An emergency fund is designed to cover unexpected expenses, providing financial security during unforeseen events like medical emergencies or job loss. A sidecar account complements this by setting aside money for planned but flexible expenses, such as travel or large purchases, without jeopardizing the emergency savings. Prioritizing an emergency fund ensures a safety net, while a sidecar account enhances savings organization and goal-specific financial planning.

Table of Comparison

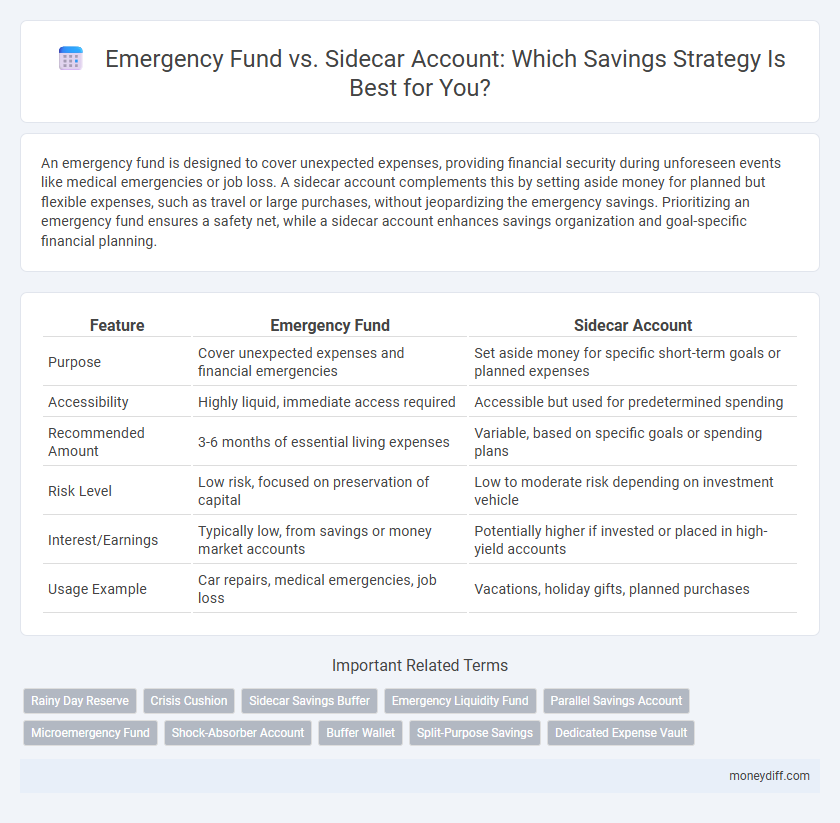

| Feature | Emergency Fund | Sidecar Account |

|---|---|---|

| Purpose | Cover unexpected expenses and financial emergencies | Set aside money for specific short-term goals or planned expenses |

| Accessibility | Highly liquid, immediate access required | Accessible but used for predetermined spending |

| Recommended Amount | 3-6 months of essential living expenses | Variable, based on specific goals or spending plans |

| Risk Level | Low risk, focused on preservation of capital | Low to moderate risk depending on investment vehicle |

| Interest/Earnings | Typically low, from savings or money market accounts | Potentially higher if invested or placed in high-yield accounts |

| Usage Example | Car repairs, medical emergencies, job loss | Vacations, holiday gifts, planned purchases |

Understanding Emergency Funds: Purpose and Importance

Emergency funds serve as a critical financial safety net, designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring financial stability without incurring debt. Unlike sidecar accounts that allocate money for planned or discretionary expenses, emergency funds prioritize liquidity and accessibility to provide immediate support when unforeseen situations arise. Maintaining an emergency fund with three to six months' worth of living expenses is essential for reducing financial stress and safeguarding long-term financial health.

What is a Sidecar Account? A Modern Approach to Savings

A Sidecar Account is a specialized savings tool designed to complement an emergency fund by segregating money for specific goals or upcoming expenses while maintaining liquidity. Unlike a traditional emergency fund that covers unforeseen financial crises, a sidecar account allows for proactive saving toward planned purchases, travel, or projects without compromising core financial security. This modern savings strategy enhances financial organization and flexibility, making it easier to manage funds for both emergencies and short-term goals.

Key Differences Between Emergency Funds and Sidecar Accounts

Emergency funds are designed to cover unplanned, essential expenses such as medical emergencies or job loss, typically held in highly liquid accounts to ensure immediate access. Sidecar accounts serve as supplementary savings buckets for short-term goals or variable expenses, providing more flexibility without compromising the core emergency fund. The primary distinction lies in purpose and accessibility: emergency funds prioritize financial security, while sidecar accounts enable targeted saving for planned expenditures.

Benefits of Maintaining an Emergency Fund

An emergency fund provides financial security by covering unexpected expenses such as medical emergencies or car repairs, reducing reliance on high-interest debt. Maintaining this fund helps preserve long-term investments by preventing impulsive withdrawals during crises. Unlike a sidecar account, which supports planned expenses, an emergency fund serves as a critical safety net for unforeseen financial challenges.

Advantages of Using a Sidecar Account for Savings

A sidecar account offers the advantage of targeted savings by allowing individuals to allocate funds for specific expenses without risking their emergency fund, enhancing financial discipline. It provides easy access to savings designated for planned purchases or short-term goals, preventing the temptation to dip into critical reserves. This separation helps maintain the integrity of the emergency fund, ensuring readiness for unforeseen financial crises while supporting strategic money management.

When Should You Use an Emergency Fund?

An emergency fund should be used exclusively for unexpected, high-priority expenses such as medical emergencies, urgent car repairs, or job loss to ensure financial stability. It typically covers three to six months of essential living costs, providing a safety net without risking financial setbacks during unforeseen events. Using the emergency fund for non-essential spending can deplete resources needed in critical situations, making a sidecar account more suitable for planned or discretionary expenses.

Ideal Scenarios for Sidecar Account Utilization

Sidecar accounts are ideal for managing irregular but anticipated expenses, such as annual insurance premiums, vehicle maintenance, or upcoming vacations, allowing for smoother cash flow without disrupting the primary emergency fund. They provide targeted savings compartments that improve financial organization and reduce the risk of dipping into essential emergency reserves. Using sidecar accounts optimizes budget allocation by segregating funds for specific goals, resulting in better preparedness for planned expenditures while maintaining the integrity of the emergency fund for true financial crises.

Emergency Fund or Sidecar Account: Which Suits Your Goals?

An emergency fund provides a financial safety net covering three to six months of essential expenses, ensuring stability during unexpected crises. A sidecar account, in contrast, serves as a separate savings pool for planned short-term goals or variable expenses, optimizing cash flow management. Choosing between the two depends on your financial priorities: prioritize an emergency fund for risk protection and opt for a sidecar account to organize and track specific savings goals.

How to Set Up and Manage Separate Savings Accounts

Establish an emergency fund by depositing three to six months' worth of essential expenses into a high-yield savings account to ensure liquidity during unexpected financial setbacks. Create a sidecar account linked to your primary checking account, allocating a fixed percentage of monthly income for specific short-term goals or irregular expenses, enabling disciplined saving without compromising emergency reserves. Regularly monitor and adjust contributions through automated transfers to maintain targeted balances and optimize financial preparedness across both accounts.

Tips for Balancing Emergency Savings and Specialized Sidecar Funds

Prioritize maintaining a liquid emergency fund covering three to six months of essential expenses to ensure financial security during unforeseen events. Allocate separate sidecar accounts for specialized savings goals like travel, home repairs, or education, which prevent the erosion of your emergency fund. Regularly review and adjust contribution amounts to balance immediate protection with future financial objectives effectively.

Related Important Terms

Rainy Day Reserve

An emergency fund is a dedicated Rainy Day Reserve designed to cover unexpected expenses such as medical emergencies or job loss, ensuring financial stability without debt. A sidecar account, while used for short-term goals or variable expenses, lacks the immediate readiness and strict liquidity criteria of a traditional emergency fund.

Crisis Cushion

An emergency fund serves as a primary crisis cushion by providing immediate financial resources to cover unexpected expenses like medical bills or job loss, ensuring liquidity and peace of mind. A sidecar account complements this by setting aside supplementary savings for less urgent, but still essential, financial needs, enhancing overall financial resilience without depleting the main emergency reserve.

Sidecar Savings Buffer

A Sidecar Savings Buffer offers a flexible, easily accessible account designed to supplement your primary Emergency Fund by covering smaller, unexpected expenses without depleting critical reserves. Unlike traditional Emergency Funds earmarked for major crises, Sidecar accounts enable targeted savings for predictable but irregular costs, enhancing overall financial resilience.

Emergency Liquidity Fund

An Emergency Liquidity Fund is a dedicated savings reserve designed to cover unexpected expenses or financial disruptions, ensuring immediate access to cash without penalties or delays. Unlike a Sidecar account, which may serve planned or discretionary spending alongside primary savings, the Emergency Liquidity Fund prioritizes financial stability by maintaining highly liquid assets for true emergencies.

Parallel Savings Account

A Parallel Savings Account, such as an Emergency Fund or Sidecar Account, allows separate allocation of funds for specific goals, ensuring quick access without impacting main savings. This strategy optimizes liquidity and financial security by maintaining distinct reserves for unexpected expenses and planned purchases.

Microemergency Fund

A Microemergency Fund, as a smaller, more accessible portion of savings compared to a traditional Emergency Fund, provides quick liquidity for minor unexpected expenses without depleting long-term financial security. Unlike a Sidecar account, which is often used for specific goals or planned expenses, a Microemergency Fund prioritizes immediate financial resilience for micro-crises, ensuring stability with minimal disruption to primary savings.

Shock-Absorber Account

A Shock-Absorber Account, often referred to as a sidecar account, functions as a secondary savings buffer designed to handle unexpected expenses without depleting the primary emergency fund, thus preserving financial stability. Unlike a traditional emergency fund, which is reserved strictly for major crises, this sidecar account offers more accessible liquidity for smaller shocks, enhancing overall savings strategy flexibility.

Buffer Wallet

A Buffer Wallet serves as a flexible savings tool designed to cover unexpected expenses, providing an accessible alternative to a traditional emergency fund by allowing incremental deposits without strict withdrawal restrictions. By contrast, a sidecar account complements core savings by targeting specific short-term goals, but lacks the immediate liquidity and broad safety net that a Buffer Wallet offers in managing financial uncertainties.

Split-Purpose Savings

An emergency fund is a high-liquidity reserve designed to cover unexpected expenses like medical bills or car repairs, ensuring financial stability during crises. A sidecar account complements this by allocating savings for targeted goals such as travel or home improvements, enabling disciplined split-purpose saving without compromising the primary emergency fund.

Dedicated Expense Vault

A Dedicated Expense Vault, such as an Emergency Fund, provides a secure financial buffer for unexpected costs, ensuring immediate access to cash without disrupting regular savings goals. In contrast, a Sidecar Account supports planned but irregular expenses, helping to manage budget flexibility without compromising long-term financial stability.

Emergency fund vs Sidecar account for savings. Infographic

moneydiff.com

moneydiff.com