The Cash Envelope System offers a tangible way to manage savings by allocating physical cash into labeled envelopes, helping users control spending and stay disciplined. App-Based Budgeting Pots provide a digital alternative, allowing seamless tracking and categorization of savings goals with real-time updates and automated transfers. Choosing between these methods depends on personal preference for physical money handling versus convenience and technology integration.

Table of Comparison

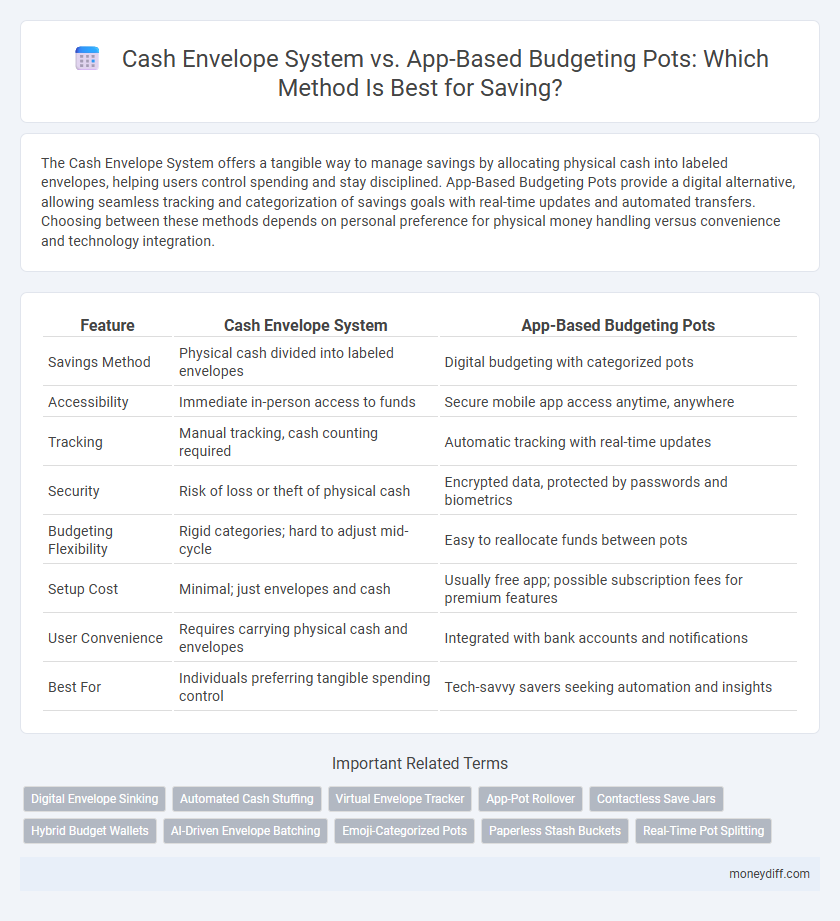

| Feature | Cash Envelope System | App-Based Budgeting Pots |

|---|---|---|

| Savings Method | Physical cash divided into labeled envelopes | Digital budgeting with categorized pots |

| Accessibility | Immediate in-person access to funds | Secure mobile app access anytime, anywhere |

| Tracking | Manual tracking, cash counting required | Automatic tracking with real-time updates |

| Security | Risk of loss or theft of physical cash | Encrypted data, protected by passwords and biometrics |

| Budgeting Flexibility | Rigid categories; hard to adjust mid-cycle | Easy to reallocate funds between pots |

| Setup Cost | Minimal; just envelopes and cash | Usually free app; possible subscription fees for premium features |

| User Convenience | Requires carrying physical cash and envelopes | Integrated with bank accounts and notifications |

| Best For | Individuals preferring tangible spending control | Tech-savvy savers seeking automation and insights |

Introduction to Savings: Cash Envelopes vs App-Based Pots

Cash envelope systems create physical categories for saving money, helping users control spending by handling cash within labeled envelopes. App-based budgeting pots digitize this method, offering automated tracking, real-time updates, and easier access via smartphones. Both methods promote disciplined saving habits, with cash envelopes favoring tangible control and app pots enhancing convenience and data insights.

How the Cash Envelope System Works for Saving

The Cash Envelope System works for saving by allocating a specific cash amount into labeled envelopes for various spending categories, providing a tangible method to control and limit expenses. This physical separation encourages disciplined spending by making individuals more aware of their budget constraints, reducing the risk of overspending compared to digital accounts. By using cash directly, the system enhances saving habits through intentional money management and immediate visual feedback on expenditure limits.

Understanding App-Based Budgeting Pots for Savings Goals

App-based budgeting pots enable users to digitally allocate funds toward specific savings goals, offering real-time tracking and automatic transfers that enhance financial discipline. Features like customizable categories, spending insights, and integration with bank accounts simplify managing multiple savings objectives simultaneously. Compared to the cash envelope system, app-based pots provide greater convenience, security, and detailed analytics for optimizing savings strategies.

Physical vs Digital: Comparing Tangibility in Savings Methods

Cash Envelope System offers a tangible way to manage savings by physically separating funds into labeled envelopes, enhancing spending awareness through direct cash handling. In contrast, App-Based Budgeting Pots provide a digital alternative, allowing users to create virtual categories that streamline tracking and adjustment without physical limitations. The physicality of the envelope system promotes disciplined cash management, while digital pots enable real-time data access and automated notifications, catering to different preferences in saving habits.

Tracking Savings Progress: Manual vs Automated Approaches

The Cash Envelope System offers a tactile method for tracking savings progress by physically allocating funds, which enhances spending awareness but requires diligent manual updates. In contrast, app-based budgeting pots automate savings tracking through real-time transaction synchronization and progress visualization, enabling effortless monitoring and adjustments. Both approaches present unique advantages, with manual systems promoting mindfulness and apps providing data-driven insights for optimized financial management.

Flexibility and Adjustments: Cash Envelopes vs Budgeting Apps

Cash envelope systems offer tangible control by physically separating funds, which enhances discipline but can limit flexibility when immediate adjustments are needed. App-based budgeting pots provide dynamic allocation and real-time updates, allowing users to quickly reassign funds according to changing priorities or unexpected expenses. Digital platforms also facilitate automatic syncing with bank accounts, enhancing accuracy and adaptability compared to the manual nature of envelope budgeting.

Security and Risk: Protecting Your Savings

The Cash Envelope System minimizes digital security risks by keeping physical cash separated, reducing exposure to online fraud and hacking threats. App-based budgeting pots offer encrypted platforms and multi-factor authentication, enhancing protection against unauthorized access but remain vulnerable to cyberattacks and technical failures. Balancing physical security with technological safeguards is essential to effectively protect your savings in either method.

Accessibility and Convenience: Which Method Wins?

The Cash Envelope System offers tactile control by physically separating funds, enhancing discipline but limiting accessibility outside physical locations. App-Based Budgeting Pots provide instant, on-the-go access across devices, sync with bank accounts, and offer automated tracking for seamless saving. Digital solutions typically win on accessibility and convenience due to real-time updates, portability, and integration with financial tools.

Suitability: Which Savings System Fits Different Lifestyles?

The Cash Envelope System suits individuals who prefer tangible money management, providing clear visual boundaries for spending and saving, ideal for those with variable income or a need for strict discipline. App-Based Budgeting Pots fit tech-savvy users who value automated tracking, flexibility, and real-time adjustments, beneficial for regular income earners seeking convenience and detailed financial insights. Choosing between these depends on lifestyle factors such as income stability, comfort with technology, and personal discipline in managing finances.

Final Verdict: Choosing Between Envelopes and Budgeting Pots

Cash Envelope System offers tangible control over spending by physically dividing cash into designated envelopes, enhancing discipline for those who prefer hands-on management. App-Based Budgeting Pots provide flexibility and real-time tracking through digital interfaces, ideal for tech-savvy users seeking convenience and automation. The final verdict depends on personal preference: opt for envelopes to curb overspending with cash or choose budgeting apps for seamless integration and detailed financial oversight.

Related Important Terms

Digital Envelope Sinking

Digital envelope sinking within app-based budgeting pots allows users to allocate funds into specific categories virtually, providing real-time tracking and flexibility not available in traditional cash envelope systems. This method enhances savings discipline by automating reminders and integrating with bank accounts, reducing the risk of overspending while promoting targeted financial goals.

Automated Cash Stuffing

Automated cash stuffing within the Cash Envelope System streamlines physical money allocation by integrating digital alerts and withdrawals, enhancing discipline without sacrificing tactile control. In contrast, app-based budgeting pots automate savings through linked accounts and real-time tracking, offering convenience but potentially reducing the psychological commitment fostered by handling actual cash.

Virtual Envelope Tracker

The Virtual Envelope Tracker in app-based budgeting pots offers real-time transaction updates and automatic categorization, enhancing accuracy and convenience compared to the physical cash envelope system. Its integration with bank accounts enables seamless tracking of spending limits and progress toward savings goals without the need for manual cash handling.

App-Pot Rollover

App-based budgeting pots offer a seamless rollover feature that automatically transfers unused funds to the next saving period, maximizing savings potential without manual adjustments. This digital convenience enhances cash flow management and reduces the risk of overspending compared to the static allocation in the Cash Envelope System.

Contactless Save Jars

Contactless Save Jars offer a modern twist on the traditional Cash Envelope System by combining the tactile satisfaction of physical saving with the convenience of app-based tracking, enabling users to allocate funds without handling cash. This hybrid approach enhances saving discipline and accessibility, making it ideal for those seeking the psychological benefits of tangible envelopes alongside the efficiency and security of digital budgeting pots.

Hybrid Budget Wallets

Hybrid budget wallets combine the tactile benefits of the Cash Envelope System with the convenience of App-Based Budgeting Pots, enabling users to allocate cash physically while tracking expenses digitally. This integration enhances savings discipline by providing real-time insights alongside tangible spending limits, optimizing budget management and financial accountability.

AI-Driven Envelope Batching

AI-driven envelope batching enhances the traditional Cash Envelope System by automatically allocating funds into digital envelopes based on spending patterns, increasing savings efficiency and reducing manual errors. This technology leverages real-time data analysis to optimize budget distribution across categories, ensuring personalized and adaptive saving strategies compared to static app-based budgeting pots.

Emoji-Categorized Pots

Emoji-categorized pots in app-based budgeting offer a visually engaging way to track savings goals, enhancing user motivation and clarity compared to the traditional cash envelope system's physical limitations. These digital pots allow instant updates, customizable categories, and easy integration with bank accounts, making savings management more efficient and accessible.

Paperless Stash Buckets

Paperless stash buckets in app-based budgeting offer a digital alternative to the traditional cash envelope system, enabling users to allocate funds into specific savings categories without carrying physical cash. This method enhances tracking accuracy and provides real-time updates on spending and savings progress through intuitive mobile interfaces.

Real-Time Pot Splitting

Cash Envelope System offers tangible control by physically dividing money into labeled envelopes, enhancing spending discipline, whereas App-Based Budgeting Pots provide real-time pot splitting with instant balance updates and automated tracking, optimizing flexibility and accuracy for savings management. Real-time synchronization in digital apps ensures immediate reallocation of funds across multiple saving goals, surpassing the static nature of cash envelopes for dynamic financial planning.

Cash Envelope System vs App-Based Budgeting Pots for savings. Infographic

moneydiff.com

moneydiff.com