Bank savings offer security, interest earnings, and easy access through digital platforms, making them ideal for long-term financial goals. Cash envelope savings enable better budgeting discipline by physically separating money into categories, reducing overspending and increasing awareness. Combining both methods can enhance financial control and growth by balancing accessibility with mindful spending.

Table of Comparison

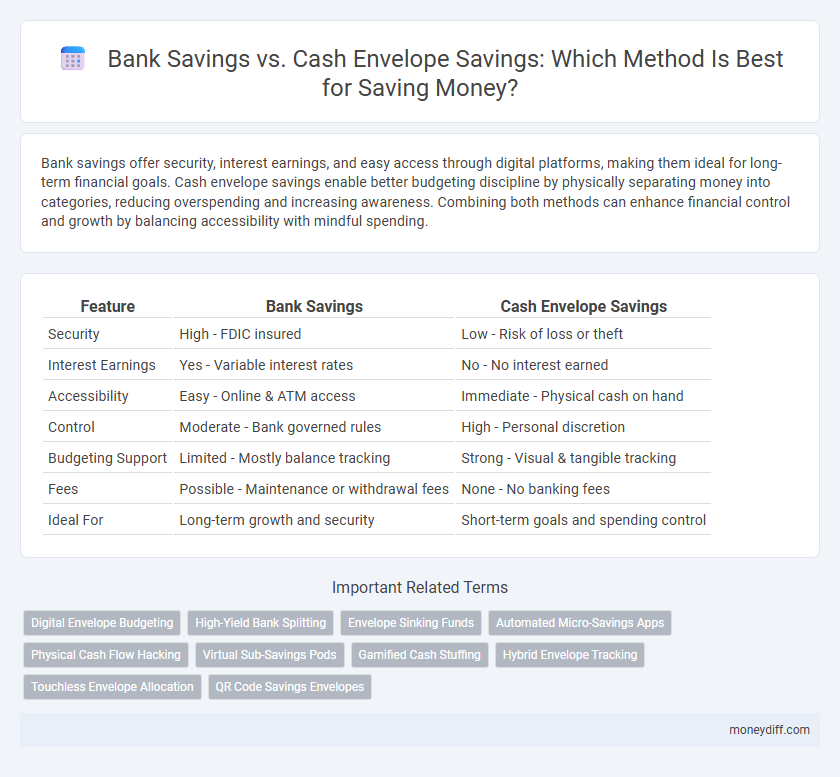

| Feature | Bank Savings | Cash Envelope Savings |

|---|---|---|

| Security | High - FDIC insured | Low - Risk of loss or theft |

| Interest Earnings | Yes - Variable interest rates | No - No interest earned |

| Accessibility | Easy - Online & ATM access | Immediate - Physical cash on hand |

| Control | Moderate - Bank governed rules | High - Personal discretion |

| Budgeting Support | Limited - Mostly balance tracking | Strong - Visual & tangible tracking |

| Fees | Possible - Maintenance or withdrawal fees | None - No banking fees |

| Ideal For | Long-term growth and security | Short-term goals and spending control |

Understanding Bank Savings and Cash Envelope Systems

Bank savings accounts offer secure interest-earning opportunities with easy access and digital management, making them ideal for long-term financial growth. Cash envelope savings systems provide a tactile budgeting method by allocating physical cash into specific spending categories, enhancing spending discipline and control. Understanding these options helps individuals choose between digital convenience and hands-on budgeting to effectively manage and grow their savings.

Key Differences Between Bank Savings and Cash Envelope Savings

Bank savings accounts offer interest earnings, security through FDIC insurance, and digital access for easy fund management, whereas cash envelope savings provide tangible budgeting by physically allocating cash into categories, enhancing spending awareness. Bank accounts facilitate automatic deposits and withdrawals, while cash envelopes require disciplined manual handling and limit overspending through visible cash constraints. The choice depends on preference for digital convenience versus hands-on control and immediate visual tracking of spending habits.

Pros and Cons of Bank Savings Accounts

Bank savings accounts provide security through FDIC insurance and easy access via ATMs and online banking, making them convenient for managing and growing funds with interest accrual. However, these accounts often offer lower interest rates compared to other saving methods, and some impose fees or require minimum balances that can diminish overall savings. Unlike cash envelope savings, bank accounts lack tangible budgeting aids, potentially reducing spending discipline for individuals without strong financial habits.

Advantages and Disadvantages of Cash Envelope Savings

Cash envelope savings offer a tangible and visual method to manage budgets, enhancing discipline by limiting spending to the physical cash available in each envelope. This approach reduces the risk of overdraft fees and bank penalties since it avoids reliance on digital transactions. However, cash envelope savings carry disadvantages such as security risks from loss or theft and lack of interest growth compared to bank savings accounts.

Security Considerations: Bank vs. Cash Envelopes

Bank savings accounts offer enhanced security through federal insurance programs like the FDIC, protecting deposits up to $250,000 per depositor. Cash envelope savings pose higher risks of theft, loss, or damage since physical money lacks insurance and is susceptible to environmental hazards. Choosing bank accounts for savings ensures regulatory safeguards, while cash envelopes provide tactile budgeting control but less protection from financial loss.

Accessibility and Convenience in Savings Methods

Bank savings offer easy accessibility through online banking platforms, ATMs, and mobile apps, allowing users to manage funds anytime with secure electronic transactions. Cash envelope savings provide tangible control over budgeting by physically separating money for different expenses, promoting disciplined spending but limiting instant access and requiring manual handling. Both methods accommodate different preferences for convenience and accessibility, with bank savings favored for digital ease and cash envelopes preferred for hands-on budget management.

Budget Control: Which Method Encourages Better Discipline?

Bank savings accounts provide automated tracking and secure interest accrual, promoting consistent budget control through digital oversight. Cash envelope savings physically limit spending by allocating fixed amounts for each category, enhancing discipline through tangible boundaries. Choosing between them depends on individual preferences for digital management versus hands-on control in maintaining savings discipline.

Interest Earnings: Bank Savings vs. Cash at Home

Bank savings accounts offer interest earnings that can grow your funds over time, whereas cash held in envelopes at home generates no interest and risks depreciation due to inflation. High-yield savings accounts often provide competitive interest rates, enhancing the value of your savings compared to stagnant cash. The compound interest effect in bank savings significantly outpaces the zero return from cash envelope savings, making banks a superior option for long-term financial growth.

Best Savings Method for Different Financial Goals

Bank savings accounts offer higher interest rates and security, making them ideal for long-term financial goals such as emergency funds or retirement savings. Cash envelope savings provide tangible budgeting control for short-term or discretionary expenses, enhancing spending awareness and discipline. Selecting the best savings method depends on goal duration, liquidity needs, and personal spending habits.

Choosing the Right Savings Strategy for You

Bank savings accounts provide secure interest accumulation and easy access to funds, ideal for long-term financial goals and emergency funds. Cash envelope savings offer tactile budgeting control by physically dividing money into categories, helping manage daily expenses and prevent overspending. Selecting the right savings strategy depends on your financial habits, goals, and preference for digital convenience or hands-on management.

Related Important Terms

Digital Envelope Budgeting

Digital envelope budgeting enhances traditional cash envelope savings by offering automated allocation of funds into virtual categories, improving spending discipline and financial tracking. Bank savings accounts provide security and interest accrual, while digital envelopes combine this with real-time expense monitoring and flexible budgeting, optimizing overall savings efficiency.

High-Yield Bank Splitting

High-yield bank savings accounts offer competitive interest rates that significantly amplify your savings over time compared to cash envelope savings, which lack interest accrual. Splitting funds between multiple high-yield accounts optimizes returns while maintaining liquidity and budgeting discipline.

Envelope Sinking Funds

Envelope sinking funds provide a structured approach to savings by allocating specific amounts of cash into designated categories, promoting disciplined spending and clear visibility of financial goals. Unlike traditional bank savings, this method helps prevent temptation to overspend, enabling better control over budgeting for future expenses.

Automated Micro-Savings Apps

Automated micro-savings apps optimize bank savings by enabling seamless, small transfers from checking accounts, enhancing consistency and growth potential compared to manual cash envelope savings, which rely on self-discipline and physical management. These digital tools use AI-driven algorithms to analyze spending habits, automatically allocating funds to savings without user intervention, thereby maximizing compound interest benefits within traditional bank accounts.

Physical Cash Flow Hacking

Bank savings accounts offer security and potential interest growth but often limit immediate access and tangible control over funds, whereas cash envelope savings leverage physical cash to enhance budgeting discipline and real-time spending awareness, optimizing physical cash flow hacking strategies. Using cash envelopes creates visible saving milestones and reduces impulsive spending by allocating fixed amounts to specific categories, fostering better financial habits and improved cash management.

Virtual Sub-Savings Pods

Virtual sub-savings pods within bank savings accounts offer enhanced organization and goal-specific tracking compared to traditional cash envelope systems, allowing users to digitally allocate funds into distinct categories without physical cash management. These digital pods improve saving discipline by providing real-time updates, automated transfers, and increased security, making them a more efficient and flexible alternative to cash envelope savings.

Gamified Cash Stuffing

Bank savings offer secure interest accrual and digital tracking, while Gamified Cash Stuffing with cash envelopes enhances budgeting discipline through tactile interaction and visual progress cues. This method leverages behavioral psychology, increasing saving motivation by transforming financial goals into engaging, game-like challenges.

Hybrid Envelope Tracking

Hybrid Envelope Tracking combines the discipline of cash envelope budgeting with the convenience of digital bank savings, allowing users to allocate funds across virtual envelopes while maintaining real-time balance updates. This method enhances budgeting accuracy and flexibility by integrating bank transaction data with categorized spending goals, optimizing both savings growth and expense control.

Touchless Envelope Allocation

Touchless envelope allocation in bank savings enables automated, digital categorization of funds, enhancing efficiency and reducing manual errors compared to traditional cash envelope savings. This method leverages technology to track spending and savings goals seamlessly, offering convenience and real-time financial control without physical cash handling.

QR Code Savings Envelopes

Bank savings offer security and interest accumulation through regulated financial institutions, while cash envelope savings provide tangible control over spending by physically allocating funds. QR code savings envelopes enhance the traditional cash method by enabling digital tracking and instant deposit transfers, merging convenience with disciplined budget management.

Bank Savings vs Cash Envelope Savings for savings. Infographic

moneydiff.com

moneydiff.com