A personal savings account offers flexible access to funds and typically features lower minimum balance requirements, making it ideal for general savings and emergency funds. Purpose-driven savings accounts are designed with specific financial goals in mind, encouraging disciplined saving by often providing higher interest rates or incentives tied to the account's objective. Choosing between the two depends on whether you prioritize accessibility or goal-oriented growth in your savings strategy.

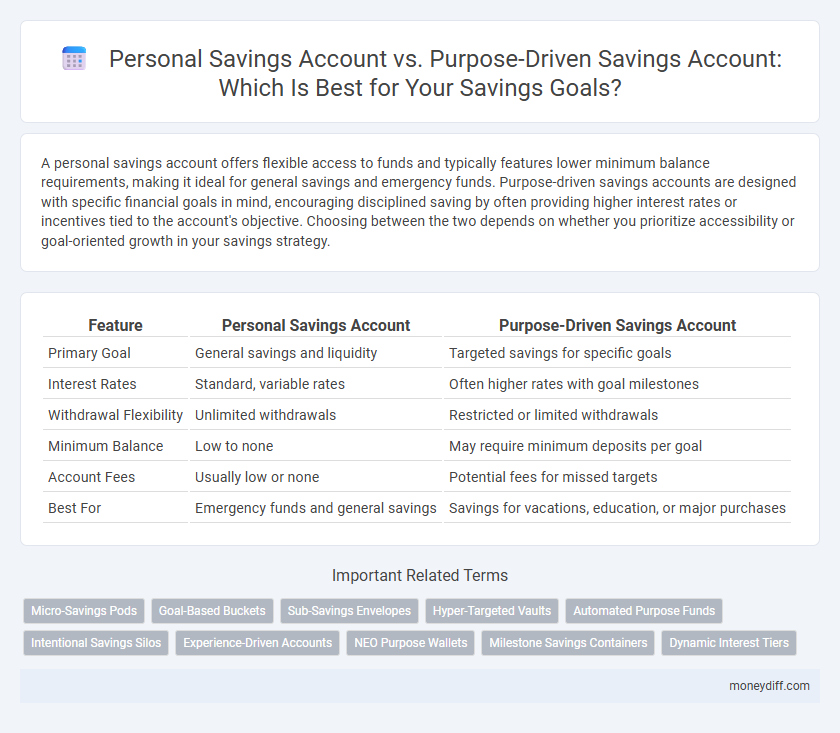

Table of Comparison

| Feature | Personal Savings Account | Purpose-Driven Savings Account |

|---|---|---|

| Primary Goal | General savings and liquidity | Targeted savings for specific goals |

| Interest Rates | Standard, variable rates | Often higher rates with goal milestones |

| Withdrawal Flexibility | Unlimited withdrawals | Restricted or limited withdrawals |

| Minimum Balance | Low to none | May require minimum deposits per goal |

| Account Fees | Usually low or none | Potential fees for missed targets |

| Best For | Emergency funds and general savings | Savings for vacations, education, or major purchases |

Understanding Personal Savings Accounts

Personal Savings Accounts offer a flexible way to build emergency funds or general savings with easy access and typically lower interest rates, making them ideal for everyday financial goals. These accounts often feature FDIC insurance up to $250,000 and minimal fees, ensuring security and affordability. Understanding the terms and interest compounding methods helps maximize growth while maintaining liquidity.

What Is a Purpose-Driven Savings Account?

A Purpose-Driven Savings Account is designed for specific financial goals such as vacations, emergencies, or large purchases, allowing users to allocate funds with clear targets in mind. Unlike a general Personal Savings Account, it often includes features like goal tracking, automatic transfers, and potentially higher interest rates to incentivize saving. This targeted approach helps improve financial discipline and motivation by linking savings directly to tangible objectives.

Key Differences Between Personal and Purpose-Driven Savings

Personal savings accounts offer flexible access to funds without restrictions, making them ideal for emergency reserves and general savings goals. Purpose-driven savings accounts are designed with specific goals in mind, often featuring higher interest rates and features like automatic transfers or spending limits to encourage disciplined saving for intended purchases or life events. The key difference lies in the targeted saving strategy and account structure, with purpose-driven accounts promoting goal-oriented financial planning while personal accounts provide broad saving flexibility.

Flexibility: Personal Savings vs Purpose-Driven Accounts

Personal savings accounts offer greater flexibility by allowing unrestricted deposits and withdrawals, making them ideal for emergency funds or general savings. Purpose-driven savings accounts typically impose limits on transactions or require funds to be used for specific goals, such as education or travel, fostering disciplined saving habits. Comparing interest rates and withdrawal rules helps determine which account best aligns with individual financial goals and liquidity needs.

Goal Setting with Purpose-Driven Savings

Purpose-driven savings accounts enhance goal setting by allowing individuals to allocate funds toward specific financial objectives, such as emergencies, vacations, or education. These accounts often feature customizable labels and progress tracking tools that increase motivation and accountability compared to generic personal savings accounts. Using purpose-driven savings strategies improves financial discipline and helps prioritize spending aligned with long-term goals.

Interest Rates and Earnings Comparison

Personal Savings Accounts typically offer lower interest rates ranging from 0.01% to 0.10%, resulting in modest earnings primarily suitable for emergency funds. Purpose-Driven Savings Accounts provide higher interest rates, often between 0.50% and 2.00%, incentivizing saving for specific goals like vacations, education, or large purchases. Higher rates in purpose-driven accounts significantly increase earnings over time, making them more effective for targeted financial objectives.

Accessibility and Withdrawal Rules

Personal Savings Accounts offer high accessibility with flexible withdrawal options, allowing savers to access funds anytime without penalties, making them ideal for emergency cash needs. Purpose-Driven Savings Accounts often impose withdrawal restrictions or limited transactions to encourage disciplined saving towards specific goals, reducing impulse spending. Understanding these accessibility and withdrawal rules is crucial for aligning account choice with individual savings objectives and cash flow requirements.

Suitability for Different Saving Goals

Personal savings accounts offer flexibility and easy access, making them ideal for general savings and emergency funds without specific goals. Purpose-driven savings accounts are designed with targeted features, such as higher interest rates or automated transfers, tailored for defined goals like buying a home, education, or vacations. Choosing between them depends on whether the priority is accessibility or maximizing returns aligned with specific financial objectives.

Security and Insurance Features

Personal Savings Accounts typically offer standard security features such as FDIC or NCUA insurance coverage up to $250,000, ensuring the safety of deposited funds against bank failures. Purpose-Driven Savings Accounts may provide similar insurance protections but often include additional security measures tailored to specific financial goals, such as automatic transfer limits and goal-specific spending restrictions. Both account types prioritize fund security, with insurance safeguarding deposits and security features designed to minimize unauthorized access.

Choosing the Right Savings Account for You

Choosing between a Personal Savings Account and a Purpose-Driven Savings Account depends on your financial goals and saving habits. Personal Savings Accounts offer flexible access and are ideal for general saving or emergency funds, while Purpose-Driven Savings Accounts provide structured saving options with incentives tailored to specific goals like vacations or education. Evaluating interest rates, fees, and account features can help determine the most beneficial option for maximizing your savings growth.

Related Important Terms

Micro-Savings Pods

Personal Savings Accounts provide flexible access to funds and are ideal for general savings goals, while Purpose-Driven Savings Accounts, including Micro-Savings Pods, enable targeted saving by dividing funds into specific sub-accounts for short-term objectives. Micro-Savings Pods facilitate disciplined saving habits by allowing users to allocate small amounts regularly toward multiple goals, enhancing financial organization and motivation.

Goal-Based Buckets

Personal savings accounts offer flexible access to funds without specific goals, while purpose-driven savings accounts use goal-based buckets to allocate money toward targeted objectives like vacations, emergencies, or home purchases, enhancing motivation and financial discipline. Goal-based buckets provide clear tracking and separate funds, improving the ability to meet distinct savings targets efficiently.

Sub-Savings Envelopes

Personal Savings Accounts offer a flexible way to accumulate funds with easy access and competitive interest rates, but Purpose-Driven Savings Accounts with Sub-Savings Envelopes allow users to allocate money into specific goals, enhancing budget management and motivation to save for distinct financial objectives like vacations or emergencies. These envelopes enable precise tracking and optimized savings growth by separating funds based on purpose, encouraging disciplined financial habits and targeted wealth accumulation.

Hyper-Targeted Vaults

Hyper-targeted vaults within purpose-driven savings accounts offer tailored saving goals and automated rules, enabling users to efficiently allocate funds for specific objectives like travel or emergencies. Personal savings accounts provide broader flexibility but lack the granular control and motivation features that hyper-targeted vaults deliver for disciplined financial growth.

Automated Purpose Funds

Automated purpose-driven savings accounts enable users to allocate funds toward specific goals like vacations, emergency funds, or education, optimizing financial discipline through targeted automation. Personal savings accounts offer general saving flexibility but often lack automated features that help maintain focus on individual financial objectives.

Intentional Savings Silos

Personal Savings Accounts provide flexible access to funds, while Purpose-Driven Savings Accounts enable intentional savings silos by allowing individuals to allocate money towards specific financial goals. Establishing separate silos within purpose-driven accounts enhances budgeting discipline and accelerates progress towards targeted savings objectives.

Experience-Driven Accounts

Experience-driven savings accounts offer tailored features such as reward programs and goal tracking tools that enhance user engagement compared to traditional personal savings accounts. These purpose-driven accounts leverage behavioral economics to motivate consistent saving habits aligned with specific life goals, resulting in higher retention and satisfaction rates among users.

NEO Purpose Wallets

NEO Purpose Wallets offer tailored savings solutions by allowing users to allocate funds toward specific financial goals, unlike traditional Personal Savings Accounts that pool money without designated purposes. This goal-oriented structure enhances disciplined saving behavior and provides clearer tracking for milestones such as travel, emergencies, or large purchases.

Milestone Savings Containers

Personal Savings Accounts offer flexibility for general savings, while Purpose-Driven Savings Accounts with Milestone Savings Containers provide targeted goals tracking and automated progress for specific financial ambitions like vacations or emergency funds. Milestone Savings Containers enhance motivation by breaking larger savings targets into manageable increments, increasing the likelihood of achieving set objectives.

Dynamic Interest Tiers

Personal Savings Accounts typically offer fixed interest rates regardless of the balance, while Purpose-Driven Savings Accounts use dynamic interest tiers that increase rates based on savings milestones, encouraging higher deposits. This tiered system rewards savers with progressively better yields, optimizing growth potential aligned with specific financial goals.

Personal Savings Account vs Purpose-Driven Savings Account for savings. Infographic

moneydiff.com

moneydiff.com