Goal-Oriented Jars provide a straightforward way to allocate funds toward specific savings targets, helping maintain focus and discipline. Dynamic Sub-Savings Buckets offer flexibility by allowing adjustments in contributions based on changing priorities and financial situations. Choosing between these methods depends on whether structured goal tracking or adaptable savings management better suits your financial habits.

Table of Comparison

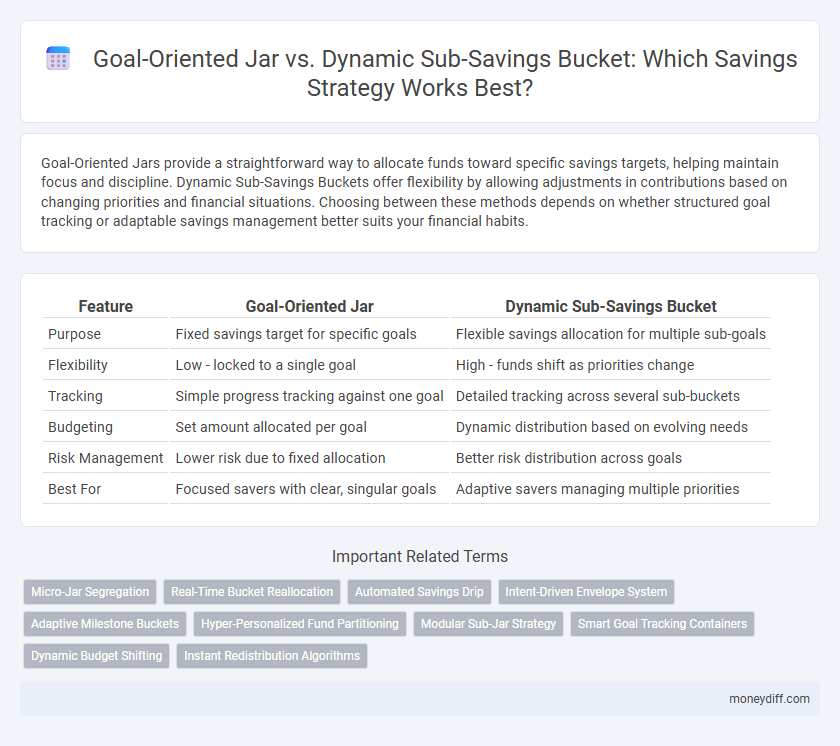

| Feature | Goal-Oriented Jar | Dynamic Sub-Savings Bucket |

|---|---|---|

| Purpose | Fixed savings target for specific goals | Flexible savings allocation for multiple sub-goals |

| Flexibility | Low - locked to a single goal | High - funds shift as priorities change |

| Tracking | Simple progress tracking against one goal | Detailed tracking across several sub-buckets |

| Budgeting | Set amount allocated per goal | Dynamic distribution based on evolving needs |

| Risk Management | Lower risk due to fixed allocation | Better risk distribution across goals |

| Best For | Focused savers with clear, singular goals | Adaptive savers managing multiple priorities |

Goal-Oriented Jar vs Dynamic Sub-Savings Bucket: An Overview

Goal-Oriented Jars segment savings into fixed categories tied to specific financial objectives, ensuring disciplined fund allocation for goals like vacations or emergency funds. Dynamic Sub-Savings Buckets offer flexible, adjustable portions within a main savings account, allowing users to reallocate funds based on changing priorities without creating separate accounts. Comparing both, Goal-Oriented Jars emphasize structure and clarity, while Dynamic Sub-Savings Buckets prioritize adaptability and ease of fund management.

Defining the Goal-Oriented Jar Approach

The Goal-Oriented Jar approach involves allocating specific amounts of money into separate jars or accounts, each dedicated to a distinct financial goal, such as a vacation, emergency fund, or new car. This method enhances financial discipline by clearly defining and tracking progress toward each goal, ensuring targeted savings without mixing funds. By contrast, Dynamic Sub-Savings Buckets allow for more flexible adjustments, but the Goal-Oriented Jar provides a structured framework that aligns with clear, measurable objectives.

Understanding Dynamic Sub-Savings Buckets

Dynamic sub-savings buckets allow users to allocate funds into flexible, purpose-driven categories that adjust based on changing financial goals and priorities. Unlike a fixed goal-oriented jar, dynamic buckets provide real-time adaptability, enabling savers to optimize cash flow for varying expenses such as vacations, emergency funds, or upcoming events. This method promotes smarter money management by aligning savings distribution with evolving financial needs and timelines.

Flexibility in Savings: Jars vs Sub-Buckets

Goal-oriented jars offer clear, specific targets that help maintain disciplined saving habits, ensuring funds are allocated towards distinct objectives. Dynamic sub-savings buckets provide greater flexibility by allowing easy adjustments and reallocation of money based on changing priorities or unexpected expenses. This adaptability makes sub-buckets ideal for managing fluctuating financial goals while preserving organized savings.

Customization for Financial Goals

Goal-Oriented Jars provide targeted customization by allowing savers to allocate funds specifically for distinct financial goals such as vacations, emergencies, or down payments, enhancing focused progress tracking. Dynamic Sub-Savings Buckets offer flexible customization within a primary savings account, enabling users to adjust allocations in real-time based on changing priorities and cash flow. Leveraging either method optimizes financial discipline by aligning savings strategies with individual goal-specific requirements and adaptability.

Tracking Progress: Visualization and Motivation

Goal-oriented jars provide clear visualization of specific targets, enhancing motivation by showing precise progress towards a fixed amount. Dynamic sub-savings buckets allow for flexible allocation across multiple goals, offering a comprehensive overview of overall savings growth. Both methods utilize visual tracking but differ in adaptability, with goal-oriented jars focusing on individual milestones and dynamic buckets promoting broader savings management.

Adapting to Changing Financial Priorities

Goal-oriented jars provide clear, targeted savings for specific objectives, ensuring disciplined progress toward fixed financial goals. Dynamic sub-savings buckets offer flexibility by allowing reallocations between priorities as circumstances shift, adapting effortlessly to evolving financial needs. Combining both methods enhances saving efficiency by balancing structured goals with adaptable strategies.

Ease of Implementation and Management

Goal-Oriented Jars simplify savings by designating fixed targets, making allocation straightforward and monitoring progress easier for users. Dynamic Sub-Savings Buckets adjust allocations automatically based on changing priorities, requiring more complex setup and ongoing management. While Goal-Oriented Jars offer user-friendly implementation and minimal management effort, Dynamic Sub-Savings Buckets provide flexibility at the cost of increased complexity.

Psychological Impact on Saving Behavior

Goal-oriented jars provide clear, singular targets that enhance motivation and commitment by visualizing specific achievements, fostering stronger emotional connections to savings goals. Dynamic sub-savings buckets offer flexibility by allowing funds to be reallocated across changing priorities, reducing friction and stress about reaching multiple objectives simultaneously. The psychological impact of goal-oriented jars tends to create more disciplined savings habits, while dynamic buckets promote adaptability and sustained engagement in long-term saving strategies.

Choosing the Right Method for Your Savings Journey

Goal-Oriented Jars provide a clear structure by allocating funds to specific savings objectives, enhancing focus and motivation for reaching targets. Dynamic Sub-Savings Buckets offer flexibility, allowing adjustments based on changing priorities and financial circumstances without rigid constraints. Selecting the right method depends on your need for structure versus adaptability in managing multiple savings goals effectively.

Related Important Terms

Micro-Jar Segregation

Goal-Oriented Jars provide a fixed, targeted approach to saving by allocating funds into specific, clearly defined micro-jars for distinct expenses, enhancing clarity and discipline. Dynamic Sub-Savings Buckets offer flexible reallocation within micro-jars, allowing adaptive prioritization based on changing financial goals and emergent needs.

Real-Time Bucket Reallocation

Goal-Oriented Jars allocate fixed amounts to predefined savings goals, limiting flexibility, while Dynamic Sub-Savings Buckets enable real-time reallocation of funds across multiple objectives based on shifting priorities and spending patterns. Real-time bucket reallocation maximizes financial efficiency by allowing users to adjust savings effortlessly, ensuring optimal fund distribution aligned with immediate needs and long-term plans.

Automated Savings Drip

Goal-oriented jars enable automated savings drip by directing fixed amounts into specific targets, ensuring disciplined progress toward financial milestones. In contrast, dynamic sub-savings buckets adapt contributions based on spending patterns, optimizing flexibility without compromising automated growth.

Intent-Driven Envelope System

An intent-driven envelope system like Goal-Oriented Jars allows savers to allocate funds specifically toward predetermined objectives, enhancing commitment and tracking efficiency. In contrast, Dynamic Sub-Savings Buckets offer flexibility by adjusting allocations based on changing priorities, supporting adaptive financial planning without rigid categorization.

Adaptive Milestone Buckets

Adaptive Milestone Buckets within Goal-Oriented Jars provide a structured approach to savings by setting fixed targets aligned with specific financial goals, enhancing motivation and progress tracking. In contrast, Dynamic Sub-Savings Buckets offer flexible allocation that adjusts based on changing priorities, enabling responsive management but potentially sacrificing the clarity and focus of milestone-driven objectives.

Hyper-Personalized Fund Partitioning

Goal-oriented jars enable hyper-personalized fund partitioning by designating specific savings targets, fostering disciplined allocation toward defined financial objectives. Dynamic sub-savings buckets offer flexible, real-time adjustments to fund distribution, optimizing cash flow and adapting to changing priorities without compromising overall savings goals.

Modular Sub-Jar Strategy

A modular sub-jar strategy enhances savings efficiency by dividing funds into specific, goal-oriented jars, allowing precise tracking and allocation to distinct financial objectives. This method contrasts with dynamic sub-savings buckets by providing fixed, well-defined targets that promote disciplined saving habits and clear progress measurement.

Smart Goal Tracking Containers

Smart Goal Tracking Containers like Goal-Oriented Jars provide a structured approach to savings by allocating fixed amounts towards specific objectives, enhancing discipline and clarity. In contrast, Dynamic Sub-Savings Buckets adapt fluidly to changing priorities, allowing flexible fund redistribution across multiple goals based on evolving financial needs.

Dynamic Budget Shifting

Dynamic budget shifting in a Dynamic Sub-Savings Bucket enables flexible allocation of funds across multiple saving goals, optimizing financial resources in real-time based on changing priorities. Unlike a Goal-Oriented Jar with fixed targets, this approach enhances adaptability and efficiency by automatically redistributing savings to meet evolving needs and maximize overall wealth growth.

Instant Redistribution Algorithms

Goal-oriented jars use fixed allocation rules to distribute savings toward specific targets, optimizing discipline and clarity but often lacking flexibility in reallocating funds. Dynamic sub-savings buckets leverage instant redistribution algorithms to automatically adjust and reallocate funds across multiple goals, enhancing adaptability and maximizing overall savings efficiency.

Goal-Oriented Jar vs Dynamic Sub-Savings Bucket for savings. Infographic

moneydiff.com

moneydiff.com