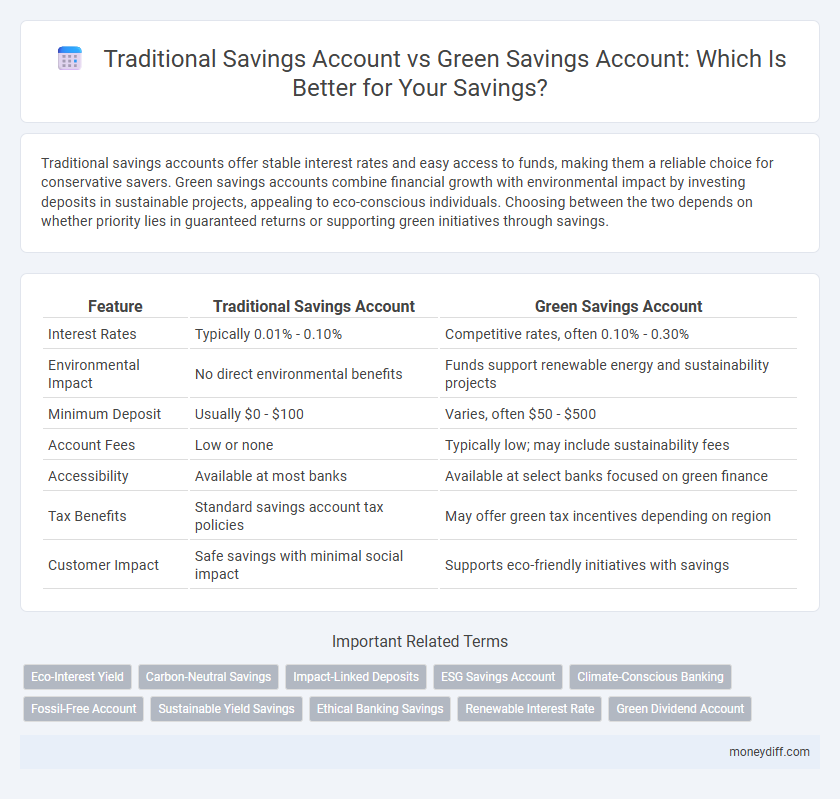

Traditional savings accounts offer stable interest rates and easy access to funds, making them a reliable choice for conservative savers. Green savings accounts combine financial growth with environmental impact by investing deposits in sustainable projects, appealing to eco-conscious individuals. Choosing between the two depends on whether priority lies in guaranteed returns or supporting green initiatives through savings.

Table of Comparison

| Feature | Traditional Savings Account | Green Savings Account |

|---|---|---|

| Interest Rates | Typically 0.01% - 0.10% | Competitive rates, often 0.10% - 0.30% |

| Environmental Impact | No direct environmental benefits | Funds support renewable energy and sustainability projects |

| Minimum Deposit | Usually $0 - $100 | Varies, often $50 - $500 |

| Account Fees | Low or none | Typically low; may include sustainability fees |

| Accessibility | Available at most banks | Available at select banks focused on green finance |

| Tax Benefits | Standard savings account tax policies | May offer green tax incentives depending on region |

| Customer Impact | Safe savings with minimal social impact | Supports eco-friendly initiatives with savings |

Understanding Traditional Savings Accounts

Traditional savings accounts offer a secure way to store money with easy access and a fixed interest rate, typically provided by established banks or credit unions. These accounts prioritize liquidity and safety, making them ideal for emergency funds or short-term savings goals. Unlike green savings accounts, traditional options do not focus on environmental impact or sustainable investments, often resulting in lower interest rates and fewer incentives for eco-conscious savers.

What is a Green Savings Account?

A Green Savings Account is a specialized savings product designed to support environmentally sustainable projects by investing deposits in renewable energy, conservation efforts, or eco-friendly businesses. Unlike traditional savings accounts that primarily focus on capital preservation and interest earnings, Green Savings Accounts align financial growth with environmental impact, often offering competitive interest rates alongside green initiatives. This type of account appeals to socially conscious investors seeking to contribute to environmental sustainability while maintaining liquidity and earning returns.

Key Features of Traditional Savings Accounts

Traditional savings accounts offer a secure place to deposit cash with easy access and a fixed interest rate, typically lower than specialized accounts. They provide FDIC insurance up to $250,000, ensuring protection for deposited funds. Monthly maintenance fees and minimum balance requirements vary by bank, affecting overall returns and account management.

Unique Benefits of Green Savings Accounts

Green savings accounts offer unique benefits by directly supporting environmentally sustainable projects such as renewable energy or conservation efforts. These accounts often provide competitive interest rates while promoting positive ecological impact, aligning financial growth with environmental responsibility. Investors seeking both returns and eco-friendly initiatives find green savings accounts a strategic option for ethical savings.

Interest Rates: Traditional vs Green Savings Accounts

Traditional savings accounts typically offer fixed or variable interest rates averaging around 0.05% to 0.10%, while green savings accounts often provide competitive or slightly higher rates ranging from 0.10% to 0.30% to attract eco-conscious savers. Green savings accounts not only offer financial returns but also fund environmentally friendly projects, adding a social impact dimension to the interest earned. Choosing a green savings account can align your savings growth with sustainability goals without compromising on interest rate benefits.

Environmental Impact of Green Savings Accounts

Green Savings Accounts invest deposits in environmentally sustainable projects, significantly reducing carbon footprints compared to Traditional Savings Accounts that typically fund conventional industries. By choosing Green Savings Accounts, savers support renewable energy, conservation efforts, and eco-friendly initiatives, promoting a cleaner, greener economy. This environmentally conscious option encourages financial growth aligned with global sustainability goals.

Accessibility and Convenience Compared

Traditional savings accounts offer widespread accessibility through numerous physical branches and widespread ATM networks, making deposits and withdrawals convenient for most customers. Green savings accounts, while increasingly available online, often emphasize digital platforms that provide 24/7 access but may lack extensive physical locations. Both account types support mobile banking, yet traditional accounts benefit from established infrastructure, whereas green accounts prioritize eco-friendly initiatives with digital-first convenience.

Safety and Security in Both Savings Accounts

Traditional savings accounts provide robust safety through FDIC insurance up to $250,000, ensuring depositor funds are protected against bank failures. Green savings accounts offer similar security features, often with added transparency on environmental impact, while maintaining federal insurance protections. Both account types prioritize customer security, but green accounts appeal to environmentally conscious savers seeking ethical investment options.

Who Should Choose a Green Savings Account?

Individuals committed to environmental sustainability and seeking to align their finances with eco-friendly values should choose a Green Savings Account. These accounts often invest in renewable energy projects or environmentally responsible companies, making them ideal for socially conscious savers. Traditional Savings Accounts may offer higher liquidity or broader accessibility, but Green Savings Accounts provide a unique opportunity to support green initiatives while earning interest.

Making the Right Choice for Your Savings Goals

Traditional savings accounts offer stable interest rates and easy access, making them suitable for emergency funds and short-term goals. Green savings accounts channel deposits into sustainable projects, providing eco-conscious investors a way to grow their money while supporting environmental initiatives. Evaluating interest rates, fees, and the social impact of your deposit helps align your savings choice with both financial objectives and personal values.

Related Important Terms

Eco-Interest Yield

Traditional savings accounts typically offer lower interest rates with no environmental impact considerations, while green savings accounts provide competitive eco-interest yields that support sustainable projects and promote environmentally friendly investments. Choosing a green savings account allows savers to earn returns while contributing to renewable energy, conservation efforts, and other sustainability initiatives.

Carbon-Neutral Savings

Traditional savings accounts offer basic interest earnings without environmental benefits, while green savings accounts invest deposited funds in carbon-neutral projects and renewable energy initiatives, promoting sustainability alongside financial growth. Choosing a green savings account supports carbon offset efforts and reduces your overall carbon footprint, making your savings environmentally impactful.

Impact-Linked Deposits

Impact-linked deposits in green savings accounts allocate funds specifically to environmentally sustainable projects, offering savers measurable social and ecological benefits alongside financial returns. Traditional savings accounts typically generate interest without earmarking funds for positive environmental impact, limiting the potential for conscious investment influence.

ESG Savings Account

Traditional savings accounts offer reliable interest rates but lack environmental or social impact, whereas green savings accounts prioritize ESG criteria by investing deposited funds into sustainable projects and companies, fostering eco-friendly growth and socially responsible initiatives. By choosing green savings accounts, savers support environmental sustainability and ethical governance while still enjoying competitive returns aligned with responsible investing principles.

Climate-Conscious Banking

Traditional savings accounts offer standard interest rates without environmental impact considerations, while green savings accounts specifically invest in sustainable projects, supporting climate-conscious banking priorities. Choosing a green savings account aligns your savings with renewable energy initiatives and eco-friendly investments, promoting a positive environmental footprint.

Fossil-Free Account

Traditional savings accounts typically offer modest interest rates without considering environmental impact, whereas Green Savings Accounts prioritize fossil-free investments, enabling savers to support sustainable energy projects while earning competitive returns. Fossil-Free Accounts steer funds away from coal, oil, and gas industries, promoting renewable energy and contributing to a greener economy.

Sustainable Yield Savings

Traditional savings accounts offer stable interest rates with minimal environmental impact considerations, while Green Savings Accounts prioritize sustainable yield by investing deposits in eco-friendly projects and renewable energy initiatives, potentially enhancing both financial returns and environmental benefits. Choosing a Green Savings Account aligns your savings with sustainable development goals, promoting long-term positive impact alongside competitive yield opportunities.

Ethical Banking Savings

Traditional savings accounts offer standard interest rates with minimal focus on social or environmental impact, while green savings accounts prioritize ethical banking by investing deposits in sustainable projects and environmentally responsible initiatives, promoting both financial growth and positive ecological outcomes. Choosing a green savings account supports renewable energy, conservation efforts, and socially responsible businesses, aligning financial goals with ethical values.

Renewable Interest Rate

Traditional savings accounts typically offer fixed or variable interest rates based on general market conditions, providing consistent but modest returns. Green savings accounts feature renewable interest rates linked to sustainable projects and eco-friendly investments, often incentivizing higher yields aligned with environmental impact.

Green Dividend Account

Green Dividend Accounts offer environmentally conscious savers competitive interest rates while funding sustainable projects, contrasting with traditional savings accounts that prioritize liquidity and low risk without environmental impact. Investing in a Green Dividend Account supports renewable energy and eco-friendly initiatives, aligning financial growth with green values.

Traditional Savings Account vs Green Savings Account for savings. Infographic

moneydiff.com

moneydiff.com