Bank certificates offer a fixed interest rate and guaranteed returns, making them a secure choice for risk-averse savers seeking predictable growth. Prize-linked savings accounts combine the safety of traditional savings with the chance to win cash rewards, appealing to individuals looking for excitement alongside savings. Choosing between these options depends on whether stability or the potential for additional prizes aligns best with your financial goals.

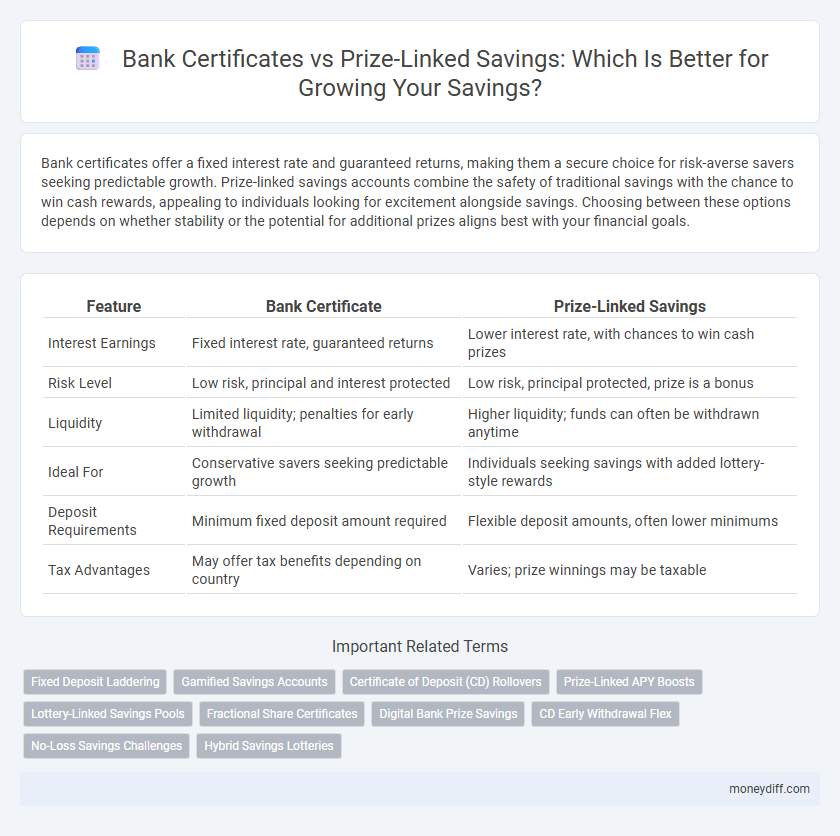

Table of Comparison

| Feature | Bank Certificate | Prize-Linked Savings |

|---|---|---|

| Interest Earnings | Fixed interest rate, guaranteed returns | Lower interest rate, with chances to win cash prizes |

| Risk Level | Low risk, principal and interest protected | Low risk, principal protected, prize is a bonus |

| Liquidity | Limited liquidity; penalties for early withdrawal | Higher liquidity; funds can often be withdrawn anytime |

| Ideal For | Conservative savers seeking predictable growth | Individuals seeking savings with added lottery-style rewards |

| Deposit Requirements | Minimum fixed deposit amount required | Flexible deposit amounts, often lower minimums |

| Tax Advantages | May offer tax benefits depending on country | Varies; prize winnings may be taxable |

Understanding Bank Certificates and Prize-Linked Savings

Bank certificates, also known as certificates of deposit (CDs), provide fixed interest rates and guaranteed returns over a specified term, offering low risk and predictable growth. Prize-linked savings combine the security of traditional savings with the chance to win cash prizes, encouraging higher savings rates without sacrificing principal. Understanding these options helps savers balance risk, return, and motivation to achieve their financial goals.

Key Features of Bank Certificates

Bank certificates offer fixed interest rates and guaranteed returns over a specified term, providing stability and predictability for savings growth. They are typically insured by government agencies, ensuring principal protection, and require minimal risk tolerance, making them suitable for conservative investors. Unlike prize-linked savings, bank certificates do not offer bonus incentives but prioritize steady income through compound interest.

How Prize-Linked Savings Accounts Work

Prize-linked savings accounts work by entering depositors into regular drawings or raffles where winners receive cash prizes instead of traditional interest. Unlike standard bank certificates that pay fixed interest rates, these accounts encourage saving through the chance to win significant rewards while preserving the principal amount. The effectiveness of prize-linked savings lies in blending behavioral incentives with the safety and liquidity of conventional savings products.

Comparing Interest Rates and Potential Returns

Bank certificates typically offer fixed interest rates ranging from 1% to 4%, providing predictable returns over a set term, while prize-linked savings accounts combine lower guaranteed interest rates, often below 1%, with the chance to win cash prizes, potentially increasing overall returns. Prize-linked savings accounts appeal to risk-tolerant savers who prioritize lottery-style incentives over steady income, whereas bank certificates suit conservative savers seeking stable growth. Comparing potential returns involves balancing the certainty of fixed interest against the probabilistic gains from prize-linked mechanisms, impacting long-term saving strategies.

Accessibility and Flexibility: Which Option Wins?

Bank certificates of deposit offer fixed terms and limited liquidity, making access to funds less flexible during the investment period. Prize-linked savings accounts provide easier access to funds with no fixed withdrawal schedules, enhancing liquidity while offering the chance to win prizes. For savers prioritizing accessibility and flexibility, prize-linked savings generally present a more advantageous option than traditional bank certificates.

Risk Factors in Bank Certificates and Prize-Linked Savings

Bank certificates typically carry low risk due to fixed interest rates and federal insurance protections like FDIC coverage up to $250,000, but they lack liquidity before maturity. Prize-linked savings accounts offer the potential for higher rewards through lottery-like prize drawings, yet they involve variable returns without guaranteed interest, making them riskier for conservative savers. Both options should be evaluated for risk tolerance, with bank certificates providing consistent, insured growth and prize-linked savings focusing on chance-based incentives for savers willing to trade guaranteed returns.

Early Withdrawal Penalties and Liquidity Considerations

Bank certificates often impose strict early withdrawal penalties, reducing liquidity and potentially diminishing returns if funds are accessed before maturity. Prize-linked savings accounts typically allow more flexible withdrawals without penalties, offering better liquidity while still providing opportunities for prize-based incentives. Evaluating the trade-off between guaranteed returns with limited access versus flexible savings with chance-based rewards is essential for optimizing personal finance strategies.

Suitability for Different Savings Goals

Bank certificates offer fixed interest rates and guaranteed returns, making them ideal for conservative savers aiming for stable, long-term growth or specific future expenses like education or home purchases. Prize-linked savings accounts provide an element of chance with potential lottery-style rewards, appealing to those seeking excitement and the possibility of higher, albeit uncertain, returns without risking their principal. Choosing between the two depends on whether the primary goal is secure accumulation or the allure of bonus prizes tied to savings behavior.

Government Guarantees and Safety of Funds

Bank certificates offer government guarantees on principal and interest payments, ensuring high safety of funds through regulatory protections. Prize-linked savings accounts promote savings by awarding chances to win cash prizes while still typically safeguarding deposits with government-backed insurance schemes. Investors prioritizing capital preservation tend to favor bank certificates, whereas prize-linked savings attract those seeking both security and potential rewards.

Choosing Between Bank Certificates and Prize-Linked Savings

Bank certificates offer fixed interest rates and guaranteed returns, making them ideal for risk-averse savers seeking predictable growth over a set period. Prize-linked savings accounts combine the safety of traditional savings with the excitement of entering draws for cash prizes, appealing to individuals willing to trade some interest income for the chance to win rewards. Evaluating liquidity needs, risk tolerance, and return preferences is crucial when choosing between the stability of bank certificates and the variable incentives of prize-linked savings.

Related Important Terms

Fixed Deposit Laddering

Fixed Deposit Laddering maximizes returns by staggering maturities, providing liquidity and higher interest rates compared to a traditional Bank Certificate, which offers fixed yields with less flexibility. Prize-linked savings can complement laddering but generally lack the predictable income and structured growth of Fixed Deposit ladders in wealth accumulation.

Gamified Savings Accounts

Bank certificates offer fixed interest rates and guaranteed returns, while prize-linked savings accounts gamify the saving process by providing chances to win cash prizes, boosting engagement and motivation to save regularly. Gamified savings accounts blend financial discipline with entertainment, making them an attractive alternative for those seeking both security and excitement in their savings strategy.

Certificate of Deposit (CD) Rollovers

Certificate of Deposit (CD) rollovers provide a secure way to extend fixed-term savings with predictable interest rates, ensuring capital preservation while earning steady returns. Prize-linked savings offer the chance to win cash rewards without risking the principal, but CD rollovers guarantee consistent growth by reinvesting funds at maturity to maximize interest accumulation.

Prize-Linked APY Boosts

Prize-linked savings accounts offer competitive APY boosts by combining traditional interest earnings with the chance to win cash prizes, enhancing overall savings growth potential. Unlike standard bank certificates with fixed rates, prize-linked accounts incentivize consistent deposits and long-term saving habits through engaging reward mechanisms.

Lottery-Linked Savings Pools

Bank certificates typically offer fixed interest rates with guaranteed returns, providing stable growth for savers. Prize-linked savings pools combine savings with lottery-style prize incentives, encouraging higher deposits through the chance of winning cash rewards while maintaining principal security.

Fractional Share Certificates

Fractional Share Certificates in bank certificates offer guaranteed returns with fixed interest rates, providing stability for conservative savers, whereas prize-linked savings accounts incentivize deposits through the chance to win cash prizes while allowing access to principal. The choice depends on prioritizing predictable growth versus the opportunity for enhanced rewards without risking the initial investment.

Digital Bank Prize Savings

Digital Bank Prize Savings offer a unique advantage over traditional bank certificates by combining secure savings with the chance to win cash prizes, enhancing the savings experience without sacrificing guaranteed returns. This innovative approach encourages higher savings rates through digital platforms, leveraging lottery-style incentives that appeal to tech-savvy customers seeking both safety and excitement in their financial growth.

CD Early Withdrawal Flex

Bank certificates, such as CDs, offer fixed interest rates with penalties for early withdrawal, limiting liquidity but ensuring predictable returns, while prize-linked savings accounts provide chances to win cash prizes without sacrificing access to funds. The CD Early Withdrawal Flex option allows savers some flexibility by reducing penalties on early withdrawals, blending steady interest earnings with improved funds accessibility.

No-Loss Savings Challenges

Bank certificates provide fixed interest rates guaranteeing principal safety, making them a reliable option for conservative savers seeking no-loss savings challenges. Prize-linked savings combine the security of traditional savings accounts with lottery-style prizes, offering risk-free opportunities to win rewards without risking the initial deposit.

Hybrid Savings Lotteries

Hybrid savings lotteries combine the guaranteed returns of bank certificates with the excitement of prize-linked savings, offering savers a dual opportunity to earn interest and win cash prizes. This innovative approach enhances traditional savings by integrating secure investment benefits with the unpredictability and engagement of lottery-style rewards.

Bank certificate vs Prize-linked savings for savings. Infographic

moneydiff.com

moneydiff.com