Goal-based savings provide a clear financial target, helping individuals stay motivated by tracking progress toward specific objectives like vacations or emergencies. Micro-saving apps automate small transfers from daily transactions, making saving effortless and consistent without requiring large upfront contributions. Combining these methods can enhance financial discipline by blending purposeful saving goals with the simplicity of incremental deposits.

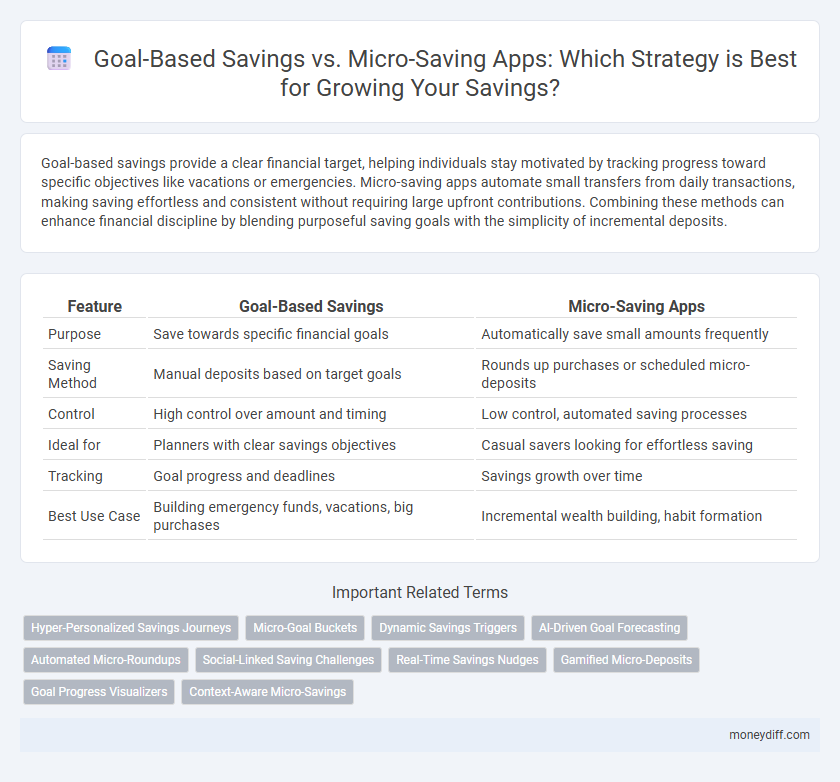

Table of Comparison

| Feature | Goal-Based Savings | Micro-Saving Apps |

|---|---|---|

| Purpose | Save towards specific financial goals | Automatically save small amounts frequently |

| Saving Method | Manual deposits based on target goals | Rounds up purchases or scheduled micro-deposits |

| Control | High control over amount and timing | Low control, automated saving processes |

| Ideal for | Planners with clear savings objectives | Casual savers looking for effortless saving |

| Tracking | Goal progress and deadlines | Savings growth over time |

| Best Use Case | Building emergency funds, vacations, big purchases | Incremental wealth building, habit formation |

Understanding Goal-Based Savings

Goal-based savings prioritize setting specific financial targets, such as saving for a vacation, emergency fund, or down payment, which helps improve motivation and tracking progress. Unlike micro-saving apps that focus on small, frequent deposits often rounded-up from daily transactions, goal-based savings offer structured planning and personalized timelines to achieve measurable outcomes. This targeted approach enhances financial discipline by aligning saving habits directly with meaningful life objectives.

What Are Micro-Saving Apps?

Micro-saving apps automate small, frequent transfers from a user's checking account into a separate savings account, often rounding up everyday purchases to the nearest dollar and saving the difference. These apps leverage behavioral finance principles to encourage consistent saving habits with minimal effort, appealing to users who find traditional goal-based savings plans too rigid or demanding. Popular examples include Acorns and Qapital, which integrate with bank accounts and use algorithms to optimize saving amounts based on user spending patterns.

How Goal-Based Savings Plans Work

Goal-based savings plans work by allowing individuals to set specific financial targets, such as a vacation, emergency fund, or down payment, and allocate regular contributions toward these objectives. These plans use structured timelines and automated transfers to keep savings on track, often providing progress tracking and adjustments based on user behavior. Compared to micro-saving apps that round up transactions or save small amounts, goal-based savings emphasize strategic accumulation aligned with defined milestones.

Key Features of Micro-Saving Apps

Micro-saving apps automate savings by rounding up everyday purchases to the nearest dollar and transferring the difference into a dedicated savings account, promoting effortless incremental savings. Key features include customizable savings goals, real-time transaction tracking, and low minimum transfer amounts to accommodate various income levels. Integration with multiple bank accounts and personalized notifications enhance user engagement and financial discipline.

Benefits of Setting Savings Goals

Setting savings goals enhances financial discipline by providing clear targets and motivation, which increases the likelihood of consistent saving behavior. Goal-based savings allow for personalized planning towards specific objectives such as emergency funds, vacations, or retirement, improving overall financial security. In contrast to micro-saving apps that round up transactions, goal-based strategies offer measurable progress and better alignment with long-term financial success.

Pros and Cons of Micro-Saving Apps

Micro-saving apps automate savings by rounding up everyday purchases, making it easier to accumulate funds without significant effort, which appeals to users looking for convenience and low commitment. However, these apps may encourage small, frequent transactions that can add up to higher fees or dilute savings growth compared to larger, goal-based savings deposits. Users may also find micro-saving apps less effective for reaching substantial financial targets due to limited control over savings allocation and slower capital accumulation.

Which Method Suits Different Financial Profiles?

Goal-based savings plans cater to individuals with clear financial targets, such as buying a home or funding education, by providing structured strategies that align with specific timelines and amounts. Micro-saving apps suit users seeking flexible, low-commitment options, ideal for those with variable incomes or just starting to build a savings habit through small, automated transfers. Choosing between these methods depends on financial stability, savings goals, and personal discipline, with goal-based plans favoring disciplined savers aiming for larger objectives and micro-savings supporting incremental progress for cautious or irregular earners.

Tracking Progress: Goal-Based vs Micro-Saving

Goal-based savings platforms offer detailed progress tracking by allowing users to set specific financial objectives and monitor milestones toward those targets. Micro-saving apps automatically round up purchases or transfer small amounts, providing less granular but consistent tracking of incremental savings growth. While goal-based tools emphasize clear, purpose-driven visualization, micro-saving apps excel in effortless accumulation with simplified progress feedback.

Security and Accessibility in Both Approaches

Goal-based savings platforms emphasize robust encryption and multi-factor authentication to ensure account security while offering user-friendly interfaces accessible via web and mobile apps. Micro-saving apps provide secure transactions through bank-level security protocols and integrate seamlessly with users' everyday spending, allowing effortless access through smartphones. Both approaches prioritize protecting financial data but differ in accessibility, with goal-based solutions catering to structured, long-term saving needs and micro-saving apps focusing on instant, small-scale deposits.

Choosing the Best Savings Strategy for You

Goal-based savings strategies prioritize setting specific financial targets, allowing individuals to allocate funds systematically toward objectives like emergency funds or vacations. Micro-saving apps automatically round up purchases or transfer small amounts regularly, promoting consistent saving habits without requiring large initial deposits. Evaluating your spending behavior and financial discipline can help determine whether structured goal-setting or effortless micro-savings best supports your long-term financial growth.

Related Important Terms

Hyper-Personalized Savings Journeys

Goal-based savings platforms use hyper-personalized algorithms to tailor financial milestones and automated contributions aligned with individual income, spending habits, and future plans. In contrast, micro-saving apps enhance user engagement by instantly rounding up transactions and leveraging behavioral nudges to create seamless, incremental savings tailored to daily cash flow patterns.

Micro-Goal Buckets

Micro-saving apps that utilize micro-goal buckets enable users to allocate small, frequent deposits toward specific financial objectives, enhancing motivation and tracking efficiency. These apps optimize savings habits by breaking down large goals into manageable amounts, increasing the likelihood of consistent contributions compared to traditional goal-based savings methods.

Dynamic Savings Triggers

Goal-based savings utilize dynamic savings triggers by analyzing individual financial goals and adjusting contributions automatically based on income fluctuations and spending patterns. Micro-saving apps implement real-time transaction monitoring to round up purchases and transfer small amounts to savings, optimizing growth through personalized, automated prompts.

AI-Driven Goal Forecasting

AI-driven goal forecasting in goal-based savings platforms uses machine learning algorithms to predict and optimize users' savings timelines, enhancing accuracy in reaching financial targets. Micro-saving apps, while convenient for accumulating small amounts, typically lack advanced AI models, making goal-based platforms more effective for personalized financial planning and milestone achievement.

Automated Micro-Roundups

Automated micro-roundups in micro-saving apps incrementally round up everyday purchases to the nearest dollar, funneling small amounts into savings without user intervention. This approach contrasts with goal-based savings by promoting consistent, effortless accumulation, ideal for users seeking gradual wealth building rather than targeted financial milestones.

Social-Linked Saving Challenges

Goal-based savings strategies leverage social-linked saving challenges to boost motivation through community accountability and friendly competition, resulting in higher engagement and consistent saving habits. Micro-saving apps integrate these challenges by enabling automated small deposits while fostering peer interactions, effectively increasing users' overall savings over time.

Real-Time Savings Nudges

Goal-based savings offer structured financial growth through targeted milestones, enhancing motivation by visualizing progress, while micro-saving apps leverage real-time savings nudges to prompt frequent, small deposits that accumulate effortlessly; integrating real-time behavioral triggers in goal-based platforms can optimize consistent savings habits and increase overall financial resilience.

Gamified Micro-Deposits

Gamified micro-deposit apps enhance user engagement by turning small, frequent savings into interactive challenges, promoting consistent habit formation and accelerating goal achievement. Unlike goal-based savings that emphasize long-term targets, these apps leverage behavioral economics and instant rewards to motivate users through immediate feedback and gradual accumulation.

Goal Progress Visualizers

Goal-Based Savings tools offer visual progress trackers that display milestones and completion percentages, enhancing motivation by making savings objectives tangible. Micro-Saving apps integrate real-time visualizers that update incrementally with each small deposit, reinforcing consistent saving habits through immediate feedback.

Context-Aware Micro-Savings

Context-aware micro-saving apps analyze spending patterns and financial behavior to automate small, frequent transfers into savings, fostering consistent growth without impacting daily budgets. Goal-based savings prioritize specific targets and timelines, while context-aware micro-saving apps enhance flexibility by adapting savings amounts in real-time to changes in income and expenses, improving user engagement and financial resilience.

Goal-Based Savings vs Micro-Saving Apps for savings. Infographic

moneydiff.com

moneydiff.com