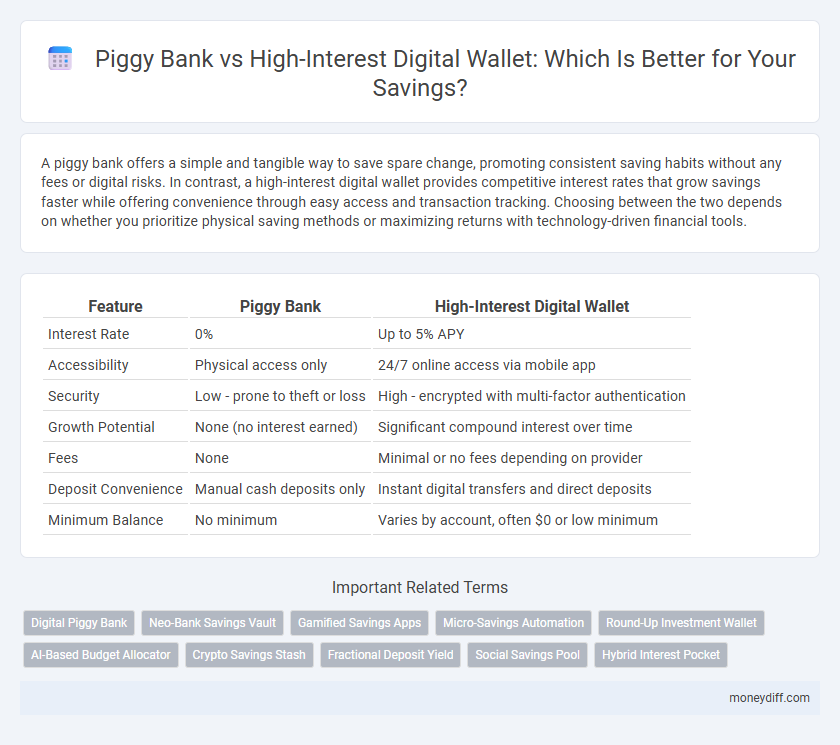

A piggy bank offers a simple and tangible way to save spare change, promoting consistent saving habits without any fees or digital risks. In contrast, a high-interest digital wallet provides competitive interest rates that grow savings faster while offering convenience through easy access and transaction tracking. Choosing between the two depends on whether you prioritize physical saving methods or maximizing returns with technology-driven financial tools.

Table of Comparison

| Feature | Piggy Bank | High-Interest Digital Wallet |

|---|---|---|

| Interest Rate | 0% | Up to 5% APY |

| Accessibility | Physical access only | 24/7 online access via mobile app |

| Security | Low - prone to theft or loss | High - encrypted with multi-factor authentication |

| Growth Potential | None (no interest earned) | Significant compound interest over time |

| Fees | None | Minimal or no fees depending on provider |

| Deposit Convenience | Manual cash deposits only | Instant digital transfers and direct deposits |

| Minimum Balance | No minimum | Varies by account, often $0 or low minimum |

Understanding Piggy Banks: Traditional Savings Method

Piggy banks serve as a traditional savings method, primarily used for storing small amounts of cash securely at home, making them accessible and easy for children to develop saving habits. Unlike high-interest digital wallets, piggy banks do not generate interest or offer digital tracking features, limiting growth potential and financial management capabilities. Their primary value lies in tangible, physical saving motivation rather than maximizing returns or leveraging digital financial tools.

What Is a High-Interest Digital Wallet?

A high-interest digital wallet is an online financial tool that offers users competitive interest rates on their savings, surpassing traditional piggy banks' zero-interest benefits. These wallets combine the convenience of mobile access with secure, FDIC-insured accounts, allowing users to grow their funds effectively while managing spending and saving in one platform. By integrating automated savings features and real-time transaction tracking, high-interest digital wallets provide a modern, efficient solution for maximizing returns on everyday money.

Accessibility and Convenience: Physical vs Digital Savings

Piggy banks offer tangible, immediate access to savings, ideal for teaching children financial habits, but require physical presence and manual handling to retrieve funds. High-interest digital wallets provide seamless accessibility through smartphones, enabling instant transfers, automated savings, and real-time balance monitoring from anywhere. Digital wallets combine convenience with enhanced security features, making them superior for modern, on-the-go financial management.

Interest Rates: Earning Potential Compared

High-interest digital wallets typically offer interest rates ranging from 3% to 5% annually, significantly surpassing the negligible or zero interest provided by traditional piggy banks. This higher rate enables savers to grow their funds more efficiently through compound interest, maximizing earning potential over time. Choosing a digital wallet with competitive APYs can lead to substantial financial growth compared to storing cash in a piggy bank without interest accumulation.

Security Features: Protecting Your Savings

High-interest digital wallets offer advanced security features such as multi-factor authentication, encryption, and real-time fraud monitoring to protect your savings from unauthorized access. In contrast, traditional piggy banks provide physical security but lack digital safeguards and are vulnerable to theft or loss. Choosing a digital wallet enhances the protection of your funds through robust cybersecurity measures, ensuring safer long-term savings.

Ease of Deposits and Withdrawals

Piggy banks offer simple and immediate access for deposits and withdrawals, making them highly convenient for cash savings without technological requirements. High-interest digital wallets provide seamless digital transactions with instant transfers, automated deposits, and easy access via mobile apps, optimizing liquidity and earning potential. Choosing between the two depends on whether physical cash handling or digital convenience and higher returns are prioritized.

Saving Discipline: Old-School vs Tech-Driven Approaches

Piggy banks promote saving discipline through physical interaction and visual accumulation of coins, reinforcing habitual saving behaviors especially for children. High-interest digital wallets leverage technology by providing real-time balance updates, automated savings plans, and higher returns, encouraging consistent saving with minimal effort. The tech-driven approach optimizes savings growth, while the old-school method strengthens foundational money management skills.

Tracking and Goal Setting in Savings Platforms

Digital wallets with high-interest rates offer advanced tracking and goal-setting features that provide real-time insights into savings progress, enabling users to customize targets and receive automated reminders. Piggy banks lack digital tracking capabilities and rely on manual monitoring, which can limit users' ability to set structured goals or adjust savings strategies effectively. Platforms like high-interest digital wallets enhance savings discipline by integrating analytics and behavioral nudges, driving more efficient and goal-oriented savings habits.

Fees and Hidden Costs: Breaking Down the Numbers

High-interest digital wallets typically offer higher returns but may include maintenance fees, transaction charges, or minimum balance penalties that reduce overall savings growth. Piggy banks have no fees but provide zero interest, making them cost-effective yet less lucrative for long-term savings. Analyzing fee structures and hidden costs in digital wallets is crucial to maximizing net gains compared to the fee-free simplicity of traditional piggy banks.

Which Is Best for Your Savings Goals?

Piggy banks offer a simple, tangible way to save small amounts of money easily, ideal for cultivating saving habits or short-term goals. High-interest digital wallets provide higher returns through competitive interest rates and easy access, making them suitable for long-term savings and growth. Choosing between the two depends on your savings goals: quick accessibility and discipline with a piggy bank or growth potential and convenience with a high-interest digital wallet.

Related Important Terms

Digital Piggy Bank

A digital piggy bank combines the nostalgia of traditional saving with advanced features like automated deposits, real-time balance tracking, and higher interest rates compared to physical piggy banks. High-interest digital wallets offer secure, accessible platforms that encourage consistent saving habits through user-friendly interfaces and customizable goals.

Neo-Bank Savings Vault

High-interest digital wallets like the Neo-Bank Savings Vault offer superior savings growth compared to traditional piggy banks by providing competitive interest rates and instant access to funds. These platforms leverage advanced technology to ensure secure, flexible, and higher-yield savings options ideal for maximizing returns.

Gamified Savings Apps

Gamified savings apps within high-interest digital wallets enhance user engagement by incorporating rewards and challenges that encourage consistent saving behavior, outperforming traditional piggy banks in both interest accumulation and financial literacy development. These apps leverage behavioral economics and real-time feedback to increase savings rates, making them a more effective tool for building financial discipline and boosting overall returns.

Micro-Savings Automation

Piggy banks offer a traditional, tangible method for saving small amounts of cash but lack automated features and interest growth. High-interest digital wallets provide seamless micro-savings automation, automatically rounding up purchases and earning competitive interest rates to maximize savings efficiently.

Round-Up Investment Wallet

Round-Up Investment Wallets enhance savings by automatically rounding up everyday purchases and investing the spare change, offering higher returns compared to traditional Piggy Banks that store cash without growth potential. These digital wallets leverage compounding interest and diversified portfolios, making them a smarter long-term option for maximizing savings growth.

AI-Based Budget Allocator

AI-based budget allocators integrated within high-interest digital wallets analyze spending patterns and automate optimal fund allocation, maximizing interest yields compared to traditional piggy banks that offer no growth on stored cash. These advanced tools enable personalized savings strategies by dynamically adjusting contributions, facilitating faster wealth accumulation through data-driven financial management.

Crypto Savings Stash

A Piggy Bank offers a simple, physical method for saving small amounts of cash with zero interest, while a High-Interest Digital Wallet provides the potential for higher returns on savings through crypto asset accumulation and staking rewards. Crypto Savings Stash platforms enable users to maximize their digital assets' growth by leveraging compound interest on cryptocurrencies, significantly outperforming traditional piggy bank savings.

Fractional Deposit Yield

Piggy banks offer zero fractional deposit yield as they simply store cash without generating interest, making them less effective for growing savings. High-interest digital wallets provide fractional deposit yields through compounded interest rates, significantly increasing the value of small, frequent deposits over time.

Social Savings Pool

A Social Savings Pool in a high-interest digital wallet offers users the advantage of collective financial growth through group contributions, often yielding higher returns compared to traditional piggy banks that lack interest accumulation. Digital wallets enhance savings efficiency by providing transparent tracking and seamless access to pooled funds, fostering community-driven financial discipline and accelerated wealth building.

Hybrid Interest Pocket

The Hybrid Interest Pocket combines the simplicity of a piggy bank with the growth potential of a high-interest digital wallet, offering a secure way to save while earning competitive interest rates that surpass traditional methods. This innovative savings tool provides easy access to funds alongside smart interest accumulation, optimizing both liquidity and returns.

Piggy Bank vs High-Interest Digital Wallet for savings. Infographic

moneydiff.com

moneydiff.com