Choosing between a Christmas Club and a sinking fund depends on your saving goals and flexibility needs. Christmas Clubs are specialized accounts designed for holiday spending, offering discipline through regular deposits but limited access until maturity. Sinking funds provide a more flexible approach, allowing you to allocate savings for specific expenses like holidays while adjusting contributions based on your budget and timeline.

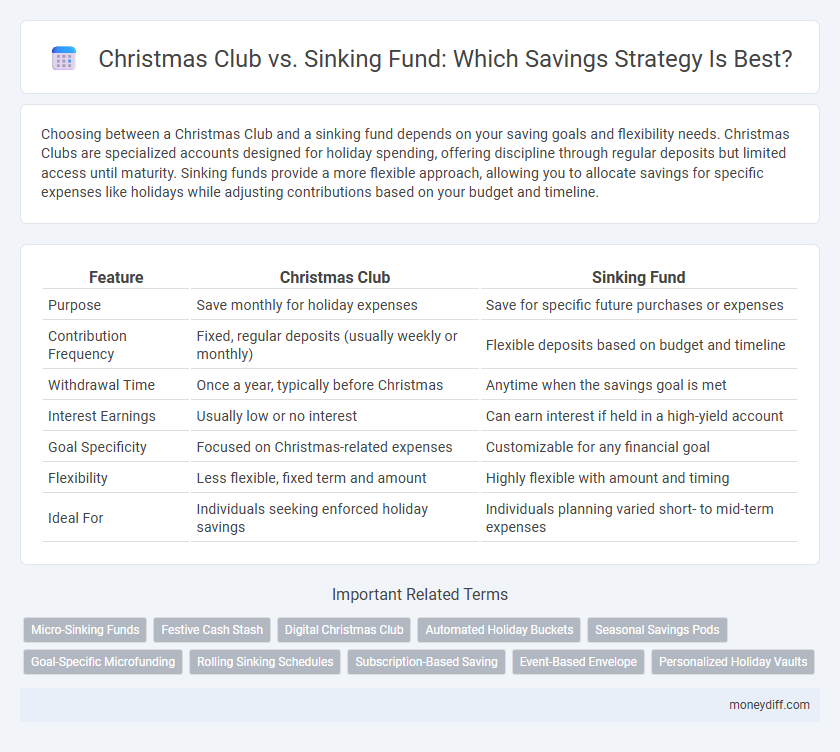

Table of Comparison

| Feature | Christmas Club | Sinking Fund |

|---|---|---|

| Purpose | Save monthly for holiday expenses | Save for specific future purchases or expenses |

| Contribution Frequency | Fixed, regular deposits (usually weekly or monthly) | Flexible deposits based on budget and timeline |

| Withdrawal Time | Once a year, typically before Christmas | Anytime when the savings goal is met |

| Interest Earnings | Usually low or no interest | Can earn interest if held in a high-yield account |

| Goal Specificity | Focused on Christmas-related expenses | Customizable for any financial goal |

| Flexibility | Less flexible, fixed term and amount | Highly flexible with amount and timing |

| Ideal For | Individuals seeking enforced holiday savings | Individuals planning varied short- to mid-term expenses |

Understanding Christmas Clubs and Sinking Funds

Christmas Clubs are specialized savings accounts designed to help individuals accumulate funds gradually for holiday expenses, typically requiring regular, disciplined deposits throughout the year. Sinking funds are a broader financial strategy involving setting aside money in separate accounts for specific future expenses, allowing for flexible contributions and withdrawals beyond seasonal expenses. Understanding these savings tools enables better financial planning by aligning saving habits with specific goals and timelines.

Key Differences Between Christmas Clubs and Sinking Funds

Christmas Clubs require regular, fixed deposits into a dedicated account that matures before the holiday season, promoting disciplined saving specifically for Christmas expenses. Sinking Funds offer flexible contributions and withdrawals, allowing savers to allocate money toward various upcoming large expenses by gradually building a fund over time. The key difference lies in the rigidity of Christmas Clubs versus the adaptability of Sinking Funds to meet diverse financial goals beyond the holiday period.

Benefits of Using a Christmas Club for Holiday Savings

A Christmas Club offers a structured approach to holiday savings by allowing individuals to deposit small, manageable amounts regularly throughout the year, which reduces financial stress during the holiday season. This method encourages disciplined saving habits and prevents last-minute borrowing or credit card debt. Unlike a sinking fund, which can be more flexible but less targeted, a Christmas Club is specifically designed to accumulate funds for holiday expenses, ensuring dedicated savings and peace of mind.

Advantages of Sinking Funds for Planned Expenses

Sinking funds offer precise control over savings by allocating specific amounts toward planned expenses, reducing reliance on credit and minimizing financial stress during major purchases or holidays. These funds enhance budgeting accuracy by breaking down large expenses into manageable monthly contributions, ensuring funds are available when needed. Compared to Christmas clubs, sinking funds provide greater flexibility for various expenditures beyond the holiday season, supporting overall financial stability.

When to Choose a Christmas Club Over a Sinking Fund

Choose a Christmas Club when disciplined, automated savings for a specific holiday goal is desired, as it offers structured deposits and limited withdrawal options to prevent overspending. This method is ideal for individuals who prefer a hands-off approach and want to ensure funds are reserved solely for Christmas expenses. Conversely, a sinking fund provides greater flexibility for various savings goals but lacks the enforced commitment that a Christmas Club guarantees.

Flexibility: Sinking Funds vs Christmas Clubs

Sinking funds offer greater flexibility by allowing individuals to allocate savings toward multiple goals and adjust contributions as financial priorities change. Christmas clubs typically require fixed deposits over a specific period, limiting access to funds before the designated payout time. This restriction makes sinking funds more adaptable for managing diverse savings objectives throughout the year.

How to Set Up a Christmas Club Account

To set up a Christmas Club account, visit your local bank or credit union and inquire about their specific holiday savings programs, which typically require a small initial deposit and regular contributions throughout the year. Automate transfers from your checking account to the Christmas Club to ensure consistent savings without the temptation to spend. This targeted approach helps accumulate funds exclusively for holiday expenses, differing from a sinking fund by its formal structure and scheduled withdrawal.

Steps to Create and Manage a Sinking Fund

Creating and managing a sinking fund begins by identifying a specific savings goal and determining the total amount needed along with the deadline for achieving it. Regular contributions are scheduled based on the target amount and time frame, ensuring consistent progress without impacting daily finances. Tracking contributions through budgeting tools or dedicated accounts helps maintain discipline and adjust contributions as necessary to meet the goal efficiently.

Pros and Cons: Christmas Club vs Sinking Fund

Christmas Club savings offer disciplined, regular deposits specifically for holiday expenses, reducing the risk of overspending, but they often have lower interest rates and limited withdrawal flexibility. Sinking Funds provide more control and flexibility by allowing savings for various goals with potential higher returns through different investment options, yet they require greater financial discipline to prevent early withdrawals. Choosing between the two depends on whether you prioritize goal-specific saving convenience (Christmas Club) or adaptable financial planning and potential growth (Sinking Fund).

Which Savings Strategy Fits Your Financial Goals?

Christmas Clubs offer a disciplined way to save small amounts regularly for holiday expenses, ideal for short-term goal planning with limited flexibility. Sinking Funds provide greater control by allowing you to set aside money over time for various anticipated expenses, supporting more personalized and adaptable financial goals. Choosing between these strategies depends on your need for structured saving versus flexibility to cover multiple or variable financial objectives.

Related Important Terms

Micro-Sinking Funds

Micro-sinking funds offer flexible, goal-specific savings by allowing small, regular contributions earmarked for particular expenses, making them more adaptable than traditional Christmas Club accounts with fixed schedules. Utilizing micro-sinking funds enhances financial control and prioritization, optimizing savings strategies for variable holiday or emergency costs.

Festive Cash Stash

A Christmas Club provides a structured, limited-time savings plan specifically designed to accumulate a festive cash stash for holiday spending, often with scheduled deposits throughout the year. In contrast, a sinking fund offers flexible contributions for various expenses, allowing savers to build a cash reserve for Christmas while managing other financial goals simultaneously.

Digital Christmas Club

Digital Christmas Club accounts offer automated, scheduled deposits specifically for holiday spending, ensuring disciplined savings with easy access and digital tracking features. In contrast, sinking funds provide flexible, goal-based saving for various expenses but typically lack the structured, holiday-focused automation available in digital Christmas Club programs.

Automated Holiday Buckets

Automated Holiday Buckets leverage the structured approach of Christmas Clubs for dedicated seasonal saving while incorporating the flexibility of a Sinking Fund to manage diverse holiday expenses throughout the year. This hybrid method optimizes cash flow by scheduling regular, automated deposits directly into segmented accounts, ensuring timely funds without disrupting monthly budgets.

Seasonal Savings Pods

Seasonal savings pods like Christmas Clubs provide a structured approach to save specifically for holiday expenses through regular, small deposits, ensuring funds are available when needed. Sinking Funds, by contrast, offer flexibility by allowing savers to allocate money toward various future expenses, adapting amounts and schedules to changing financial goals.

Goal-Specific Microfunding

Christmas Clubs offer structured, goal-specific microfunding by allowing regular deposits into locked accounts designated for holiday expenses, ensuring disciplined savings. Sinking Funds provide flexible, targeted savings for various future expenses by allocating smaller, periodic contributions to specific financial goals, enhancing budget control and preparedness.

Rolling Sinking Schedules

Christmas Clubs typically involve fixed contributions over a set period, but rolling sinking fund schedules offer greater flexibility by allowing savers to adjust deposit amounts and timelines dynamically. This approach enables more efficient management of cash flow and aligns savings goals with varying financial circumstances, optimizing funds for specific expenses like holiday spending.

Subscription-Based Saving

Subscription-based saving through a Christmas Club offers a structured approach with fixed contributions and predetermined withdrawal dates, ideal for earmarking funds for holiday expenses. In contrast, a sinking fund provides flexible contributions and timing, allowing savers to allocate variable amounts toward specific future goals beyond just seasonal spending.

Event-Based Envelope

Christmas Club accounts provide a structured, event-based envelope for holiday savings by automatically setting aside funds throughout the year, ensuring dedicated money for seasonal spending. Sinking Funds offer flexible event-driven savings by allocating specific amounts regularly to cover planned expenses, making them ideal for various financial goals beyond holidays.

Personalized Holiday Vaults

Personalized Holiday Vaults in Christmas Clubs offer targeted savings with fixed deposits and automated contributions, ensuring disciplined budgeting for seasonal expenses. In contrast, Sinking Funds provide flexible, incremental savings tailored to varying holiday costs, allowing adaptable fund allocation throughout the year.

Christmas Club vs Sinking Fund for savings. Infographic

moneydiff.com

moneydiff.com