platforms often feature lower interest rates, around 0.5% to 1.5%, but excel in flexibility and accessibility for small, frequent deposits. Understanding the trade-off between interest rate benefits and savings convenience helps optimize financial growth strategies.

Accessibility and Flexibility in Saving Options

Regular Savings Plans typically require fixed monthly deposits and often have minimum balance thresholds, limiting accessibility for individuals with irregular income streams. Micro-Savings Platforms offer greater flexibility by allowing users to save small amounts on-demand, making saving more inclusive and adaptable to varying financial situations. This accessibility and flexibility enable broader participation and consistent saving habits among diverse populations.

Fees and Minimum Balance Requirements

Regular Savings Plans often have higher minimum balance requirements and may charge monthly maintenance fees, impacting overall returns. Micro-Savings Platforms typically offer lower or no minimum balance requirements and minimal fees, making them accessible for individuals with limited funds. Fee structures and balance thresholds significantly influence the suitability and cost-effectiveness of each savings option.

Which Is Better for Beginners?

Regular Savings Plans offer structured, fixed contributions ideal for beginners seeking disciplined, predictable growth and easier financial planning. Micro-Savings Platforms provide flexibility with small, frequent transactions, making them accessible for users with irregular income or those wanting to build saving habits gradually. Beginners benefit more from Regular Savings Plans due to automated schedules and clearer goal tracking, promoting consistent saving behavior.

Choosing the Right Savings Method for Your Goals

Regular Savings Plans offer disciplined, scheduled contributions that build wealth steadily, ideal for long-term goals like retirement or education. Micro-Savings Platforms enable frequent, small deposits, perfect for short-term objectives or emergency funds with flexible access. Selecting the right savings method depends on your financial goals, preferred saving habits, and the level of accessibility you require.

Related Important Terms

Automated Savings Bot

Automated savings bots in micro-savings platforms enable seamless, small, and frequent deposits by analyzing spending patterns, increasing saving consistency without manual input. Regular savings plans, while structured with fixed contributions, lack the adaptive automation that micro-savings bots provide, making them less flexible for maximizing incremental savings.

Fractional Savings Increment

Regular Savings Plans typically require fixed, larger deposit amounts, whereas Micro-Savings Platforms enable fractional savings increments, allowing users to save small amounts continuously and build wealth gradually. This flexibility in fractional contributions enhances accessibility and promotes consistent saving habits for diverse income levels.

Micro-Rounding Contributions

Micro-rounding contributions in micro-savings platforms automatically round up everyday purchases to the nearest dollar, channeling small amounts into savings without noticeable impact on daily budgets. This method enhances consistent saving behavior and accelerates wealth accumulation compared to traditional regular savings plans that require fixed, often larger, monthly commitments.

Instant Micro-Sweep

Regular Savings Plans encourage consistent contributions over time, ideal for building a predictable financial habit, while Micro-Savings Platforms leverage Instant Micro-Sweep technology to automatically transfer small, frequent amounts from daily transactions into savings, enhancing flexibility and boosting accumulation without impacting cash flow. Instant Micro-Sweep optimizes savings by capturing spare change in real-time, making it a seamless and efficient method to grow funds passively.

Recurring Micro-Deposit

Recurring micro-deposits in micro-savings platforms provide a flexible and automated approach to building savings through small, frequent contributions that accumulate over time, ideal for users with variable income or tight budgets. Regular savings plans typically require fixed, larger deposits at set intervals, which may create barriers for consistent saving among low-income individuals.

Neo-Banking Micro-Savings

Neo-banking micro-savings platforms leverage automated, small-scale transactions that accumulate wealth effortlessly, offering higher flexibility and lower entry barriers compared to traditional regular savings plans. These digital solutions harness AI-driven algorithms to optimize savings frequency and amounts, enhancing long-term financial discipline and growth for users.

Gamified Incremental Savings

Regular Savings Plans offer structured, consistent contributions that build wealth steadily, while Micro-Savings Platforms leverage gamified incremental savings features to encourage small, frequent deposits through engaging challenges and rewards. Gamification enhances user motivation, making it easier to develop saving habits and achieve financial goals faster by turning incremental deposits into an interactive experience.

Passive Round-Up Engine

A Regular Savings Plan typically requires fixed monthly contributions, while a Micro-Savings Platform leverages a Passive Round-Up Engine that automatically rounds up everyday purchases and allocates the spare change to savings, optimizing incremental wealth accumulation without user intervention. This round-up mechanism enhances savings discipline and accelerates financial growth by making micro-contributions seamless and consistent.

Just-In-Time Savings

Regular Savings Plans typically involve fixed, scheduled contributions that build wealth steadily, while Micro-Savings Platforms leverage just-in-time savings by rounding up everyday transactions to the nearest dollar and automatically transferring the difference into savings. This just-in-time approach enables seamless, incremental accumulation of funds without impacting daily cash flow, enhancing financial discipline and long-term savings growth.

Personalized Savings Trigger

A Regular Savings Plan typically involves fixed contributions scheduled at set intervals, helping individuals build discipline and steady growth, while a Micro-Savings Platform leverages personalized savings triggers based on spending behavior or income patterns to automate small, frequent deposits, enhancing user engagement and savings consistency. Personalized savings triggers on micro-savings platforms offer tailored reminders and real-time adjustments that increase saving efficiency by aligning with individual financial habits and goals.

Regular Savings Plan vs Micro-Savings Platform for savings. Infographic

moneydiff.com

moneydiff.com