The Envelope Method offers a tangible way to manage budgeting by physically allocating cash into labeled envelopes for specific expenses, promoting disciplined spending habits. Smart-savings algorithms automate the process by analyzing spending patterns and transferring optimal amounts into savings accounts, enhancing efficiency and personalized goal achievement. While the Envelope Method relies on manual control and visible boundaries, smart algorithms leverage technology for adaptive, data-driven savings optimization.

Table of Comparison

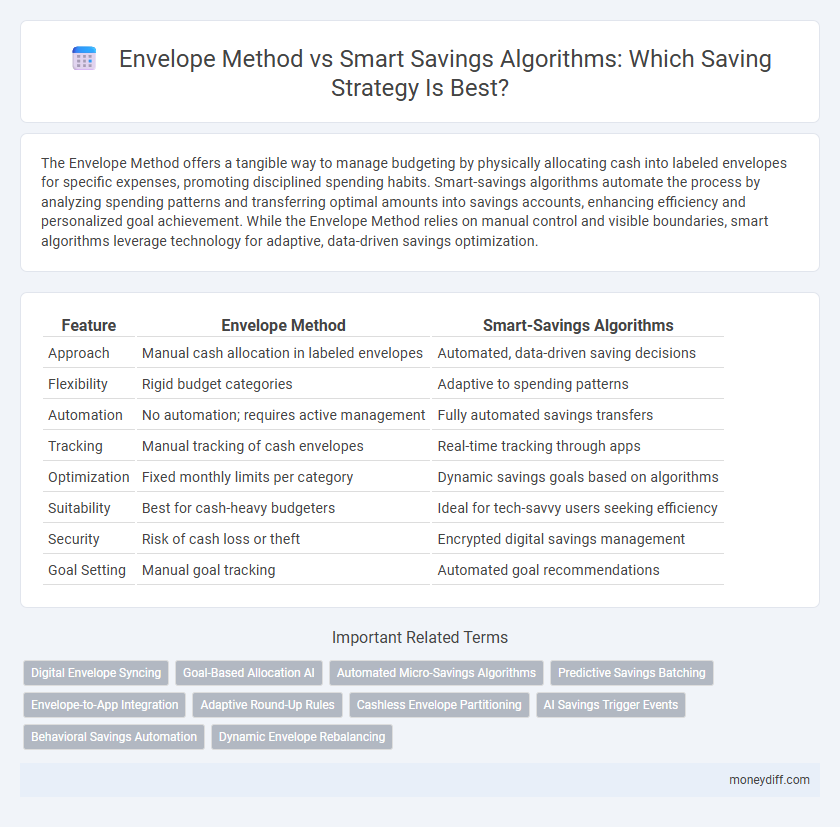

| Feature | Envelope Method | Smart-Savings Algorithms |

|---|---|---|

| Approach | Manual cash allocation in labeled envelopes | Automated, data-driven saving decisions |

| Flexibility | Rigid budget categories | Adaptive to spending patterns |

| Automation | No automation; requires active management | Fully automated savings transfers |

| Tracking | Manual tracking of cash envelopes | Real-time tracking through apps |

| Optimization | Fixed monthly limits per category | Dynamic savings goals based on algorithms |

| Suitability | Best for cash-heavy budgeters | Ideal for tech-savvy users seeking efficiency |

| Security | Risk of cash loss or theft | Encrypted digital savings management |

| Goal Setting | Manual goal tracking | Automated goal recommendations |

Introduction: Traditional vs. Modern Savings Strategies

The Envelope Method relies on physically allocating cash into labeled envelopes to control spending and encourage discipline, making it a tactile approach rooted in traditional budgeting. Smart-Savings Algorithms use machine learning and real-time data analysis to automate savings by predicting spending patterns and optimizing contributions, offering a dynamic and adaptive strategy. Comparing these methods highlights the shift from manual, granular control toward algorithm-driven automation in modern savings techniques.

Understanding the Envelope Method for Budgeting

The Envelope Method for budgeting allocates cash into physical or digital envelopes labeled for specific expense categories, ensuring disciplined spending and clear financial boundaries. This traditional approach encourages users to physically separate funds, making it easier to visualize and control discretionary spending. Compared to Smart-Savings Algorithms that automate and optimize savings based on spending patterns, the Envelope Method relies on manual tracking and conscious decision-making to reinforce budgeting habits.

What Are Smart-Savings Algorithms?

Smart-savings algorithms use machine learning and data analysis to automate personalized saving strategies based on individual spending habits, income patterns, and financial goals. Unlike the envelope method, which relies on manual cash allocation into physical or digital envelopes, these algorithms dynamically adjust saving amounts and timing to optimize financial efficiency. Integrating real-time transaction data, smart-savings algorithms minimize the risk of overspending while maximizing long-term savings growth.

How the Envelope Method Promotes Financial Discipline

The Envelope Method promotes financial discipline by allocating fixed cash amounts into categorized envelopes, limiting spending to the budgeted funds for each category. This tactile system enforces mindful spending and prevents overspending, fostering a stronger awareness of personal finances. Unlike smart-savings algorithms, which rely on automated adjustments, the Envelope Method requires active participation, creating a more hands-on approach to budget control.

The Role of Automation in Smart-Savings Algorithms

Smart-savings algorithms leverage automation to analyze spending patterns and automatically allocate funds into designated savings categories, optimizing financial efficiency without manual effort. This contrasts with the envelope method, which relies on physically dividing cash into categories, making it less flexible and more time-consuming. Automation in smart-savings algorithms enhances precision and consistency, enabling users to build savings seamlessly alongside their regular expenses.

Comparing Flexibility: Envelope Method vs. Algorithms

The Envelope Method offers tangible control by allocating fixed cash amounts to spending categories, promoting disciplined budgeting but limiting flexibility in dynamic financial situations. Smart-Savings Algorithms adapt in real-time to income fluctuations and spending patterns, optimizing savings without rigid constraints and enabling personalized financial adjustments. These algorithms leverage data analytics and AI to enhance responsiveness, outperforming static envelope allocations in accommodating diverse and evolving financial goals.

Accuracy and Tracking: Which Method Performs Better?

The Envelope Method offers precise budget allocation by physically dividing cash into designated categories, providing clear visual tracking of spending limits and helping users stay on target. Smart-Savings Algorithms utilize advanced machine learning to analyze spending patterns and automatically adjust savings contributions, enhancing accuracy through real-time data monitoring and predictive analytics. While the Envelope Method relies on manual discipline and tangible limits, Smart-Savings Algorithms deliver superior accuracy and dynamic tracking by adapting to individual financial behavior and market conditions.

User Experience: Manual Money Handling vs. Digital Solutions

The Envelope Method offers tangible control by physically dividing cash into labeled envelopes, enhancing budgeting discipline through hands-on management. Smart-Savings Algorithms provide automated tracking and personalized recommendations, streamlining savings with data-driven insights and minimizing user effort. Digital solutions ensure real-time adjustments and goal progress visibility, elevating convenience compared to the manual, tactile process of the envelope system.

Cost and Accessibility of Both Savings Approaches

The Envelope Method offers a low-cost, tangible way to manage budgets by physically allocating cash into labeled envelopes, ensuring precise control over spending without requiring technology or fees. Smart-Savings Algorithms, often integrated within digital banking apps, provide automated, personalized savings with minimal effort but may involve subscription costs or require smartphone access. While the Envelope Method excels in accessibility and zero financial overhead, Smart-Savings Algorithms deliver convenience and dynamic adjustments at the potential expense of service charges and digital dependence.

Choosing the Right Savings Method for Your Goals

Choosing between the Envelope Method and Smart-Savings Algorithms depends on your financial goals and spending habits. The Envelope Method offers tangible control by allocating cash into physical categories, ideal for those who prefer hands-on budgeting. Smart-Savings Algorithms leverage automation and data analysis to optimize deposits and growth, suitable for tech-savvy savers aiming for long-term wealth accumulation.

Related Important Terms

Digital Envelope Syncing

Digital envelope syncing integrates traditional Envelope Method budgeting with Smart-Savings Algorithms, enabling real-time allocation and tracking of funds across multiple digital categories. This fusion enhances financial discipline by automating savings adjustments based on spending patterns and goals, maximizing efficiency and personalized money management.

Goal-Based Allocation AI

Goal-Based Allocation AI enhances savings by dynamically adjusting contributions toward specific financial objectives, outperforming the static distribution characteristic of the Envelope Method. This smart-savings algorithm leverages real-time data and spending patterns to optimize fund allocation, ensuring faster achievement of personalized goals.

Automated Micro-Savings Algorithms

Automated micro-savings algorithms leverage AI-driven patterns to transfer small amounts from checking to savings accounts seamlessly, optimizing savings growth without user intervention. Unlike the envelope method's manual categorization of funds, these intelligent systems analyze spending habits and cash flow in real-time, maximizing efficiency and accumulation through personalized, data-driven allocations.

Predictive Savings Batching

The Envelope Method segments savings into predefined categories, limiting flexibility and responsiveness, while Smart-Savings Algorithms leverage predictive savings batching to analyze spending patterns and automatically allocate funds for future needs. Predictive savings batching enhances cash flow optimization by forecasting expenses and dynamically adjusting contributions, resulting in more efficient and goal-oriented savings growth.

Envelope-to-App Integration

Envelope-to-app integration enhances traditional Envelope Method savings by digitizing budget categories and real-time tracking, ensuring precise allocation of funds and reducing overspending risks. Smart-savings algorithms leverage this integration to optimize fund distribution based on spending habits, seasonal trends, and financial goals, maximizing savings efficiency.

Adaptive Round-Up Rules

Adaptive Round-Up Rules in smart-savings algorithms dynamically adjust rounding thresholds based on spending habits, enabling more efficient and personalized saving compared to the static allocations of the Envelope Method. This approach optimizes small, frequent savings by rounding purchases to the nearest increment and funneling the difference into savings, enhancing growth potential without rigid budget constraints.

Cashless Envelope Partitioning

Cashless envelope partitioning enhances savings by digitally dividing funds into categorized virtual envelopes, allowing precise budget control without physical cash. Smart-savings algorithms optimize this process by analyzing spending patterns and automatically reallocating funds, maximizing efficiency and personalized financial discipline.

AI Savings Trigger Events

Smart-savings algorithms leverage AI-driven savings trigger events such as unexpected income, bill payment completions, or spending pattern changes to automate and optimize fund allocation, surpassing the manual Envelope Method by enhancing precision and responsiveness. AI integration enables real-time adjustments that maximize savings growth while minimizing user effort and error.

Behavioral Savings Automation

The Envelope Method encourages disciplined budgeting by allocating cash into physical or digital envelopes for specific expenses, promoting mindful spending and savings behavior. Smart-savings algorithms leverage data-driven automation and personalized insights to dynamically adjust savings contributions, optimizing financial goals while minimizing behavioral friction.

Dynamic Envelope Rebalancing

Dynamic Envelope Rebalancing enhances the traditional Envelope Method by automatically adjusting spending limits based on real-time income, expenses, and savings goals using smart-savings algorithms. This approach optimizes cash flow management and maximizes savings potential by continuously allocating funds to high-priority envelopes without manual intervention.

Envelope Method vs Smart-Savings Algorithms for savings. Infographic

moneydiff.com

moneydiff.com