Joint savings accounts combine funds from multiple individuals, enabling shared access and collective goal achievement, which often encourages disciplined saving habits through mutual accountability. Individual savings pods, on the other hand, allow people to save independently within smaller, goal-oriented groups that share interest earnings or rewards, promoting personalized financial growth while benefiting from social motivation. Choosing between joint savings and individual pods depends on preferences for shared financial responsibility versus maintaining separate control over personal funds.

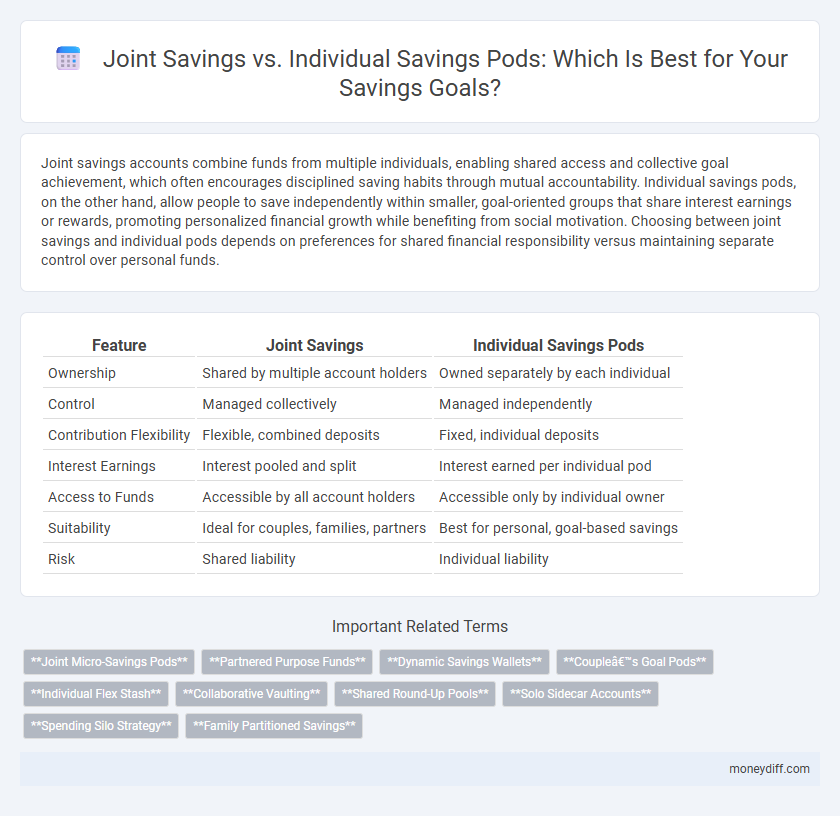

Table of Comparison

| Feature | Joint Savings | Individual Savings Pods |

|---|---|---|

| Ownership | Shared by multiple account holders | Owned separately by each individual |

| Control | Managed collectively | Managed independently |

| Contribution Flexibility | Flexible, combined deposits | Fixed, individual deposits |

| Interest Earnings | Interest pooled and split | Interest earned per individual pod |

| Access to Funds | Accessible by all account holders | Accessible only by individual owner |

| Suitability | Ideal for couples, families, partners | Best for personal, goal-based savings |

| Risk | Shared liability | Individual liability |

Understanding Joint Savings Accounts

Joint savings accounts allow two or more individuals to combine their funds, providing easier access and shared control over the savings. These accounts are ideal for couples, families, or business partners seeking to manage money collaboratively while benefiting from consolidated interest earnings. Unlike individual savings pods, joint accounts require mutual consent for withdrawals and offer transparency in tracking each contributor's deposits and expenditures.

What Are Individual Savings Pods?

Individual Savings Pods are specialized accounts designed for personalized financial goals, allowing users to save independently within a shared platform. These pods provide tailored interest rates and spending controls, enhancing flexibility compared to traditional joint savings accounts. By isolating funds in distinct pods, account holders maintain clear ownership and easy tracking without the risks of joint liability.

Pros and Cons of Joint Savings

Joint savings accounts foster shared financial transparency and collective goal-setting, enabling partners to pool resources for significant purchases or emergencies, which can accelerate savings growth. However, joint accounts also pose risks such as potential conflicts over spending decisions, loss of individual control, and complications in the event of relationship changes or legal disputes. Balancing these benefits and drawbacks is essential for those considering joint savings as a collaborative financial strategy.

Benefits of Individual Savings Pods

Individual savings pods offer personalized financial control and tailored goal-setting, enabling savers to allocate funds specifically for distinct purposes such as emergencies, travel, or education. This approach enhances motivation through clear, measurable progress toward each target, while minimizing conflicts that may arise in joint accounts. Moreover, individual pods provide increased privacy and flexibility, allowing users to adjust contributions without affecting others.

Shared Goals: How Joint Savings Work

Joint savings accounts enable multiple individuals to pool funds toward shared financial goals, enhancing collective planning and accountability. These accounts often feature joint access, allowing all members to contribute and withdraw, fostering transparency and collaborative decision-making. Compared to individual savings pods, joint accounts streamline goal tracking and can accelerate the achievement of common objectives through combined resources.

Personalized Savings: Features of Savings Pods

Savings Pods offer personalized features that adapt to individual financial goals within both joint and individual savings contexts, enhancing motivation and discipline. These pods provide tailored budgeting tools, automated transfers, and progress tracking that align with specific saving targets, allowing users to optimize their savings strategies. In joint savings pods, shared goals and transparent contributions foster collaboration, while individual pods emphasize autonomy and customized financial planning.

Trust and Transparency in Joint Accounts

Trust and transparency are critical factors in joint savings accounts, where multiple parties share access and responsibility. Clear communication and agreed-upon rules help prevent misunderstandings and ensure all contributors are informed about deposits, withdrawals, and account balances. Individual savings pods offer more control and privacy, but joint accounts provide the benefit of collective financial accountability and shared goals.

Flexibility and Control with Individual Pods

Individual savings pods offer greater flexibility by allowing contributors to tailor their financial goals and withdrawal schedules independently. Unlike joint savings accounts, each pod maintains separate control, reducing conflicts over fund usage and enhancing personalized budgeting. This autonomy supports diverse saving strategies while preserving individual ownership and decision-making power.

Choosing the Right Option for Couples and Families

Couples and families should evaluate joint savings accounts versus individual savings pods based on shared financial goals, spending habits, and the need for financial independence. Joint savings offer streamlined management and easier access for all members, fostering transparency and collective responsibility. Individual savings pods provide personalized control and privacy, which can be beneficial for tracking separate financial contributions or saving for distinct goals within the household.

Security and Risk Factors: Joint vs Individual

Joint savings accounts offer shared access, increasing exposure to risks such as unauthorized withdrawals or disputes between account holders, whereas individual savings pods provide greater control and limit security vulnerabilities to a single user. The risk of identity theft and fraud can be higher in joint accounts due to multiple users having access credentials, while individual accounts benefit from more straightforward monitoring and personalized security measures. Financial institutions often implement robust fraud detection systems for both types, but individuals retain sole responsibility and risk mitigation in individual accounts, reducing the likelihood of internal conflicts.

Related Important Terms

Joint Micro-Savings Pods

Joint micro-savings pods enable small groups to pool resources regularly, accelerating savings growth through collective discipline and peer accountability while reducing individual risk. These pods leverage social commitment and shared financial goals, making them highly effective for building emergency funds or targeted savings compared to individual savings accounts.

Partnered Purpose Funds

Partnered Purpose Funds in joint savings pods enable couples to pool resources for shared financial goals, optimizing interest earnings and simplifying tracking of contributions. Individual savings pods, while offering autonomy, often lack the combined growth potential and mutual accountability that partnered funds provide for achieving major purchases or emergencies.

Dynamic Savings Wallets

Dynamic Savings Wallets enable flexible allocation of funds between joint savings and individual savings pods, enhancing personalized financial management and collaborative goals. Leveraging real-time tracking and customizable rules, these wallets optimize savings growth by adapting contributions based on each member's income and spending patterns.

Couple’s Goal Pods

Couple's Goal Pods in joint savings enable partners to combine resources for targeted financial objectives, enhancing accountability and accelerating goal achievement compared to individual savings pods. These collaborative accounts optimize budgeting and tracking, ensuring aligned priorities while maintaining flexibility for both contributors.

Individual Flex Stash

Individual Flex Stash offers personalized control and flexible access to funds, unlike joint savings pods which require consensus for withdrawals, making it ideal for users seeking autonomy in managing their savings. Its tailored features optimize interest accrual and spending flexibility, enhancing effective money growth without shared restrictions.

Collaborative Vaulting

Collaborative vaulting in joint savings pools enhances financial goals by enabling multiple contributors to combine resources, increasing saving power and fostering collective accountability. Individual savings pods offer personalized control and flexible goal-setting but lack the compounded benefits of shared contributions and mutual motivation found in joint savings.

Shared Round-Up Pools

Shared Round-Up Pools in joint savings allow multiple users to collectively round up purchases and funnel the spare change into a common account, accelerating growth compared to individual savings pods that only accumulate round-ups on a single user's transactions. This pooled strategy leverages combined spending habits, increasing savings velocity and enhancing goal achievement through communal financial discipline.

Solo Sidecar Accounts

Solo Sidecar Accounts offer a unique approach to savings by allowing individuals to maintain separate, personalized savings goals within a joint savings framework, enhancing financial autonomy while benefiting from shared account features. This hybrid structure combines the security and convenience of joint savings with the flexibility of individual control, optimizing both collaboration and personal financial growth.

Spending Silo Strategy

Joint savings pods enable families or partners to implement a spending silo strategy by allocating funds into clearly defined categories for shared expenses, fostering transparency and goal alignment. In contrast, individual savings pods provide personal control over spending silos, allowing individuals to target specific financial goals while maintaining separate accountability and flexibility.

Family Partitioned Savings

Family partitioned savings offer a structured approach to managing finances by creating distinct savings pods for individual family members while maintaining a collective pool, enhancing transparency and accountability. This method optimizes goal-specific savings within a joint framework, combining the benefits of personalized financial discipline and collaborative wealth growth.

Joint Savings vs Individual Savings Pods for savings. Infographic

moneydiff.com

moneydiff.com