The Envelope System offers a hands-on approach to budgeting by allocating cash into labeled envelopes, promoting mindful spending and disciplined savings. In contrast, AI-driven automated savings leverage algorithms to analyze spending habits, automatically transferring optimal amounts into savings with minimal effort. Combining both methods can enhance financial control and efficiency, balancing conscious budgeting with smart automation.

Table of Comparison

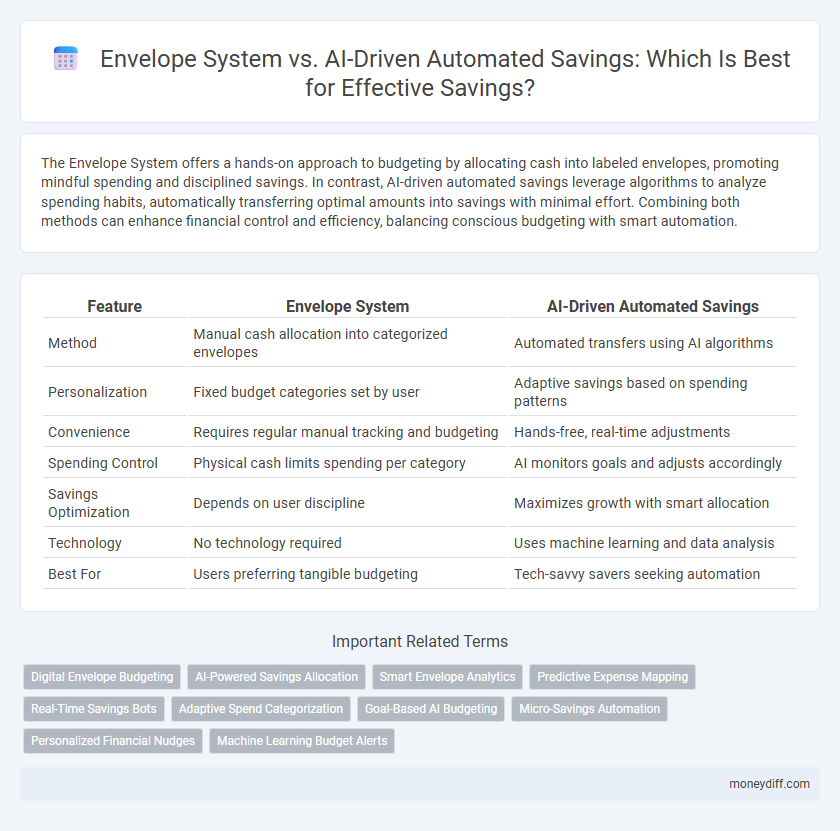

| Feature | Envelope System | AI-Driven Automated Savings |

|---|---|---|

| Method | Manual cash allocation into categorized envelopes | Automated transfers using AI algorithms |

| Personalization | Fixed budget categories set by user | Adaptive savings based on spending patterns |

| Convenience | Requires regular manual tracking and budgeting | Hands-free, real-time adjustments |

| Spending Control | Physical cash limits spending per category | AI monitors goals and adjusts accordingly |

| Savings Optimization | Depends on user discipline | Maximizes growth with smart allocation |

| Technology | No technology required | Uses machine learning and data analysis |

| Best For | Users preferring tangible budgeting | Tech-savvy savers seeking automation |

Introduction: Comparing Traditional Envelope System and AI-Driven Automated Savings

The traditional Envelope System relies on physically dividing cash into labeled envelopes to control spending and prioritize savings goals. In contrast, AI-Driven Automated Savings uses algorithms to analyze spending patterns and automatically allocate funds into digital savings buckets, optimizing savings efficiency. This technological approach offers personalized insights and real-time adjustments, enhancing financial discipline beyond manual budgeting methods.

How the Envelope System Works for Savings

The Envelope System organizes savings by allocating cash into physical envelopes designated for specific expenses or savings goals, promoting disciplined spending and clear budget tracking. Each envelope represents a category, such as groceries or emergency funds, encouraging users to only spend what is physically available, which reduces overspending. This tangible method enhances financial accountability and helps individuals manage their money by visually separating funds for different purposes.

What Is AI-Driven Automated Savings?

AI-driven automated savings use machine learning algorithms to analyze spending patterns and income, automatically transferring optimal amounts into savings accounts. This method adapts in real-time, optimizing savings goals without manual effort, reducing the risk of overspending. Unlike the Envelope System, which relies on physical or digital budget allocation, AI-driven savings offer personalized, dynamic management that enhances financial discipline and growth.

Key Benefits of the Envelope System

The Envelope System offers a tangible method for budgeting by allocating physical cash into designated categories, enhancing spending awareness and control. This hands-on approach reduces overspending and fosters disciplined financial habits. By visually compartmentalizing funds, users gain immediate clarity on their available resources for each expense type.

Advantages of AI-Driven Automated Savings Solutions

AI-driven automated savings solutions offer unparalleled precision by analyzing spending patterns and adjusting savings contributions in real-time to maximize growth. These systems reduce human error and discipline lapses, ensuring consistent savings without manual intervention. Integration with multiple financial accounts and personalized goal-setting features enhance efficiency and user experience beyond traditional envelope systems.

Flexibility and Control: Manual vs. Automated Methods

The Envelope System offers greater flexibility and control by allowing users to manually allocate cash into specific categories, which helps track spending and adjust budgets in real time. AI-driven automated savings rely on algorithms to analyze spending patterns and automatically transfer funds, reducing the need for active management but limiting immediate user intervention. Manual methods empower personalized adjustments, while automation provides consistent discipline, blending convenience with structured savings.

Savings Discipline: Tangibility vs. Technology

The Envelope System emphasizes savings discipline through tangible cash allocation, enhancing awareness and control over spending by physically segregating funds. In contrast, AI-Driven Automated Savings leverage technology to analyze spending patterns and automate transfers, promoting consistent saving without manual intervention. Both approaches foster savings discipline, with the Envelope System relying on physical interaction and AI systems emphasizing seamless, data-driven management.

Security and Privacy: Physical Cash vs. Digital Platforms

The Envelope System securely stores physical cash, minimizing exposure to digital hacking risks and providing tangible control over savings. AI-driven automated savings platforms use encryption and multi-factor authentication to protect user data but remain vulnerable to cyberattacks and data breaches. Users seeking enhanced security and privacy must weigh the tactile safety of cash against the sophisticated safeguards of digital savings technologies.

Efficiency and Customization: Which System Boosts Savings Faster?

The Envelope System offers a tangible, budget-focused approach by allocating cash into designated categories, enhancing spending discipline and preventing overspending. AI-driven automated savings leverage machine learning to analyze spending habits, predict cash flow, and dynamically adjust savings contributions, maximizing efficiency and optimizing customization in real-time. While the Envelope System relies on manual tracking and fixed limits, AI-driven solutions boost savings faster through personalized automation and continuous adaptation to changes in financial behavior.

Choosing the Right Savings Method: Which Fits Your Financial Goals?

The Envelope System offers a hands-on approach to budgeting by physically allocating cash into designated categories, ideal for those who prefer tactile control and clear spending limits. AI-driven automated savings leverage algorithms to analyze spending habits and automatically transfer optimal amounts into savings, catering to users seeking convenience and personalized financial growth. Selecting the right savings method depends on your financial goals, whether it's disciplined budgeting for expense management or dynamic, data-driven saving strategies for maximizing returns.

Related Important Terms

Digital Envelope Budgeting

Digital Envelope Budgeting allocates funds into virtual categories for precise expense management, promoting disciplined savings by limiting spending to preset budgets. AI-Driven Automated Savings leverages machine learning algorithms to analyze spending patterns and automatically transfer optimal savings amounts, offering a personalized and adaptive approach to grow savings effortlessly.

AI-Powered Savings Allocation

AI-powered savings allocation uses advanced algorithms to analyze spending patterns and automatically distribute funds into designated savings envelopes, maximizing efficiency and personalized financial goals. This method outperforms traditional envelope systems by providing real-time adjustments and predictive insights, ensuring optimized savings growth without manual intervention.

Smart Envelope Analytics

Smart Envelope Analytics enhances the traditional Envelope System by using AI-driven algorithms to analyze spending patterns and optimize budget allocations across categories, ensuring more precise and efficient savings without manual adjustments. This technology leverages real-time data to predict future expenses and automate fund transfers, maximizing savings potential and financial discipline.

Predictive Expense Mapping

The Envelope System uses physical or digital categories to allocate funds for specific expenses, promoting disciplined saving by limiting spending to predefined budgets. AI-driven automated savings leverage predictive expense mapping to analyze spending patterns and forecast future expenses, enabling dynamic fund allocation that maximizes savings without manual intervention.

Real-Time Savings Bots

Real-time savings bots within AI-driven automated savings optimize fund allocation by instantly analyzing spending patterns, enabling precise transfers into designated envelopes without manual intervention. This dynamic approach outperforms the traditional envelope system by enhancing efficiency and accuracy in budgeting and saving goals.

Adaptive Spend Categorization

The Envelope System relies on predefined budget categories with fixed cash allocations, limiting flexibility in changing spending habits, whereas AI-Driven Automated Savings use adaptive spend categorization to analyze transaction patterns in real time, enabling dynamic budget adjustments. This AI-powered approach enhances personalized savings by automatically reallocating funds based on evolving spending behavior, optimizing financial discipline and goal achievement.

Goal-Based AI Budgeting

The Envelope System allocates cash into physical or digital categories for disciplined spending, while AI-driven automated savings leverage goal-based budgeting algorithms to dynamically adjust saving amounts based on real-time income and spending patterns. AI budgeting enhances financial efficiency by personalizing savings strategies, optimizing goal achievement timelines, and minimizing manual effort compared to traditional envelope methods.

Micro-Savings Automation

The Envelope System allocates physical or digital funds into predefined categories to control spending, promoting disciplined savings habits through manual tracking. In contrast, AI-Driven Automated Savings employs algorithms to analyze spending patterns and automatically transfer micro-savings from checking accounts, optimizing small, frequent deposits without user intervention for enhanced accumulation efficiency.

Personalized Financial Nudges

The Envelope System allocates budget into physical or digital categories, helping users control spending through clear limits, while AI-Driven Automated Savings use personalized financial nudges based on spending habits and income patterns to optimize savings without constant manual tracking. AI systems analyze real-time data to deliver tailored reminders and adjust savings targets dynamically, enhancing user engagement and maximizing saving efficiency compared to static envelope methods.

Machine Learning Budget Alerts

Machine learning budget alerts in AI-driven automated savings analyze spending patterns to provide real-time, personalized notifications that help optimize savings without manual tracking. Unlike the envelope system's rigid cash allocation, AI adapts dynamically to financial behavior, enhancing saving efficiency through predictive insights and automatic adjustments.

Envelope System vs AI-Driven Automated Savings for savings. Infographic

moneydiff.com

moneydiff.com