An emergency fund is designed to cover significant, unexpected expenses such as medical bills, job loss, or major home repairs, providing financial security during critical situations. A rainy day fund, on the other hand, is intended for smaller, less urgent expenses like car maintenance, minor home fixes, or occasional bills, helping to avoid debt for routine financial hiccups. Both funds are essential for a balanced savings strategy, with the emergency fund serving as a financial safety net and the rainy day fund supporting everyday financial stability.

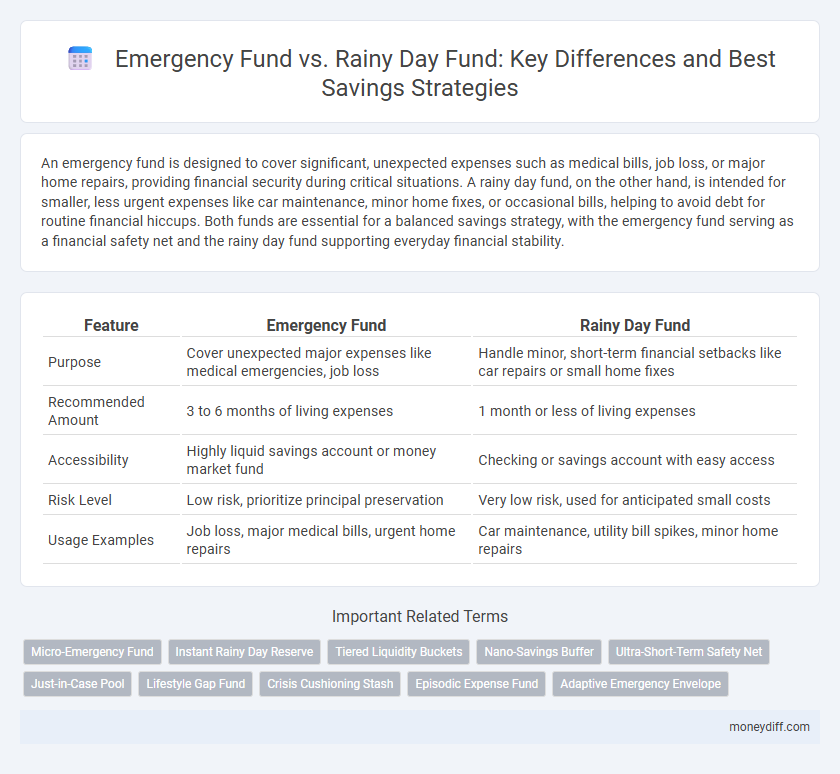

Table of Comparison

| Feature | Emergency Fund | Rainy Day Fund |

|---|---|---|

| Purpose | Cover unexpected major expenses like medical emergencies, job loss | Handle minor, short-term financial setbacks like car repairs or small home fixes |

| Recommended Amount | 3 to 6 months of living expenses | 1 month or less of living expenses |

| Accessibility | Highly liquid savings account or money market fund | Checking or savings account with easy access |

| Risk Level | Low risk, prioritize principal preservation | Very low risk, used for anticipated small costs |

| Usage Examples | Job loss, major medical bills, urgent home repairs | Car maintenance, utility bill spikes, minor home repairs |

Understanding Emergency Funds and Rainy Day Funds

Emergency funds are savings set aside specifically to cover unexpected, significant financial crises such as job loss, medical emergencies, or major repairs, typically amounting to three to six months of living expenses. Rainy day funds are smaller, more accessible reserves intended for minor, less urgent expenses such as car repairs or household maintenance, often equal to a few hundred dollars. Understanding the distinct purpose and recommended size of each fund helps optimize personal financial resilience and liquidity management.

Key Differences Between Emergency and Rainy Day Savings

Emergency funds are typically larger reserves intended for significant, unexpected expenses such as medical emergencies or job loss, emphasizing financial security during crises. Rainy day funds, in contrast, cover smaller, more predictable costs like minor car repairs or household maintenance, ensuring smooth cash flow without disrupting monthly budgets. The key difference lies in the fund size and purpose: emergency funds provide long-term financial protection, while rainy day funds address short-term, non-critical financial needs.

Why You Need Both Funds in Your Financial Plan

An Emergency Fund provides a dedicated safety net for unexpected major expenses such as medical emergencies, job loss, or urgent home repairs, typically covering 3 to 6 months of living expenses. A Rainy Day Fund addresses smaller, less severe financial disruptions like minor car repairs, appliance replacements, or occasional unexpected bills, ensuring cash flow continuity without dipping into long-term savings. Maintaining both funds in your financial plan enhances financial resilience by balancing immediate liquidity needs with protection against significant financial shocks.

Typical Uses for Emergency Funds

Emergency funds are primarily designed to cover significant, unexpected financial crises such as medical emergencies, job loss, or urgent home repairs. These funds typically amount to three to six months' worth of living expenses to provide a financial safety net during prolonged hardship. In contrast, rainy day funds handle smaller, less severe expenses like car maintenance or minor home repairs, preserving emergency savings for true crises.

Common Situations for Rainy Day Funds

Rainy day funds typically cover smaller, unexpected expenses such as car repairs, medical co-pays, or home maintenance costs. These funds act as a financial buffer for occasional, unplanned costs that do not require depleting the emergency fund. Maintaining a rainy day fund prevents disruption of monthly budgets and preserves long-term savings for true emergencies.

How Much to Save: Emergency Fund vs Rainy Day Fund

An emergency fund typically requires saving three to six months' worth of essential living expenses to cover unexpected events such as job loss or medical emergencies. A rainy day fund, however, is smaller, often set at one to two months' worth of discretionary expenses, designed to handle minor, non-emergency financial setbacks like car repairs or home maintenance. Prioritizing an adequate emergency fund before building a rainy day fund ensures long-term financial stability and better preparedness.

Where to Keep Your Emergency and Rainy Day Savings

Emergency funds should be kept in highly liquid, low-risk accounts such as high-yield savings accounts or money market accounts to ensure quick access during unforeseen events. Rainy day funds, designed for smaller, less urgent expenses, can be stored in readily accessible accounts with slightly higher returns, like short-term CDs or savings accounts. Prioritizing the right accounts balances accessibility with growth potential, safeguarding financial stability.

Tips for Building Your Savings Funds Faster

Establish clear financial goals and allocate a specific percentage of your income to both your emergency fund and rainy day fund, ensuring consistent contributions each month. Automate transfers to separate savings accounts to reduce temptation and track progress effectively. Prioritize high-yield savings accounts or low-risk investments to maximize growth while maintaining liquidity for unexpected expenses.

Mistakes to Avoid With Emergency and Rainy Day Funds

Common mistakes to avoid with emergency and rainy day funds include underestimating the amount needed and using these savings for non-essential expenses. Failing to replenish funds promptly after withdrawals can leave you unprepared for unexpected financial challenges. Separating these funds into distinct accounts helps maintain clarity and ensures proper allocation for true emergencies versus minor, anticipated expenses.

Integrating Both Funds Into Your Overall Money Management

Integrating an emergency fund and a rainy day fund into your overall money management strategy ensures financial resilience and flexibility. An emergency fund, typically covering three to six months of essential expenses, provides a safety net for unforeseen major crises like job loss or medical emergencies. Complementing this, a rainy day fund handles smaller, irregular expenses such as car repairs or home maintenance, preventing disruption to your main savings and maintaining financial stability.

Related Important Terms

Micro-Emergency Fund

A Micro-Emergency Fund is a smaller, more accessible savings reserve designed to cover immediate, unexpected expenses such as minor car repairs or medical co-pays, whereas a traditional Emergency Fund typically holds three to six months' worth of living expenses for larger financial crises. Prioritizing a Micro-Emergency Fund enhances short-term financial resilience by providing quick liquidity without dipping into longer-term savings goals.

Instant Rainy Day Reserve

An Emergency Fund typically covers unexpected major expenses like medical bills or job loss, while a Rainy Day Fund focuses on smaller, immediate needs such as car repairs or utility bills. Instant Rainy Day Reserve provides quick access to cash for these minor, sudden expenses without disrupting long-term savings goals.

Tiered Liquidity Buckets

Emergency funds provide a designated savings buffer for significant unexpected expenses and should be held in highly liquid accounts such as savings or money market funds to ensure immediate access. Rainy Day Funds, typically part of tiered liquidity buckets, cover smaller, anticipated disruptions and can be stored in short-term certificates of deposit or high-yield savings accounts offering a balance between liquidity and higher returns.

Nano-Savings Buffer

A Nano-Savings Buffer serves as a micro-level emergency fund designed to cover unexpected expenses that arise suddenly, unlike a traditional rainy day fund which is geared toward less urgent, smaller financial setbacks. This ultra-small reserve, typically ranging from $50 to $200, provides immediate liquidity to prevent reliance on credit or debt for minor emergencies.

Ultra-Short-Term Safety Net

An Emergency Fund provides a robust ultra-short-term safety net, typically covering 3 to 6 months of essential expenses to protect against major financial disruptions like job loss or medical emergencies. In contrast, a Rainy Day Fund targets smaller, immediate cash needs such as car repairs or minor household expenses, ensuring quick access to funds without jeopardizing long-term financial stability.

Just-in-Case Pool

An Emergency Fund acts as a Just-in-Case Pool designed to cover unexpected, significant financial setbacks such as medical emergencies or job loss, typically amounting to three to six months of essential expenses. A Rainy Day Fund, while also a safety net, targets smaller, foreseeable costs like home repairs or car maintenance, requiring a smaller, more liquid reserve.

Lifestyle Gap Fund

An Emergency Fund is a larger, more comprehensive savings reserve designed to cover significant unexpected expenses or income loss, typically enough to sustain 3-6 months of living expenses. In contrast, a Rainy Day Fund addresses smaller, routine financial setbacks, bridging the lifestyle gap by covering day-to-day costs without disrupting long-term financial goals.

Crisis Cushioning Stash

An Emergency Fund is a designated savings pool typically covering three to six months of essential expenses, serving as a crisis cushioning stash for unforeseen events like job loss or medical emergencies. In contrast, a Rainy Day Fund targets smaller, irregular expenses such as car repairs or minor home maintenance, providing short-term financial flexibility without depleting the core emergency savings.

Episodic Expense Fund

An Emergency Fund is designed to cover unexpected, significant financial setbacks like medical emergencies or job loss, while a Rainy Day Fund addresses smaller, predictable expenses such as minor car repairs or home maintenance. The Episodic Expense Fund, often considered a subset of these savings, prepares for irregular but anticipated costs like annual insurance premiums or quarterly tax payments.

Adaptive Emergency Envelope

An Adaptive Emergency Envelope tailors savings specifically to cover unexpected, high-impact expenses like medical emergencies or job loss, unlike a Rainy Day Fund which handles smaller, routine financial setbacks such as car repairs or minor home maintenance. This targeted approach enhances financial resilience by dynamically adjusting the fund's size and allocation based on evolving personal risk factors and income fluctuations.

Emergency Fund vs Rainy Day Fund for savings. Infographic

moneydiff.com

moneydiff.com