Manual savings require consistent effort and discipline to set aside money regularly, often leading to irregular contributions that can slow down financial growth. Automated round-up savings simplify the process by rounding up purchases to the nearest dollar and transferring the difference into a savings account, promoting effortless and consistent accumulation. This automated approach leverages small, frequent contributions to build savings steadily without the need for active management.

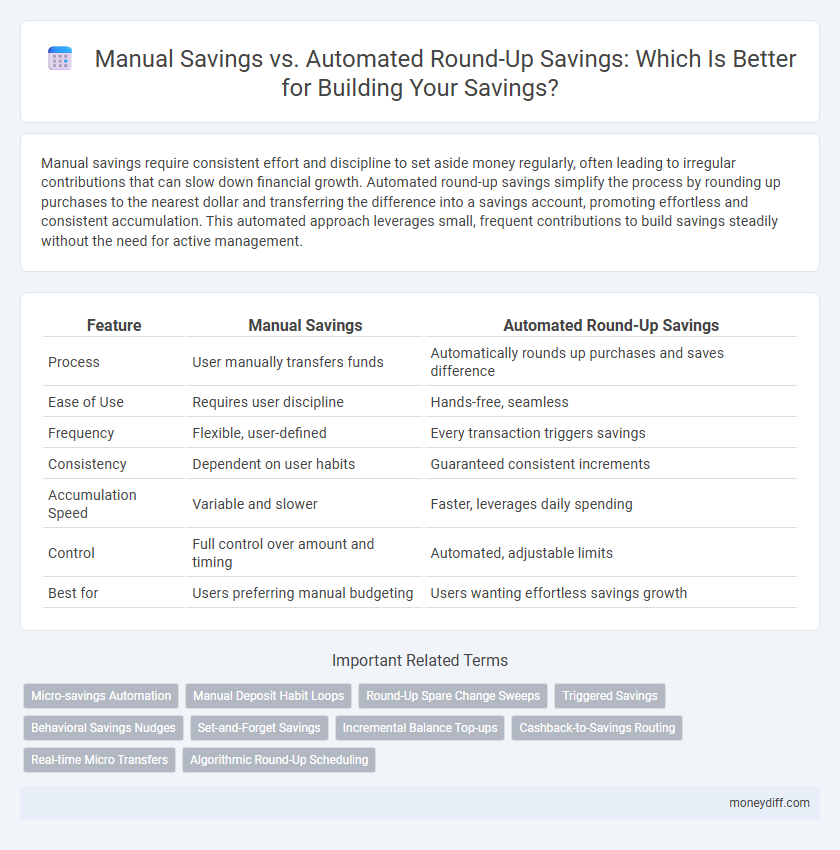

Table of Comparison

| Feature | Manual Savings | Automated Round-Up Savings |

|---|---|---|

| Process | User manually transfers funds | Automatically rounds up purchases and saves difference |

| Ease of Use | Requires user discipline | Hands-free, seamless |

| Frequency | Flexible, user-defined | Every transaction triggers savings |

| Consistency | Dependent on user habits | Guaranteed consistent increments |

| Accumulation Speed | Variable and slower | Faster, leverages daily spending |

| Control | Full control over amount and timing | Automated, adjustable limits |

| Best for | Users preferring manual budgeting | Users wanting effortless savings growth |

Understanding Manual Savings: Traditional Approaches

Manual savings involve deliberately setting aside a specific amount of money based on personal budgeting decisions, typically requiring consistent discipline and time management. This traditional approach allows individuals to have full control over their savings schedule and amounts, but it may lead to irregular contributions due to forgetfulness or fluctuating motivation. Understanding manual savings highlights the importance of conscious financial planning and self-regulation in achieving savings goals.

How Automated Round-Up Savings Work

Automated round-up savings work by linking your debit or credit card to a savings account, then rounding up each purchase to the nearest dollar and transferring the difference into your savings. This method effortlessly accumulates small amounts over time, maximizing savings growth with minimal user effort. Studies show that users can save up to 15% more annually compared to manual saving methods due to consistent micro-transactions.

Benefits of Manual Savings Methods

Manual savings methods offer precise control over budgeting and spending habits, allowing individuals to allocate specific amounts based on their financial goals and priorities. This approach fosters a disciplined saving behavior by requiring active decision-making, which can increase awareness of personal finances. Manual savings also provide flexibility, enabling savers to adjust contributions in response to changing income or expenses without relying on automated systems.

Advantages of Automated Round-Up Savings

Automated round-up savings effortlessly boost your funds by rounding up everyday purchases to the nearest dollar and transferring the difference to your savings account, ensuring consistent growth without conscious effort. This method enhances saving discipline, minimizes the temptation to spend excess cash, and leverages small amounts that accumulate significantly over time. Integration with mobile apps provides real-time tracking and personalized insights, making automated round-up savings a practical and efficient strategy for building a robust financial cushion.

Comparing Control: Manual vs Automated Savings

Manual savings provide users with full control over when and how much money to save, allowing for tailored financial decisions based on immediate needs and goals. Automated round-up savings reduce the need for active management by automatically transferring spare change from everyday purchases into a savings account, promoting consistency and discipline without user intervention. While manual savings offer flexibility, automated round-ups ensure steady growth by leveraging habitual spending patterns, resulting in a balanced approach to building a savings buffer.

Psychological Impact of Each Saving Method

Manual savings enhance conscious spending awareness by requiring active decision-making, which can increase feelings of control and commitment to financial goals. Automated round-up savings leverage behavioral psychology by minimizing decision fatigue and making saving effortless, often leading to higher saving consistency. Both methods influence saving habits differently: manual savings promote mindfulness and discipline, while automated round-ups encourage seamless accumulation through subtle, incremental contributions.

Ease of Use: Manual Input versus Automatic Round-Up

Manual savings require users to actively input specific amounts, which can lead to inconsistent saving habits due to forgetfulness or lack of discipline. Automated round-up savings leverage technology to instantly save small amounts by rounding up everyday purchases, providing a seamless and effortless method to accumulate funds over time. This automatic process enhances user convenience and promotes consistent savings without requiring ongoing manual effort.

Security and Privacy in Manual and Automated Savings

Manual savings methods offer greater control over security and privacy by allowing users to directly manage their transactions without sharing data with third-party apps. Automated round-up savings rely on linking bank accounts and financial data to apps, which may introduce privacy risks through data sharing and potential breaches. Choosing manual savings reduces exposure to unauthorized access, while automated systems provide convenience with a trade-off in data security and privacy management.

Ideal Users: Who Should Choose Manual or Automated Savings?

Manual savings benefit individuals who prefer full control over the amount and timing of deposits, such as those with irregular incomes or specific savings goals requiring flexibility. Automated round-up savings suit users seeking effortless, consistent growth by linking savings to everyday purchases, ideal for busy professionals or those new to saving. Choosing between manual and automated methods depends on one's budgeting style, income stability, and commitment to regular saving habits.

Maximizing Savings: Combining Manual and Automated Strategies

Maximizing savings involves leveraging both manual contributions and automated round-up savings to accelerate financial growth. Manual savings allow for strategic, larger deposits based on income and budget fluctuations, while automated round-ups provide consistent, incremental boosts by rounding up everyday purchases to the nearest dollar and saving the difference. Combining these strategies creates a disciplined yet flexible saving routine, optimizing both intentional deposits and passive savings accumulation for long-term financial stability.

Related Important Terms

Micro-savings Automation

Micro-savings automation leverages automated round-up savings to effortlessly transfer spare change from daily transactions into savings accounts, enhancing consistent accumulation without requiring manual input. This method outperforms manual savings by reducing the likelihood of missed contributions and promoting habitual financial growth through seamless, incremental deposits.

Manual Deposit Habit Loops

Manual savings rely on habit loops formed through conscious, repetitive actions like setting aside a fixed amount regularly, which reinforces financial discipline and self-control. Unlike automated round-up savings that transfer spare change passively, manual deposits engage cognitive processes that strengthen long-term saving habits and enhance personal accountability.

Round-Up Spare Change Sweeps

Round-Up Spare Change Sweeps automatically round up everyday purchases to the nearest dollar, transferring the difference into a savings account, enhancing consistent saving without manual effort. This automated approach leverages micro-savings to build substantial reserves over time, outperforming traditional manual savings methods that rely solely on deliberate contributions.

Triggered Savings

Triggered savings in manual savings require conscious effort to transfer funds regularly, resulting in inconsistent saving patterns. Automated round-up savings leverage technology to round up purchases and deposit the difference, ensuring seamless, consistent contributions without user intervention.

Behavioral Savings Nudges

Manual savings rely on conscious, deliberate actions to set aside funds, often causing inconsistent accumulation due to fluctuating motivation levels. Automated round-up savings leverage behavioral nudges by effortlessly rounding purchases to the nearest dollar and funneling the difference into savings, promoting steady growth with minimal user intervention.

Set-and-Forget Savings

Automated round-up savings enhance set-and-forget financial discipline by rounding up purchases to the nearest dollar and transferring the difference to a savings account, ensuring consistent contributions without manual effort. Manual savings require active decision-making and regular deposits, which can lead to irregular saving patterns and decreased long-term accumulation compared to automated round-up methods.

Incremental Balance Top-ups

Incremental balance top-ups in automated round-up savings seamlessly enhance your savings by rounding up each transaction to the nearest dollar and transferring the difference, creating consistent micro-deposits without manual intervention. Manual savings require deliberate contributions, often resulting in irregular top-ups, whereas automated round-up methods maximize incremental balance growth through effortless, incremental increments tied to everyday spending.

Cashback-to-Savings Routing

Manual savings require active user input to transfer cashback rewards into savings accounts, often resulting in inconsistent contributions and slower growth. Automated round-up savings systems instantly redirect cashback earnings into savings by rounding up purchases to the nearest dollar, ensuring seamless, frequent deposits and accelerated accumulation.

Real-time Micro Transfers

Manual savings require deliberate transfers of larger sums, slowing accumulation, while automated round-up savings enable real-time micro transfers by rounding up purchases to the nearest dollar and instantly saving the difference. This seamless method encourages consistent growth of savings with minimal effort and maximizes the power of small, frequent contributions.

Algorithmic Round-Up Scheduling

Algorithmic round-up scheduling leverages advanced algorithms to automatically track and round up purchases, transferring the difference into a savings account, which enhances consistency and maximizes small-dollar savings without manual effort. This automated process outperforms manual savings methods by minimizing human error and ensuring systematic growth of emergency funds and long-term savings through seamless integration with spending behaviors.

Manual Savings vs Automated Round-Up Savings for savings. Infographic

moneydiff.com

moneydiff.com