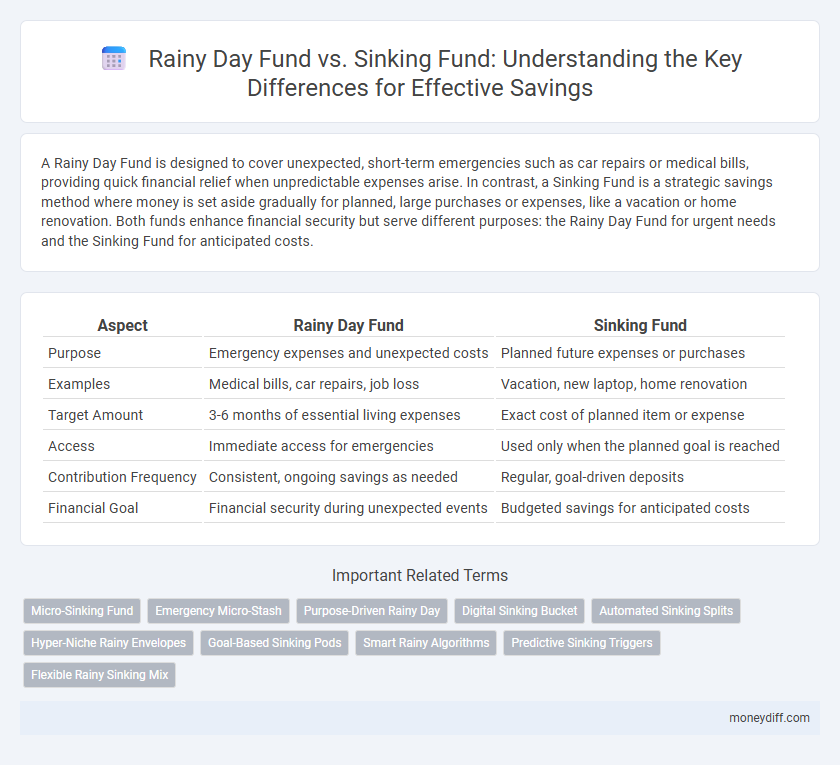

A Rainy Day Fund is designed to cover unexpected, short-term emergencies such as car repairs or medical bills, providing quick financial relief when unpredictable expenses arise. In contrast, a Sinking Fund is a strategic savings method where money is set aside gradually for planned, large purchases or expenses, like a vacation or home renovation. Both funds enhance financial security but serve different purposes: the Rainy Day Fund for urgent needs and the Sinking Fund for anticipated costs.

Table of Comparison

| Aspect | Rainy Day Fund | Sinking Fund |

|---|---|---|

| Purpose | Emergency expenses and unexpected costs | Planned future expenses or purchases |

| Examples | Medical bills, car repairs, job loss | Vacation, new laptop, home renovation |

| Target Amount | 3-6 months of essential living expenses | Exact cost of planned item or expense |

| Access | Immediate access for emergencies | Used only when the planned goal is reached |

| Contribution Frequency | Consistent, ongoing savings as needed | Regular, goal-driven deposits |

| Financial Goal | Financial security during unexpected events | Budgeted savings for anticipated costs |

Understanding Rainy Day Funds: What Are They?

Rainy day funds are emergency savings set aside to cover unexpected, short-term expenses such as car repairs or medical bills, providing financial security and minimizing debt reliance. Unlike sinking funds, which are allocated for planned, specific future expenses like vacations or large purchases, rainy day funds offer flexibility for unplanned financial disruptions. Maintaining a rainy day fund typically involves saving three to six months' worth of essential living expenses to ensure preparedness for sudden setbacks.

Sinking Funds Explained: Purpose and Benefits

Sinking funds are dedicated savings accounts designed to accumulate money for specific future expenses, such as home repairs, vacations, or car maintenance. They help individuals manage large, planned costs by breaking them into manageable, regular contributions, reducing financial strain and avoiding debt. Unlike rainy day funds, which cover unexpected emergencies, sinking funds provide structured savings for anticipated, non-emergency expenditures.

Key Differences Between Rainy Day and Sinking Funds

A Rainy Day Fund is designed for unexpected, short-term emergencies like car repairs or medical bills, offering quick access to cash without penalties. In contrast, a Sinking Fund is a planned savings strategy intended for specific, anticipated large expenses such as a vacation or a down payment, typically built over months or years. The key difference lies in purpose and timeline: Rainy Day Funds provide financial security for unforeseen events, while Sinking Funds enable disciplined saving toward predetermined goals.

When to Use a Rainy Day Fund vs a Sinking Fund

A Rainy Day Fund is best used for unexpected, short-term emergencies like medical expenses or car repairs, providing immediate financial security. A Sinking Fund is ideal for planned, large purchases or debts, allowing systematic savings over time to avoid borrowing. Prioritize a Rainy Day Fund for liquidity and an Sinking Fund for targeted financial goals.

How to Set Up a Rainy Day Fund for Emergencies

Establishing a rainy day fund requires calculating three to six months' worth of essential expenses, including rent, utilities, groceries, and transportation costs, to ensure adequate financial security during emergencies. Use a separate high-yield savings account to keep funds liquid and accessible, while avoiding temptation to spend on non-emergencies. Regularly contribute fixed amounts from each paycheck, adjusting savings goals based on changes in income or household expenses to maintain sufficient coverage.

Planning Your Sinking Fund Goals Effectively

Planning your sinking fund goals effectively involves setting specific timeframes and target amounts for anticipated expenses, such as home repairs, vacations, or debt repayments, ensuring disciplined monthly contributions that align with your budget. Prioritize categorizing each sinking fund by purpose and tracking progress regularly to avoid overspending and meet your financial objectives without disrupting your emergency savings. Allocating funds strategically helps maintain liquidity for both planned costs and unforeseen financial challenges, optimizing your overall savings strategy.

Pros and Cons: Rainy Day Funds vs Sinking Funds

Rainy day funds provide immediate access to cash for unexpected expenses, promoting financial security but may be underutilized if overly cautious. Sinking funds allow for targeted savings toward specific future expenses, enhancing budget discipline yet requiring careful planning and regular contributions. Both strategies optimize savings, balancing liquidity with long-term financial goals depending on individual needs.

Common Mistakes to Avoid with Both Funds

Common mistakes when managing Rainy Day Funds and Sinking Funds include failing to clearly define the purpose of each fund, leading to inappropriate withdrawals and depletion. Overestimating monthly expenses or underfunding can result in insufficient reserves during emergencies or planned expenses. Ignoring regular contributions and periodic reviews reduces the effectiveness of both funds in providing financial security and meeting long-term goals.

Integrating Both Funds Into Your Budget Strategy

Integrating a Rainy Day Fund and a Sinking Fund into your budget strategy enhances financial stability by addressing both unexpected expenses and planned future costs. Allocating a specific percentage of your income to each fund ensures balanced growth, with the Rainy Day Fund providing emergency liquidity and the Sinking Fund enabling organized savings for large purchases or debt repayment. This dual-fund approach reduces financial stress and improves overall money management by clearly defining short-term and long-term savings goals.

Choosing the Right Savings Method for Your Needs

A Rainy Day Fund provides quick access to cash for unexpected expenses, ensuring financial security during emergencies, while a Sinking Fund is strategically planned for specific future purchases or debt repayment, promoting disciplined savings. Evaluating your financial goals and the timing of your anticipated expenses helps determine whether the flexibility of a Rainy Day Fund or the targeted growth of a Sinking Fund better suits your needs. Prioritize liquidity and emergency preparedness with a Rainy Day Fund, or focus on planned savings with a Sinking Fund to optimize your financial strategy.

Related Important Terms

Micro-Sinking Fund

A Rainy Day Fund covers unexpected, short-term emergencies like medical bills or car repairs, while a Micro-Sinking Fund is a targeted savings strategy for small, planned expenses, accumulated gradually to avoid financial strain. Establishing a Micro-Sinking Fund optimizes cash flow by allocating specific amounts regularly, ensuring readiness for upcoming minor purchases or periodic bills without disrupting the overall budget.

Emergency Micro-Stash

An Emergency Micro-Stash within a Rainy Day Fund provides immediate access to small, unexpected expenses like minor car repairs or medical co-pays, offering financial flexibility without disrupting long-term goals. Unlike a Sinking Fund, which targets planned purchases with a specific timeline, this micro-stash emphasizes liquidity and rapid availability for true emergencies, ensuring peace of mind in everyday financial challenges.

Purpose-Driven Rainy Day

A Rainy Day Fund serves as a flexible financial cushion for unexpected emergencies or short-term setbacks, ensuring immediate access to cash without disrupting long-term goals. In contrast, a Sinking Fund is a purpose-driven savings account designed to accumulate funds over time for specific expenses or planned purchases, promoting disciplined financial planning and goal achievement.

Digital Sinking Bucket

A Digital Sinking Bucket offers a strategic advantage over traditional Rainy Day Funds by enabling customizable, goal-specific savings with automated deposits and real-time tracking. This approach enhances financial discipline and provides clearer visibility into progress, making it easier to allocate funds for planned expenses or emergencies without commingling resources.

Automated Sinking Splits

Automated sinking splits enhance disciplined savings by allocating fixed amounts periodically into a sinking fund, ensuring timely accumulation for specific future expenses unlike a rainy day fund, which serves as an emergency cash reserve without scheduled contributions. This method optimizes financial planning by targeting predetermined liabilities, reducing the risk of last-minute borrowing or liquidity crunches.

Hyper-Niche Rainy Envelopes

Rainy Day Fund savings focus on covering unexpected, urgent expenses like medical emergencies or urgent home repairs, while Sinking Funds allocate money for planned future purchases or expenses such as vacations or car replacements. Hyper-Niche Rainy Envelopes refine these concepts by creating highly specific subcategories within a Rainy Day Fund, enabling targeted savings for narrowly defined risks and enhancing financial preparedness.

Goal-Based Sinking Pods

Goal-based sinking funds target specific future expenses by setting aside fixed amounts regularly, enhancing financial discipline and preventing premature use of savings compared to a general rainy day fund. This strategic allocation aligns savings directly with anticipated costs, optimizing fund growth and ensuring timely availability.

Smart Rainy Algorithms

Rainy Day Funds provide emergency cash reserves for unexpected expenses, while Sinking Funds allocate specific amounts toward planned future costs, enabling controlled budgeting. Smart Rainy Algorithms optimize savings by dynamically adjusting contributions based on spending patterns and predictive analytics, ensuring efficient fund management and financial stability.

Predictive Sinking Triggers

Rainy Day Funds are designed for unexpected emergencies without specific triggers, whereas Sinking Funds utilize predictive sinking triggers by allocating savings for planned future expenses like insurance premiums or annual memberships. This approach ensures targeted financial preparation, enhancing cash flow management and reducing the risk of sudden financial strain.

Flexible Rainy Sinking Mix

A Flexible Rainy Sinking Mix combines the liquidity of a Rainy Day Fund, providing quick access to emergency cash, with the structured approach of a Sinking Fund, which allocates savings for specific future expenses. This hybrid strategy enhances financial resilience by balancing immediate accessibility and targeted saving goals, optimizing overall savings efficiency.

Rainy Day Fund vs Sinking Fund for savings. Infographic

moneydiff.com

moneydiff.com