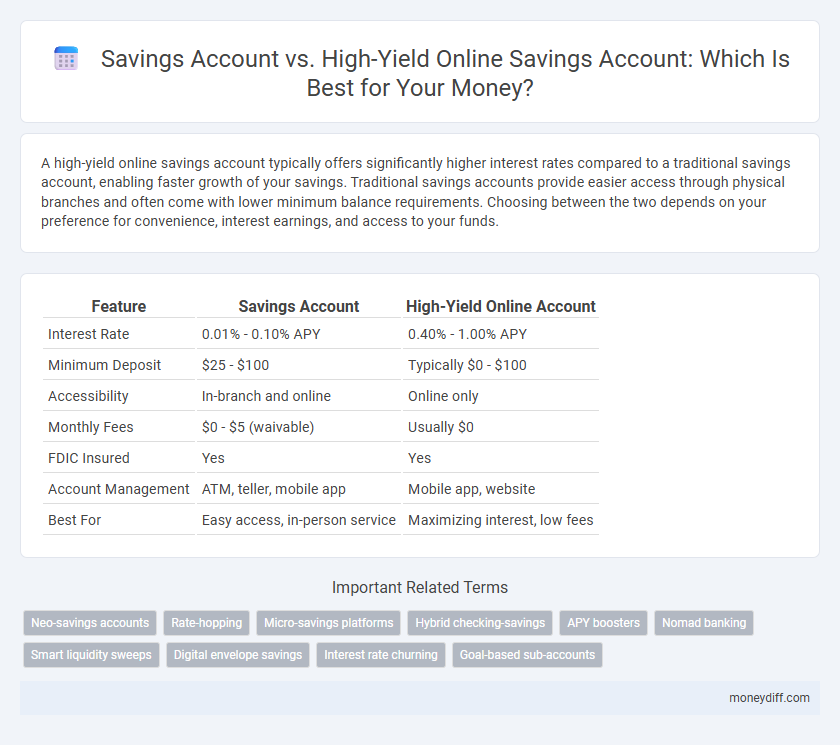

A high-yield online savings account typically offers significantly higher interest rates compared to a traditional savings account, enabling faster growth of your savings. Traditional savings accounts provide easier access through physical branches and often come with lower minimum balance requirements. Choosing between the two depends on your preference for convenience, interest earnings, and access to your funds.

Table of Comparison

| Feature | Savings Account | High-Yield Online Account |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 0.40% - 1.00% APY |

| Minimum Deposit | $25 - $100 | Typically $0 - $100 |

| Accessibility | In-branch and online | Online only |

| Monthly Fees | $0 - $5 (waivable) | Usually $0 |

| FDIC Insured | Yes | Yes |

| Account Management | ATM, teller, mobile app | Mobile app, website |

| Best For | Easy access, in-person service | Maximizing interest, low fees |

Understanding Savings Accounts: Basics and Features

Savings accounts typically offer lower interest rates and easy access to funds, making them ideal for emergency savings and short-term goals. High-yield online savings accounts provide significantly higher annual percentage yields (APYs), often exceeding 3.5%, by leveraging lower overhead costs and digital banking platforms. Features like FDIC insurance, minimum balance requirements, and customer service vary, so evaluating these aspects helps maximize returns while ensuring liquidity and security.

What is a High-Yield Online Savings Account?

A high-yield online savings account offers significantly higher interest rates compared to traditional savings accounts, often exceeding 4% APY due to lower overhead costs of online banks. These accounts provide secure, FDIC-insured savings options with easy digital access, making it convenient to manage funds without physical branch visits. The primary advantage lies in maximizing interest earnings while maintaining liquidity and safety for emergency funds or short-term savings goals.

Interest Rates: Traditional vs. High-Yield Accounts

Traditional savings accounts typically offer interest rates ranging from 0.01% to 0.10%, which often fail to keep pace with inflation, reducing the real growth of your savings. High-yield online savings accounts provide significantly higher interest rates, usually between 3.00% and 5.00%, maximizing the potential returns with compound interest. Choosing a high-yield online account can accelerate wealth accumulation by capitalizing on these superior rates while maintaining liquidity and FDIC insurance protection.

Accessibility and Convenience: Brick-and-Mortar vs. Online

Savings accounts at brick-and-mortar banks offer easy access through physical branches and ATMs, providing personal service and immediate cash withdrawals. High-yield online savings accounts prioritize convenience with 24/7 digital access via mobile apps and websites, often featuring faster transfers and automated savings tools. While online accounts may lack in-person support, their higher interest rates and seamless integration with digital financial management make them ideal for tech-savvy savers seeking both accessibility and efficiency.

Fees and Minimum Balance Requirements

High-yield online savings accounts typically offer higher interest rates with lower fees compared to traditional savings accounts, making them more cost-effective for growing savings. Traditional savings accounts often require a higher minimum balance and charge fees if the balance falls below this threshold, which can reduce overall returns. Online accounts usually have minimal or no fees and low minimum balance requirements, providing better accessibility and more efficient savings growth.

Account Security and FDIC Insurance

A savings account and a high-yield online savings account both offer FDIC insurance, protecting deposits up to $250,000 per depositor, per insured bank, ensuring account security. Traditional savings accounts typically provide in-person banking and established institutional safeguards, while high-yield online accounts use robust encryption and digital security protocols to protect funds. Customers should verify FDIC membership and security features to maximize account protection regardless of account type.

Digital Tools and Account Management

High-yield online savings accounts offer advanced digital tools such as real-time balance monitoring, automated savings features, and mobile app integrations that enhance user experience and ease of account management. Traditional savings accounts often lack these seamless digital capabilities, limiting accessibility and proactive financial planning. Utilizing high-yield online accounts maximizes efficiency in tracking and growing savings through innovative technology and user-friendly interfaces.

Transfer Speed and Fund Availability

Savings accounts typically offer slower transfer speeds and limited fund availability due to branch processing times and traditional banking protocols. High-yield online savings accounts provide faster transfer speeds and quicker fund availability by leveraging digital platforms and real-time transaction processing. Customers seeking immediate access to funds often benefit from the streamlined transfer capabilities of online high-yield accounts compared to standard savings accounts.

Customer Service Experience: In-Person vs. Online

Traditional savings accounts offer personalized, face-to-face customer service through branch visits, which many customers find reassuring and accessible for resolving issues swiftly. High-yield online savings accounts prioritize digital support, providing 24/7 assistance via chat, email, and phone, appealing to tech-savvy users who prefer convenience and quick responses without needing physical presence. Choosing between the two depends on individual preferences for human interaction versus digital efficiency in managing savings.

Which Account Is Right for Your Savings Goals?

Choosing between a traditional savings account and a high-yield online account depends on your savings goals and accessibility needs. High-yield online accounts offer significantly higher interest rates, often 3 to 5 times greater than standard banks, accelerating growth for long-term savings. Conversely, traditional savings accounts provide easier access to funds and in-person customer service, making them suitable for emergency funds or short-term savings.

Related Important Terms

Neo-savings accounts

Neo-savings accounts offer higher interest rates compared to traditional savings accounts by leveraging advanced online platforms and low overhead costs, resulting in more competitive returns for users. These high-yield online accounts provide seamless digital management, enhanced accessibility, and often no monthly fees, making them an attractive option for maximizing savings growth.

Rate-hopping

High-yield online savings accounts offer significantly higher interest rates compared to traditional savings accounts, enabling rate-hopping to capitalize on the best returns across multiple institutions. Rate-hopping leverages the agility of online platforms to maximize earnings by frequently transferring funds to accounts with superior interest rates, a strategy less feasible with brick-and-mortar savings accounts due to lower rates and limited accessibility.

Micro-savings platforms

Micro-savings platforms integrate with both traditional savings accounts and high-yield online accounts, enabling automatic, small deposit transfers to optimize growth and liquidity. High-yield online accounts typically offer interest rates multiple times higher than standard savings accounts, making them ideal for maximizing returns on micro-savings with minimal balance requirements.

Hybrid checking-savings

Hybrid checking-savings accounts combine features of both savings accounts and checking accounts, offering competitive interest rates similar to high-yield online accounts while providing easy access to funds for everyday transactions. These accounts optimize liquidity and growth potential by blending the accessibility of checking accounts with the higher yields typically found in online savings options.

APY boosters

High-yield online savings accounts typically offer APYs that are several times greater than traditional savings accounts, maximizing interest earnings and accelerating savings growth. These APY boosters leverage digital-only platforms to reduce overhead costs, allowing banks to pass higher interest rates directly to account holders.

Nomad banking

Nomad banking offers a high-yield online savings account that typically provides interest rates significantly above traditional savings accounts, maximizing your savings growth with low fees and easy digital access. Unlike conventional savings accounts, Nomad's online platform combines competitive APYs with seamless global accessibility, ideal for travelers and remote workers seeking flexible financial solutions.

Smart liquidity sweeps

Smart liquidity sweeps in high-yield online savings accounts automatically transfer excess funds from checking to maximize interest earnings while maintaining easy access to cash, unlike traditional savings accounts with lower APYs and less flexible transfer options. This automation optimizes savings growth and cash flow management by leveraging real-time balance monitoring and instant fund allocation.

Digital envelope savings

Digital envelope savings in high-yield online accounts offer significantly higher interest rates compared to traditional savings accounts, maximizing growth potential. These accounts utilize automated budgeting tools to allocate funds into customizable digital envelopes, enhancing savings discipline and goal tracking.

Interest rate churning

Savings accounts typically offer lower interest rates compared to high-yield online accounts, making interest rate churning a strategic approach where savers frequently switch accounts to maximize returns. High-yield online accounts often provide competitive APYs that outperform traditional savings, enabling more effective growth of savings through periodic account changes.

Goal-based sub-accounts

Goal-based sub-accounts in savings accounts enable targeted financial planning by segregating funds into specific objectives, whereas high-yield online accounts typically consolidate savings under one balance but offer superior interest rates to accelerate growth. Utilizing goal-based sub-accounts within traditional savings accounts enhances budgeting precision, while high-yield options maximize returns, making the choice dependent on personal savings strategy and prioritization of growth versus compartmentalization.

Savings Account vs High-Yield Online Account for savings. Infographic

moneydiff.com

moneydiff.com