Bank savings accounts offer secure, insured deposits with steady interest rates and easy access to funds, making them a reliable choice for traditional savers. Impact savings platforms combine financial growth with social and environmental benefits, allowing users to support meaningful projects while earning competitive returns. Choosing between the two depends on whether the priority is financial security or driving positive impact through savings.

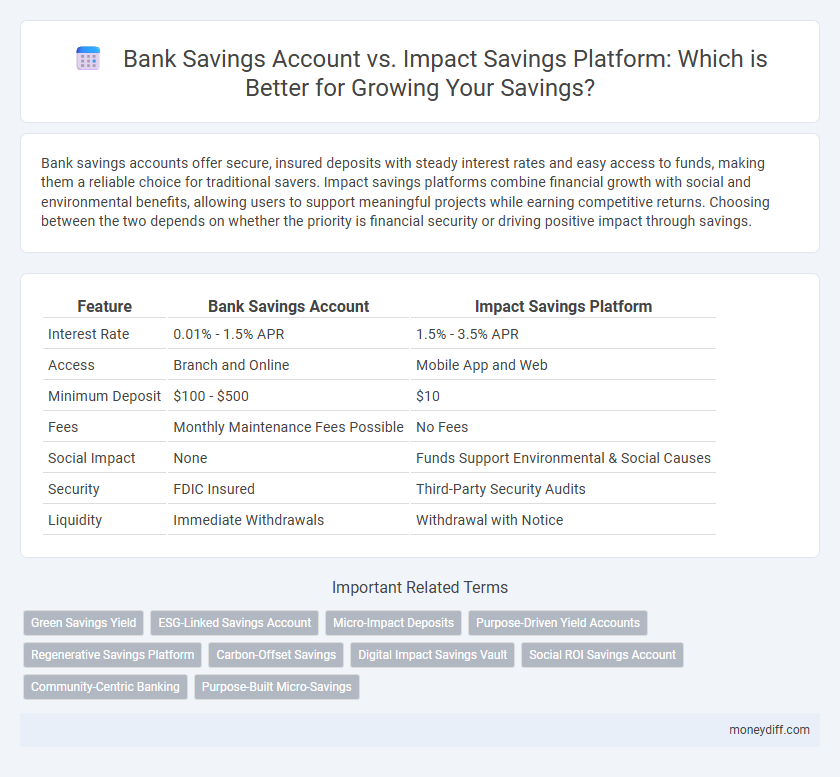

Table of Comparison

| Feature | Bank Savings Account | Impact Savings Platform |

|---|---|---|

| Interest Rate | 0.01% - 1.5% APR | 1.5% - 3.5% APR |

| Access | Branch and Online | Mobile App and Web |

| Minimum Deposit | $100 - $500 | $10 |

| Fees | Monthly Maintenance Fees Possible | No Fees |

| Social Impact | None | Funds Support Environmental & Social Causes |

| Security | FDIC Insured | Third-Party Security Audits |

| Liquidity | Immediate Withdrawals | Withdrawal with Notice |

Introduction to Traditional Bank Savings Accounts

Traditional bank savings accounts offer a secure place to store funds with federally insured protection up to $250,000 through the FDIC, ensuring principal safety. They provide easy access to money via ATMs, online banking, and branch services, often featuring modest interest rates reflecting low risk. These accounts are ideal for individuals seeking liquidity and stable, government-backed savings solutions without exposure to market fluctuations.

Exploring Impact Savings Platforms

Impact Savings Platforms offer a transformative approach to traditional bank savings accounts by aligning financial growth with social and environmental goals. These platforms leverage technology to provide transparent tracking of how saved funds contribute to sustainable projects, enhancing the value beyond mere interest accrual. Users benefit from competitive returns while supporting impactful initiatives, making Impact Savings Platforms a compelling alternative for socially conscious savers.

Key Differences Between Bank and Impact Savings Options

Bank savings accounts provide secure, interest-bearing deposits regulated by financial institutions, typically offering lower interest rates and limited social impact. Impact savings platforms focus on directing funds toward social or environmental projects, often combining competitive returns with measurable positive outcomes. Key differences include regulation, interest rates, liquidity, and alignment with personal values through targeted impact investments.

Interest Rates: Bank Savings vs. Impact Platforms

Bank savings accounts typically offer lower interest rates, averaging around 0.01% to 0.10% annually, which limits growth on deposits over time. Impact savings platforms often provide higher interest rates, ranging from 1% to 5% or more, by leveraging socially responsible investments and innovative financial technologies. These platforms combine competitive returns with positive environmental or social impact, making them an attractive alternative for savers seeking both interest income and ethical investment opportunities.

Accessibility and Flexibility of Savings Options

Bank savings accounts offer easy accessibility through widespread branch networks and ATM availability, allowing users to deposit and withdraw funds conveniently. Impact savings platforms provide enhanced flexibility with customizable savings goals and automated contributions, often accessible via mobile apps that enable real-time tracking and adjustments. The combination of traditional accessibility and digital flexibility in these platforms empowers savers to manage their finances efficiently and tailor their savings strategies to personal needs.

Security and Risk Considerations

Bank savings accounts provide federal insurance protection through agencies like the FDIC, ensuring principal security up to $250,000 per depositor. Impact savings platforms may offer higher returns by funding social or environmental projects but typically lack the same regulatory safeguards, increasing exposure to investment risk and potential loss of principal. Evaluating security measures and risk tolerance is essential before choosing between traditional bank accounts and impact-driven savings solutions.

Social and Environmental Impact of Your Savings

Bank savings accounts typically offer low-interest rates with minimal influence on social or environmental causes, focusing primarily on capital preservation and liquidity. Impact savings platforms allocate funds to socially responsible projects, enabling savers to support environmental sustainability, renewable energy, and community development while earning competitive returns. Choosing an impact savings platform aligns financial growth with positive social and environmental outcomes, making your savings a tool for meaningful change.

Fees and Account Maintenance Costs Compared

Bank savings accounts typically impose monthly maintenance fees and minimum balance requirements that can reduce overall returns, whereas Impact Savings Platforms often offer lower or no fees with transparent cost structures. Account maintenance costs in traditional banks can include hidden charges for inactivity, withdrawals, or account servicing, whereas Impact Savings Platforms prioritize minimal fees to maximize user savings growth. Comparing fee structures reveals that Impact Savings Platforms generally provide a more cost-effective solution for savers seeking to minimize expenses and maximize net savings.

Ideal Users for Bank Accounts vs. Impact Platforms

Bank savings accounts are ideal for individuals seeking secure, low-risk storage of funds with easy access and FDIC insurance coverage. Impact savings platforms cater to socially conscious savers aiming to align investments with environmental, social, and governance (ESG) goals while potentially earning competitive returns. Users prioritizing liquidity and traditional banking benefits prefer bank accounts, whereas those focused on purposeful investing and impact-driven financial growth gravitate towards impact savings platforms.

Making the Right Choice for Your Savings Goals

Choosing between a traditional bank savings account and an impact savings platform depends on your financial goals and values. Bank savings accounts offer security, government insurance, and predictable interest rates, making them ideal for short-term savings and emergency funds. Impact savings platforms focus on socially responsible investments, enabling savers to support environmental or social causes while earning competitive returns aligned with their ethical priorities.

Related Important Terms

Green Savings Yield

Bank savings accounts typically offer lower interest rates with limited impact on environmental sustainability, while Impact Savings Platforms provide competitive Green Savings Yields by investing deposits in eco-friendly projects and renewable energy initiatives. Choosing an Impact Savings Platform aligns your savings growth with positive environmental outcomes, enhancing both financial returns and sustainable impact.

ESG-Linked Savings Account

ESG-linked savings accounts integrate environmental, social, and governance criteria into traditional bank savings, enabling customers to support sustainable projects while earning competitive interest rates. Impact savings platforms often offer enhanced transparency and measurable outcomes, allowing savers to track their contributions' direct influence on social and environmental initiatives.

Micro-Impact Deposits

Bank savings accounts offer secure, interest-bearing options with FDIC insurance but generally provide lower returns and limited social impact. Micro-impact deposits on specialized Impact Savings Platforms channel funds directly into community projects or sustainable ventures, combining financial growth with measurable social and environmental benefits.

Purpose-Driven Yield Accounts

Purpose-driven yield accounts on impact savings platforms prioritize social and environmental returns alongside financial gains, offering savers the opportunity to support sustainable projects while earning competitive interest rates. Traditional bank savings accounts primarily focus on capital preservation and liquidity, often providing lower yields without direct impact on community or environmental initiatives.

Regenerative Savings Platform

A regenerative savings platform offers enhanced impact by channeling funds into sustainable projects that promote environmental restoration and social well-being, contrasting with traditional bank savings accounts that primarily focus on capital preservation and low-interest returns. This approach not only supports financial growth but also drives measurable positive change in communities and ecosystems through purpose-driven investments.

Carbon-Offset Savings

Bank savings accounts offer traditional interest accrual but lack direct environmental benefits, while Impact Savings Platforms enable users to contribute to carbon-offset projects through their deposits, turning savings into measurable climate action. Carbon-offset savings on these platforms help reduce carbon footprints by funding renewable energy, reforestation, and carbon capture initiatives.

Digital Impact Savings Vault

The Digital Impact Savings Vault offers a secure, transparent way to grow funds while supporting social and environmental initiatives, contrasting with traditional bank savings accounts that primarily provide fixed interest rates without direct social impact. This platform integrates real-time impact tracking and flexible withdrawal options, empowering savers to make meaningful contributions through their savings.

Social ROI Savings Account

Social ROI savings accounts prioritize investments that generate measurable social and environmental benefits alongside financial returns, unlike traditional bank savings accounts that focus solely on interest accumulation. Impact savings platforms leverage these accounts to drive positive change by funding projects with social impact metrics, offering savers a dual benefit of financial growth and meaningful community development.

Community-Centric Banking

A Bank Savings Account offers traditional security and interest accrual through regulated financial institutions, whereas an Impact Savings Platform emphasizes community-centric banking by pooling funds to support local social and environmental projects. This approach fosters collective impact and financial inclusion, transforming savings into tangible community benefits beyond personal wealth growth.

Purpose-Built Micro-Savings

Purpose-built micro-savings platforms enable users to save small amounts more frequently with automated tools designed for specific goals, contrasting with traditional bank savings accounts that typically offer broader, less tailored savings options. These impact savings platforms often feature social or environmental incentives, enhancing user engagement and financial discipline beyond standard interest accumulation.

Bank Savings Account vs Impact Savings Platform for savings. Infographic

moneydiff.com

moneydiff.com