Regular savings accounts offer stable interest rates and insured security, making them ideal for risk-averse individuals seeking predictable growth. Crypto-compatible savings provide higher yields through decentralized finance platforms but come with increased volatility and regulatory uncertainty. Balancing traditional savings with crypto options can diversify portfolios and optimize long-term returns.

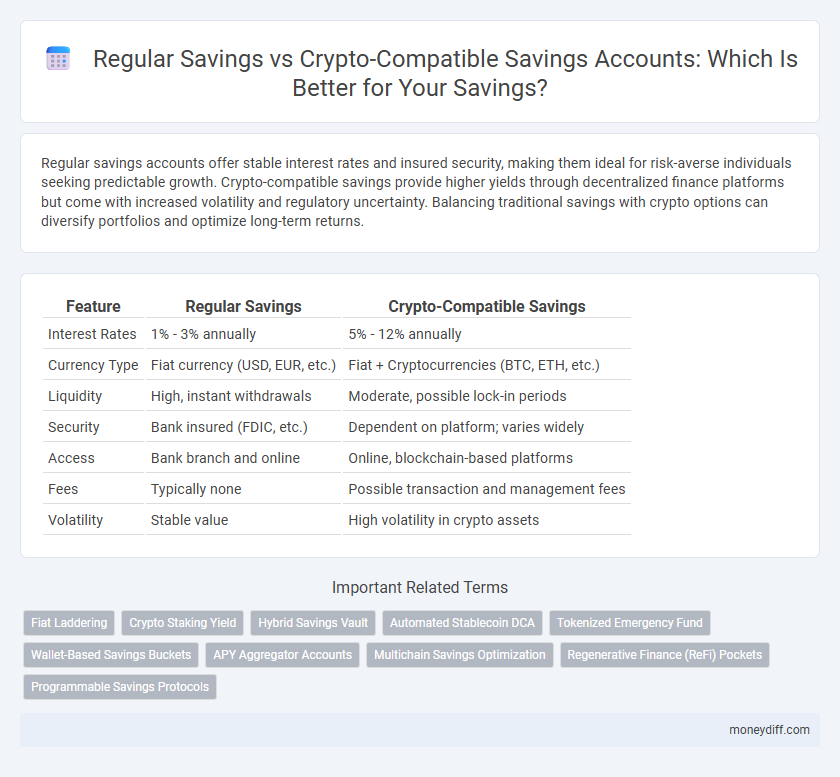

Table of Comparison

| Feature | Regular Savings | Crypto-Compatible Savings |

|---|---|---|

| Interest Rates | 1% - 3% annually | 5% - 12% annually |

| Currency Type | Fiat currency (USD, EUR, etc.) | Fiat + Cryptocurrencies (BTC, ETH, etc.) |

| Liquidity | High, instant withdrawals | Moderate, possible lock-in periods |

| Security | Bank insured (FDIC, etc.) | Dependent on platform; varies widely |

| Access | Bank branch and online | Online, blockchain-based platforms |

| Fees | Typically none | Possible transaction and management fees |

| Volatility | Stable value | High volatility in crypto assets |

Understanding Traditional Regular Savings Accounts

Traditional regular savings accounts offer a secure way to grow funds with predictable interest rates, FDIC insurance coverage, and easy access to money. These accounts prioritize stability and lower risk, making them suitable for conservative savers looking for reliable growth. Unlike crypto-compatible savings, they do not expose users to market volatility or digital asset risks.

Exploring Crypto-Compatible Savings Options

Crypto-compatible savings accounts offer higher interest rates compared to traditional regular savings by leveraging blockchain technology and decentralized finance protocols. These accounts enable users to earn rewards on cryptocurrency holdings through staking or lending, providing diversification and enhanced growth potential. Exploring crypto-compatible savings options requires understanding risks such as market volatility and regulatory changes to optimize returns while safeguarding assets.

Security Features: Banking vs Blockchain

Traditional regular savings accounts offer robust security through federal insurance schemes like FDIC or FSCS, ensuring depositor protection up to set limits. Crypto-compatible savings leverage blockchain technology, providing decentralized encryption and immutable transaction records that reduce fraud risk but lack government-backed guarantees. Security in banking relies on regulatory oversight and insurance, while blockchain prioritizes cryptographic protocols and decentralized consensus mechanisms.

Interest Rates Comparison: Fiat vs Crypto Savings

Interest rates for regular fiat savings accounts typically range between 0.01% and 1.5% annually, offering stable but low returns. Crypto-compatible savings platforms provide higher interest rates, often between 4% and 12%, leveraging blockchain technology and DeFi protocols. However, crypto savings carry increased volatility and risk, contrasting the predictable growth of traditional fiat savings.

Accessibility and Ease of Use

Regular savings accounts offer widespread accessibility through established banks and online platforms, providing user-friendly interfaces and insured deposits for financial security. Crypto-compatible savings platforms enable seamless integration with digital assets, allowing users to earn interest on cryptocurrencies while maintaining control through decentralized wallets. Both options cater to different user preferences, balancing traditional ease of use with innovative digital accessibility.

Risk Factors: Market Stability and Volatility

Regular savings accounts offer stability by protecting deposits through government insurance and consistent interest rates, minimizing market risk. Crypto-compatible savings accounts expose funds to high volatility due to cryptocurrency price fluctuations, which can significantly impact potential returns. Investors seeking security prioritize regular savings, while those willing to accept market instability may explore crypto-compatible options for higher yield opportunities.

Regulatory Protections and Insurance

Regular savings accounts benefit from strong regulatory protections such as FDIC insurance in the United States, which insures deposits up to $250,000 per account holder, providing a secure safety net for savers. Crypto-compatible savings accounts, while offering high-yield opportunities, typically lack equivalent government-backed insurance, exposing funds to greater risk in cases of platform insolvency or cyber theft. Understanding the differences in insurance coverage and regulatory oversight is critical when choosing between traditional savings options and crypto-linked savings products.

Liquidity: Withdrawing Your Savings

Regular savings accounts typically offer higher liquidity with easy, penalty-free withdrawals and immediate access to funds through ATMs or online transfers. Crypto-compatible savings platforms may impose withdrawal delays, network fees, or require conversions to fiat currency, impacting the speed and cost of accessing your savings. Understanding these liquidity differences is essential for choosing the right savings option based on access needs and financial goals.

Long-Term Growth Potential

Regular savings accounts offer stable, low-risk interest rates ideal for preserving capital over time, but typically yield modest returns that may not outpace inflation. Crypto-compatible savings platforms provide higher interest rates by leveraging decentralized finance protocols, presenting significant long-term growth potential with increased volatility and risk. Investors seeking greater returns should weigh the security and regulatory differences between traditional banks and blockchain-based savings solutions.

Choosing the Right Savings Strategy for Your Goals

Regular savings accounts offer stable returns and federal insurance protection, ideal for conservative savers focused on capital preservation and predictable growth. Crypto-compatible savings integrate digital assets, providing higher interest rates but with increased volatility and risk exposure, suitable for those comfortable with market fluctuations. Aligning your savings strategy with financial goals and risk tolerance ensures optimal balance between security and growth potential.

Related Important Terms

Fiat Laddering

Regular savings accounts provide stable, interest-bearing options for fiat currency, ensuring predictable growth and liquidity, whereas crypto-compatible savings incorporate digital assets, offering potentially higher yields through decentralized finance but with increased risk and volatility. Fiat laddering in regular savings involves staggering deposit maturities to optimize liquidity and interest accrual, a strategy less common in crypto savings due to the fluctuating nature of digital assets.

Crypto Staking Yield

Regular savings accounts typically offer low interest rates averaging around 0.05% annually, whereas crypto-compatible savings enable staking yields ranging from 5% to over 15%, significantly boosting passive income opportunities. Crypto staking allows users to earn rewards by locking digital assets in blockchain networks, providing higher returns compared to traditional bank savings while carrying increased market volatility risks.

Hybrid Savings Vault

Hybrid Savings Vault combines the stability of Regular Savings with the high-yield potential of Crypto-Compatible Savings, offering diversified asset allocation and flexible liquidity options. This innovative approach maximizes interest earnings while mitigating risks through automatic rebalancing between fiat and cryptocurrency holdings.

Automated Stablecoin DCA

Automated Stablecoin Dollar-Cost Averaging (DCA) within crypto-compatible savings platforms enables consistent, low-volatility investments by systematically purchasing stablecoins, reducing market timing risks common in volatile assets. This method contrasts with traditional regular savings by offering higher yield potential through decentralized finance protocols while maintaining asset stability and automated portfolio growth.

Tokenized Emergency Fund

A tokenized emergency fund within crypto-compatible savings offers instant liquidity and enhanced accessibility compared to regular savings accounts, allowing holders to quickly convert digital assets into cash during emergencies. This approach leverages blockchain technology for transparent tracking and increased security, making it an efficient alternative to traditional savings methods.

Wallet-Based Savings Buckets

Wallet-based savings buckets allow users to organize funds into separate categories, enhancing financial discipline and goal tracking in both regular and crypto-compatible savings. Crypto-compatible savings integrate digital assets, providing diversification and potential for higher returns compared to traditional savings buckets limited to fiat currency.

APY Aggregator Accounts

Regular savings accounts typically offer lower APYs averaging around 0.05% to 0.50%, while crypto-compatible savings accounts accessed through APY aggregator platforms can provide substantially higher returns, often exceeding 5% APY. APY aggregator accounts optimize earnings by pooling various DeFi protocols and stablecoin yields, allowing savers to maximize interest while maintaining liquidity and minimizing risk through diversified crypto asset allocations.

Multichain Savings Optimization

Multichain savings optimization leverages the benefits of both regular and crypto-compatible savings by enabling users to diversify assets across traditional fiat accounts and multiple blockchain networks, enhancing liquidity and yield potential. This approach maximizes returns through seamless asset transfers and arbitrage opportunities across decentralized finance (DeFi) platforms while mitigating risks associated with single-chain exposure.

Regenerative Finance (ReFi) Pockets

Regular savings accounts offer stable interest rates and government-backed security, making them suitable for conservative investors seeking predictable growth. Crypto-compatible savings within Regenerative Finance (ReFi) pockets leverage blockchain technology to provide higher yields through impact-driven projects, combining financial returns with environmental and social regeneration.

Programmable Savings Protocols

Programmable savings protocols enable automated, rule-based allocation of funds, enhancing traditional regular savings by integrating smart contracts that optimize interest accrual and asset diversification, including crypto-compatible options. These protocols leverage blockchain technology to provide transparent, secure, and customizable savings plans, offering greater flexibility and potential yield compared to conventional savings accounts.

Regular Savings vs Crypto-Compatible Savings for Savings. Infographic

moneydiff.com

moneydiff.com